What Did We Learn From The Iowa Caucuses? Morgan Stanley Answers

While the Iowa caucus will be remembered more for the sheer “incompetence and idiocy” or, worse, corruption of the Democratic Party, the results are still trickling in and some are hoping to make detailed analytical conclusion based on the outcome. After all, just two weeks ago, Goldman said that “the results of the Iowa caucuses on February 3 could have a noticeable and immediate effect on the perceived likelihood of the outcome. In 2004 and 2008 the winners in Iowa received roughly 30pp increases in implied chances of winning the nomination immediately following the caucuses. While in 2004 Sen. Kerry’s chances continued to rise steadily over the subsequent several weeks, in 2008 Sen. Obama’s odds retrenched roughly a week later after the New Hampshire primary. Other cycles for which prediction market data are available are not as relevant, as in the 2000 and 2016 Democratic nomination contests, the eventual nominee already commanded at least a 70% implied chance of winning in the polls, and in 1992 Gov. Bill Clinton unsurprisingly lost the Iowa caucuses to a US Senator from Iowa.”

Well, don’t hold your breath.

As Morgan Stanley’s political strategist, Michael Zezas writes in his Iowa post-mortem, “we don’t think investors learned anything meaningful about the 2020 election and the path for US public policy from the Iowa caucuses. The lack of a clear winner and the delays and confusion about the final result enable several candidates to claim momentum and question the results.”

This, to Morgan Stanley, suggests Iowa won’t provide a clear front runner or preferred set of policies that could influence economic and market outlooks, and the process of narrowing the field will likely be extended.

And while the New Hampshire primary is next, on February 11, Zezas is skeptical it will provide much clarity either for the following reasons:

- Candidates from the region could complicate the interpretation of results

- Not many delegates at stake until Super Tuesday

- No clear read-through to the Senate yet

- New Hampshire, like Iowa, is not representative of the Democratic electorate

As such, look to the Nevada and South Carolina caucuses, on Feb 22 and 29, respectively, for a better signal, but the lack of recent polling in those states also contributes to uncertainty.

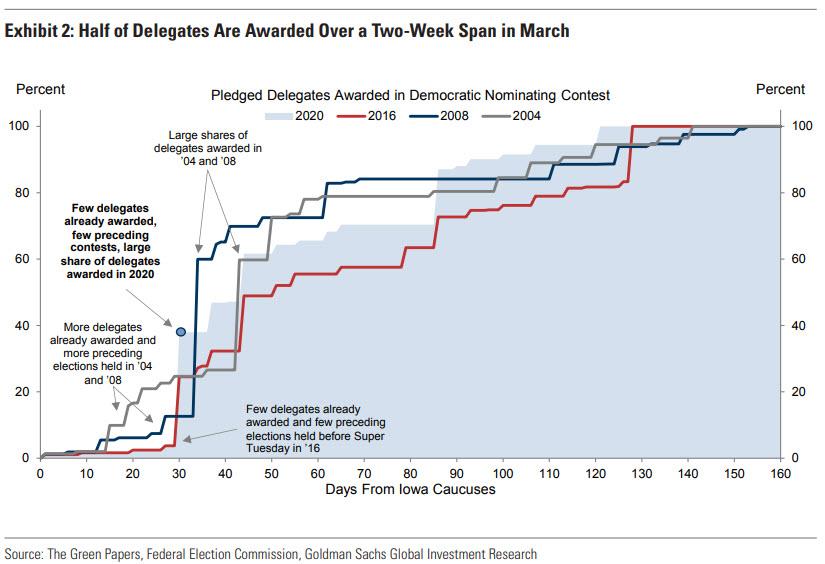

The real test, of course, is on the March 3, Super Tuesday, which will be the major political catalyst, for two reasons. First, the cumulative share of delegates awarded will jump sharply. As shown in the next chart, in both 2004 and 2008 there were multiple primary elections that awarded a moderate share of pledged delegates between Iowa and Super Tuesday, allowing the winner in Iowa to benefit from momentum. By contrast, this year the cumulative share of pledged delegates jumps from under 5% to nearly 40% overnight.

Second, several candidates could remain competitive into March. In prior cycles, the field narrowed considerably after the Iowa and New Hampshire contests, as those who fared less well in the early contests declined in polls and in fundraising. But this time, the potential persistence of self-funded candidates – especially Michael Bloomberg – could keep the field slightly larger for longer.

Tyler Durden

Wed, 02/05/2020 – 10:45

via ZeroHedge News https://ift.tt/31z6Zp1 Tyler Durden