Another Massively Oversubscribed Term Repo Confirms Persisting Liquidity Woes

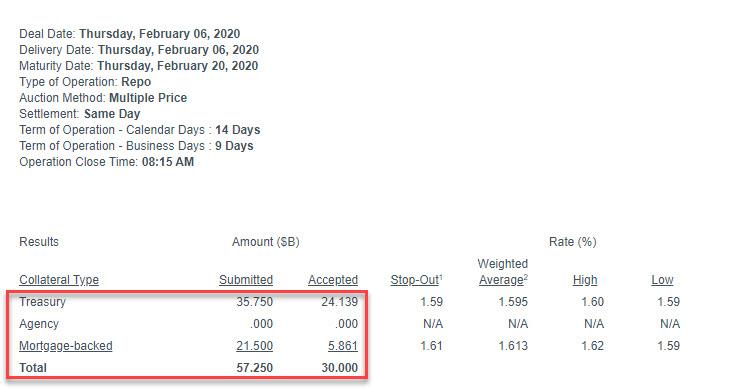

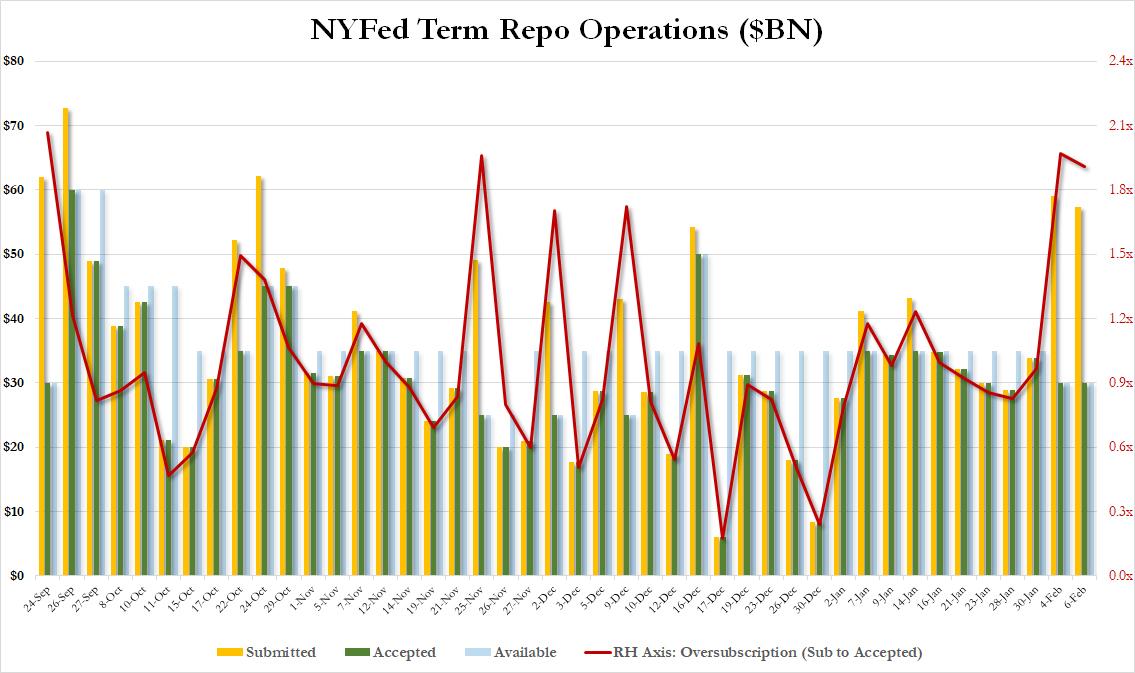

Two days after dealers unexpectedly flooded the first reduced term-repo (from $35BN previously to $30BN) offered by the Fed, the liquidity shortage in the repo market – which was supposed to be temporary and few if any strategists said would continue beyond year-end – persists, and today the Fed announced that in its latest 2-week term repo (maturing Feb 20), it was $57.25BN in submissions ($35.75BN in TSYs, $21.5BN in MBS) for a maximum $30BN in available reserves.

This means that for the second time in three days, the term repo operation saw a massive oversubscription, which at 1.9x was the 4th highest ever since the Fed restarted term-repos in late September, and just shy of the 2.0x submitted-to-accepted ratio recorded on Monday.

As we concluded on Monday, “the massive demand for term repo today means that the liquidity crisis that continues to percolate just below the surface of the market and has clogged up the critical plumbing within the US financial system, is getting worse, not better, and today’s massive oversubscription indicates that one or more entities continues to face a dire shortage of reserves, i.e., cash.”

We hope that eventually someone at the Fed will address this ongoing issue which was supposed to be resolved over a month ago.

Tyler Durden

Thu, 02/06/2020 – 08:44

via ZeroHedge News https://ift.tt/3biwPCg Tyler Durden