Coronavirus Will Whack 2% From Global GDP Growth In Q1: Goldman

While the market today soared to just shy of new all time high amid a return of the “coronavirus is contained” euphoria following unconfirmed speculation overnight that drugs are in the pipeline, the reality is that China, and the world, are at best months away from a lab setting and actual human usage. But while a vaccine will eventually emerge, the more important question for markets is what is the impact on the Chinese and global economy from the coronavirus pandemic which has effectively shut down much of China’s production capacity, crippling supply chains critical to keep not only the second largest economy in the world humming, but the world itself.

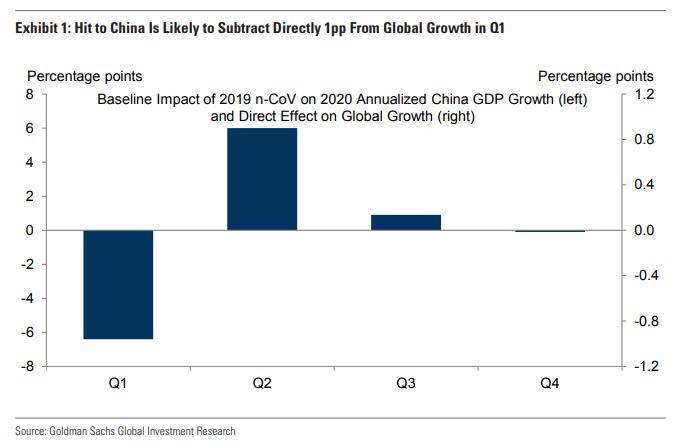

In this vein, last week Goldman estimated that the coronavirus outbreak is set to reduce Chinese GDP growth in the first quarter of 2020 by 1.6% in year-over-year terms, or 6.4% in quarter-on-quarter annual rate terms, resulting in a sub-5% GDP Q1 print. However, with Goldman expecting the outbreak to be contained by Q2, it then sees GDP surging and making up for almost all of the Q1 shortfall. Whether or not this is an optimistic take remains to be seen.

What does that Chinese GDP “shock” mean for the rest of the world?

In a follow-up note published this week, Goldman also provides its first preliminary estimate of the impact of this shock on global GDP growth.

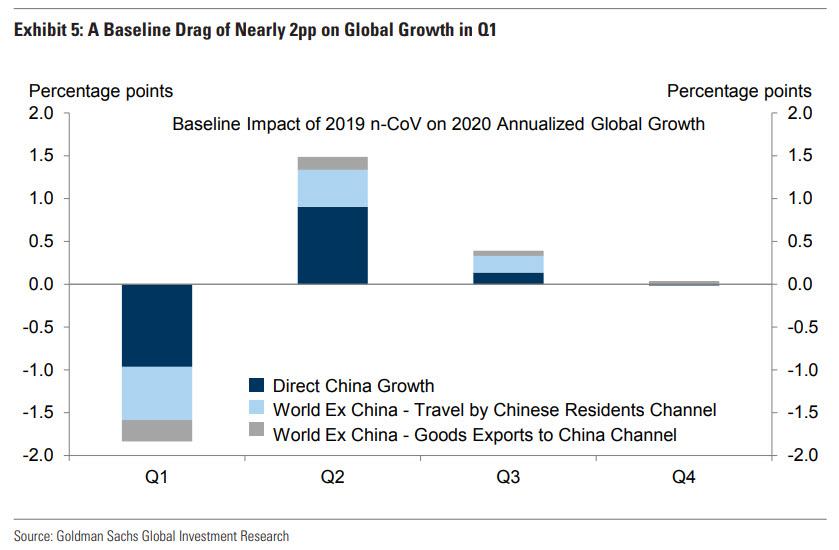

According to Goldman’s chief economist Jan Hatzius, the assumed hit to Chinese growth will directly subtract about 1% from global GDP growth in Q1. In addition, spillover effects to the rest of the world will take just under 1% off global growth, for a total hit of nearly 2% in the first quarter. The spillover effects consist of reduced exports to China (worth about 0.3%) and reduced spending by Chinese tourists abroad (worth about 0.6%).

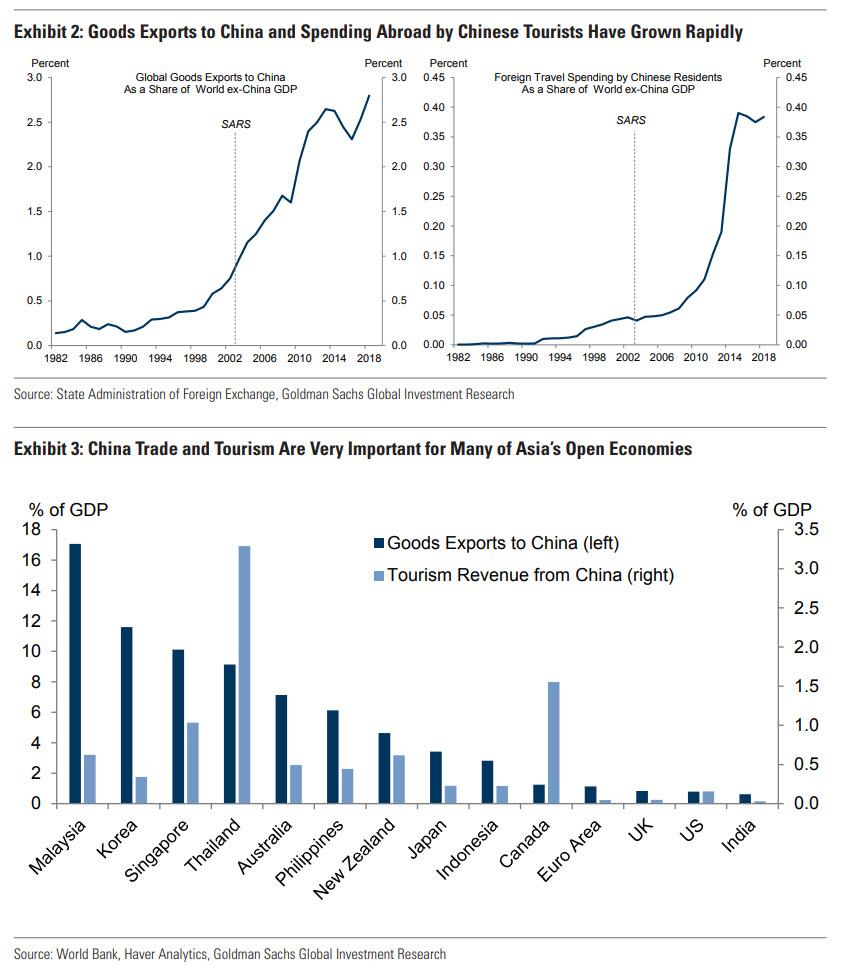

As shown in the next chart, both channels of transmission to the rest of the world have increased greatly in importance since the 2003 SARS epidemic because of the breathtaking growth of the Chinese economy over the past two decades. Exhibit 3 shows that several Asian countries are now particularly exposed to China. As a result, our Asia team has cut its growth forecast in Thailand due to its tourism exposure and has signaled downside risk in Korea and Taiwan due to their trade exposure.

Using these two transmission channels, Goldman then calculates the overall impact on global growth. The next chart shows a hit of about 2% in Q1. Roughly half of that impact reflects the direct effect of weaker growth in China while the other half reflects spillover effects, with effects of about 0.3% from reduced Chinese goods imports and 0.6% from reduced tourist flows.

Why is the hit confined to just the first quarter? Because as Goldman explains, its baseline assumption is that the “aggressive response from the authorities in China and elsewhere will bring the rate of new infections down sharply by the end of Q1.” If so, global economic activity should normalize in subsequent quarters, with positive GDP growth effects of about 1½% in Q2 and ½% in Q3. For the year as a whole, Goldman concludes this would imply a modest hit to annual-average global GDP growth of 0.1-0.2pp but still allow for a slight reacceleration from 3.1% in 2019 to 3¼% in 2020.

What if Goldman’s baseline assumption is too optimistic? Well, in a more severe scenario, the bank’s Asia Economics team assumes that it would take until “sometime in the second quarter for the rate of new infections to peak.” If so, the predicted Q2 recovery would obviously be delayed and the hit to global GDP growth in 2020 would likely rise to about 0.3%, which while modest, would likely be the best case outcome for markets as it would prompt global central banks to engage in more aggressive easing, boosting risk assets around the globe. It also means that the reacceleration of full-year global growth that Goldman now expects to take place in 2020 would likely be delayed until 2021.

Of course, if the epidemic can’t be contained by the end Q2, then the world will have a far bigger problem than what GDP will be in the second half of the year, or any other time in the future for that matter.

With all that said, Hatzius is adamant that the coronavirus outbreak “does not change our baseline view that underlying global growth has bottomed and the next leg is likely to be higher, driven by a reduced drag from the trade war and the past easing in financial conditions.” For this reason, the Goldman economist thinks monetary policy easing in the largest advanced economies is probably behind us, and rate cuts in 2020 will be largely confined to a minority of EM central banks.

That said, with every passing day that China fails to contain the pandemic, the less confident Goldman is, with Hatzius saying that at least “the near-term risks to both our growth and monetary policy views are clearly on the downside until the outbreak is contained.”

As for Goldman’s forecast that there will be no more rate cuts, just remember that in December 2018 Goldman predicted 4 rate hikes in 2019. Instead the Fed went on to cut 3 times, and it didn’t need a global viral pandemic for justification.

Finally, we are curious why Goldman did not account for the crunch that global supply chains are already sustaining: while Chinese tourism and exports are certainly important economic pathways, we wonder what will happen to both vendors and customers of intermediate goods that rely on Chinese factory tolling for output and for downstream products. Or perhaps that will be the topic of a subsequent Goldman report looking at how badly corporate earnings will be hit as the GDP hit impacts the corporate top and bottom line. We eagerly await such a report not only from Goldman but the other banks who have been oddly mute on the topic. Perhaps they are just waiting for the wave of guidance cuts that will inevitably be unleashed in the coming weeks by S&P500 member companies.

Tyler Durden

Wed, 02/05/2020 – 19:45

via ZeroHedge News https://ift.tt/3bev1Kh Tyler Durden