Tesla Shares Plunge Again As Company Says It Will Shutter China Stores Due To Coronavirus

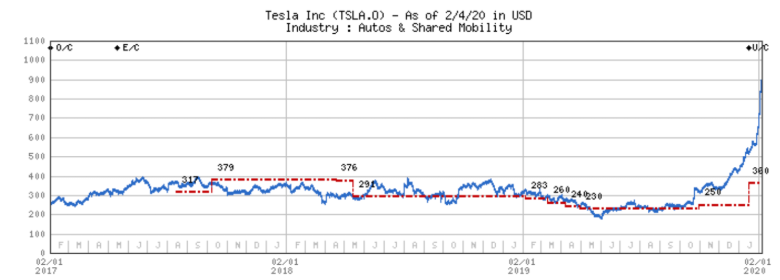

Following yesterday’s record 17% drop, Tesla shares are down again in pre-market trading on Thursday after the company announced it is temporarily closing stores in mainland China as of February 2. Tesla shares dropped another 5% in early trading Thursday morning ostensibly on a combination of the China news, and what probably is just a badly needed reality check after a 72-hour parabolic binge due to a short squeeze, gamma-hedging frenzy and increasing numbers of hysteric retail traders.

The company announced in an online post to its employees that it temporarily closed its stores beginning last Sunday. The move follows suit with the rest of China, which has ground to a standstill to try and control the coronavirus, which has (according to the Chinese government) killed more than 500 people. That number is in dispute.

CNBC translated a note that was sent to Tesla China employees on WeChat regarding the closures. It stated:

“From today on, Tesla stores are all closed throughout China. But I will answer questions online, around the clock. Online orders are still welcome. We suggest all of you stay home, and take good care of your health.”

Tao Lin, a Tesla VP in China, also helped along the company’s 17% decline on Wednesday when he announced on Weibo that cars scheduled for delivery in early February would be delayed due to the spread of the virus. Shanghai has ordered local businesses not to resume work before February 10, which means that Tesla’s production factory is also shut down.

This, of course, led us to ask why Tesla doesn’t just set up another quarantine tent for production like they did in Fremont?

Tesla has 24 stores in mainland China and its Chinese operations have been a large catalyst for hype around the stock over the last several months, since the company’s Shanghai plant was completed.

As for the stock, we wouldn’t be surprised to see the reality check continue. Even one of Tesla’s most ardent supporters, Adam Jonas at Morgan Stanley, issued a note Thursday morning with an underweight rating and a $360 price target – now about 50% downside – saying it is “too soon” to declare a winner in the global EV market.

He noted the astounding volume with which Tesla has traded. Jonas says that “Tesla traded over 48 million shares on Wednesday (over 25% of shares outstanding) for a value traded of approximately $36bn. For comparison, Apple, a company with roughly 10x the market cap of Tesla traded approximately $9.5bn of value yesterday. Tesla traded nearly 4x the value of the world’s most valuable public company.”

And he also was cautious about calling Tesla the winner in the EV space, given its new entrants: “Moreover, with US and global EV penetration at approximately 2% we believe it may be too early to declare the ultimate winner in the global EV market. At a minimum, there may be substantial risk to modeling the growth and market share of a market at such a low level of maturity today.”

He concluded by noting that even the bulls he was speaking sound like they are starting to change their tone:

“We continue to engage with investors in high volume on Tesla, but noted a slight change in feedback where even some bulls on the name we have spoken with have expressed a degree of uncertainty, and in some cases, concern around the recent price action..”

Tyler Durden

Thu, 02/06/2020 – 08:50

via ZeroHedge News https://ift.tt/383T6lj Tyler Durden