Futures Slide On Fresh Virus Fears Ahead Of Payrolls As German Industrial Production Craters

Following a torrid 3% rally on “hopes” that the coronavirus epidemic is contained after last Friday’s plunge, coupled with even more “hopes” that trade relations with China are on the mend after Beijing slashed its duties on some US goods by up to 50%, overnight renewed coronavirus worries took a hit at world markets on Friday ahead of today’s payroll report (which will include major downward revisions), although the modest drop sparked by fears of a mini epidemic on board a Japanese cruise ship wasn’t going to stand in the way of the best week for stocks since June and the strongest for the dollar since August.

U.S. equity futures dropped and European stocks pared a week of big gains as doubt spread that the spread of the coronavirus was contained, while Treasuries and safe havens climbed before American jobs data.

Europe’s trading day began with stocks down and safe-haven government bonds up, a pattern that had been set in Asia where the death toll from the virus in China has more than doubled in less than a week, and stood at 638 on Friday, 636 in China (although doubt in the veracity in the official numbers is spreading just as fast as the underlying epidemic) and two abroad and it was also revealed that one of the first doctors to raise the alarm about the virus had died from it at a hospital in Wuhan, the outbreak’s epicenter. Drops in miners and carmakers led the Stoxx Europe 600 Index lower, while luxury retailer Burberry Group slipped scrapping guidance over the virus hitting China sales. Credit Suisse slumped after ousting its CEO. The mood turned more sour as the latest data showed German industrial production had the biggest monthly tumble since the financial crisis, crushing the narrative that Germany’s economy was on the mend.

Earlier in the session, equities slipped across most of Asia as news of further infections on a cruise ship off Japan offered another reminder that cases remain on the rise, even as China is scrambling to restore a sense of calm by reported a decline in the number of news cases.

And even though the World Health Organization has said it is too early to call a peak in the outbreak, the “data” out of China sufficient for some investors-turned epidemiologists who were all too eager to believe China’s bullshit statistics: “We are not that nervous, actually we are increasing our risk allocation,” said SEB investment management’s global head of asset allocation Hans Peterson, adding the risk of a massive worldwide epidemic seemed to have dropped. “We look more at this moment at the macro data in the U.S. which is really very good… and we presume we will get substantial support from central banks like we did in China on Monday.” So… win-win: bad news is great as it will only improve, but good news is even better as central banks will provide backstops. What’s not to like.

Not everyone shared the optimism that bankers will as usual save the day: expectations the outbreak will be contained and growth will rebound from the second quarter on the back of stimulus and pent-up activity are “probably somewhat optimistic,” Sue Trinh, macro strategist at Manulife Asset Management, told Bloomberg TV. “The very real risk is that this outbreak spreads, quite literally, into the second quarter and beyond.”

After to a $400 billion wipeout on Monday, Shanghai is poised for its worst week in eight months. But the other Asian indexes are ahead and the pan-European FTSEurofirst is heading for its best week since late 2016.

Also overnight, Singapore lifted its national disease response to the second-highest level, the same one for the SARS epidemic. Apple’s Chinese iPhone maker Foxconn told employees not to return to work at its Shenzhen facility when the extended Lunar New Year break ends Feb. 10. Meanwhile, the presidents of China and the U.S. reaffirmed their commitment to the implementation of a phase-one trade deal in a phone call Friday.

Yields on 10Y TSYs dropped back to 1.61%, and have failed to breach a key technical resistance amid slowdown fears.

In FX, the euro fell to its lowest since October in early European trading after German industrial output recorded its biggest decline in a decade (see chart above) and strong U.S. employment numbers on Thursday had primed the dollar for monthly payrolls later. The yen halted a slide that has it set for its worst week in 18 months, leaving the currency sitting just above a two-week low at 109.85 per dollar. The Australian dollar, often seen as a proxy for China, weakened 0.5% to $0.6699 after the Reserve Bank of Australia slashed growth forecasts in its quarterly economic outlook, blaming its bushfires and the coronavirus. The Aussie was still on track for its first weekly gain this year, whereas Singapore dollar and Thai baht have been trampled in a rush from emerging market currencies into majors.

Owing to much greater exposure to Chinese demand and less access to the benefits of monetary stimulus, commodity prices have been more sensitive to conditions on the ground. Oil and metal prices fell hard as the coronavirus outbreak gained pace and have been slow to recover. Brent crude was a touch firmer on Friday at $55.17 per barrel, but is heading for its fifth back-to-back weekly drop having lost over 16% this year. A rally in copper – often seen as a barometer of global economic health because of its wide industrial use – stalled at $5,695 per tonne though it has been its strongest week since the start of December.

“We think that demand could come back strongly as opposed to gradually in Q2 2020,” said Commonwealth Bank commodities analyst Vivek Dhar. “But the risk in the near term is that (Chinese) provinces take longer to return to work in order to contain the spread of the virus.”

Expected data include non-farm payrolls, unemployment, and wholesale inventories. AbbVie, Avantor, and Canada Goose are among companies reporting earnings.

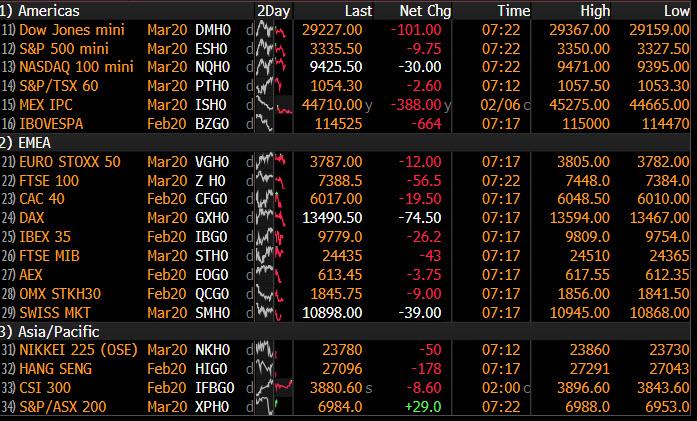

Market Snapshot

- S&P 500 futures down 0.3% to 3,336.50

- STOXX Europe 600 down 0.2% to 424.57

- MXAP down 0.5% to 169.76

- MXAPJ down 0.8% to 547.76

- Nikkei down 0.2% to 23,827.98

- Topix down 0.3% to 1,732.14

- Hang Seng Index down 0.3% to 27,404.27

- Shanghai Composite up 0.3% to 2,875.96

- Sensex down 0.3% to 41,172.95

- Australia S&P/ASX 200 down 0.4% to 7,022.58

- Kospi down 0.7% to 2,211.95

- German 10Y yield fell 1.8 bps to -0.388%

- Euro down 0.2% to $1.0960

- Italian 10Y yield unchanged at 0.798%

- Spanish 10Y yield fell 1.7 bps to 0.278%

- Brent futures little changed at $54.91/bbl

- Gold spot up 0.2% to $1,569.30

- U.S. Dollar Index up 0.1% to 98.61

Top Overnight News

- China’s January trade data was scheduled to be released Friday, but will instead be announced together with February data, according to the customs administration

- Germany is facing a possible recession again after industrial production plunged by the most since the global financial crisis

- A nascent recovery in Indonesian exports is under threat, with the coronavirus outbreak set to sap Chinese demand for commodities including palm oil, coal, paper and pulp

- The death of a 34-year-old doctor on Friday has unleashed a wave of fury that is sparking a rare crisis of confidence in the Chinese Communist Party and its handling of the coronavirus outbreak

- A Chinese doctor who was initially sanctioned for warning about the deadly Wuhan coronavirus outbreak in early January has died, stoking fresh anger online at the Communist Party-led government. The number of infections on China’s mainland climbed to more than 31,000

- President Trump and China’s President Xi Jinping “agreed to continue extensive communication and cooperation between both sides,” White House says in readout of leaders’ call

- OPEC expects Russia to respond in days, rather than weeks, to a production-cut proposal as the cartel confronts a price rout triggered by the collapse in petroleum demand from China, according to a delegate. U.S. weighs sanctions on Rosneft but is wary of oil market chaos

- European Union Trade Commissioner Phil Hogan had a “useful and constructive” meeting in Washington on Thursday with his U.S. counterpart, according to an EU official

- Pete Buttigieg holds a razor-thin lead over Bernie Sanders in the Iowa caucus with 100% of precincts reporting. Buttigieg had 26.2% to Sanders’ 26.1%, according to official results. Elizabeth Warren had 18%, Joe Biden had 15.8% and Amy Klobuchar had 12.3%. Other candidates were far behind

- Declines in Japan’s household spending worsened in December, signaling that government measures to ease the shock of October’s sales tax hike may not be working as well as economists and policy makers expected

Asian equity markets were mostly subdued as the momentum from Wall St, where all major indices posted record levels and tech outperformed, was clouded by coronavirus fears and cautiousness heading into the latest Chinese trade data and US Non-Farm Payrolls. ASX 200 (-0.4%) was dragged lower by weakness in energy and miners amid ongoing demand concerns triggered by the outbreak in China, while Nikkei 225 (-0.2%) was indecisive with focus in Tokyo on a deluge of earnings, weaker than expected Household Spending and reports of 41 additional coronavirus cases onboard the cruise ship off Yokohama, although it wasn’t all gloom and doom as SoftBank gapped higher by 8% after Elliot Management acquired a USD 2.5bln stake. Elsewhere, Hang Seng (-0.3%) and Shanghai Comp. (+0.3%) declined amid the ongoing coronavirus fears and tentativeness ahead of the trade figures which are expected to show exports and imports slipped into contraction territory, although officials have remained supportive including the PBoC’s Beijing branch which directed banks to cap interest rates offered to key enterprises at 100bps below the Loan Prime Rate. Finally, 10yr JGBs benefitted from the risk averse tone which lifted prices back above the 152.50 level, while the BoJ were also present in the market for over JPY 1.1tln of JGBs with 1yr-10yr maturities.

Top Asian News

- Japan Lawmakers Call on BOJ to Mull Digital Yen to Counter China

- China Delays January Trade Data to Merge With February Release

- Taiwan Exports Plummet as Coronavirus Threatens Trade Recovery

- Toyota, Honda Extend China Shutdowns as Virus Gathers Pace

A relatively subdued session thus far for European equities [Eurostoxx 50 -0.3%], with participants on guard amid virus jitters ahead of the release of the key US labour market report later today. APAC bouses ended the week on a mixed footing following a mostly subdued session – Mainland China eked mild gains after reports of supportive steps by the PBoC to cope with downward pressures arising from the coronavirus outbreak. Back to Europe, bourses are mostly subdued with no clear standouts. Sectors are largely in negative territory with defensives faring modestly better than cyclicals. In terms of individual movers, Credit Suisse (-2.5%) slipped to the foot of the SMI (~3% weighting) following the departure of CEO Thiam following the spying scandal. Thiam will be leaving his post on February 14th and is to be replaced by Thomas Gottstein, the current head of the bank’s Swiss business. Note: Credit Suisse will be reporting its results on February 13th. Elsewhere, Burberry’s (-1.3%) withdrawal of guidance and bleak demand outlook for the luxury market (amid the virus outbreak) has prompted sympathy play from European peers including Richemont (-1.3%), Swatch (-0.9%), LVMH (-1.0%) and Kering (-1.5%). Fiat Chrysler (-2.2%) slid to the foot of the FTSE MIB after warning that its European plants may see closures within weeks if China closures are extended as a result of the outbreak as factories will find it difficult to source key parts. In terms of earnings, L’Oreal (+1.2%) leads the gains in the CAC amid an all-round solid report and a 10% annual increase to its dividend, although the Co. did highlight a temporary slowdown from its Chinese beauty market, a key driver of its growth. Finally, Ericsson (+4.8%) and Nokia (+6.7%) see renewed tailwinds from US AG Barr’s endorsement in Cos for 5G technology as opposed to Huawei.

Top European News

- Nordea Fixes Bonus Culture After Investor Lambastes Bank

- Calisen Gains After Raising $426 Million in London IPO

- Carbon Pollution Costs Are Likely to Rise Again in Europe

- Short Sellers’ Nordic Nightmare Attracts a $130 Billion Fund

In FX, it remains gradual and measured, but relatively resolute as the Greenback maintains positive momentum and on track to extend its winning streak amidst widespread if not universal gains vs currency rivals. Indeed, DXY pull-backs are becoming increasingly shallow and short-lived with the index now building a platform around 98.500 and just posting a fresh peak at 98.639 ahead of the next bullish chart resistance level at 98.885 (higher Fib retracement from 2019 peak to December trough). US jobs data may present a fundamental hurdle, but in the current constructive climate the bar appears high in terms of an upset to stall the Buck’s rally or halt the bull run altogether.

- AUD/NZD – The clear G10 underperformers, as the Aussie recoils further from Tuesday’s post-RBA peaks and the Kiwi retreats partly in sympathy towards 0.6680 and 0.6400 respectively vs their US counterpart. Aud/Usd gleaned little if any traction via the SOMP or latest rhetoric from Governor Lowe as the former revealed lower GDP forecasts based on the assumption that rates will be reduced by another 25 bp. Moreover, news of a delay to Chinese trade data and the ongoing spread of the coronavirus are weighing on risk sentiment in general, as the YUAN slips back to 7.0000 against the US Dollar.

- EUR/CAD/CHF – Also unable to resist the Greenback’s advances, with the Euro also blighted by more dire German/Eurozone data and increasingly bearish technical impulses having fallen through a sub-1.1000 Fib (1.0964) and now testing the resolve of bids around 1.0950 ahead of last October’s pre-2019 full year low (1.0941). Similarly, the Loonie has lost grip of the 1.3300 handle, but could yet be saved from a worse fate and stops said to be poised on a break of 1.3320 by decent option expiry interest between 1.3290-1.3300, if not impending Canadian payrolls. Meanwhile, the Franc is still somewhat mixed given weakness vs the Buck below 0.97500 in contrast to strength through 1.0700 against the Euro.

- JPY/GBP – The Yen is paring losses amidst a partial reversal in risk-on flows and renewed safe-haven positioning, with Usd/Jpy back down to circa 109.70 from just above 110.00 even though media reports suggest official GPIF sponsored selling of the Japanese unit alongside PBoC OMOs. However, the Pound is also holding up fairly well in the circumstances, as Cable hovers above 1.2900 and the post-UK GE trough, and Eur/Gbp remains capped around 0.8500.

- NOK – Disappointing Norwegian data and another downturn in oil prices have combined to propel Eur/Nok above 10.1600 even though the single currency has its own negative factors to contend with, as noted above.

In commodities, WTI and Brent front-month futures remain choppy as focus remains on OPEC’s move following a three-day meeting by the group’s JTC. In terms of the fallout, the committee reportedly proposed a 600k supply cut to start immediately which will continue through to June if agreed by all members and they expect Russia to respond in a matter of days according to sources, while there were twitter reports of unconfirmed chatter OPEC+ are proposing extending current cuts into year-end. That said, Russian Energy Minister Novak continued to push back against these cuts stating that Russia needs a few days to analyse situation on oil market and will come up next week with its position for OPEC+ meeting due next month, although Russian Foreign Minister Lavrov that he supports the panel’s proposal of cutting oil output – but did not specify a preferred magnitude of reductions. WTI and Brent futures have largely traded on either side of USD 51/bbl and USD 55/bbl respectively before prices moved lower in tandem with sentiment. Elsewhere, spot gold treads water just under USD 1570/oz with the yellow metal’s 21 DMA seen around 1564/oz. Meanwhile, copper prices saw brutal losses after hitting resistance at USD 2.6/lb (low USD 2.55/lb) with reports noting that Chinese copper traders, the metal’s largest market, asked miners to cancel or halt shipments of the red metal as the virus outbreak takes its toll on demand.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 165,000, prior 145,000

- Average Hourly Earnings YoY, est. 3.0%, prior 2.9%

- Change in Private Payrolls, est. 155,000, prior 139,000

- Change in Manufact. Payrolls, est. -1,500, prior -12,000

- Unemployment Rate, est. 3.5%, prior 3.5%

- Average Hourly Earnings MoM, est. 0.3%, prior 0.1%

- Average Weekly Hours All Employees, est. 34.3, prior 34.3

- Labor Force Participation Rate, est. 63.15%, prior 63.2%

- Underemployment Rate, prior 6.7%

- 10am: Wholesale Inventories MoM, est. -0.1%, prior -0.1%; Wholesale Trade Sales MoM, est. 0.1%, prior 1.5%

- 3pm: Consumer Credit, est. $15.0b, prior $12.5b

DB’s Jim Reid concludes the overnight wrap

Being in Dubai this week I’ve learnt something new about the climate here. The area is a significant user of cloud seeding and frequently uses the technology to encourage precipitation and also to cool down the temperatures. I wasn’t aware it could be done at such an industrial level. I’ve been doing a bit of reading on geo-engineering recently in my work on climate change and boy this is a controversial topic. I suspect it will get more attention in the years ahead as we try to fight climate change and the technology improves. Given that my last two rounds of golf at home have been cancelled due to a sodden course this is starting to influence my opinions on the topic! Looking at the stormy weather forecast for this Sunday in the U.K. and many parts of Europe I suspect I’ll be in even less control of my golf ball than usual. If you’re reading from this region then maybe make the most of Saturday this weekend!!

The storm clouds have certainly been swept away in markets this week even if the wind direction has slightly changed in the Asia session. Attention today will turn to US payrolls. In terms of what to expect from the announcement, DB’s US economists are looking for a +160k increase in nonfarm payrolls, which is basically in line with the consensus +163k call. They assume a 10k boost from temporary government hiring for the decennial census, so investor focus should be on private payrolls instead, where we’re expecting a +150k reading. Some might look for optimism given the ADP’s report of private payrolls on Wednesday, which saw a +291k increase, the most since May 2015. However the ADP reports have actually proved somewhat wide of the mark recently, with the previous month’s ADP reading overestimating the private payrolls number by +60k. Furthermore, the ISM non-manufacturing employment reading earlier this week fell to 53.1, the lowest since September.

Staying with the US, Democratic candidates will be gathering in New Hampshire for their latest TV debate tonight, which comes ahead of that state’s primary on Tuesday. We’ve seen a remarkable shift in the betting odds this week. Joe Biden, who still leads in national polling averages, has seen his PredictIt odds crash to 16%, the lowest reading of this cycle (c.35% last week). The majority of his numbers seems to have been siphoned to Buttigieg (seemingly the narrowest of winners in Iowa) and Bloomberg, as the market seems to being looking for an alternative moderate. Sanders is now up to 45%, with the more liberal wing of the party coalescing around him as Warren is down to 6%, after being over 50% back in October. The most recent polling data either omits or only partially includes days after the Iowa caucuses, but we should know in a few days how performances there and in the aftermath have affected national and regional numbers. Finally fivethirtyeight.com’s model forecasting the Democratic primary now has Sanders with a 49% chance of winning the nomination, with “no one” or a contested convention coming in second at 24%. Betting markets and polling currently look good for Sanders winning the nomination. However, equity markets do not seem to be pricing that in or – as the EMR survey from January shows – market participants do not believe in Sanders’s (or any Democrat’s) ability to beat President Trump in November. We’ll be doing our latest market survey next week so we’ll see how markets feel about the race then.

Back to yesterday now, and for the time being at least, markets seem to be taking the coronavirus in their stride, as the S&P 500 rose +0.33% to a new record, while the STOXX 600 also reached a fresh high with a +0.44% advance. Positive earnings releases supported the advance, with Twitter +15.03% and the top performer in the S&P 500 after the company reported quarterly revenue over $1bn for the first time, beating expectations. Over in Europe meanwhile, ArcelorMittal was up +11.04% as the company reported the lowest net debt since their 2006 merger and struck a positive note on the 2020 outlook.

Other asset classes continued to join in the rebound with copper, a key bellwether for global economic demand, powering forward for a 3rd consecutive session yesterday, up +0.84%, and after 13 straight days of declines before that. 10yr Treasury and Bund yields both fell around 1bps.

Coronavirus fears are resurfacing a little this morning as Japan found an additional 41 coronavirus cases (bringing the total tally to 61) on a quarantined cruise ship. It is the biggest outbreak number outside of China and the number could potentially jump higher as only 273 of the 3700 passengers on the ship have been tested so far. Meanwhile Japan has banned a separate cruise ship from berthing at a port in the country, saying a person onboard was suspected of having contracted the virus. In other related news, Japanese PM Shinzo Abe has said that Japan will put together emergency spending measures next week to address the coronavirus crisis, tapping budgeted reserves.

Back in China, the total number of infected cases now stands at 31,161 (vs. 24,324 yesterday) with the death toll at 636 (vs. 490 yesterday). Meanwhile, Pan Gongsheng, a deputy governor at the PBoC, said overnight that the central bank will give higher priority to economic growth as the virus outbreak is intensifying downward pressure on the economy, but also pledged to consider other factors such as controlling debt and the yuan exchange rate. Markets are increasingly expecting the PBoC to lower the MLF rate by 10bps around the middle of the month after it has already lowered the short term repo rates by the same amount earlier this week.

Asian markets are trading lower this morning with the Nikkei (-0.21%), Hang Seng (-0.87%), Shanghai Comp (-0.80%) and Kospi (-1.15%) all down. Elsewhere, futures on the S&P 500 are down -0.21% and the yield on 10yr USTs are down -2.1bps. Brent crude oil prices are trading up +0.18% after yesterday’s news that technical experts from OPEC+ recommended a further supply curb of 600,000 barrels a day until June even as Russia’s response over this is awaited. In addition they recommended that the current 2.1 mn barrel/day cut already in place be extended until the end of the year, rather than expiring in March as originally planned. As for overnight data releases, Japan’s December household spending came in at -4.8% yoy vs. -1.7% yoy expected and real cash earnings came in line with consensus at -0.9% yoy.

In other news, the US President Trump spoke overnight with Chinese President Xi Jinping and both sides reaffirmed their commitment to the implementation of Phase 1 deal. Elsewhere, Bloomberg reported that the US is weighing whether to sanction Russia’s biggest oil producer, Rosneft, for maintaining ties with Venezuela.

Back to the Coronavirus and yesterday our China economists released their latest update on the impact (link here), where they write that it is still too early to call it a turning point. Although the outbreak appears to be plateauing outside of Hubei province, the situation in Wuhan and Hubei may still be very difficult, and they write that the disruption to China’s economy is likely to continue in the short term. The two biggest keys to watch for according to our economists are: (1) How the virus spreads after the new round of travel post the elongated Chinese New Year and (2) How long it takes for production to get back to full capacity.

On central banks, we heard yesterday from ECB President Lagarde, who appeared before the European Parliament’s Economic and Monetary Affairs Committee. In her testimony, she highlighted the coronavirus, saying that the uncertainty from its impact was “a renewed source of concern”, and came as the Euro Area economy was showing “tentative signs of stabilisation”. Notably, she also explicitly warned of the ECB’s diminishing ability to respond to future negative shocks, saying that the “low interest rate and low inflation environment has significantly reduced the scope for the ECB and other central banks worldwide to ease monetary policy in the face of an economic downturn.” Her remarks came as we got more poor data from Germany, with factory orders surprising to the downside thanks to a -2.1% decline in December (vs. +0.6% expected). The reading brings the year-on-year decline to -8.7%, the lowest since September 2009. That said, data yesterday also showed the country’s construction PMI rising to 54.9 in January, its highest level since March.

The data from the US was somewhat better yesterday, with weekly initial jobless claims falling to 202k (vs. 215k expected), their lowest level since April, which also sent the 4-week moving average down to its lowest since April as well. We also got the preliminary nonfarm productivity data for Q4, which was up +1.4% qoq (vs. +1.6% expected), bouncing back from the first quarterly decline since 2015 in Q3. Though the reading was less than forecast, the full-year figure for 2019 was up +1.7%, the fastest increase since 2010.

Wrapping up now, and yesterday the new state premier of the German state of Thuringia stood down and called for fresh elections after one day in office. It follows an outcry after the FPD politician got the job thanks to the backing of both the CDU and the AfD, which marks the first time that the AfD have acted as kingmakers in Germany. While the story hasn’t had much of a market impact, it has roiled domestic German politics, where the major parties have all previously rejected any cooperation with the AfD. Chancellor Merkel said the vote yesterday, which also was supported by the CDU in the state, marked “a day that broke with the values and the convictions of the CDU”.

To the day ahead now, and as well as the aforementioned US jobs report, today’s data highlights include both Germany and France’s industrial production and current account balance for December, along with December retail sales from Italy. On the other side of the Atlantic, there’ll be Canada’s employment report, as well as the final US wholesale inventories figure for December. From central banks, the Fed will be releasing their semi-annual Monetary Policy Report to Congress, and we’ll also get a monetary policy decision from the Russian central bank. There isn’t much in the way of earnings today, though AbbVie is scheduled to report. Finally, ahead of New Hampshire’s primary on Tuesday, there’ll be a TV debate taking place there tonight between the Democratic candidates.

Tyler Durden

Fri, 02/07/2020 – 07:58

via ZeroHedge News https://ift.tt/2OvhTXF Tyler Durden