Here Is The Buying Panic: Fed Liquidity Flood Leads To Record Inflows Into Bonds, EMs And Tech

The world has never been as much of an Onion/Babylon Bee (insert as per your ideological preference) satire of itself, as it is now.

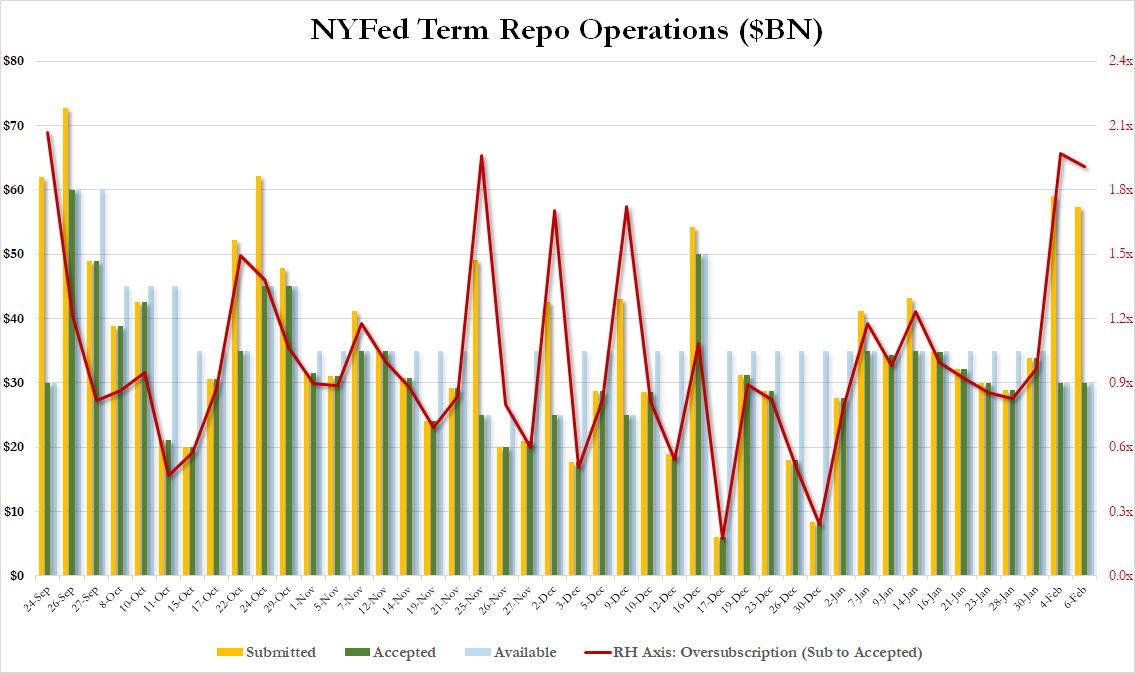

Earlier this morning, the Fed had the temerity to lament that “asset valuations are elevated” even as it hinted that as a result of the coronavirus pandemic, which presents a “new risk to the outlook“, it may ease further as if printing money can somehow vaccinate people against a deadly virus. Meanwhile, in response to the repo market crisis last September, which should have been long contained by now, and yet which just saw the two most oversubscribed term repo operations in months this week as dealers literally scrambled for liquidity just as the Fed trimmed the operation by a tiny $5 billion to $30 billion …

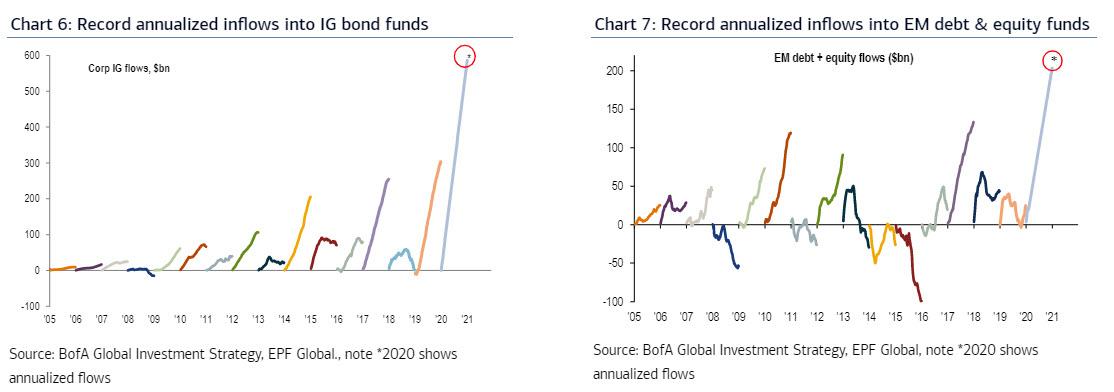

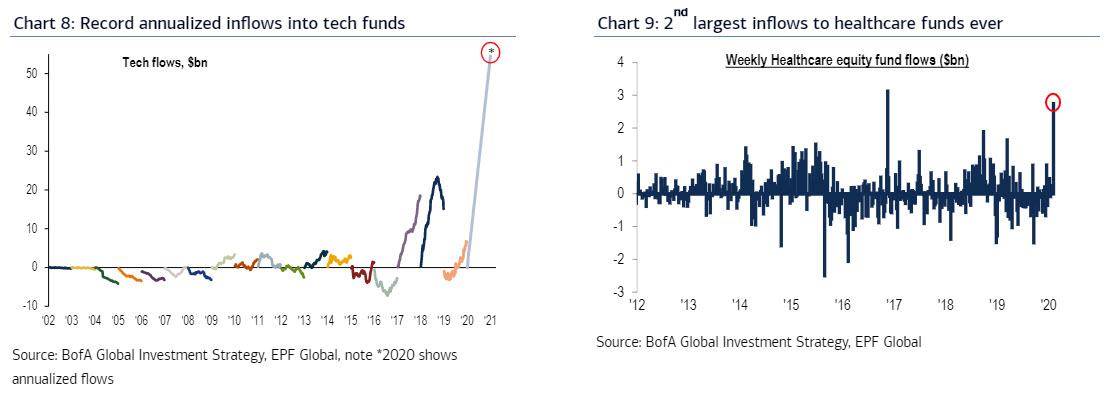

… the Fed’s balance sheet has exploded by half a trillion dollars in three months, and the result is an unprecedented meltup in stocks, which as BofA’s Michael Hartnett shows has resulted in unprecedented, gargantuan, record annualized inflows into everything from bonds, to EM debt, to tech stocks and even healthcare funds.

This is how Hartnett describes these massive flows:

- bond inflows $918bn (annualized vs. record $481bn 2019)

- IG bond inflow $587bn (annualized vs. record $308bn in ’19)

- EM debt & equity inflows $166bn (annualized vs. record $133bn in ’17)

- tech inflows $54bn (annualized vs. record $18bn in ’17).

And so, for all those still looking for confirmation of “buying frenzy” among the investing community and coming up short, here is Exhibit A… and B, C and D, starting with bonds and EMs…

… and tech and healthcare.

In short, for those who need evidence of both euphoria and a Fed-inflated bubble – which would include not only Jerome Powell and his merry FOMC men, but all members of Congress who will be asking Powell questions next week – the above 4 charts tell you all you need to know.

Tyler Durden

Fri, 02/07/2020 – 14:03

via ZeroHedge News https://ift.tt/2tHH5D8 Tyler Durden