Payrolls Revisions Wipe Out 520,000 Job Gains Under Trump

As we pointed out overnight, the big story in today’s jobs report would not be the January payrolls increase, which as we observed earlier was impressive, surging by 225K, well above the 165K consensus forecast, but the historical revisions to Payrolls data, which would be reduced by as much as half a million jobs as a result of the BLS’ recalibration of its business birth/death adjustment.

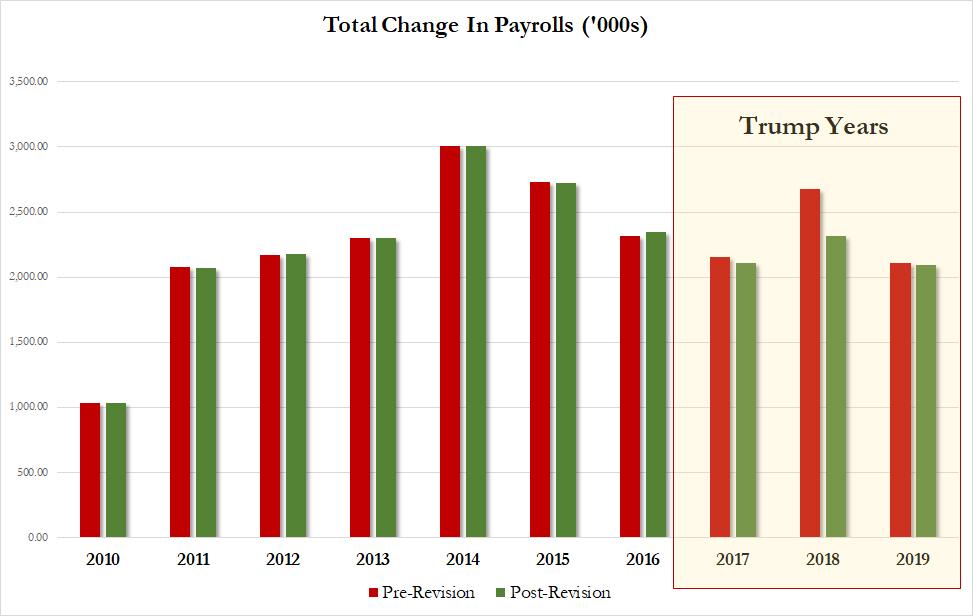

Sure enough, the reason why the market is in a risk-off mood and why yields are tumbling again, is because as expected, the payrolls revisions did indeed wipe out as many as 520K jobs in 2018 (as of April 2019), and the delta in December was a sizable and negative 422K, with 152.383 million pre-revision jobs contrasted to the 151.961 million post-revision.

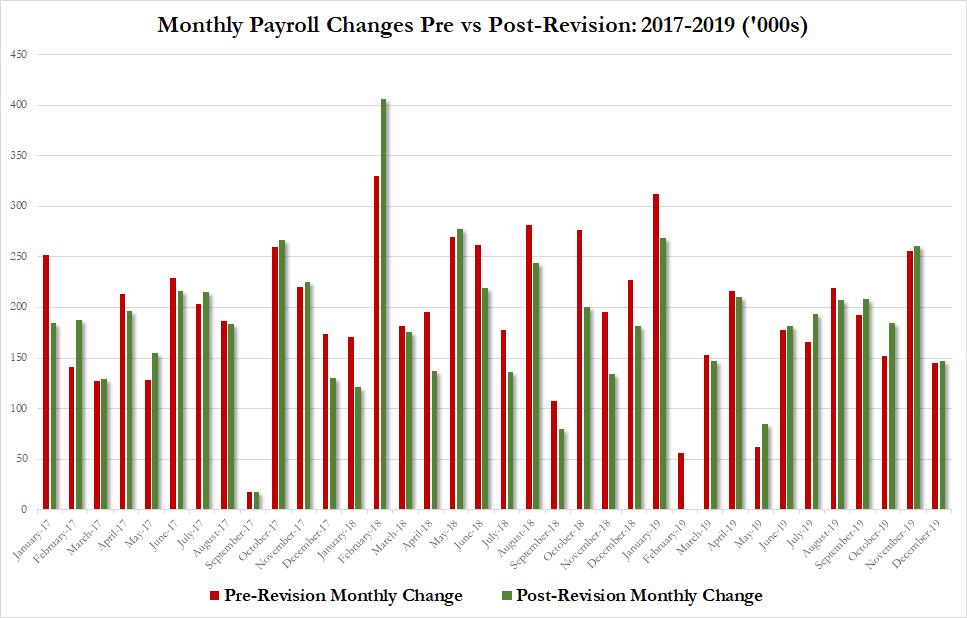

The chart below shows the change in monthly payrolls pre and post-benchmark revision, and there are two things to note here: i) the bulk of the downward revisions took place during 2018, which means that the Fed launched its tightening cycle and was hiking rates based on false payrolls information even as yields were sliding with the bond market sniffing out the underlying misreported payrolls weakness, and ii) the February 2019 payroll gain was revised to just 1,000 from 56,000… but it was still a positive 1,000, as a negative number would have broken the string of 112 consecutive positive monthly increase in payrolls.

The best way to visualize the substantial revision lower to payrolls is in the Y/Y jobs growth chart, which shows that instead of rising as much as 1.9% in late 2018 when the Fed was already set to reverse its monetary policy to dovish, jobs were in fact growing at a far slower pace annually; and after a tumultuous 2018 and 2019, the pre- and post-series have now converged to roughly 1.4% annual growth.

There was a silver lining: in contrast to the negative job revisions, the growth of average hourly earnings looked stronger reaching a peak of 3.5% yoy on February 2019 (up from 3.4% yoy previously) as fewer working hours helped boost earnings.

The BLS also incorporate population controls to its household survey which helped boost the labor force participation rate which consequently bumped up the unemployment rate to 3.6%.

On net, the biggest loser here is Trump, as the annual revisions took some of the shine off one of President Donald Trump’s bragging points, as Bloomberg put it, cutting 2018’s job gain to just 2.31 million from 2.68 million, while the increases in 2017 and 2019 were roughly unchanged at about 2.1 million, meaning that each year under Trump — while still strong — has been slightly slower than the 2.35 million increase in the final year of Barack Obama’s presidency.

Tyler Durden

Fri, 02/07/2020 – 10:15

via ZeroHedge News https://ift.tt/2H2xDx5 Tyler Durden