This Is How Americans Paid For That Record Holiday Spending: Credit Card Debt Exploded In December

There was something strange in last month’s consumer credit data from the Federal Reserve: at a time when Americans were getting ready to unleash a record holiday spending spree, revolving, i.e., credit card debt actually contract the most since March, which meant that either Americans were saving a whole lot more or their hourly incomes had soared higher. And since neither of these had happened, it wasn’t clear just how US consumers entered the last month of the year with the first November decline in revolving debt since 2013.

In fact, as we concluded our January post on consumer credit, “considering the strong end to the year for retail sales, especially online, we assume this was a one-off event, and in December any credit card “shrinkage” was more than offset with aggressive year-end “charging.” If not, then the US consumer may indeed be reaching the limits of their debt-funded spending euphoria.”

Well, we were right again: the answer was revealed on Friday afternoon when the Fed reported the consumer credit change for the last month of 2019, and of the decade… and it was a doozy.

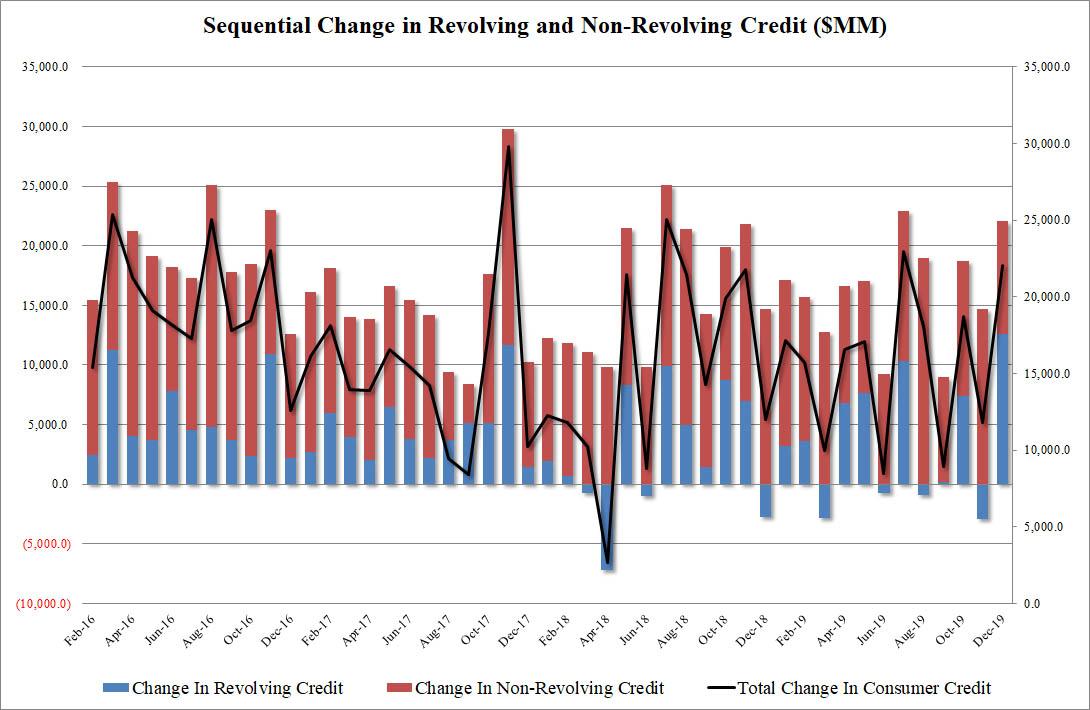

With analysts expecting a $15BN increase in consumer credit, the actual print was a whopping $22.1 billion, bringing total consumer credit outstanding to a new monthly all time high of $4.2 trillion.

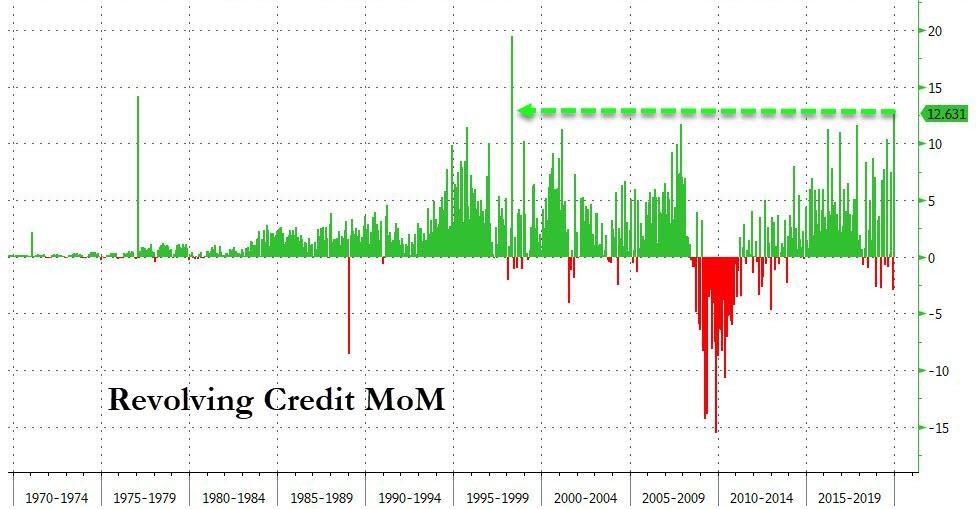

However it was the composition of this number that sparked raised eyebrows across Wall Street, because while consumers added a rather subdued $9.4bn in non-revolving credit, i.e., auto and student loans, it was the $12.63 billion surge in revolving credit that explained not only November’s modest drop in credit card debt, but the record holiday spending in 2019, which – as we now know – was to a record extent thanks to credit card debt. In fact, as the chart below shows, it was the biggest one month increase in credit card debt since 1998!

And so, for yet another month, Americans sank ever deeper in debt just so their obsession with purchasing things they don’t need nor cad afford – obviously – can be satisfied. Although in a world in which central banks and politicians now openly encourage excessive spending and living beyond one’s means, who can blame Americans for doing just as all monetary and fiscal officials demand of them…

Tyler Durden

Fri, 02/07/2020 – 17:05

via ZeroHedge News https://ift.tt/2H141Ai Tyler Durden