Distortion: Investors Are Un-Cautiously Optimistic

Once again they took all the pain away.

As NorthmanTrader.com’s Sven Henrich notes, what looked like the beginning of a larger market correction, amid renewed reductions in global growth outlooks, was again aborted in its tracks by renewed panic interventions by central banks, namely the PBOC which injected vast amounts of liquidity, cut rates and banned short selling as the Fed continued on its track of massive repo liquidity injections and continued treasury bill buying and voila: New market highs.

The net effect was so violent that the previous week’s sell-off was forgotten by Monday morning, by Tuesday $NDX made new highs again, by Wednesday $SPX made a new all time close highs and by Thursday $DJIA, $SPX and $NDX all made new all time highs with most of the market gains for the week driven by magic overnight gap ups and marked by tight intra-day ranges. Nothing matters or so it seems.

The liquidity wave continues to dominate the market action, yet the warning signs keep mounting, the distortions keep expanding in a market that is dominated by a handful of stocks that control the index price action via historically unprecedented market cap expansion while the broader market shows marked weakness beneath.

Yields again croaked, not confirming any notion of reflation with the 10 year closing at 1.58%, banks didn’t make new highs, neither did small caps, or transports, the laggers keep lagging.

A narrowing of leadership, vast price extensions above key moving averages, and negative divergences on new highs leading to a pullback below previous highs raising the possibility of a double top.

Are central banks and their interventions leading investors off a cliff I asked this week, as sentiment indicates desperation to buy every conceivable dip abandoning all sense of risk. Yet corporate insiders are selling strength and asset managers did not buy the rally to new highs, rather continued to reduce long exposure signaling that not all are in the ‘pile in at all cost’ camp.

Indeed Mohamed El-Erian, who previously urged investors to resist the temptation to buy this dip, put out another warning out on Friday:

In riding big liquidity-driven #markets, #investors should remember the surfer analogy:

The bigger the wave …

the greater the ride;

the more tempted you are to stay on;

the more uncertain the when and how it breaks; and

Only the best of surfers get off really smoothly.— Mohamed A. El-Erian (@elerianm) February 7, 2020

Confidence is high, as it is in every market bubble, confidence that investors all can get off the train in time. So far this confidence continues to be validated as markets are continuing to avoid any damage that the fundamental global economy would indicate while valuations remain historically stretched and central bank liquidity injections continue to control the price action.

Yet did this vertical surge in equity prices last week put in conditions for a larger sell-off still to come? Indeed did the rejection of new highs amid building negative divergences signal something more sinister? Or will the distortions in markets run unabated forever ignoring all risks?

For the technical market review please see the market video below:

Please be sure to watch it in HD for clarity. To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

* * *

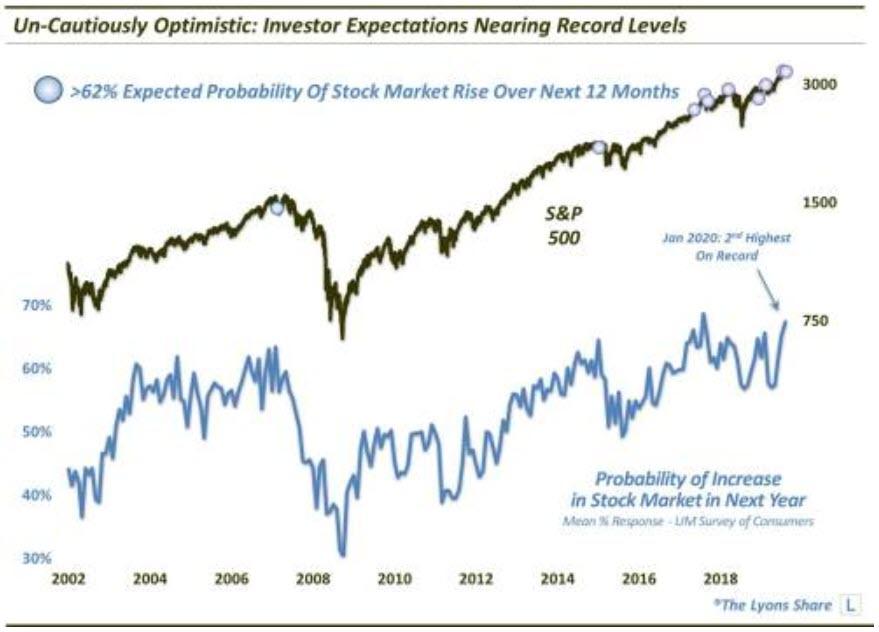

Additionally, as Dana Lyons details, investor expectations for stocks have almost never been this high.

Markets, it is said, like to climb a “wall of worry”. Of course, the theory is that an abundance of worry on the part of market participants suggests that there is ample money “on the sidelines” available to enter the market and perpetuate a rally. Such a condition was arguably present this past fall as stocks were nearing the end of a months-long consolidation. The prolonged sideways market action seemed to inflict investors with a healthy dose of skepticism and caution towards the prospects for stock. That caution helped fuel the subsequent breakout and extended run to new highs that continues today. That caution, however, does not continue today.

In the monthly University of Michigan Survey of Consumers, one of the questions asked of respondents is their estimation of the “probability of an increase in the stock market in the next year”. In January, the mean response to the question reached 65.6%. That is the 2nd highest level on record since the inception of the survey question in 2002 (only the reading at the intermediate-term top in January 2018 was higher, at 66.7%).

Of course the concern is that once expectations get too high, it may be a sign that most of the potential investable dollars are already in the market. Therefore, there may be relatively little fuel remaining to boost stock prices.

Looking historically at the survey, we see that in addition to elevated reading in early 2018, high readings were also observed in July 2007, June 2015 and late 2018. Obviously, those immediately preceded either cyclical or major intermediate-term tops.

So is the market on the verge of a significant top? Only time will tell. Prior extreme bullish readings in the UM survey certainly have had a consistent record of preceding rough patches in the market. With that being said, sentiment can be an imprecise timing tool. There is no reason why stocks can’t continue to rally in the face of extreme optimism — temporarily. However, such a rally at this point would occur without the benefit of the proverbial wall of worry.

Tyler Durden

Sat, 02/08/2020 – 15:30

via ZeroHedge News https://ift.tt/38c8LyY Tyler Durden