Morgan Stanley: Stocks Are Up Because The Worse Things Get, The More Likely We Will Get Fiscal Stimulus

Last week, Morgan Stanley’s Micheal Wilson, who now realizes that the only thing that matters in this market is the constant flood of cheap liquidity from central banks, tried to provide a “thoughtful “analysis for where he thought strong support for the S&P 500 would emerge given the modest one-day selloff observed on the prior week’s end.

Fast forward to today when Wilson writes that “that analysis turned out to be needless as the bull charged straight ahead without hesitation, never challenging our 3100-3150 support level.” So in order to not merely repeat what he had said last month, Wilson listed the five reasons he thinks contributed to the shallowness (3.5%) of the drop in the S&P 500, which is once again on the verge of hitting new all time highs driven entirely by tech/growth and momentum stocks, as traders have now put the coronavirus pandemic firmly in the “it’s contained” box.

First and foremost, is the 180 degree U-turn in consensus thinking about the driver behind risk assets. As a reminder, at the start of the year, conventional wisdom was that stocks would rise thanks to the ongoing rebound in the global economy. Well, here we are, and even if China contained the coronavirus disruption today, the world is still facing the biggest one quarter hit to GDP growth since the financial crisis. Which, apparently, is now the good news, because traders – ever so flexibly in their ideology, now equate a sharp economic slowdown with even more stimulus (and who can blame them: after all, the Fed and the world’s central banks have shown they are always willing to step in at the smallest sign of trouble).

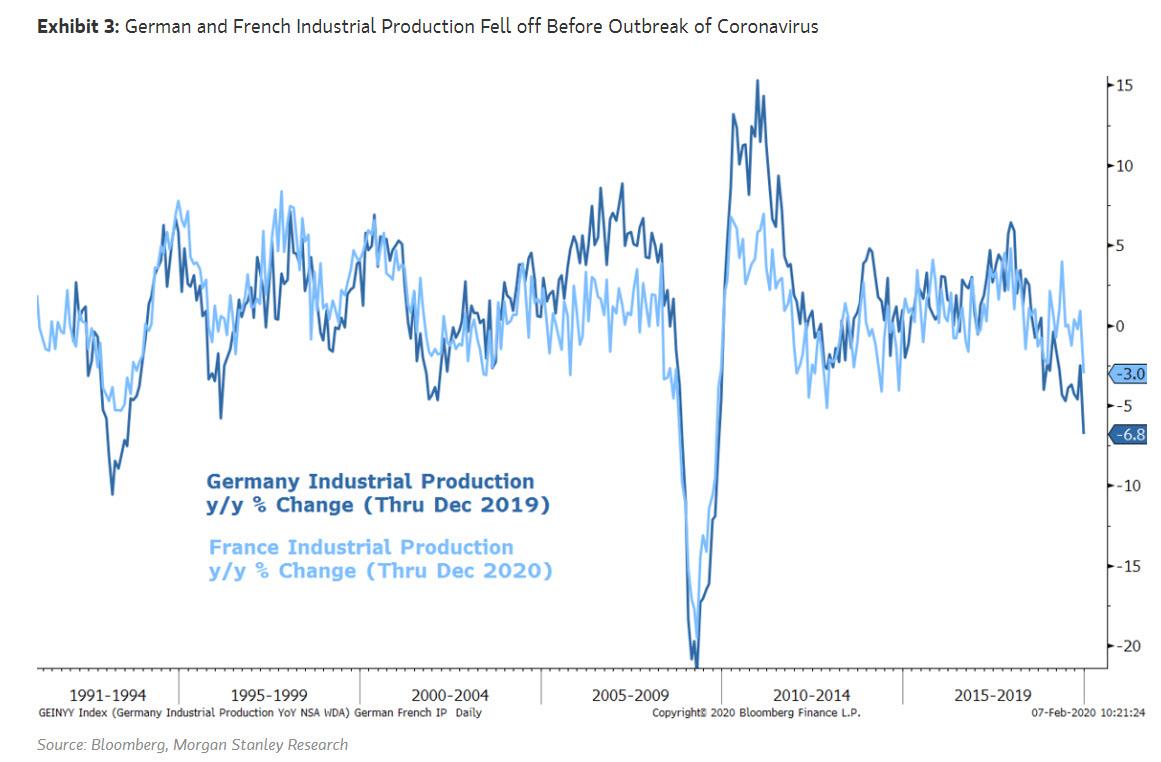

Indeed, as Wilson put it, there is now “a growing view that the worse the economy gets, the more likely we will get fiscal stimulus from China and perhaps Europe and Japan given how tied they are to China’s economy.” The strategist highlights that the latest German and French Industrial Production numbers for December were “extremely disappointing” and very inconsistent with the global recovery signaled by the PMIs, especially considering these data reflect what was happening before the outbreak of the coronavirus.

And yet, both the German Dax and French CAC barely sold off on Friday, completely oblivious to any fundamental newsflow, and instead “suggesting investors may be thinking a fiscal response is now more likely and looking through it.”

In short, in the span of just 40 days we have gone from “buy stocks because good news”, to “buy stocks because bad news.“

Besides hope for a massive fiscal stimulus that will be launched if the global economy implodes, Wilson lists four other factors that prompted the aggressive BTFD response in the market:

- First, data from China’s National Health Commission suggested that the pace of infection has slowed: “This alleviated some fears going into the prior weekend on the pace of the virus’s spread. The rate of change matters for markets, especially when they were starting to price a further acceleration.” Last Friday, some concern returned about the lack of further deceleration in new cases among other things but failed to significantly dent the major US averages.

- Second, while the correction was virtually non-existent for the S&P 500 at just 3.5% but it was much more severe for stocks and assets geared to global growth, especially China. As Wilson, who has been pushing the cyclicals over defensives and value over growth themes in recent weeks, said, “given already weak performance of such assets, they are now discounting a fairly negative outcome given the fact many of these measures are back to where they traded last summer when recession fears were prominent.“

- Third, MS notes that some investors believe the likelihood of major policy changes following the US election went down last week: “Our view has been that major changes will likely require a unified government with larger potential changes needing leadership from the executive branch. Last week we saw an acquittal of President Trump and Iowa results that obfuscated the ultimate direction of the Democratic primary. On the margin, investors may think this reduces the probability for major changes.”

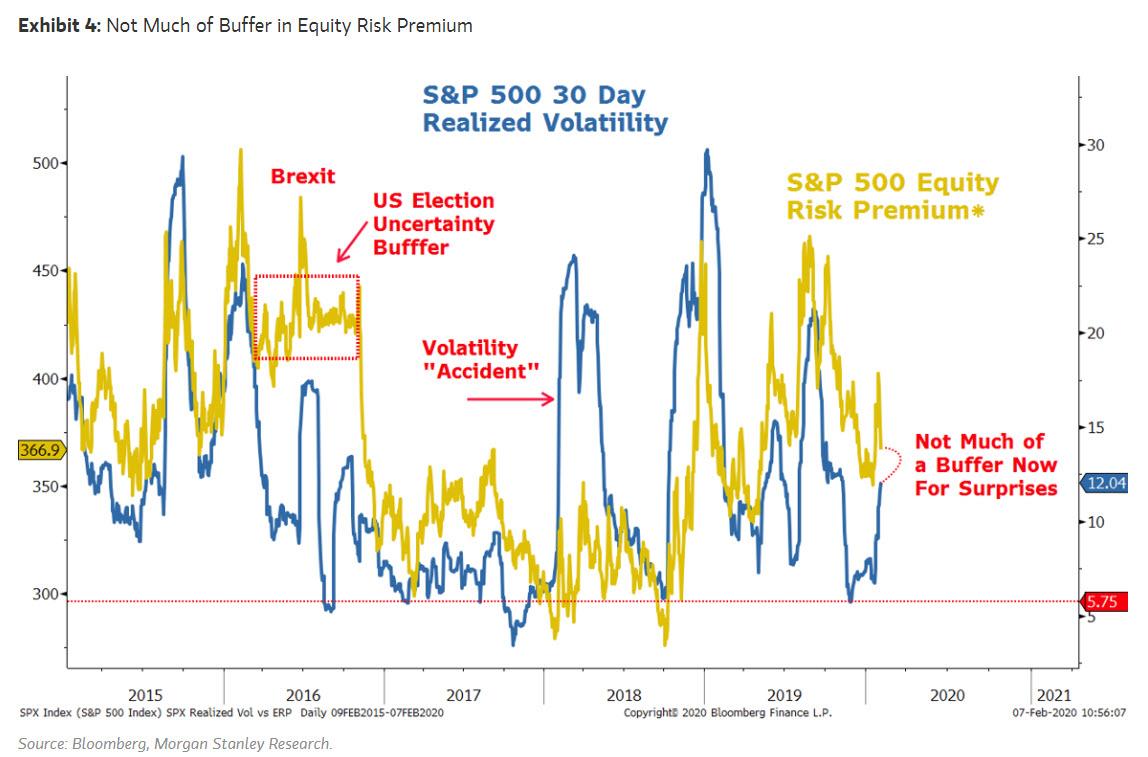

- Fourth, Wilson writes that the S&P 500 is often viewed as a safe haven itself because of its high quality defensive growth characteristics: “In short, it is the appropriate asset to own if rates continue to fall so long as we don’t have a recession.” As a result, whenever 400bps on the equity risk premium is breached to the upside, there has been a strong bid, as Wilson shows in the chart below. And indeed, two Fridays ago, when the markets had their big one day sell off, “the Equity Risk Premium reached 402bps which attracted capital like a magnet.”

The flipside is that since then, the equity risk premium has fallen sharply for the S&P 500 and, while not yet back to the lows reached in early January, realized equity volatility has spiked too, “leaving very little buffer for additional shocks at this point” according to Wilson, who adds that “this suggests further gains from here will require this gap to completely close or equity realized volatility needs to fall back first.”

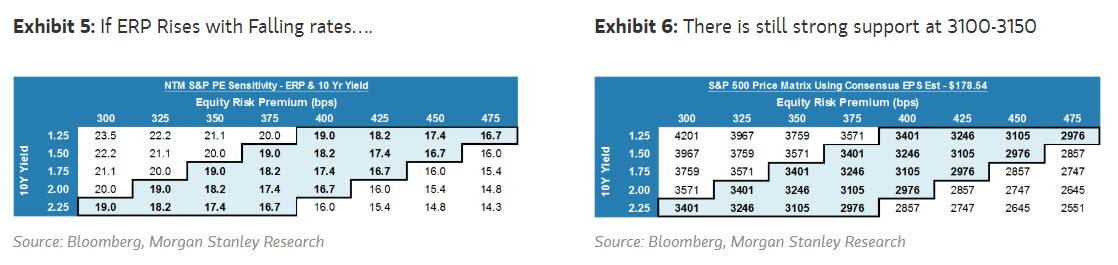

So going back to Wilson’s analysis from last week, the strategist concludes that there is “strong support at 3100-3150 should markets start to have increased concerns about the coronavirus or other risks.”

Our ERP matrix (Exhibit 5), shows that with rates falling again (we think new all time lows are likely) the S&P 500 has strong support at 3100-3150 even if Equity Risk premium breaches 400. Using 1.25% or 1.50% on a 10 year Treasury yield, the Equity Risk Premium could rise as high as 450 or 425bps, respectively and find support at 3100. The bottom line is that we still see a first half 2020 range of 3100-3500 for the S&P 500 with upside to 3500.

The take home message: once upon a time, about ten years ago, we used to joke that either World War III or the apocalypse would be sufficient to send the S&P limit up. Now, after almost $20 trillion in liquidity injections by central banks and monetary intervention any time there is even a 5% drop in stocks, it is no longer a joke.

Tyler Durden

Mon, 02/10/2020 – 16:25

via ZeroHedge News https://ift.tt/2SAYYvE Tyler Durden