Blistering Demand For Stellar 10Y Auction As Yield Tumbles

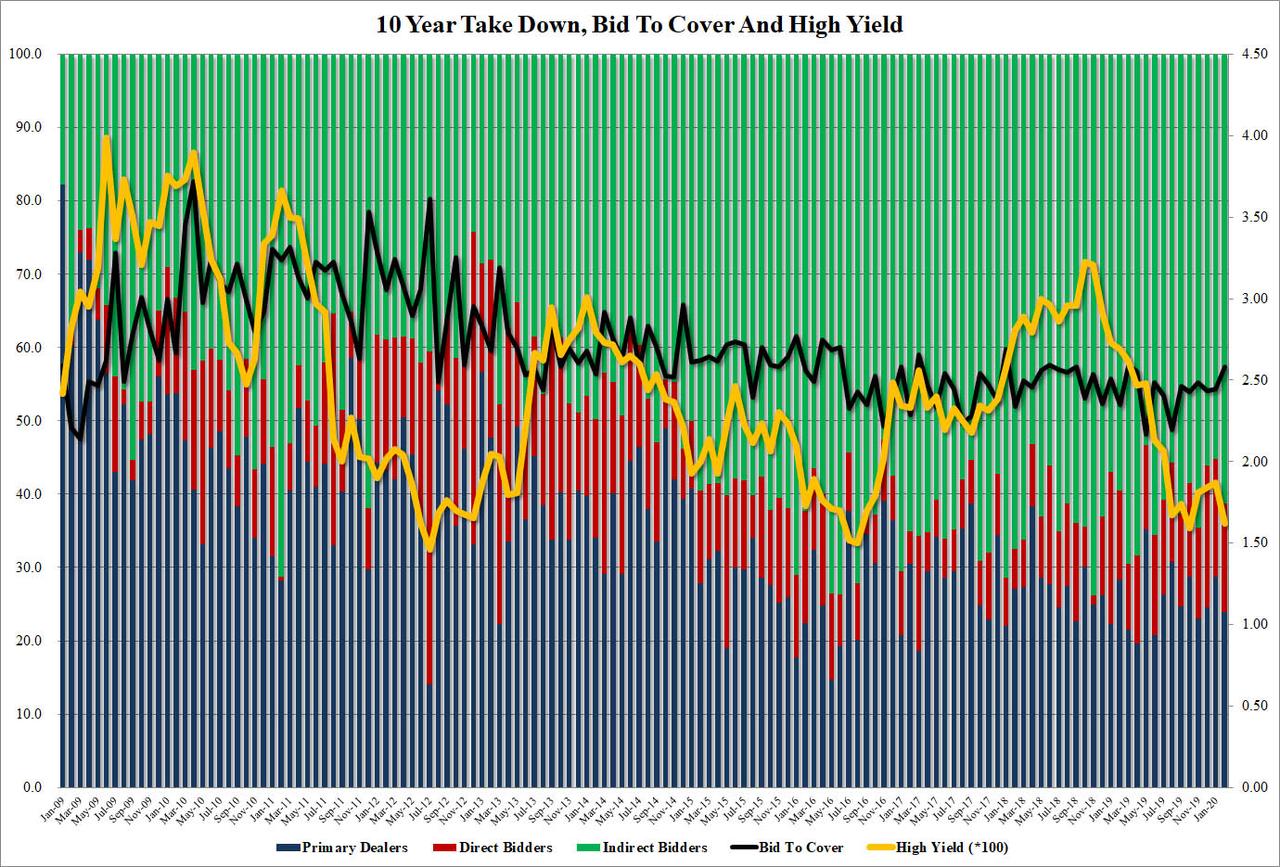

After yesterday’s solid but tailing 3Y auction, moments ago the US Treasury sold $27BN in 10Y notes at a sharply lower yield compared to January: stopping out at 1.622%, today’s 10Y issuance stopped through the 1.623% When Issued, and was almost 25bps lower than January’s 1.8690%; it was also the lowest yield since the October recession scare when the 10Y priced at 1.59%.

The internals were even more impressive: the bid to cover of 2.58 was not only far above last month’s 2.45, but also the highest since June 2018.

Completing the picture, Indirects jumped to 61.3% from 55.2%, and well above the 58.8 in December. And with Directs dipping slightly to 14.8% from 16.1% and in line with the recent average, that left 23.9% for Dealers, several points below the 26.7% six auction average.

In short, anyone concerned that primary market demand for US paper would drop as yields declined, can put such fears on hiatus for at least the next 9-12 months, by which point the first hint of what MMT in the US will look like should begin to unleash chaos within the US bond market.

Tyler Durden

Wed, 02/12/2020 – 13:16

via ZeroHedge News https://ift.tt/2OP3TZ3 Tyler Durden