Chinese Dealmaking And IPOs Freeze Amid Virus Outbreak

Investment bankers and M&A lawyers told the Financial Times that the number of acquisitions and IPOs in China has plummeted since the virus outbreak began in early January.

One Hong Kong-based banker at a European bank said coronavirus has “taken the wind out of the sails” of the M&A industry across Asia after a “very bullish start to the year.”

Dealogic data shows the number of M&A deals during China’s lunar new year holiday, involving Chinese firms, has plunged by 33% for the period over the last year. Total deal value for the period collapsed by 70% to $18 billion.

Another banker from a top international investment bank in Hong Kong said all dealmaking in the region involving China has stopped.

Two-thirds of China’s economy has effectively shut down. At least 400 million people remain in quarantine, and dozens of cities, some larger than NYC, remain closed. Top manufacturing hubs across the country are at a standstill. This has made it near impossible for bankers to travel to firms for face-to-face meetings.

“Everybody is putting on a brave face, but you can’t have meetings, you can’t go to China and you can’t get out of China,” the banker said. He said it could be several months before transportation networks reopen that would allow his team to begin evaluating Chinese assets on site.

Dealogic data showed IPO activity in China stalled after the virus outbreak gained momentum by mid-month. Most of the deals were priced in early January.

“A number of IPOs, including one or two biotechs, have been affected by this in terms of rethinking timelines,” said a Hong Kong-based banker. “I think you’ll start to see some of the bigger IPOs, including Megvii get hit if this continues.”

Megvii is China’s top artificial intelligence start-up looking to raise $500 million for a new listing. The complicated situation in China has likely pushed the company’s IPO to the 2H20 timeframe.

The overall theme with bankers and lawyers is that M&A and IPO activity will bounce back once the virus has run its course. The only problem is timing. Nobody has a clue.

“These things have a way of correcting [themselves] very quickly,” said a top IPO lawyer based in Hong Kong. “You pick up where you let off, you update [financial statements] and you move forward.”

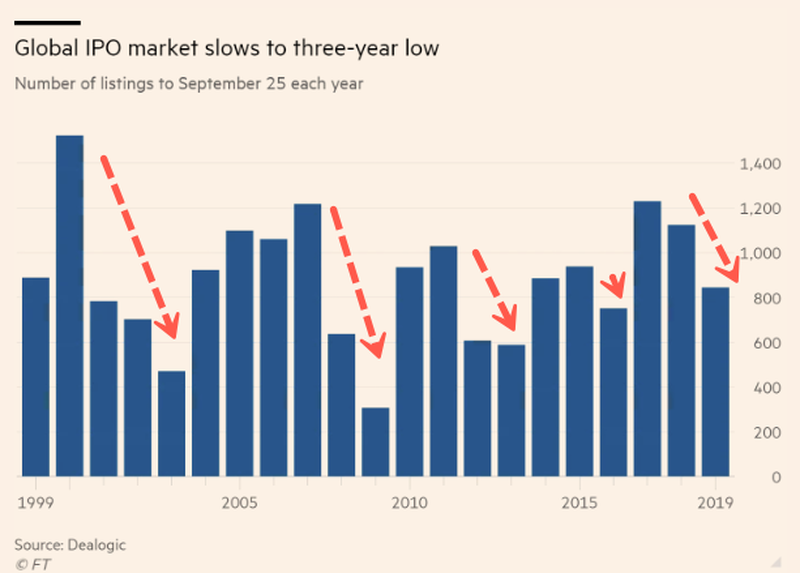

Even before the virus dented dealmaking in China, the global IPO and M&A markets turned down in Sept. 2019, as a synchronized global slowdown became more profound.

We noted last year that the window to IPO companies across the world was “rapidly closing as a global trade recession is imminent.” The economic paralysis brought about by the coronavirus in China could be the “shock” that tilts the world into below-trend growth.

Tyler Durden

Tue, 02/11/2020 – 23:45

via ZeroHedge News https://ift.tt/2vouG7t Tyler Durden