Oil Algos Confused After Huge Crude Build, Record Production, & OPEC Demand Cut

Having briefly dropped back below $50 after API reported a significantly bigger than expected crude inventory build, WTI has roared higher this morning on ever-optimistic hopes that Covid-19’s impact has peaked and utterly disregarding OPEC’s slashing of its oil demand outlook for 2020.

“Risk sentiment is dominating the market and probably helping oil prices today,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich.

“It seems the market thinks the worst is over, though time will tell.”

But, we suspect that mysterious ramp will disappear fast if official EIA data confirms API’s big builds…

API

-

Crude +6.0mm (+3.0mm exp)

-

Cushing +1.3mm (+2.3mm exp)

-

Gasoline +1.1mm (+500k exp)

-

Distillates -2.3mm (-600k exp)

DOE

-

Crude (+3.0mm exp)

-

Cushing (+2.3mm exp)

-

Gasoline (+500k exp)

-

Distillates (-600k exp)

Analysts expected another crude build in the last week (the third in a row) and DOE did not disappoint with a huge 7.459mm crude build – the most since the start of November…

Source: Bloomberg

Bloomberg Intelligence’s Senior Energy Analyst Vince Piazza warns:

“An expected build in inventories affirms concerns about demand destruction. Effects of the coronavirus are transitory, but we think fears of slowing economic growth will linger in 2020 even if U.S. production decelerates, as we anticipate.”

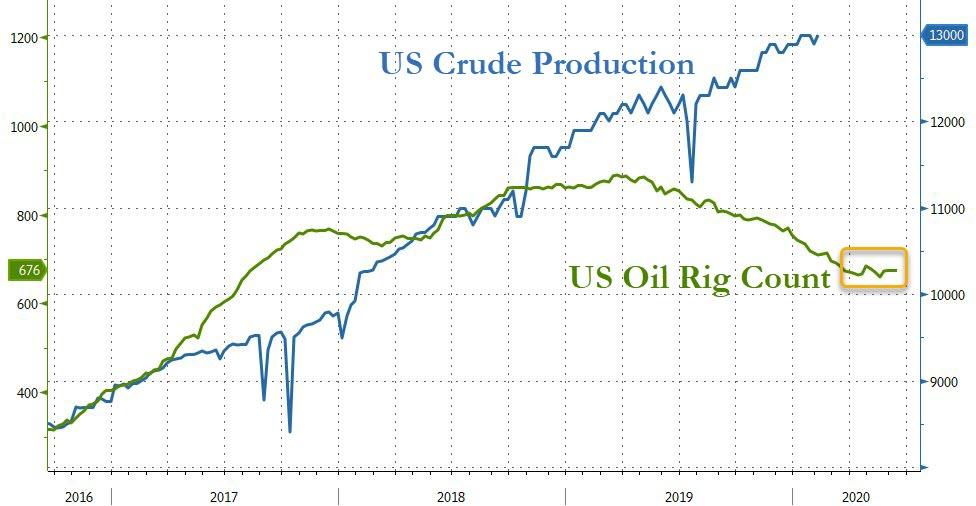

US Crude production refuses to back down…

Source: Bloomberg

WTI traded above $51.50 ahead of the DOE print (dramatically higher than the sub-$50 level after last night’s API data, but barely dropped on the huge build and record production…

As Bloomberg reports, prices have also drawn some support from signals that OPEC and its partners may intervene to shore up the market.

Russian Energy Minister Alexander Novak is meeting with the nation’s oil companies after technical experts from the Organization of Petroleum Exporting Countries and allies proposed last week that the coalition cut production further. Russia is “studying” the recommendation that the 23-nation alliance reduce supplies by an additional 600,000 barrels a day, on top of cutbacks already in progress.

OPEC said in a monthly report it slashed its estimate for demand growth in the first quarter by 440,000 barrels a day, or about a third, because of the virus’s impact.

Saudi Arabia has been leading the push for more production curbs, while Russia, whose budget is more resilient to lower oil prices, is proceeding with caution.

Tyler Durden

Wed, 02/12/2020 – 10:34

via ZeroHedge News https://ift.tt/39uLQPD Tyler Durden