Popeye’s Chicken Sandwich Propels Restaurant Brands To Massive 34% Q4 Comps, Destroying Estimates Of 15%

We have covered the “chicken sandwich wars” that have been unfolding between Chick-Fil-A and Popeye’s over the last 12 months closely…

…from the drive-thru brawls…

…to the murders…

…to the stress on the chicken supply chain…

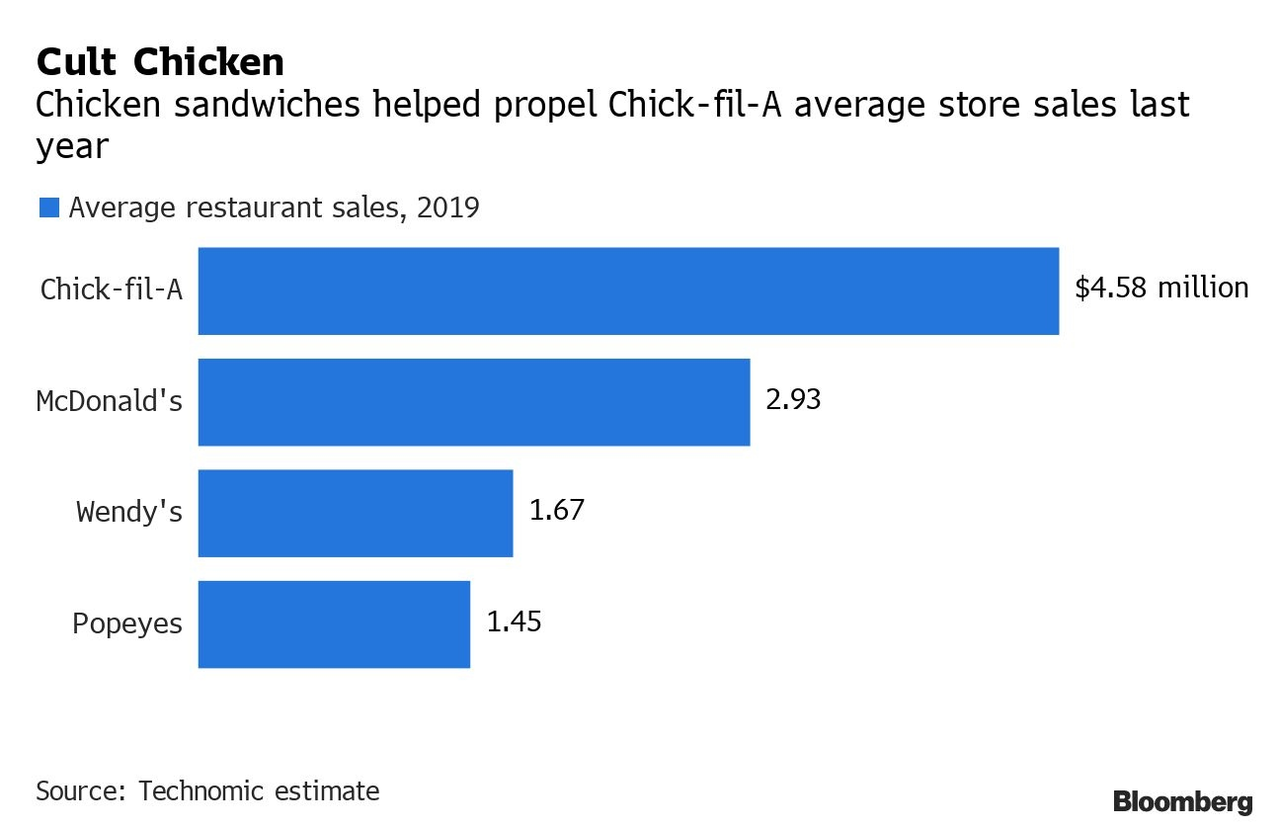

…there is no doubt the chicken sandwich has grown in importance for fast food restaurants and has grown in popularity with customers. Now, based on Restaurant Brands Q4 numbers, we’re starting to get an idea of why one little sandwich has become so damn important.

Restaurant Brands reported same store sales for the quarter of 34%, blowing out the 15% estimates that analysts had predicted. The chicken sandwich that the restaurant brought back to its menu, that it had sold out of over last summer, was the reason, according to Bloomberg.

CEO Jose Cil said: “The chicken sandwich has proven to be a game changer for the brand in every way.”

Restaurant Brands also owns Burger King and Tim Hortons. Burger King saw their same store sales rise 2.8%, but that fell short of the 3.4% growth estimates. Burger King’s success has also been attributed to new menu items, like the Impossible Whopper. Burger King plans on expanding its line of “Impossible” products further this year.

Tim Hortons, on the other hand, continues to struggle in Canada. It has failed to pull in diners with new menu items, like lunch offerings and cod coffees. Its comps fells 4.3% last quarter, more than analysts expected.

And even amidst growing chicken sandwich competition (McDonald’s is looking to enter the fray to compete with Popeye’s and Chick-Fil-A soon), Popeye’s has plans to grow in China. CEO Cil said there is “massive potential” in Asia for the brand (and, we’re guessing, also for the novel idea of actually cooking your chicken before you eat it).

Of course, those plans also may need to be put on hold for a little while while this tiny little pandemic plays out. Citigroup says it’s “too early” to say what impact the virus will have on Restaurant Brands’ business. Burger King China accounted for just 2% of systemwide sales in 2019.

Cil says the immediate focus is on the health of its partners and customers. McDonald’s and Yum have closed locations in China.

But hey, maybe the virus is nothing a little chicken sandwich can’t fix – it’s solving the rest of Restaurant Brands’ problems, after all.

Tyler Durden

Tue, 02/11/2020 – 21:45

via ZeroHedge News https://ift.tt/38kNjaX Tyler Durden