Kolanovic: The Tech Bubble Is Driven By Central Banks And Will Collapse; “This Time Is Not Different”

Having been a must-read voice of contrarian originality and market structure insight especially in the arcane realm of quant finance and derivatives for much of 2013-2016, about 3 years ago something flipped and JPM’s head quant, Marko Kolanovic abandoned his traditional skeptical perch and became ideologically aligned with the pro-central bank cabal of Fed apologists who refuse to see any signs of an asset bubble, claim the Fed can do no wrong, and generally mock anyone who warns that the injection of nearly $20 trillion in liquidity into the stock market will have a very unhappy ending. Kolanovic’s bizarre reversal went so far as to calling sites, such as this one, “fake news” as he continued to push for a bullish outcome to the debacle that was Q4 2018, if for all the wrong reasons (as this site explained repeatedly). In fact, Kolanovic’s forced transformation resulted in in-house confrontations with other JPM quants such as Nick Panigirtzoglou.

Well, in a world devoid of any logic or sense, some normality could have finally returned today when in his latest market commentary note, the real Kolanovic may be finally bacl, calling the market, or rather it best performing strategy – the low-vol/growth/momentum factor which is really just a fancy name for the handful of market-leading tech stocks- for what it is, namely one overinflated asset bubble, made possible by “central banks pushing global yields into negative territory (propping up defensive and secular growth/tech bond proxies), growth of passive indexation and momentum strategies (pushing assets into momentum, mega caps and low volatility stocks) as well as flows based on simplistic ESG schemes that just exponentiate the same crowding trends (e.g. very high correlation of ESG with low volatility, large size and momentum scores as well as sector concentration in tech).”

That said, there may have been an ulterior motive behind Kolanovic’s transformation: after all it was last July when the JPM quant said value stocks were a “once in a decade” buying opportunity, and that traders should bet on a convergence between value and low-vol (aka growth) stocks.

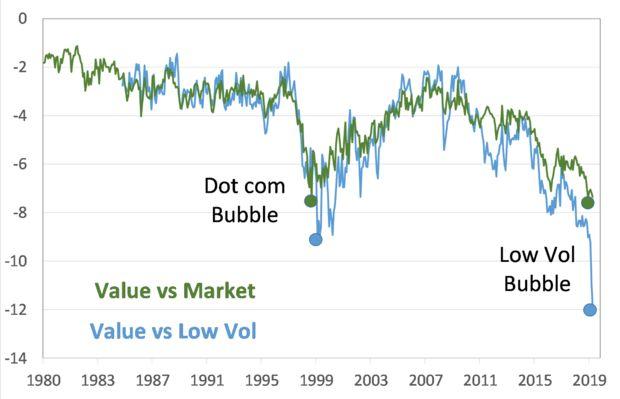

“While there is a secular trend of value becoming cheaper and low-volatility stocks becoming more expensive due to secular decline in yields, the nearly vertical move the last few months is not sustainable,” Kolanovic argued in a July 2019 research note. “The bubble of low volatility stocks versus value stocks is now more significant than any relative valuation bubble the equity market experienced in modern history.”

To justify his case, Kolanovic showed the following chart (which will reappear in an updated format later in this post)…

… and claimed that the stabilization of economic data and progress in the U.S.-China trade war could be the catalyst that triggers this long-overdue convergence. “This rotation would push significantly higher all the laggards such as small caps, oil and gas, materials, and more broadly stocks with low P/E and P/B ratios.”

Well something funny happened when the trade war finally ended in January and economic data stabilized at the end of 2019. Nothing.

Indeed, after a very brief period in which value stocks did modestly outperform which was triggered by the great value-growth quant reversal in early September, the divergence not only resumed but as stocks hit all time highs, they were led by just a handful of tech – i.e., low-vol, growth and momentum – names, and the result has been a divergence between growth and value the likes of which have never been seen before.

In short, Kolanovic may have picked the right catalysts, but had the absolutely worst possible trade to go along with them, and the result has been a -20% loss for anyone who held on to the long value-short low vol/momentum convergence trade in just the first two months of 2020!

This outcome – which one can describe as a “once in a decade” loss – may have also prompted some very angry comments from JPM clients, and led to today’s note, in which Kolanovic, no longer pretending to be JPMorgan’s “good quant cop”, penned an angry rant in which he slams not only the ridiculous, disconnected from all fundamentals market leadership but also goes after those responsible (which apparently also includes the coronavirus). To wit:

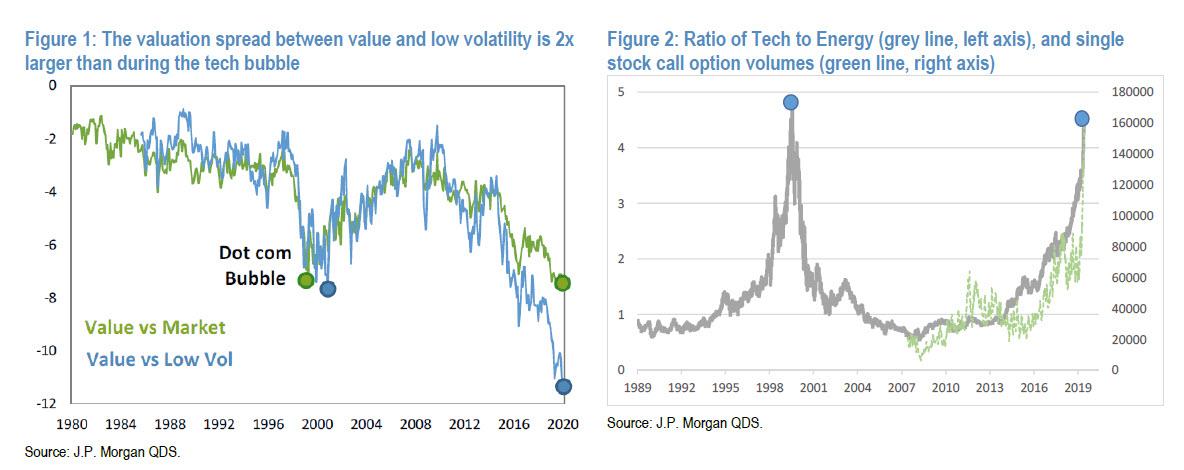

Our view that cyclical and value assets should rally in the first quarter was set back by the COVID-19 epidemic. Instead, bonds, momentum stocks, and low volatility stocks rallied – pushing the valuation spread between defensive and cyclical stocks to a level 2x worse than during the peak of the late-‘90s tech bubble.

And here again, Kolanovic reposts the same chart he used last July to demonstrate the ridiculous factor divergence, which has now reached even more ridiculous levels. In fact, the last time tech vs value was so stretched was just before the tech bubble peaked.

Commenting on the charts above, Kolanovic says is that “the bubble we are describing is expressed in equity factors (sector-neutral momentum and low volatility factors), however signs of this bubble can be seen in sectors’ performance as well.” A bubble which the Croatian quant compares to events during the dot com bubble to get a sense of the prevailing market exuberance:

For instance, the ratio of the S&P 500 technology to energy sector is now the same as during the tech bubble.

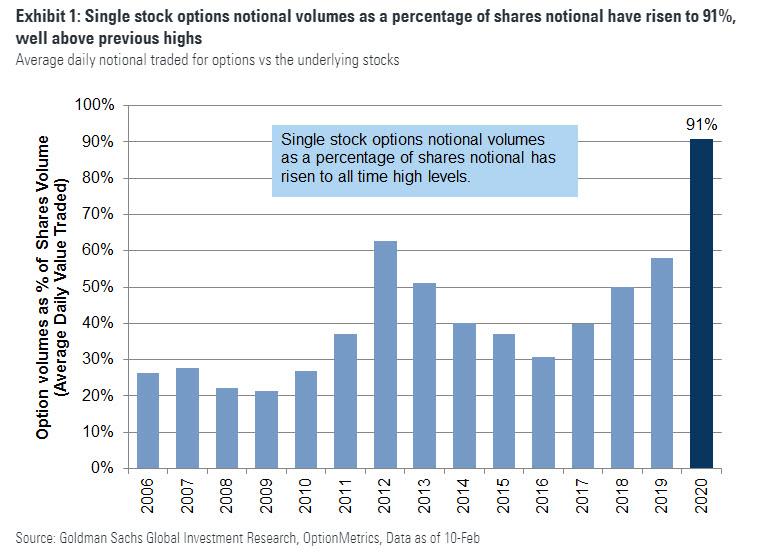

He then goes on to note what we pointed out last week, namely that signs that “certain segments of tech are trading at unsustainable valuations are supported by the record level of speculative call option activity and outsized gains in certain tech stocks (Figure 2).” Sound familiar? This is precisely what we wrote one week ago in “Frenzied Traders Send Option Volumes To All Time High; Go All-In Tesla, Tech Calls“

So back to Kolanovic who next asks, rhetorically “how was this factor bubble inflated”, and answers:

While this could be a topic for another report (or a book), in short it was driven by central banks pushing global yields into negative territory (propping up defensive and secular growth/tech bond proxies), growth of passive indexation and momentum strategies (pushing assets into momentum, mega caps and low volatility stocks) as well as flows based on simplistic ESG schemes that just exponentiate the same crowding trends (e.g. very high correlation of ESG with low volatility, large size and momentum scores as well as sector concentration in tech).

If this list sounds oddly familiar, it’s because this website, which Kolanovic in late 2018 called “fake news“, has repeatedly and constantly pounded the table on as the only factors, pardon the pun, that matter in a market that no longer has any relationship to fundamental drivers as a result of floating in an ocean of excess liquidity.

So what about Kolanovic’s favorite value stocks?

Value stocks are typically on the other side of all of these trends that inflated this bubble. We caution investors that this bubble will likely collapse, i.e. this time is not ‘different’, with valuations reverting closer to 2010-2020 average.

Yes, Marko, we agree that you will be right eventually on being long value, but not before the central banks, whose blatant and direct intervention in markets for the past 3 years you ignored or merely mocked those who pointed it out (despite it now being abundantly clear as shown in “Here It Is: One Bank Finally Explains How The Fed’s Balance Sheet Expansion Pushes Stocks Higher“) decide you should be right. And as the past 11 years have shown, that can take a long, long time.

Or maybe not and Kolanovic will have the final laugh. Because instead of capitulating, Kolanovic is once again doubling (or is that tripling down) on the value-lowvol convergence trade, which he now sees as being catalyzed not by the end of the trade war (which for all intents and purposes is over, even if there has been absolutely no change in trade flows between the US and China), but by the fading of the coronavirus pandemic.

In January, hedge funds’ allocation to momentum stocks reached all-time highs (Figure 3 below shows the percentile of factor beta based on HFRX data). Over the last few weeks, funds started to shift their allocation away from momentum and into defensive low volatility exposure which now also has a record allocation. Surprisingly, funds increased exposure to value stocks from low levels (Figure 3). Perhaps some market participants realize that the value rally can happen quickly if the virus epidemic subsides, and are starting to position for reversion. A key question is what will mark the inflection point when bond yields move higher and factors snap back. We think it will be containment of the epidemic and broader reopening of businesses in China.

Yes, well, as we noted earlier, don’t hold your breath on that. But in any case, yes, China (eventually) rebooting its economy would likely be a notable event, and one which if Kolanovic is right, could trigger a bigger quant storm than the one observed last September:

Given extreme positioning, and various monetary and fiscal stimulative measures employed or in the pipeline, the snap-back could be more significant than last September’s event.

In theory: yes, of course. In practice: what will likely happen is a continuation of the absolutely ridiculous move higher in tech names which are no longer moving on fundamentals, but on the hundreds of billions in liquidity injected by the Fed since the start of QE4. What we find odd is that not even once does Kolanovic even consider this alternative, and instead is betting it all one just one event: China’s return to normalcy, which he even goes so far as to put on the calendar as taking place “within 1-2 weeks”.

Given the severity of the outbreak, the market may wait to see not just a decline in the absolute number of cases, but a significant pick up in datasets capturing real-time economic activity. Our base case is that this would happen within 1-2 weeks.

So for all those who got crushed buying the “once in a decade” value-lowvol convergence, Kolanovic has some words of encouragement: hang in there, cause he will eventually be right, even though as he himself admits, he has absolutely no better visibility into what is going on in China than anyone else, demonstrating just how great the dangers of getting wed to a given trade can be, especially when trading without a stop loss threshold:

We reiterate our call to sell out of defensive assets and rotate into cyclical assets such as value stocks, commodity stocks and EM. Risks to our base case include the potential for new epicenters of the disease and reacceleration of new cases. Most investors are not even trying to forecast various scenarios, but rather look to bond yields for an ‘all-clear’ signal for rotation and rerisking. In various discussions, clients indicated that 10Y bond yields reaching 1.75% would be a signal to sell momentum, sell tech (secular growth) and defensives, and rotate into cyclicals and value.

We’ll check back in three weeks – when as JPM’s “base case” says predicts the Chinese chaos should be over – to see if maybe this time Kolanovic was finally correct.

Tyler Durden

Wed, 02/19/2020 – 18:05

via ZeroHedge News https://ift.tt/3bPDzYt Tyler Durden