Goldman: Imminent Market Correction Now Looks Much More Probable

One thing is for sure, the coronavirus has been a boon for stock market investors. The biggest global viral killer in decades has left tech stocks around the world up 5-10% (China’s ChiNext +11% since the start of the outbreak)…

…and while multiples have expanded dramatically as earnings expectations have dumped for the Dow (even before the virus impact)…

And this total decoupling between fun-durr-mentals and prices has started to make even the most sanguine bankers nervous (even The Fed and ECB have actually noticed). But it is Goldman Sachs’ Peter Oppenheimer that raises the red flag warning that:

1) The earnings impact of the virus is significantly underestimated; and

2) Relying on low bond yields as an excuse for higher multiples is losing its narrative control.

As Oppenheimer notes, investors have largely taken the view that the impact will be temporary, hopefully short-lived, and that most of the weakness should be reversed with a strong rebound in the quarters that follow. This reaction is understandable given the ‘playbook’ from other incidents of viral infections; comparisons are inevitably made with SARS in 2003. Then, as on other occasions, the initial response was a hit to equity markets and a fall in bond yields. The equity market reaction typically turned positive again when the rate of new infections started to slow. Thereafter, bond yields have tended to stay at lower levels for longer, thereby offering some support to equity valuations. In this sense investors have reflected a perceived incentive to act early given the well-publicized historical for longer, thereby offering some support to equity valuations. In this sense investors have reflected a perceived incentive to act early given the well-publicized historical have reflected a perceived incentive to act early given the well-publicized historical record of +20-30% post-trough performance over 3-6m in five previous virus outbreak episodes.

But, the Goldman strategist notes, this time is different… for a number of reasons.

First, the relentless rise in financial asset returns based on higher valuations is unlikely to be sustained on the back of lower interest rates alone.

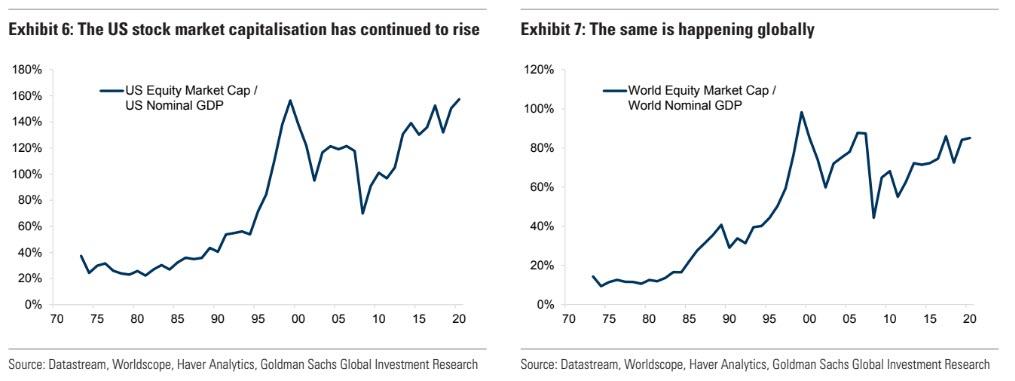

At some point these lower bond yields, and inflation expectations, should be reflected in lower growth prospects which is likely to be an ongoing headwind to equities (which, otherwise, at least offer an attractive risk premium). While there is no reason that the stock market should fully reflect the domestic economy, it is nonetheless striking that despite fears of slower growth stock market capitalisation has continued to rise relative to the size of economies (see Exhibit 6 for the US and Exhibit 7 globally).

Much of this, particularly outside the US, has occurred despite very little profit growth over recent years. This all makes market levels vulnerable to either rising bond yields or much weaker growth over time.

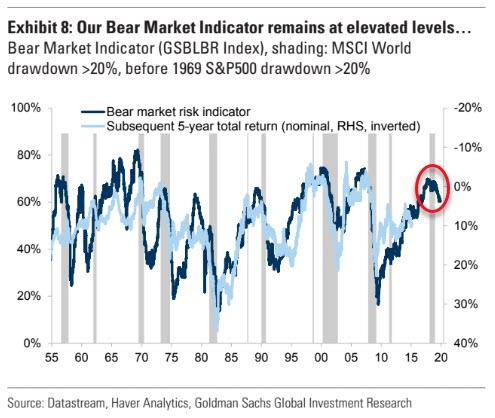

Second, related to this, the strong rise in profit margins which has offset otherwise weaker top-line growth are starting to top out. There is some evidence, at least in the broader economies, that higher wages are starting to dampen the profit shares of GDP (see Exhibit 9) but have yet to really dampen the net income margins of the public equity markets, particularly in the US where technology has such a large weight.

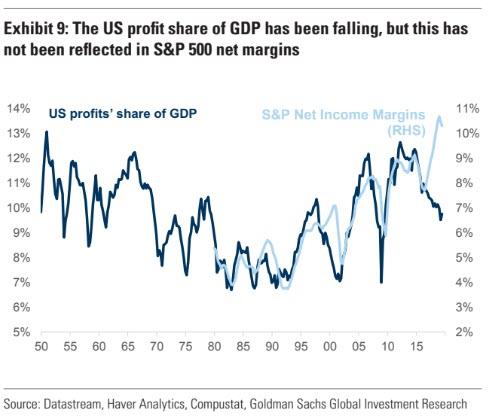

Finally, Oppenheimer notes that while our Bear Market Indicator (GSBLBR Index) has moderated from the highs reached in H22018 (partly as a result of lower rates and improved private sector balances), the absolute levels remain high. This tends to be consistent with much lower cumulative returns over the following 5 years – an observation consistent with the structural constraints discussed.

Therefore, Oppenehimer warns, in the nearer term, however, we believe the greater risk is that the impact of the coronavirus on earnings may well be underestimated in current stock prices, suggesting that the risks of a correction are high.

And, relying on past patterns of recovery is a fool’s errand as Oppenheimer details that comparisons with the SARS period may not be totally relevant. Spill overs from weaker Chinese demand (particularly tourism) are dramatically more important for the regional and world economy than a decade or two ago.

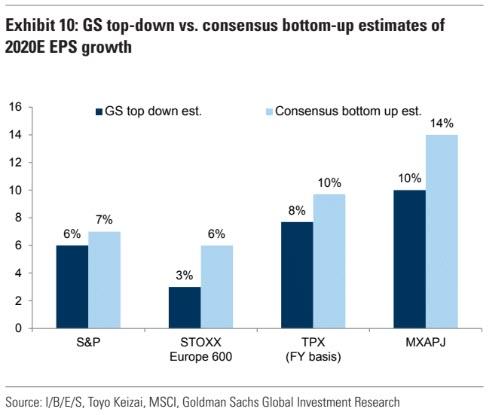

The Chinese economy is six times bigger now that it was then. As our economists have also pointed out, Chinese tourism alone now accounts for 0.4% of Global GDP, and the number of “missing work days” in China will be roughly equivalent to the entire US workforce taking an unplanned break for two months. Bearing in mind that our central forecasts for earnings growth for this year were relatively modest, even before the virus hit (see Exhibit 10) it would not take much for earnings to actually fall. For example, in the cyclically exposed European markets we estimate that a 1% fall in global sales weighted GDP (GDP weighted by the sales for earnings to actually fall.

For example, in the cyclically exposed European markets we estimate that a 1% fall in global sales weighted GDP (GDP weighted by the sales estimate that a 1% fall in global sales weighted GDP (GDP weighted by the sales exposure of companies) would reduce earnings by around 10%; in the current context that would be enough to turn them negative .

Meanwhile, an increasing number of companies are starting to ‘warn’ about the impact of the virus directly or indirectly in their guidance with comments from Apple, the World’s biggest company, being the latest high profile example. This is important because it has, alongside other tech companies, been an important driver of the better-than-expected 04 earnings results. During the fourth quarter, the 5 largest stocks in the S&P 500 (FB, AMZN, AAPL, MSFT, GOOGL) posted an average earnings surprise of +20%, compared with just 4% for the average S&P 500 company. Any weakness to these and other companies would likely push earnings estimates lower. Of course, as our US colleagues have pointed out consensus estimates are typically too optimistic.

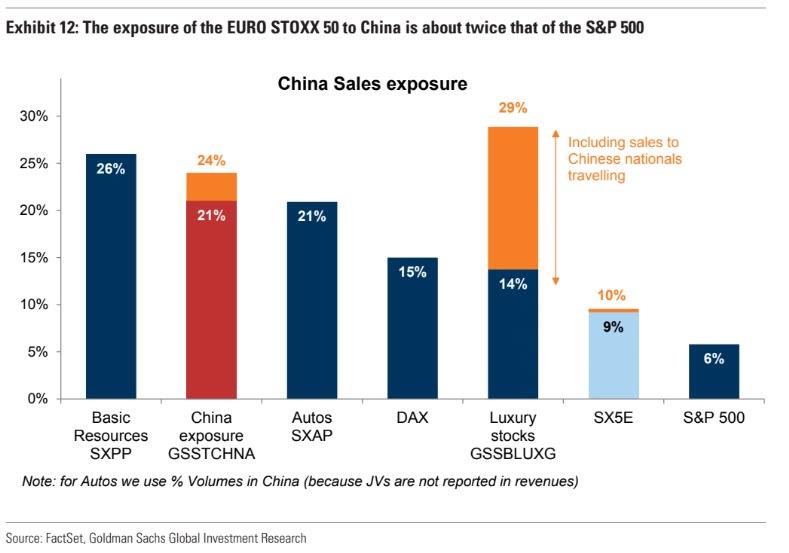

Since 1985, during the entire estimate period, bottom-up estimates have been revised higher during just 7 years. The 2020 EPS estimate has been cut by 0.7% during the past month and 1.2% during the past 3 months. But so far the magnitude of revisions is roughly in line with the historical trend. This has also been true in the more cyclical markets like Europe, where direct exposure to China is much higher (see Exhibit 12). Resources and companies with high direct China revenue growth (GSSTCHNA) are of course particularly vulnerable.

But over the past couple of months the new highs in the market have been driven by lower bond yields and looser financial conditions despite weaker growth prospects. This makes the market vulnerable to earnings disappointments.

In conclusion Oppenheimer admits that the resilience of the current very elongated economic cycle is likely to be supportive for equity markets on a relative basis over the next year and beyond; the be supportive for equity markets on a relative basis over the next year and beyond; the ERP is high and profits are unlikely to fall materially in the absence of recession.

That said, equity markets are looking increasingly exposed to near-term downward said, equity markets are looking increasingly exposed to near-term downward surprises to earnings growth and while a sustained bear market does not look likely, a near-term correction is looking much more probable.

Tyler Durden

Thu, 02/20/2020 – 09:51

via ZeroHedge News https://ift.tt/2SHSbBC Tyler Durden