“Everything Is Tactical” – Trader Fears Very Binary Scenario Here

Authored by Sven Henrich via NorthmanTrader.com,

Several key discussion items: Is this correction the beginning of something larger to come? What’s the downside risk? What’s the long trade set-up now that markets have flushed hard? Is there one? How we will know something larger may still be upon us?

Markets are faced with an unusual scenario here. Perhaps the most binary scenario we’ve seen in a long time and the outcome of this binary setup has enormous implications for bulls and bears alike and I want to highlight a few considerations.

Look, I get bashed as a permabear all the time, but I call what I see and when I don’t like the long side I say it and when I don’t like the short side I say that as well. On a big macro level I view the global debt and central bank construct as a tragedy waiting to happen and hence I get viewed as always bearish because I am very critical about the construct. And I have been very critical about this liquidity infused rally and I’ve pointed it out for weeks while prices relentlessly squeezed higher with nothing mattering.

But suddenly things mattered. Big time. Markets flushed hard in the past few days taking out weeks and months of gains in a matter of days. The technical warning signs that I’ve been discussing for weeks (see Market Analysis), including the view of coming reconnects with key technical zones have come to fruition in a swift swoop.

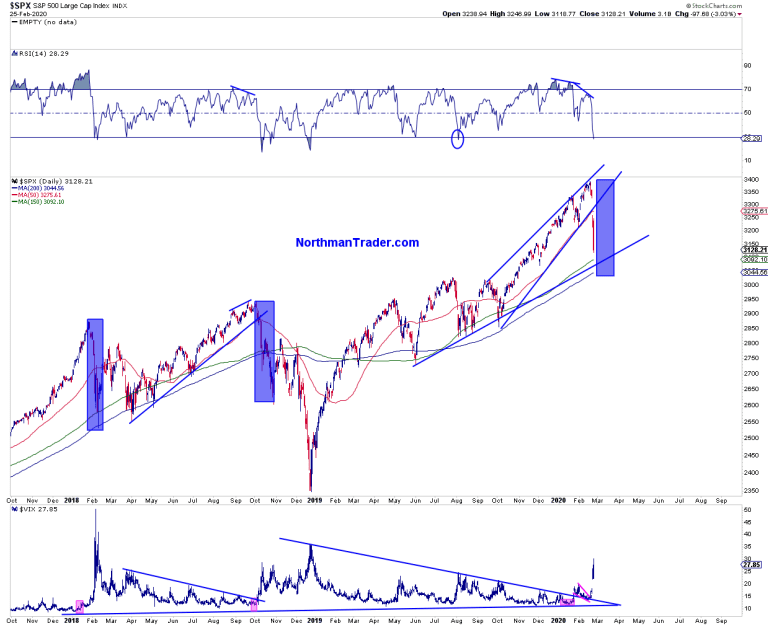

Let’s first take a quick snapshot of what just happened. The recent run up was indeed not much different than the one we saw in January 2018, a liquidity jam up. Back then it was tax cuts, now it was the Fed.

Hence on the surface we can observe that nothing was really different here:

Let me say this:

This was not different this time.

This was just another stupid liquidity rally squeezing out a tight wedge that broke to the downside.

Incidentally $NYSE is far below the Jan 2018 highs.

Which means the broader market hasn’t gone anywhere in over 2 years. pic.twitter.com/VmjiYBsjUp— Sven Henrich (@NorthmanTrader) February 25, 2020

And let’s be clear, this was significant carnage that was just inflected on markets:

$DJIA closes below the September and July highs and below the 200MA.

That’s 4 months of buying and FOMO chasing taken out in 1 week.

Who warned you?

Who didn’t? pic.twitter.com/X93WJaSdmt— Sven Henrich (@NorthmanTrader) February 25, 2020

And yes I view it as a central bank induced tragedy:

The Fed’s ill conceived liquidity program got people to chase stocks, trapped them at ungodly valuations and then a trigger (that was ignored as people had become complacent) pulled the rug from the construct.

And now lots of people got hurt.Well done Fed.

— Sven Henrich (@NorthmanTrader) February 26, 2020

So now let’s discuss the current risk profile:

The trigger for the correction is the coronavirus as the infections have now spread to Europe and the Middle East. And hence it’s a very binary scenario here: Either this virus gets contained in short order or not. If it does we may be staring at the mother of all relief rallies to come.

If it does not and it continues to expand and linger and impact the global supply chain further not only will earnings get impacted in a material way, but also the global economy may get hit with a recession in which case equities are massively overpriced still and we may end up in a multi-year bear market with central banks left with preciously less ammunition compared to before.

Maybe there’s a muddle through middle scenario, but reality is this: Nobody knows. And nobody can know. And so everybody needs to stay open minded about this.

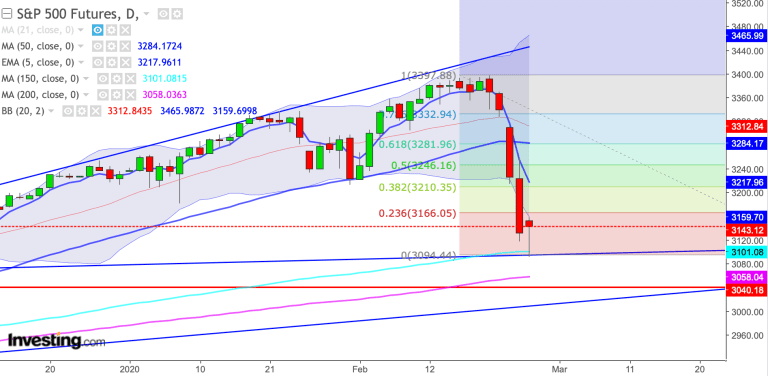

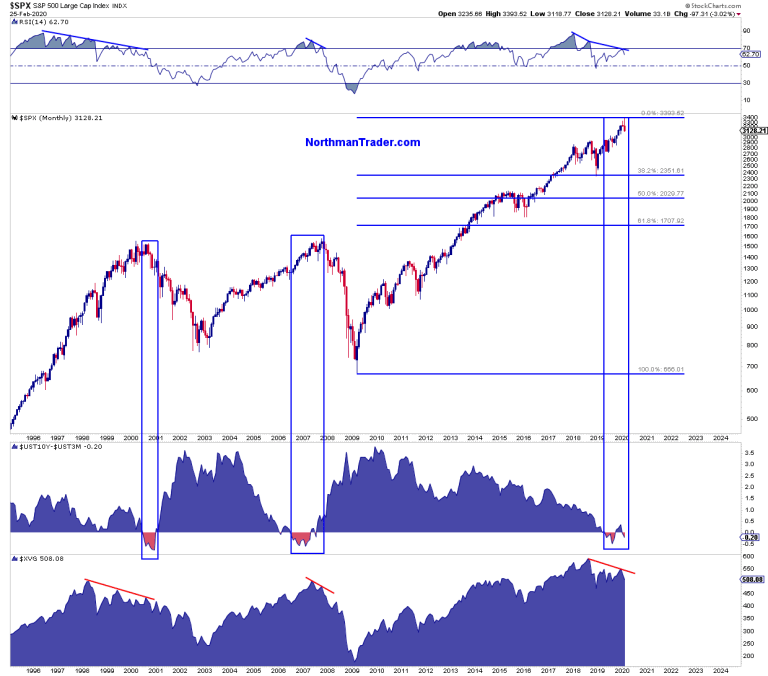

For now this correction here is no different then the ones we’ve seen before:

We went through a phase of volatility compression while $SPX build a long up channel, volatility broke out of compression, retested the breakout and then broke higher and took $SPX with it. Trend broken. Simple. Now $SPX is getting oversold, but risk remains lower into further support below.

The said bounce trade and rally setups are offering themselves up as well, as they did in February 2018 and October 2018. Whether a rally and bounce set-up will lead to further new lows or new highs may be entirely dependent on ongoing developments on the virus front.

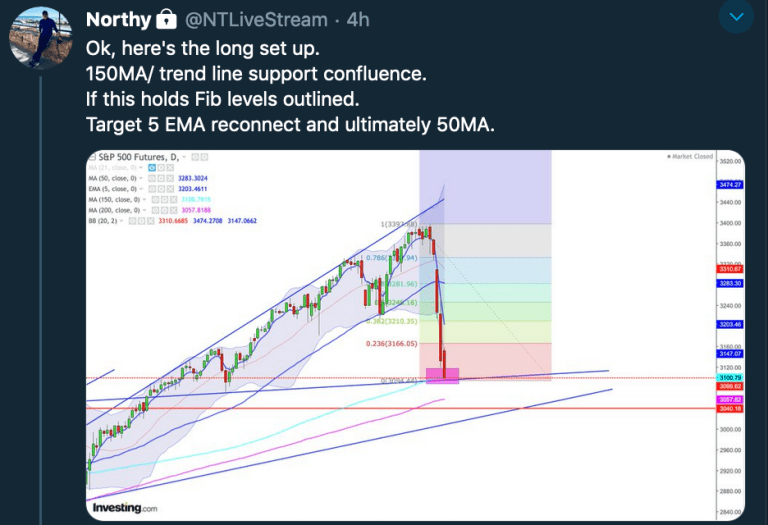

What’s a long set-up play?

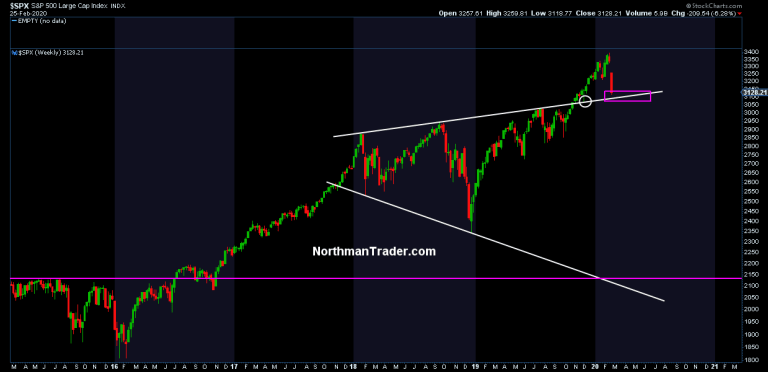

If you have been watching my market videos you are familiar with this chart:

I’ve called this trend line a key battle zone for bulls and bears for 2020. Defend it as support we can rally hard to either a lower high or new highs.

Failure to defend this line and see a sustained move below then this bull is in big trouble and there’s a lot of open space to the downside. Indeed a global recession scenario could lead to a much larger long term bear move. So this trend line is key to the market’s defense.

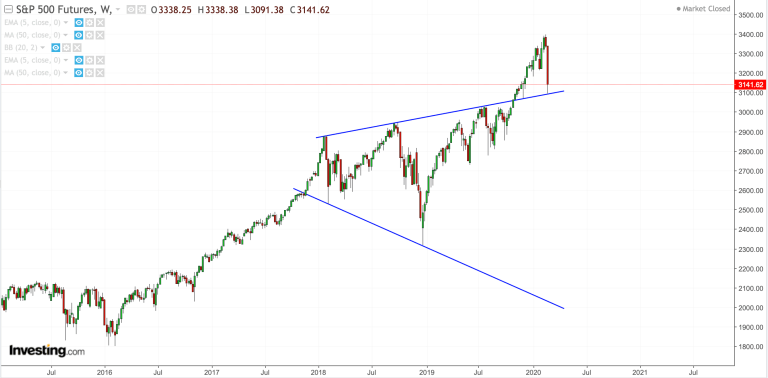

And the market appears to agree with this assessment for in overnight action that trend line was hit perfectly and bounce from there:

It should be noted that this bounce came at the very same moment that $DAX also hit key support, an amazing confluent picture on these indices.

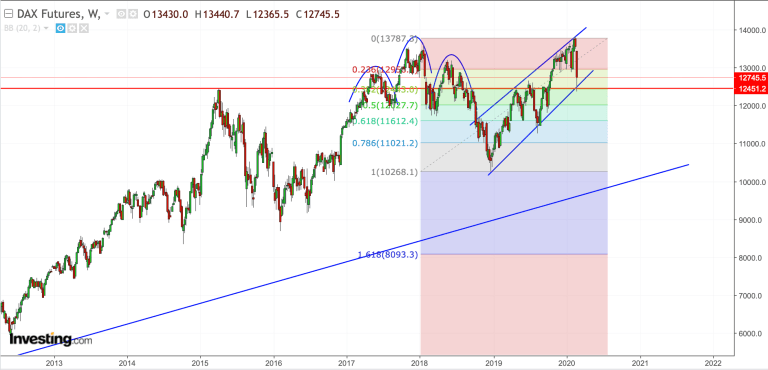

$DAX I had previously pointed to key resistance and a very clean price channel, that channel got hit in overnight:

$DAX updated

Straight down from upper trend line to lower trend line

Key support now and must hold for a bounce or further trouble. pic.twitter.com/PxKtcaPbZA— Sven Henrich (@NorthmanTrader) February 26, 2020

And now we see the bounce off of that support:

In addition to the $ES trend line, $ES also hit its 150MA at the same time, hence the cumulative picture sparked a long trade setup on our subscriber feed:

And so far the zone has served well as a bounce zone:

As long as these lows hold $ES can aim for the targets outlined including several fib retraces otherwise the earlier outlined lower risk zone continues to apply.

Bulls have had a horrid month and now markets only have 3 days left in the month there will be incentive to salvage what is left of the month.

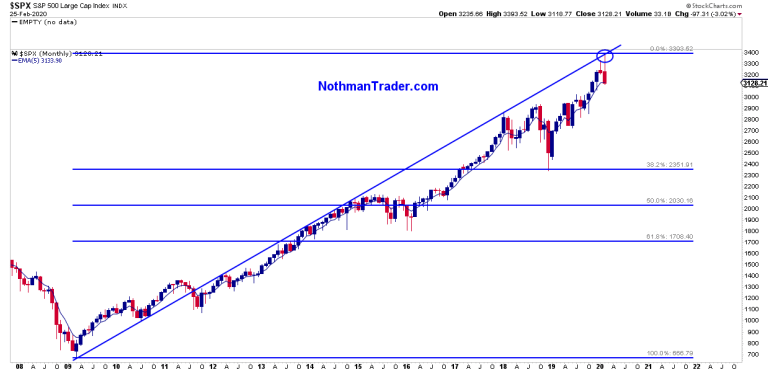

Be clear: We have had outside monthly reversal candles coming off of a key trend line resistance:

And the macro context could not be more stern:

So yes, what happens in the next few weeks is very binary and how the virus situation unfolds is critical otherwise this bull market may be over.

And the next rally may decide everything.

Don’t forget we’ve seen all this before. Example: $NDX 2000. A liquidity induced bubble high into March, a quick nasty correction, then an aggressive counter rally that failed:

And then it was over, a multi year bear market unfolded as the US went into recession by the end of 2000.

So everything is tactical at the moment. Bears finally had the correction they were positioning for. Bulls got a major wake up call and a spanking and now it’s crunch time for everybody.

I’ll leave you with a in depth interview that was recorded yesterday where I discussed some of the macro and market issues facing us right now:

Stay sharp, lots of unknowns facing everybody right now, but technicals can keep guiding us on this journey.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Wed, 02/26/2020 – 15:35

via ZeroHedge News https://ift.tt/2viHtbV Tyler Durden