February Payrolls Preview: The Most Irrelevant Jobs Report Ever

While the market’s attention will be far from today’s payrolls report which i) is a lagging indicator, ii) failed to capture the late February inflection point in the global economy due to the coronavirus and iii) will get far worse in coming months as more Americans self-quarantine and either work from home and take an extended sabbatical, algos will stick react, even if briefly, to the headlines from today’s report, which incidentally will be handily convenient on your favorite trading terminal as the BLS’ decision to end the media lockup has been delayed indefinitely meaning those familiar flashing red Bloomberg headlines will be there to guide the algos what to. That said, as Goldman cautions, the February survey period was too early to show a meaningful impact of the coronavirus outbreak on hiring. With that in mind here is what to expects at 830am ET today courtesy of RanSquawk,

- Non-farm Payrolls: Exp.175k, Prev. 225k.

- Unemployment Rate: Exp. 3.6%, Prev. 3.6%. (FOMC currently projects 3.5% at end-2019, and 4.1% in the long run).

- Avg. Earnings M/M: Exp. 0.3%, Prev. 0.2%; Avg. Earnings Y/Y: Exp. 3.0%, Prev. 3.1%.

- Avg. Work Week Hours: Exp. 34.3, Prev. 34.3.

- Private Payrolls: Exp. 160k, Prev. 206k.

- Manufacturing Payrolls: Exp. -3k, Prev. -12k.

- Government Payrolls: Prev. 19k.

- U6 Unemployment Rate: Prev. 6.9%.

- Labor Force Participation: Prev. 63.4%.

TREND RATES: After a couple of strongly above-trend readings within the last three reports, the trend of payroll growth has seen shorter term averages rise above longer-term averages, indicating momentum in the pace of hiring: the 3-month average is now 211k (from 198k), 6-month now at 206k (from 200k), and 12- month now at 171k (from 175k). However, the street looks for a print of 178k in February.

Goldman sestimate nonfarm payrolls increased 195k in February, above consensus of +175k. In addition to a 20-30k boost from weather, the bank’s forecast reflects solid labor market fundamentals in early 2020 indicated by very low jobless claims and rebounding business surveys. What is most notable, is that the February survey period was too early to show a meaningful impact of the coronavirus outbreak on hiring.

INITIAL JOBLESS CLAIMS: In the payroll survey week, the initial jobless claims headline came in at 210k, in line with the expected, with the four-week moving average falling to 209k, a welcome development since it was around 216,250 heading into the January NFP survey period. Continuing claims, meanwhile, were a touch above expectations at 1.726mln, rising from a revised 1.701mln.

ADP PAYROLLS: ADP reported 183k payrolls were added to the US economy in February, topping the consensus of 170k; the prior month’s print was downwardly revised, to 209k from 291k (some analysts explained that the large downward revision was due to back-fitting past ADP data to the official BLS series, and not to over-read into it regarding the strength of the labour market). ADP said that the labor market remains firm, and that job creation remained heavily concentrated in large companies, which continue to be the strongest performer. However, Moody’s economist Zandi noted in the report that it did not show any impact from the coronavirus: “COVID-19 will need to break through the job market firewall if it is to do significant damage to the economy. The firewall has some cracks but judging by the February employment gain it should be strong enough to weather most scenarios.” Zandi also noted that decent weather conditions helped the data.

BUSINESS SURVEYS: The manufacturing ISM’s employment sub-index rose slightly in February, to 46.9 from 46.6 (a reading over 50.8 is generally consistent with an increase in the BLS manufacturing employment growth). ISM noted that this was the seventh month of employment contraction, but at a slower rate compared to January. Among the six big industry sectors, two expanded and four contracted, and panellist comments were generally cautious regarding future employment potential, ISM said. The non-manufacturing ISM, meanwhile, was more constructive, seeing the employment sub-index rise to 55.6 from 53.1, meaning employment has been growing for 72 straight months. ISM said comments from respondents included “hiring labor needed to complete work order backlog” and “human resources is working off their backlog.” Looking at other surveys, Markit reported that employment continued to increase midway through Q1, though it was growing at the slowest pace in the current four-month sequence of growth; both manufacturers and service providers alike registered a rise in workforce numbers, Markit said, although the pace of job creation eased in both monitored sectors.

CONSUMER CONFIDENCE: The unemployment rate is seen unchanged at 3.6%, slightly above the FOMC’s 3.5% projection for 2020 as a whole. Analysts note that the latest Conference Board report on consumer confidence saw the differential between jobs ‘plentiful’ and jobs ‘hard to get’ declined to 29.8, which is a marginal negative heading into this week’s payrolls report (the higher this rate goes, the more downward pressure it puts onto the jobless rate, the theory goes). Consumers’ outlook for the labour market was mixed, CB noted, and the proportion expecting more jobs declined slightly from 16.5 to 16.2, but those anticipating fewer jobs in the months ahead also decreased, from 12.9 to 11.1.

WAGE GROWTH: Meanwhile, the pace of wage growth is seen picking-up slightly in the official data, with the Street looking for a 0.1ppts rise to 3.2% Y/Y, and the M/M pace coming in at 0.3%, accelerating slightly from the 0.2% seen in the January report. The CB report noted that there has been a slight moderation in consumers’ view of their short-term income prospects, with the percentage of consumers expecting an increase rising from 21.6 to 22.0, while the proportion expecting a decrease declined from 8.0 to 6.7.

JOB CUTS: Challenger job cuts improved in February (-16% M/M, -4% Y/Y) where 56,660 employees were laid off, down from the 67,735 in January, boding well for the NFP report. The breakdown was led by tech jobs, retail and transportation, although none of which cited the coronavirus as a reason. Challenger states “Despite widespread concerns about COVID-19, it has yet to impact job cut announcements. This may change if the supply side remains dormant, as companies grapple with whether to keep operations open without product. It could also impact Retail, Hospitality, and Travel companies, if concerns keep people at home”, adding measures are being taken by companies such as limited travel, and to work from home if technology allows them to do so. On the coronavirus, Challeger stated “While the majority of cases worldwide have been mild and many people who contract it may not even require a hospital stay, that is not the case for high-risk populations”.

Arguing for a stronger report:

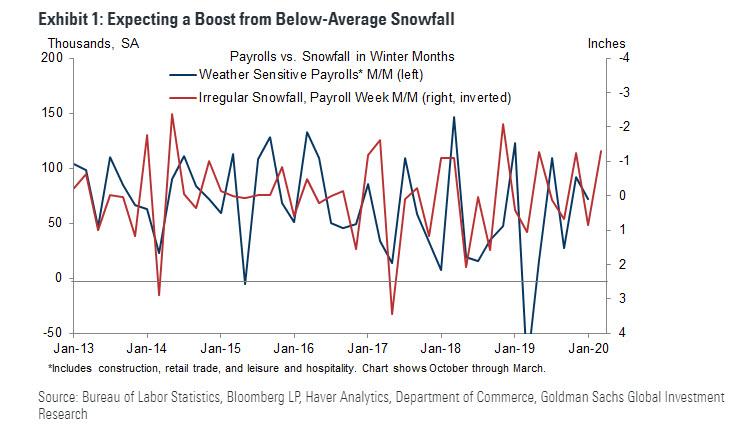

- Winter weather. Despite winter storms in the Midwest on the Thursday of the survey week, our population-weighted snowfall dataset was below average for the nation as a whole, and it declined relative to the January survey period (see Exhibit 1, right axis inverted). Accordingly, we are assuming a weather boost of 20k-30k in the February report.

- Jobless claims. Initial jobless claims decreased in the four weeks between the payroll reference periods, averaging 209k (vs. 218k in the January payroll month). Continuing claims rebounded 19k from survey week to survey week. Overall, jobless claims data remain consistent with a subdued pace of layoff activity.

- Employer surveys. Business activity surveys were firm on net in February despite late-month weakness in the manufacturing sector. For the month as a whole (the payroll data tracks employment in the middle of the month), our nonmanufacturing survey tracker rose 1.5pt to 55.8 and our manufacturing survey tracker rose 0.4pt to 53.2. The employment components exhibited similar patterns, with improvement in services (+0.7pt to 53.4, a 6-month high) but a decline in the manufacturing analog (-1.3pt to 51.6). Our employment survey composite has also increased recently (see Exhibit 2)—supported by de-escalation of the trade war and a decline in uncertainty as of mid-February. Service-sector job growth was +174k in January and averaged 177k over the last six months, while manufacturing payroll employment declined by 12k in January and averaged +1k job growth over the last six months.

- Labor market slack. With the labor market somewhat beyond full employment, the dwindling availability of workers may incentivize firms to pull forward spring hiring into the late-winter. As shown in Exhibit 3, first-print February job growth indeed tends to be strong when the labor market is tight.

- Census hiring. Temporary employment related to the 2020 Census rose 5k in January. There were only 13k Census employees in the January payroll counts, but we expect this number to rise modestly in February (by about 10k) with still a few months before the major Q2 surge for the enumeration process.

Arguing for a weaker report:

- ADP. The payroll-processing firm ADP reported a 183k increase in February private employment, 13k above consensus and close to the average pace of the previous three months (+179k). While the inputs to the ADP model probably contributed to the modest beat, ADP also noted a boost from weather that could support job growth in the official measure as well. On net, we view the ADP report as a neutral to slightly positive factor this month.

Tyler Durden

Fri, 03/06/2020 – 07:47

via ZeroHedge News https://ift.tt/39FUN92 Tyler Durden