Meltdown: Stocks Tumble, Yields Crater As Coronapanic Infects Traders

Stock markets tumbled, and bond yields cratered on Friday amid a rising trader panic as the number of coronavirus infections neared 100,000 and the economic damage wrought by the outbreak intensified resulting, appropriately enough, in business districts around the world that have begun to empty amid coronavirus evacuations. As a result, global markets were a sea of red amid mounting concern over the economic fallout of the spreading coronavirus.

European shares opened sharply lower, with travel stocks bearing the brunt. The pan-European STOXX 600 index, set for a second day of sharp losses, was down as much as 3.6%, with Germany’s DAX, Britain’s FTSE 100 and France’s CAC 40 all in freefall.

The MSCI All-Country World Index was down 0.72%; all 19 industry groups in the red, as the cost of insuring the region’s high-yield corporate debt climbed to the highest since 2016. After their worst weekly performance since the 2008 financial crisis, global stocks as measured by the index are up 1.7% this week, as sentiment recovered on the back of stimulus from policymakers to combat the economic fallout of the virus. However, at this rate panic is moving markets this morning, we may soon see all of this week’s gains – which include two 1,000+ Dow point gains – reverse.

In the US, contracts on all main index futures pointed to heavy losses at the open after Thursday’s rout, as officials and companies in Britain, France, Italy and the United States are struggling to deal with a steady rise in virus infections that have in some cases triggered corporate defaults, office evacuations, and panic buying of daily necessities. Overnight S&P Index futures slumped as much as 2.5%…

…while the VIX soared as high as 47 on Friday during Asian hours. The number of coronavirus cases worldwide approached 100,000 as the outbreak in the U.S. gathered pace, while China and South Korea continued to report new infections and deaths.

The latest leg of the sell-off kicked off in Asia, where stocks from Tokyo and Sydney to Hong Kong and Seoul slumped more than 2%, falling only for the first time this week, led by energy and finance companies, on mounting concerns over the economic impact of the spreading coronavirus. All Asian markets dropped, with Japan’s Topix index completing a fourth week of declines and Australia’s S&P/ASX 200 closing at its lowest level in almost a year. The Topix declined 2.9%, with Raccoon Holdings and Curves HD falling the most. The Shanghai Composite Index retreated 1.2%, with Ningbo Fuda and Shanghai Lonyer Fuels posting the biggest slides. Shares in China CSI300 finally fell 1.22%, while stocks in Hong Kong, another city hard hit by the virus, fell 2.12%.

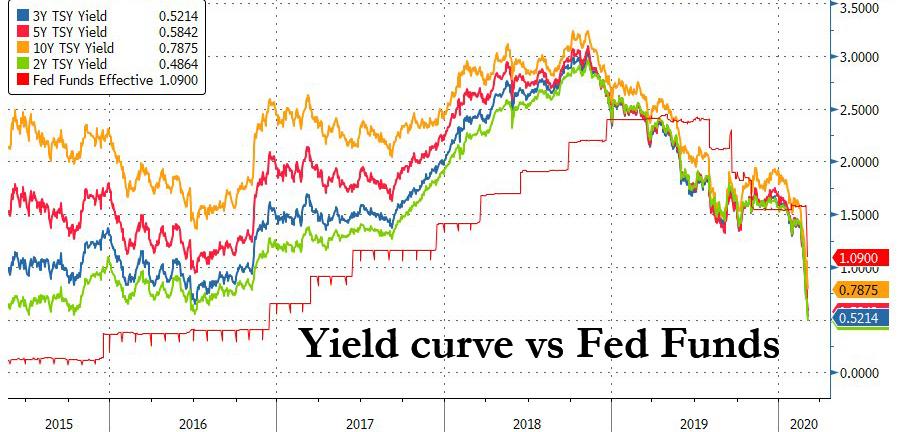

However, while stocks were in freefall, the biggest move was in rates, where the 10Y crashes as low as 0.70% overnight…

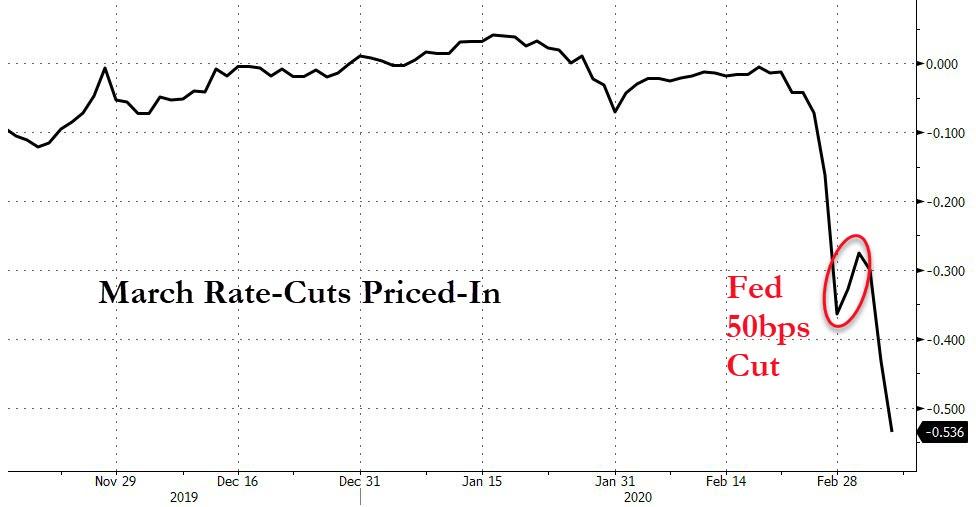

… with the entire yield curve now trading below the effective fed funds rate suggesting the Fed may have to cut as much as 75bps in two weeks.

The yields on both 10-year and 30-year treasuries fell to fresh record lows as investors fretted over an expanding health crisis that risks disrupting global supply chains. Germany’s benchmark 10-year Bund yield fell to a six-month low within striking distance of last year’s record lows.

Minneapolis Federal Reserve President Neel Kashkari said late on Thursday the Fed could cut rates further if needed. ANd indeed, money markets are pricing in more than 50 basis-point-cut from the current 1% to 1.25% range at the next Fed meeting on March 18-19.

The corona outbreak has now spread across the United States on Thursday, surfacing in at least four new states. “The interplay of virus containment fears and stimulus measures means that in the near term we expect market volatility to persist,” said Mark Haefele, chief investment officer at UBS Global Wealth Management.

An increasing number of people faced a new reality as many were asked to stay home from work, schools were closed, large gatherings and events canceled, stores emptied of staples like toiletries and water, and face masks a common sight. In London, Europe’s financial capital, the Canary Wharf district was unusually quiet. S&P Global’s large office stood empty after the company sent its 1,200 staff home, while HSBC has asked around 100 people to work from home after a worker tested positive for the illness. In New York, meanwhile, JPMorgan divided its team between central locations and a secondary site in New Jersey while Goldman Sachs sent some traders to nearby secondary offices in Greenwich, Connecticut and Jersey City.

While concerted efforts from central banks and governments to soften the blow from the virus spurred gains across equity markets earlier in the week, investors were clearly back to taking risk off the table and piling into the world’s safest and most liquid assets. The number of coronavirus cases globally approached 100,000, as more infections were reported in the U.S., Germany and South Korea.

“The focus is very much on the spread of coronavirus outside China and really markets aren’t going to settle until we see some sort of peak,” QIC managing director Susan Buckley told Bloomberg TV. “This is going to go on longer than most of us expected.”

In FX, plunging yields hammered the dollar, which fell to a six-month low versus the yen and close to a two-year trough against the Swiss franc. The yen rallied to its strongest since August versus the dollar, advancing against all G-10 peers. The euro climbed to $1.1324, its highest level since mid-2019, and was set for its best week against the greenback since 2016, even thought markets in the euro zone are pricing in a 93% chance that the European Central Bank will cut its deposit rate, now minus 0.50%, by 10 basis points next week. The single currency has now reversed all its earlier losses for the year, rising from below $1.08 a few weeks ago to above $1.13. ING analysts said they were targeting $1.15 in the coming weeks as aggressive U.S. rate cuts contrasted with the limited room for action at the European Central Bank. “For now, expect USD weakness vs G10 FX to continue, and the G10 FX segment outperforming EM FX, with carry trades under pressure,” they said in a research note.

In commodities, oil plunged below $44 per barrel in New York and was set for even greater losses if OPEC failed to reach a production cut with Russia. Focus for the crude complex remains on today’s OPEC+ meeting, where we are still awaiting remarks from Russian Energy Minister Novak himself after OPEC yesterday agreed to a 1.5mln BPD cut and an extension of existing measures. However, comments this morning from a Russian high-level source that Moscow will only agree to extend the existing OPEC+ oil cuts, will not agree to extra cuts and its position will not change caused a significant drop in crude prices.

The price action in metals has been just as fervent and spot gold has printed a new multi-year high at USD 1689.99/oz, surpassing the USD 1689.29/oz which was set last month; a high which takes us all the way back to January 2013.

To the day ahead now where the focus is on the February employment report in the US while the January trade balance and January wholesale inventories are also due to be released. Expect the Fedspeak to also be a big focus today with Evans, Mester, Bullard, Williams, Rosengren and George all due to speak.

Market Snapshot

- S&P 500 futures down 2.1% to 2,951.00

- STOXX Europe 600 down 2.7% to 370.50

- MXAP down 2% to 156.87

- MXAPJ down 2% to 516.33

- Nikkei down 2.7% to 20,749.75

- Topix down 2.9% to 1,471.46

- Hang Seng Index down 2.3% to 26,146.67

- Shanghai Composite down 1.2% to 3,034.51

- Sensex down 2.3% to 37,589.36

- Australia S&P/ASX 200 down 2.8% to 6,216.21

- Kospi down 2.2% to 2,040.22

- German 10Y yield fell 3.7 bps to -0.723%

- Euro up 0.4% to $1.1282

- Italian 10Y yield rose 5.4 bps to 0.901%

- Spanish 10Y yield rose 4.1 bps to 0.254%

- Brent Futures down 2.6% to $48.67/bbl

- Gold spot up 1% to $1,688.42

- U.S. Dollar Index down 0.8% to 96.07

Top Overnight News from Bloomberg

- Markets aren’t prepared for how severe the fallout of the global spread of coronavirus could get, according to the manager of a fund which outperformed 98% of its peers over the last month

- The number of coronavirus cases globally approached 100,000 as the outbreak in the U.S. gathered pace, and China and South Korea continued to report new infections and deaths

- Dollar-funding markets are showing signs of stress as U.S. stocks tank and rates markets price for aggressive easing by the Federal Reserve resulting in a regime change of rates

- German factories saw a rebound in demand just before China became engulfed by the coronavirus outbreak that has since spread across the globe.

- A key indicator of Japan’s economic outlook fell to its lowest level since the global financial crisis, offering an early official sign that the coronavirus is pushing Japan’s economy into recession.

- Federal Reserve Bank of Dallas President Robert Kaplan said the pace of acceleration in the coronavirus across the U.S. will be an important factor as he weighs the need for another interest rate cut when policy makers meet later this month

- The Fed’s surprise emergency interest-rate cut has put the central bank in a good position to shelter the record U.S. economic expansion, New York Fed President John Williams said

- China’s 10-year sovereign bond yield fell to the lowest since 2002, joining a global rally of government debt as concern mounts that the coronavirus outbreak will derail economic growth this year

- Oil extended its slide from the lowest close in more than two years as investors wait for a Russian response to OPEC’s plan for deeper and longer cuts to offset the demand destruction caused by the coronavirus

Asian equity markets slumped across the board as the sell-off rolled over from Wall St. where all major indices declined over 3%, led by a near 1000-point drop in the DJIA amid coronavirus fears which spurred a mass flight to safety and pressured US 10yr yields to fresh record lows. ASX 200 (-2.8%) fell deeper into correction territory as tech and financials resumed their recent underperformance although defensives and gold miners showed some resilience on the safe-haven play, while Nikkei 225 (-2.7%) was the worst performer and retreated below the 21000 level to a 6-month low with losses exacerbated by detrimental currency flows and contractions in Household Spending. Elsewhere, Hang Seng (-2.3%) and Shanghai Comp. (-1.2%) were also heavily pressured alongside the global stock rout and continued PBoC liquidity inaction. On the coronavirus front, the pace of additional confirmed cases and deaths in mainland China continued to show a mild improvement, although this failed to spur markets as attention was also on the increasing number of cases in other countries leading to fears of a global pandemic. Finally, 10yr JGBs were higher amid the bloodbath in stocks and as bond prices tracked their US counterparts higher against the backdrop of record low US 10yr Treasury yields, while the JSCC noted an emergency margin call was triggered for long-term JGB futures and China’s 10yr yield also slipped to its lowest since 2002.

Top Asian News

- China Bond Rally Pushes 10-Year Yield to Lowest Since 2002

- Virus Adds to Woes of Indonesian Carrier Facing Big Debt Payment

- Indian Bank Meltdown Takes Out Walmart’s Leading Payments App

- Erdogan’s Ottoman Dreams Lie Broken on the Syrian Battlefield

Further pain for European equities this morning (Eurostoxx 50 -3.1%) as losses in global stock markets show no sign of letting up. Once again, there hasn’t been too much in the way of notable macro newsflow, instead, attention remains on the ongoing climbing case count with particular focus Stateside amid a pickup in COVID-19 diagnosis’ and reports of 2733 people being quarantined in New York City. Commentary around the 2020 Presidential election race continues to impose itself on the market narrative, however, it appears to still be playing second fiddle to the fallout from COVID-19. Furthermore, the market is also trying to wrestle with the narrative over who will be the most favourable candidate for Trump to face in November with Biden viewed as more market-friendly than Sanders, with Sanders an easier candidate for Trump to defeat. In terms of price action in Europe, the sell-off for the DAX gathered momentum early doors (as did other global asset classes) with the Mar’20 contract taking out support at 11617 (March 2nd low) before finding some composure after stalling at 11600. However, as the session progressed, the velocity of the price action in markets accelerated dramatically with the index eventually troughing at 11446. Stateside, futures unsurprisingly indicate a negative open with the e-mini S&P lower by circa 80 points. All ten sectors in Europe are lower with slight underperformance in industrials, consumer discretionary and IT names, whilst consumer staples and telecoms are faring marginally better than their peers, however, are ultimately lower on the session. In terms of individual movers, there is a distinct lack of green on the board with focus instead, once again, to the downside with Capita (-12.6%) the notable laggard in the Stoxx 600 after adding to yesterday’s dire performance. Elsewhere, Prysmian (-9.5%) are markedly lower following disappointing FY results, Atlantia (-8%) are being weighed on after its Autostrade unit delayed results, Airbus (-6.0%) are being sold after posting no new orders in February, whilst executives at Boeing remain bullish on a return of the 737 MAX by mid-year.

Top European News

- German Factories Saw Signs of Recovery Before Coronavirus Hit

- Deadly Bridges Expose Italy’s Toxic Red Tape and Self Interest

- Ray-Ban Maker’s Management Dispute Smolders Amid CEO Search

- Hammerson Falls to Lowest Since 1993 After Goldman Downgrade

In FX, the Dollar continues to slide vs major peers while outperforming against the majority of its EM counterparts as US Treasury and other core global bond yields tank amidst more pronounced bull-flattening across the debt curves. As a result, the DXY has extended post-Fed emergency ease lows to 95.993 and there’s little in the way of technical support ahead of 95.950 if the purely psychological or sentimental round number really gives way. NFP looms and usually matters, but in the current environment China’s COVID-19 and contagion appears all consuming

- NZD/JPY/CHF/EUR/AUD/GBP – The strongest G10 currencies and roughly in descending order, partly due to relative rate differentials and grades of safe-haven appeal, as Nzd/Usd gathers pace through 0.6350 and Usd/Jpy recoils from 106.30+ overnight peaks below 105.00 (touted as the BoJ’s tolerance line), with supposed bids around 105.50 filled effortlessly along the way. Meanwhile, Usd/Chf is now under 0.9400 and Eur/Chf is threatening another downside breach of 1.0600 that will no doubt ring alarm bells at the SNB, especially as Eur/Usd is bid and now testing 1.1300. Back down under, Aud/Usd has been hampered to a degree by weak Aussie retail sales, though still comfortably above 0.6600, and Cable is approaching 1.3000 even though Eur/Gbp is hovering just shy of 0.8700. In terms of upside bullish objectives, contacts are flagging the 200 WMA around 1.3021, but chart levels are hardly being observed let alone respected at present.

- CAD/NOK/SEK – The Loonie is lagging given more dovish BoC guidance in wake of Wednesday’s ½ point rate cut, as Usd/Cad hugs 1.3400 and the same goes for the Scandinavian Kronas irrespective of ordinarily supportive Norwegian GDP and manufacturing production in advance of Riksbank remarks from Ohlsson pledging prompt action (stimulus) if required and then a relatively bland official statement effectively delivering the same message.

- EM – In short, risk aversion akin to a rout has taken a toll on all regional currencies, but with the Rouble also undermined by sinking Brent prices awaiting OPEC+, and actually Russia to give its approval to a deeper output cut pact that looks highly unlikely given comments attributed to a top ranking source. However, some solace for the Lira via truce in Syria, albeit fragile.

In commodities, focus for the crude complex remains on today’s OPEC+ meeting, where we are still awaiting remarks from Russian Energy Minister Novak himself after OPEC yesterday agreed to a 1.5mln BPD cut and an extension of existing measures. However, comments this morning from a Russian high-level source that Moscow will only agree to extend the existing OPEC+ oil cuts, will not agree to extra cuts and its position will not change caused a significant drop in crude prices. Prior to this, price action was very much subdued anyway in-line with overall sentiment as the rot in global yields and broad-based safe haven flows has exacerbated this morning to such an extent that WTI and Brent crude futures are posting losses in excess of USD 2/bbl at present, and have breached the USD 44/bbl and USD 47/bbl to the downside; with price action generally showing little signs of abating at present. Note, next week does see the monthly oil market reports released and ahead of this OPEC’s 2020 global oil demand forecast is expected to be at 480kBPD, which is a reduction from the 990kBPD mark in February. Moving to metals, where price action has been just as fervent and spot gold has printed a new multi-year high at USD 1689.99/oz, surpassing the USD 1689.29/oz which was set last month; a high which takes us all the way back to January 2013.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 175,000, prior 225,000

- 8:30am: Change in Private Payrolls, est. 160,000, prior 206,000

- 8:30am: Change in Manufact. Payrolls, est. -3,000, prior -12,000

- 8:30am: Unemployment Rate, est. 3.6%, prior 3.6%

- 8:30am: Underemployment Rate, prior 6.9%

- 8:30am: Labor Force Participation Rate, est. 63.4%, prior 63.4%

- 8:30am: Average Hourly Earnings MoM, est. 0.3%, prior 0.2%; Average Hourly Earnings YoY, est. 3.0%, prior 3.1%

- 8:30am: Average Weekly Hours All Employees, est. 34.3, prior 34.3

- 8:30am: Trade Balance, est. $46.1b deficit, prior $48.9b deficit

- 10am: Wholesale Inventories MoM, est. -0.2%, prior -0.2%; Wholesale Trade Sales MoM, prior -0.7%

- 3pm: Consumer Credit, est. $16.5b, prior $22.1b

DB’s Jim Reid concludes the overnight wrap

Market participants are scrambling to look at big data techniques to analyse real time global economic data at the moment. Indeed we’ve had great success in looking at our shipping data in China. My slightly less sophisticated model is looking at the people traffic at Heathrow yesterday and judging by my experience it was around 10-20% lower than when I last travelled a couple of weeks ago. Supermarkets must be seeing an increase in spending though. Early last week I discussed how at home we thought ourselves clever by getting an extra big shop last week. However the online delivery services in our area now have no slots for 5 days (you can normally get one next day) and we’re running out of normal supplies. So while we have toilet roll and nappies in abundance we don’t have much fresh food or milk (it’s gets drunk by the gallon in our household). Hopefully we can find some through the inconvenience of going to an actual shop this weekend.

Yesterday we updated our credit spread view from our 2020 outlook “Wider spreads…but how wide?” to bring forward the peak of the widening and increase the magnitude. In broad terms we think EU/US IG and HY have around 40bps and 250bps of widening still to come. I would like to think we are the only team on the street that have tightened their YE 2020 spread targets in this sell-off over the last two weeks though. The basic argument being that if the peak comes quicker so does the recovery relative to our previous expectations. See the full report here for more details. In addition the payments expert in my team Marion published a fascinating note yesterday about the spread of the virus via cash notes, the fact that China have destroyed cash because of it, and how it might speed up digitalisation, especially in China. See her report here.

Another day, another wild swing for markets as 2-4% moves in either direction for equities are becoming more commonplace. As for bonds it’s not either direction it’s just a straight line down in yields at the moment. The S&P 500 closed down -3.40% and this week alone we’ve seen 4 moves of at least 2% every day either up or down – the last time that happened was August 2011, when the US credit rating was cut. The market came close in August 2015, when there were 5 of 6 days in a row that saw those outsized moves. If we extend that analysis to last week then of the 9 trading days, 7 have featured moves of at least 2% which is the most since December of the global financial crisis, which was also the last time we saw a full 5 day week of such moves. Along a similar vein, the VIX closed over 30 for a full calendar week for the first time since October 2011.

Last week was all about the negatives of the virus, whereas this week there has been much more tension between worsening virus news but increasing chatter of and actual stimulus. Yesterday the bad news won out though. Indeed the developments over the last 24 hours include NYC reporting news cases, a first case in San Francisco, over 2 million being urged to work from home in Washington County, HSBC partially clearing its London trading floor following a reported case, Switzerland and the U.K. reporting their first deaths, France, Germany and Italy reporting a big jump in cases and the Trump administration admitting that the US will be unable to meet its target of having a million coronavirus tests available by the end of this week. Here in the UK we also saw Flybe go into administration – albeit a budget airline which was already under considerable pressure prior to the coronavirus. This hurt the global travel industry more yesterday. Travel and Leisure was the 3rd worst sector in the STOXX 600 yesterday down -2.90 %, with airlines making 4 of the worst 8 performers – similarly Airlines in the US were down -8.19% and the worst performing industry in the SPX. Driving the point home on airlines and travel, TUI and Air France-KLM widened +122bps and +128bps respectively yesterday to 690bps and 453bps respectively. Lufthansa was the worst performing European IG CDS yesterday widening +44bps to 160bps. It was below 60bps just two weeks ago.

Risk off has continued in Asia this morning with the Nikkei (-2.95%), Hang Seng (-2.16%), Shanghai Comp (-0.94%) and Kospi (-2.16%) all down. As for FX, the Japanese yen is up +0.32% while most EM fx is trading weak this morning and the US dollar index is down -0.29%. Elsewhere, futures on the S&P 500 are down a further -1.36% while yields on 10y USTs are down another -10.3bps to an all-time low of 0.811% and those on the 30y are down -12.5bps to 1.417% – also a record low and first time below 1.5%. Brent crude oil prices are down -1.24% to $49.37 this morning and gold prices are up +0.42%. As we go to print, Bloomberg is reporting that Thailand’s government is planning to give cash handouts to its citizens to combat the virus induced slowdown. With this it becomes 2nd country after Hong Kong to suggest such a measure. Helicopter money is coming.

Back to yesterday where there were also big moves lower for the NASDAQ (-3.10%), DOW (-3.58%) and STOXX 600 (-1.43%). Oil also fell -2.25% despite OPEC trying to lay the ground to cut daily crude output by 1m barrels in the second quarter with further cuts also expected from non-OPEC allies. But the oil producing nations are facing opposition from Russia, and could make the cuts contingent on them joining, which sent Brent lower in the NY afternoon session. In bonds, US 10y yields went under 1% again, rallying 14.0bps to 0.912%, breaching the low mark of 0.924% from earlier this week. Front end yields fell a similar amount keeping the 2s10s curve around 31bps while it’s worth noting also that Freddie Mac 30y mortgage rates fell to a record low 3.29%. In Europe we saw 10y Bund yields down 4.8bps to -0.69% while the periphery sold-off 5-7bps. European Banks were actually down -3.89% with the index testing the August lows again and down -23.78% since the local peaks just 2 weeks ago. Credit markets were also weaker with cash HY spreads in the US 26.4bps wider. Finally the USD was weaker, with the DXY down -0.53%.

30y US Treasuries closed at fresh lows of 1.54%, which is the first time it has closed lower than the SPX div yield for multiple days since the financial crisis. Staying with long bonds, the 100 year Austrian bond (2117 maturity) now trades at a price of over 218 having started the year at around 158 – nearly a 40% return in just over two months. At the start of March last year it was just under 120. I can’t help wishing I had a long dated fixed income pension portfolio in Austria. I also can’t help wishing I was still alive when it matures.

After the close last night we heard from a few Fed officials. Fed president Williams said that his baseline outlooks for the US was still “pretty darn good”, yet he saw risks for the outlook around growth in China and the global economy. He saw inflation moving up to the 2% goal, with growth around 2.25%, even with issues around the virus on China’s growth outlook. Finally he cited his concerns surrounding the transition from Libor, and called it the “biggest challenge to our financial system.” Fed president Kaplan was equally concerned about the virus and said that the spread would be important to view when deciding on whether another interest rate cut was needed, but did not view the equity moves as tightening financial conditions excessively. Fed president Kashkari cited the cut this week as insurance against negative economic effects from the spread of the virus, but acknowledged that more cuts may be needed.

Moving on. While today’s payrolls report would usually be the focal point for markets, for now the data is very much playing second/third/insert as necessary* fiddle to what is going on with the coronavirus given that it’s all too backward looking. So it’s likely markets will somewhat look beyond what the data shows however for completeness the consensus for today is 175k following a 225k print last month. This should be enough to keep the unemployment rate at 3.6% while average hourly earnings are expected to rise +0.3% mom with the annual rate at +3.0% yoy.

The same can be said for the data that was released yesterday. In fairness the claims data was about as real time as we can get and that showed no deterioration (216k versus 219k the week prior). Expect the market to be focused on this data from next week onwards however. Elsewhere Q4 nonfarm productivity was revised down to 1.2% qoq and core capex orders were unrevised in January at +1.1% mom. In Europe the only data of note was the February construction PMI in Germany which rose 0.9pts to 55.8 and the highest since January 2018.

To the day ahead now where this morning the data includes January factory orders in Germany. This afternoon the focus is on the February employment report in the US while the January trade balance and January wholesale inventories are also due to be released. Expect the Fedspeak to also be a big focus today with Evans, Mester, Bullard, Williams, Rosengren and George all due to speak.

Tyler Durden

Fri, 03/06/2020 – 07:32

via ZeroHedge News https://ift.tt/2xhLC0v Tyler Durden