February Heavy Duty Truck Orders Plunge, New 2020 Estimates Call For A 31% Drop

It has been an interesting dance over the last 18 months for the Class 8 trucking industry and its analysts. While the numbers have consistently told us one thing, namely that the economy is slowing and that the trucking industry is bearing the brunt of the recession, analysts continue to make excuses for the poor numbers while holding out what seems like neverending hope for a turnaround.

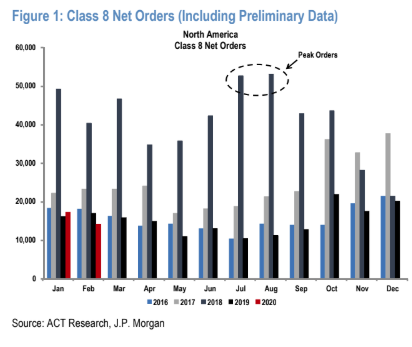

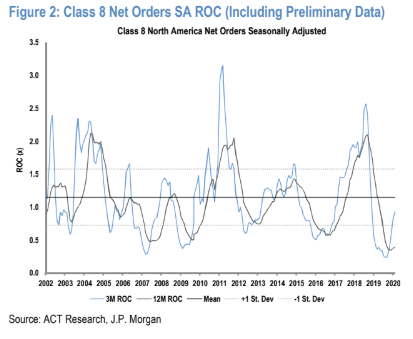

But the data doesn’t lie: February Class 8 orders fell 16%. The month is traditionally a slower one for the heavy duty trucking industry, but this year included an extra day. The seasonally adjusted orders were the weakest monthly order rate since last August, according to ACT Research.

ACT’s senior analyst Kenny Vieth said: “Weak freight market and rate conditions, as well as a still-large backlog, continue to bedevil new Class 8 orders.”

Thanks for that groundbreaking analysis of the situation. Lest we forget, ACT Research had said last month that it expected the backlog in Class 8 orders to “continue to wear away”. We guess that is no longer the case.

Forward projections for the rest of the year don’t look optimistic either. Analyst Ann Duignan from JP Morgan has said she expects production of ~236,000 Class 8 units in 2020, or down 31% y/y. She is also estimating ~240,000 units in 2021, or up 2%. We anticipate that these numbers could vary sharply depending on how severe the coronavirus outbreak in the U.S. winds up becoming.

Leading indicators remain weak, according to JP Morgan:

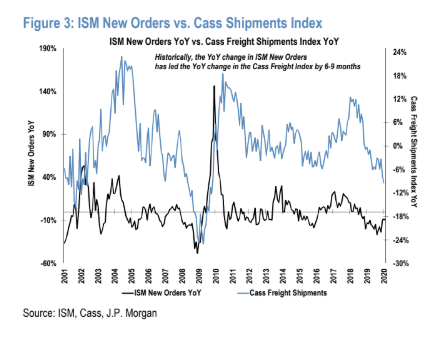

According to our analysis, the ISM New Orders Index tends to be the best leading indicator of future freight trends and truck demand. Specifically, the YoY change in ISM New Orders has historically led the YoY change in the Cass Freight Index (our preferred broad-based indicator of freight trends) by 6-9 months.

ISM New Orders Index decreased 2.2pts MoM to 49.8 in February, down 9.3% YoY and back in contraction region (<50). The Cass Freight Index was down 9.4% YoY in January (the latest month available), a fourteenth consecutive YoY decline. We note though that the Cass Freight Index includes rail freight and may be less of an indicator of overall freight, so we also look at the ATA Total Loads SA Index, which increased 4.1% YoY to 112.0 in January (vs. up 6.0% YoY in December).

And while it’s seemingly stunning to “analysts”, this data should not surprise Zero Hedge readers.

Recall, in January, Class 8 orders had a temporary dead cat bounce. While analysts pontificated about brighter days for the heavy duty truck market during almost every single data report throughout 2019 and through January 2020, we remained skeptical.

For now, it looks as though we continue to be correct.

Tyler Durden

Tue, 03/10/2020 – 18:05

via ZeroHedge News https://ift.tt/3cKvhBz Tyler Durden