Core CPI Jumps Near Highest In 12 Years As Services Costs Soar

After printing hotter than expected in January, headline consumer price inflation was expected to slow in February (and it did) but actually printed higher than expectations.

-

Headline CPI rose 2.3% YoY (slower than the +2.5% in Januray but higher than the 2.2% expectation)

-

Core CPI rose 2.4% YoY (higher than January’s +2.3%)

Source: Bloomberg

This is near the highest Core CPI since Sept 2008..

Source: Bloomberg

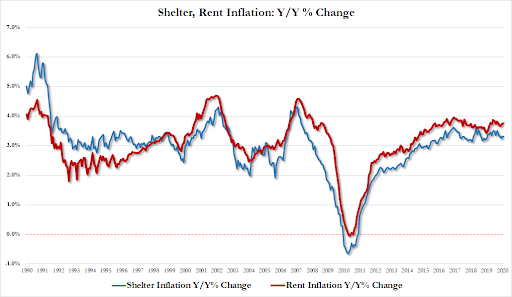

Under the hood, Services inflation continues to accelerate to its highest since August 2016 as goods inflation languishes…

Source: Bloomberg

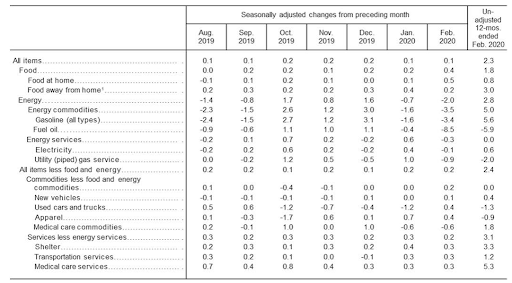

The Details:

The shelter index rose 3.3 percent over the 12-month span, and the medical care index rose 4.6 percent.

The apparel index rose 0.4 percent in February following a 0.7-percent increase the prior month. The personal care index also increased 0.4 percent over the month. The index for used cars and trucks rose 0.4 percent in February after falling 1.2 percent in January. The education index increased 0.3 percent in February, and the motor vehicle insurance index rose 0.5 percent. The indexes for household furnishings and operations, for new vehicles, for tobacco, and for alcoholic beverages also increased over the month.

The medical care index rose 0.1 percent in February with its major component indexes mixed. The index for physicians’ services rose 0.2 percent, while the index for prescription drugs fell 0.8 percent and the index for hospital services declined 0.1 percent. The recreation index was one of the few to decline over the month, falling 0.3 percent after increasing in each of the previous 4 months. The index for airline fares also fell in February, decreasing 0.3 percent after rising in January. The communication index was unchanged over the month.

Of course all of this is before the coronavirus really starte to take effect – which will have very ‘odd’ effects in terms of both inflation (some goods) and deflation (services)

Tyler Durden

Wed, 03/11/2020 – 08:41

via ZeroHedge News https://ift.tt/2W2TPjm Tyler Durden