Dual Shocks: OPEC Slashes 2020 Oil Demand Growth By 94%

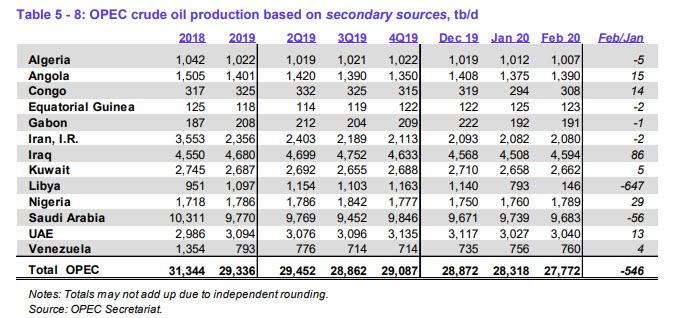

While the monthly OPEC report is usually best used as a 100-page paperweight, this month – in the aftermath of OPEC’s collapse after Saudi Arabia announced it would unleash a scorched-earth price war on all high cost oil producers (itself included) – investors actually cared what OPEC had to say, beyond just the popular monthly table which shows oil production by OPEC member stated, and which showed that in February Libyan production cratered and Saudi Arabia was just below 9.7mmb/d…

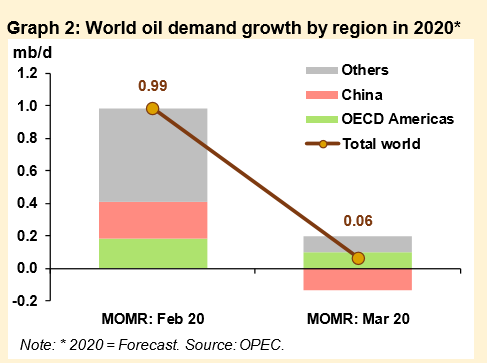

… and instead oil-market watchers were more curious about the demand side, since they already know a supply shock is coming. What they found is that OPEC also expects a concurrent demand shock – the first such double whammy since the Great Depression – as OPEC now sees a whopping 94% drop in 2020 global oil demand growth in response to the economic impact of the coronavirus even as global oil supply is set to explode.

Here are the main points, courtesy of RanSquawk

- 2020 global oil demand growth forecast revised down by 920k BPD from 990k to 60k BPD, reflecting slower global economic growth associated with a wider spread of Covid-19 beyond China, which however was the bulk of the demand collapse

- Preliminary data indicates that global oil supply in February decreased by 290k BPD to average of 99.75mln BPD, up 780k BPD YY.

- In February, OPEC crude production fell by 546k BPD MM to average 27.77mln BPD, according to secondary sources. Crude output increased in Iraq, Nigeria, Angola, Congo and UAE whilst production decreased mainly Saudi in and Libya (-647k BPD MM), Iraq and Kuwait.

Of course, with bank analysts now admitting a recession is now virtually inevitable, we expect the April MOMR will seen an outright drop in demand in 2020, one which will only get bigger with time.

Here are the other highlights:

OPEC

- Demand for OPEC crude in 2020 was revised down by 1.1 BPD compared to the prior report and stands at 28.2mln BPD, around 1.7mln BPD lower than the 2019 level

- The share of OPEC crude oil in total global production decreased by 0.5 ppt to 27.8% in February compared with the previous month

NON-OPEC

- For 2020, the FSU oil supply forecast revised up by 10k BPD to and is expected to grow 70k BPD to 14.44mln BPD OECD

- OECD oil demand was revised down by 60k BPD, with most of the downward revisions appearing in 1H20.

- Considering the latest developments, downward risks currently outweigh any positive indicators and suggest further likely downward revisions in oil demand growth, should the current status persist.

- OECD total product inventories rose by 38.6mln barrels MM in January to stand at 1.508bln barrels. This was 59.2mln barrels above the same time a year ago, but 8.8mln barrels lower than the latest five-year average.

CORONAVIRUS

- Based on preliminary and partly estimated data, China’s oil demand started the year at modest growth levels. Oil demand growth in January 2020 posted an increase of 0.16mln BPD compared to January 2019, though this was far below the average monthly growth level in 2019 of 0.36mln BPD

WORLD ECONOMY

- Following a considerably weaker economic growth for 2H19 in Japan, Euro-zone and in India, the Covid-19 related developments necessitated a further downward revision of the 2020 GDP growth forecast to 2.4% from 3.0% forecast in the previous month. This compares to a 2019 GDP growth estimate of 2.9%.

* * *

What about the supply shock? We didn’t need the OPEC MOMR for that: the following headline is sufficient to see may Brent will soon plunge into the teens as Deutsche Bank warned earlier this week.

BREAKING NEWS #OOTT pic.twitter.com/prGCU3aklZ

— Amena Bakr (@Amena__Bakr) March 11, 2020

Tyler Durden

Wed, 03/11/2020 – 09:27

via ZeroHedge News https://ift.tt/3aOkqVk Tyler Durden