Goldman Calls It: “The Bull Market Is Ending”; Cuts S&P Target To 2,450

Yesterday we reported that the perpetual sellside optimists at JPMorgan, led by Croatian tag-team of Lakos-Bujas and Kolanovic, admitted that their chronic optimism may have been catastrophically misplaced, and while repeating the bank’s year end 3,400 price target (not for long) they also said that in case they are wrong (they are) and the Covid pandemic accelerates globally, they now expect a “pessimistic scenario”, where “the equity multiple may not find a bottom until it hits 14-15x and EPS growth turns negative—implying a recession case of ~2,300 level for S&P500.”

In short, JPMorgan came this close to admitting a recession is on deck.

Now it’s Goldman’s turn.

In a note published early on Tuesday morning, Goldman’s chief equity strategist David Kostin writes that “after 11 years, 13% annualized earnings growth and 16% annualized trough-to-peak appreciation, we believe the S&P 500 bull market will soon end.”

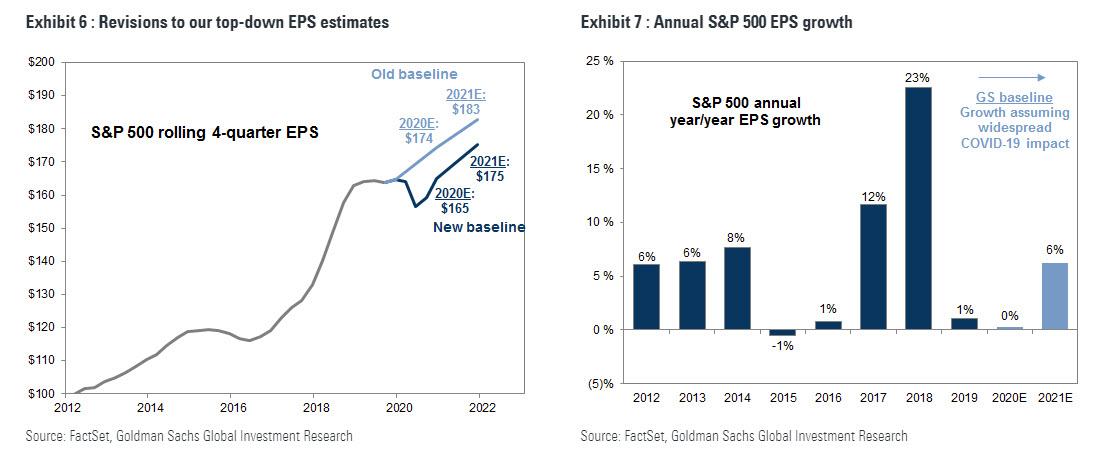

As a reminder, it was just two weeks ago on February 27th, when Goldman first cut its 2020 S&P 500 EPS estimate to $165, stating that it now expects no earnings growth in 2020 (technically, that would be the second year in a row without earnings growth), however, the bank kept a cheerful perspective by anticipating a big jump in 2021 earnings.

That optimism is now gone and as Kostin writes this morning, “we are now reducing our profit forecast again. Our revised 2020 EPS estimate equals $157, representing a decline of 5% vs. 2019.”

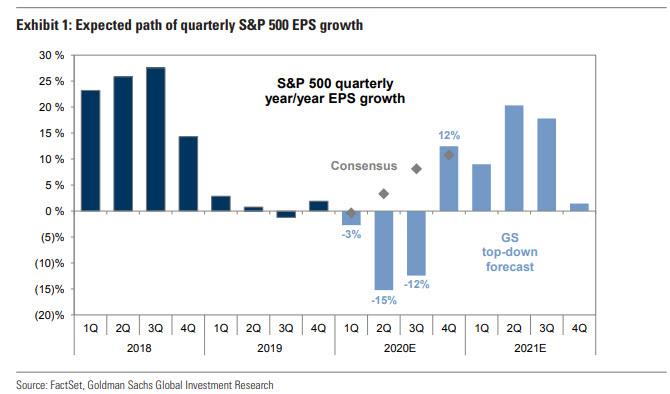

On a quarterly basis, Goldman now expects EPS to literally “collapse” by roughly 15% in 2Q (consensus expects +3%) and 12% in 3Q (consensus expects +8%) before once again predicting a surge of 12% in 4Q and 11% in 2021 – we expect that in the next downward revision to Goldman’s base case, this 2021 V-shaped rebound will quietly disappear.

Drivers of Goldman’s reduced EPS estimate include:

- lower crude oil prices that reduce Energy company profits;

- lower interest rates that squeeze net interest margin (NIM) for Financials; and

- lower volume of business activity and reduced consumer spending that curbs revenues for companies across many industries. This is underscored by reduced or withdrawn sales and earnings guidance from a number of Information Technology firms, a sector that contributes nearly 20% of aggregate S&P 500 EPS.

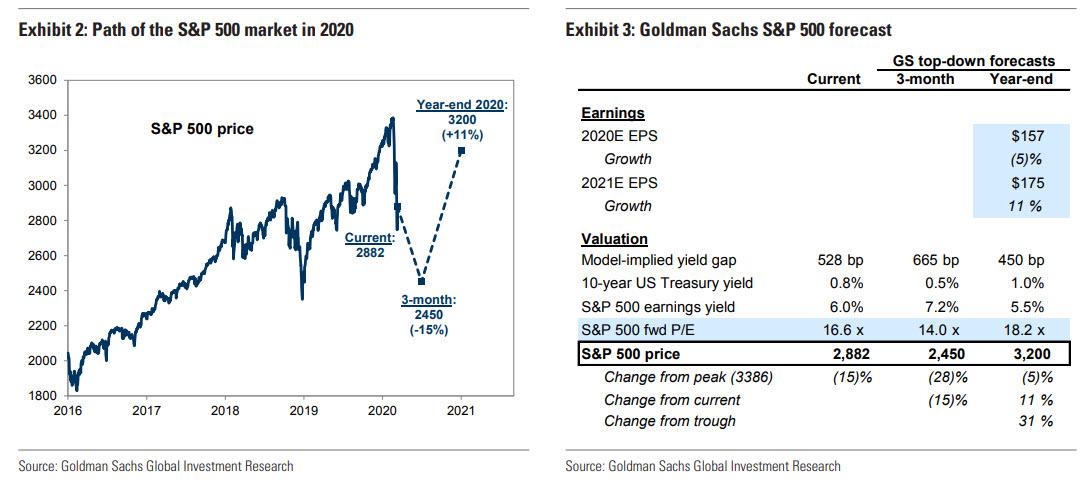

Alongside plunging earnings, Goldman now also expects a sharp drop in the S&P, and now sees the broadest US equity index will tumble into a bear market by mid-year and despite low bond yields, Goldman now has a mid-year S&P 500 target of 2450 (15% below the current level and 28% below the market peak).

Translation: After 11 years, the longest bull market in history is coming to an end.

Some more observations here from Kostin:

Ten-year US Treasury yields plunged from 1.9% at the start of 2020 to an intra-day low of 0.3% this week before rising to 0.8% today. Despite this valuation support, we expect falling growth expectations and consumer confidence as well as elevated policy uncertainty will widen the yield gap to 665 bp, corresponding with a forward P/E multiple of 14x and a mid-year S&P 500 level of 2450.

Of course, just like JPMorgan, Goldman can’t leave it on a doomish note, and as such the bank sees a silver lining in late 2020 when it expects that the impact of the coronavirus will likely wane, and as a result “a recovery in earnings and sentiment will reduce the yield gap to 450 bp and lift the S&P 500 to 3200 by year-end (+31% from the trough). The sharp rebound would be modestly higher than the median 6-month return following previous event-driven bear markets.”

Bottom line: Goldman told a part of the truth, but is terrified to tell the full truth, and is why in 3-4 weeks when Goldman downgrades its earnings forecast for the 3rd consecutive time, we expect that any hint of a V-shaped recovery will be gone for good, replace with the far more appropriate “L-shaped” recovery.

Tyler Durden

Wed, 03/11/2020 – 08:48

via ZeroHedge News https://ift.tt/2vWHK4D Tyler Durden