Rabobank: We Cannot Help But Think Of Two Historical Comparisons, And Both Are Terrible

Submitted by Michael Every of Rabobank

Tuesday duly delivered the Dead Bat Bounce we had expected; and, underlying just how unusual these times are, that included a near 5% rally in US stocks, a 29bp intraday sell-off in US 3o-year yields(!), a 10%+ jump in oil (even as the Saudis put the pedal to the metal with a pledge to exceed what this their normal maximum output), and a surge in USD that has pushed USDJPY back to 104.43, EURUSD back to 1.1338, and AUDUSD well below the psychological 0.65 level for a time.

The market was also duly focusing on what is now seen as duty: promises of fiscal and monetary stimulus. In the US, the provider of fiscal stimulus was also duly focusing on an attack on the provider of monetary stimulus for not having done enough on rates, even after an emergency 50bp cut and expectations of a minimum of another 50bp at their meeting next week, which would leave them just 50bp away from the effective zero-bound again.

Fiscally, we didn’t get any firm answers from the US. Indeed, the press reports the collective intelligence of Larry Kudlow and Steven Mnuchin has been pushing and pulling the president, initially in favour of a payroll tax cut–a bazooka–and then back towards smaller measures–(“because this is flu”)–and then, after somebody on Air Force One had to self-isolate due to a potential virus infection, back to something bigger from the infamously germ-phobic Trump….which has not been released yet. As we sit and wait to see what the US will do, I cannot help but think of two historical comparisons, and neither is flattering.

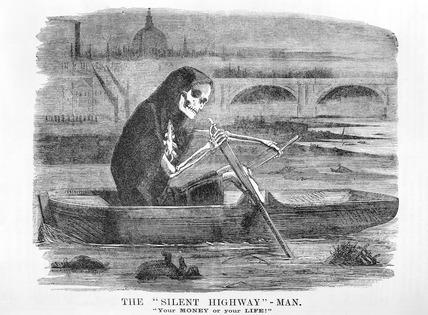

The first is the UK and “The Great Stink” of 1858. Back in the 19th century, the Thames used to receive all of London’s rubbish, industrial effluent, and raw sewage, which made it foul and dangerous. Parliament did nothing–“because small government and markets”–up until the long, hot day where the smell was so unbearable that everyone working in Westminster could no longer breathe. Suddenly funding was available for the London sewer system that the city still relies on today (and long failed to invest in “because small government and markets”).

When one considers that most of Congress is in the Covid-19 danger-zone age-wise, and that it is already spreading in policy-making circles, and that it is in New York City too, where Wall Street sits, can we expect a “Great Stink” policy response? After all, senior Pentagon figures are infected, as are political leaders from Iran to Portugal to Italy; and this morning there is the irony of the UK Health Minister being infected – clearly Keep Calm and Wash Your Hands (“because markets”) is not quite as effective as the official advice would suggest. Even PM Johnson might have to be tested now – though Trump has naturally refused to do the same.

So while we wait for that inevitable stinky fiscal response the second parallel today is the 1970s Soviet Union, which was in total economic and social stagnation and ruled by a gerontocracy that matched it. They knew change was needed; they just could not agree on what could be done that did not fundamentally change the ruling system so much that it would collapse. Which leg of the Communist table could they remove without it toppling over? The answer was none, and consequently, after long presidium meetings, the answer was always to extoll the glories of the Soviet system and its workers, and to build more statues of Marx and Lenin. Today we have inequality and populism and Forbes and Fortune magazine extolling billionaires and digital disruption as we build endless, empty high-end condos with silly names in Asia (“The Beatniq” is just round the corner from me in Bangkok. No, they don’t get the irony). Far more than just fiscal stimulus is arguably going to be needed to deal with this present virus crisis, and to prevent future damaging episodes, and to deal with the underlying socio-economic problems and weaknesses that this virus will expose. These are going to have to be structural: who can deliver?

Consider that as in the US Joe Biden trounced Bernie Sanders in more key Democratic nomination votes. Sanders is limping on and Tulsi Gabbard is also technically still in the race even if she has become mysteriously invisible to the press and DNC since she spoke back to Hilary Clinton: yet Biden is surely the nominee. In short, a 77-year old who would be 86 if he completes two presidential terms will be challenging a 73-year old who will be 78 when he leaves office if he wins; and a Democratic field that started with a young field speaking Spanish ends up with an old white man whose critics allege can’t speak English (“Malarkey 2020”). Of course, the Soviet analogy is not complete in that Trump has certainly challenged many parts of the current orthodoxy, even if he is now stumped by a virus that does not yield to rising stocks and falling taxes; so did Sanders, whose ideas like Medicare for All are so incredibly appropriate right now that they have naturally been rejected by Democratic voters. It’s unclear exactly what Biden represents other than Not Trump, but radical socio-economic change is presumably not going to be part of his platform. Markets will naturally love that – except when they realise it implies much tighter fiscal policy and not leaning on the Fed for looser monetary policy.

And consider the analogy in Europe too, where virus panic is now finally starting to sink in following developments in Italy (where 631 are now dead). Yet just days ago France was still holding a Smurf Festival, where 3,500 people turned up painted blue, as if viruses can’t happen because of the Four Freedoms (of movement of goods, services, people, and capital: Shai-Hulud! Praise the Coming and the Going!) Moreover, even as there is a realisation that Something Must Be Done in Europe, there is still no full agreement of what and how, because of the limitations of the Stability and Growth Pact and the Eurozone itself. Tomorrow it will be the turn of Christine Lagarde in that spotlight to solve that problem against a backdrop where Austria and Poland are taking their own real world actions with border controls, despite the Schengen Treaty.

Today, however, it is the turn of Rishi Sunak, the UK Chancellor whose incredible youth is supposed to illustrate the sunny demographic uplands of Brexit. He has been in the job about as many days as he has years under his belt, which in some firms is still a window in which one has not yet got one’s email up and running and business cards printed. The expectation is that Sunak will give us a budget packed full of the kind of virus-fighting, level-upping stimulus that you can only get if you: (1) dump the fiscal straight-jacket of the Eurozone; and (2) dump the “because markets” monomania of the Larry Kudlows of this world too. The press are suggesting we will see GBP600bn (USD900bn) pledged for infrastructure and R&D over the next five years, and hopefully something for health too, which will be the highest level of real investment by the public sector since 1955. As such, out the window go the UK’s Fiscal Rules. And quite right too given the 10-year Gilt yield is, as I type, all of 24 basis points. No need to kick up a Great Stink about that development as such.

Tyler Durden

Wed, 03/11/2020 – 13:30

via ZeroHedge News https://ift.tt/38JOss5 Tyler Durden