Bazooka Backfires: Stocks Tumble, FRA/OIS Soars After Fed’s Massive Repo Operation Fails To Fix Liquidity Crisis

Maybe the Fed’s repo bazooka was just a water pistol?

Less than an hour after the Fed announced a massive expansion to its repo facilities, adding one $500 billion 3-month repo today, following by an identical repo tomorrow and subsequent weekly $500BN repos (in addition to officially expanding NOT QE to a coupon monetizing QE-5), many are asking if the Fed applied the wrong medicine for two reasons:

The first, and obvious one, is that you can’t fix a viral pandemic with monetary easing… but let’s pretend that’s not an issue for now.

The less obvious, bust just as important reason is that after the Fed announced the results of the first half a trillion dollar repo today, the uptake was a tiny 15.7%.

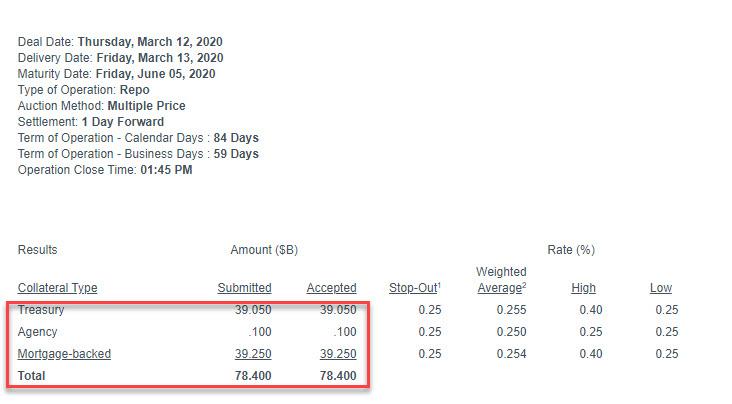

Indeed, as shown below, dealers only submitted $78.4 billion in securities for today’s massively upsized 3-month repo operation…

… which it appears will not be the panacea the Fed may have expected it to be.

As a result, even though today’s total liquidity injection between the two term and one overnight repos earlier, and the 3 month megarepo just now, the Fed has injected a total of $276.5 billion in liquidity, and yet stocks have tumbled back to session lows…

… as traders realize that what is ailing the market is not access to the Fed’s balance sheet, but an overall recession that will collapse revenues, profits and cash flow, and which the Fed’s liquidity injections are powerless to prevent.

But wait, there’s more: because as stocks sold off, a far more ominous development is that judging by the surge in the FRA/OIS, a closely followed indicator of interbank funding, following the Fed’s repo operation the liquidity shortage had nothing to do with extra repo access, and is about to get much worse especially with the Fed having already fired its bazooka.

In other words the Fed tried to fix whatever is causing the structural problem at the heart of the market’s illiquidity, and has so far failed, which means that absent another emergency bailout attempt, we may very soon have a market – and bank – holiday.

Tyler Durden

Thu, 03/12/2020 – 14:46

via ZeroHedge News https://ift.tt/39NcjbN Tyler Durden