Morgan Stanley: “Houston, We Have A Problem”

Authored by Christopher Metli, head of Quantitative and Derivatives Strategy at Morgan Stanley

Yes, we’ve used that title before. But it’s appropriate.

The stresses in many areas of the financial markets are spreading. The market is increasingly pricing in a seizing of the real economy as the market awaits more details on the timing and scope of response. Compounding these problems is growing financial stresses as cash becomes dear, which threatens to create a negative feedback loop between markets and the economy. Poor liquidity, a breakdown in correlations, physical exchanges closing (CME for now), and many working from home compound the problem. While a 2008 style financial system meltdown may not be in the cards, the market is increasingly demanding greater liquidity backstops and greater fiscal action. QDS noted on Monday financial markets had Crossed the Rubicon, and the decline now may not stop until the market gets what it is demanding from policymakers.

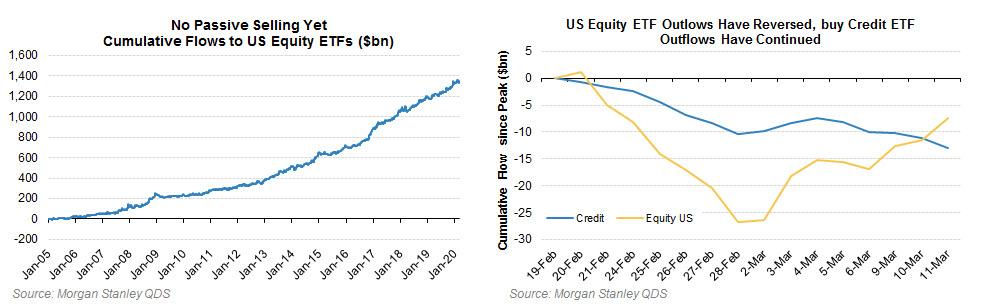

Systematic strategies have been the leading sellers so far, and asset managers have likely contributed as well. But bottoms up hedge funds have not derisked to the same extent, and retail / passive has not yet sold materially either. Only when those groups sell (and investors get clarity on the policy response) can markets find a durable bottom.

The Fed can and has acted quickly – yesterday announcing three new 1-month term repos and an upsized overnight facility. But Congress must also act to prevent small businesses from going under from an unprecedented demand + supply (labor and goods) shock. While MS Public Policy Analyst Michael Zezas notes that “things have become sufficiently worse so that a fiscal response is now turning into more of a question of ‘when’ and ‘how’ as opposed to ‘if’” the ‘when’ and ‘how’ is a problem (see What’s a Sufficient Stimulus? Mar 11 2020). He notes that “With key proposals lacking an operational and bipartisan precedent and Congress set to recess next week, we wouldn’t expect a comprehensive plan to materialize quickly.” Markets aren’t good at waiting a week.

Risk is becoming increasingly hard to manage for a host of reasons, which may finally bring in HF sellers. Retail selling of passive holdings will likely be the final wave of sell pressure, and may come only when individuals are forced to stay home, not get paid, etc.

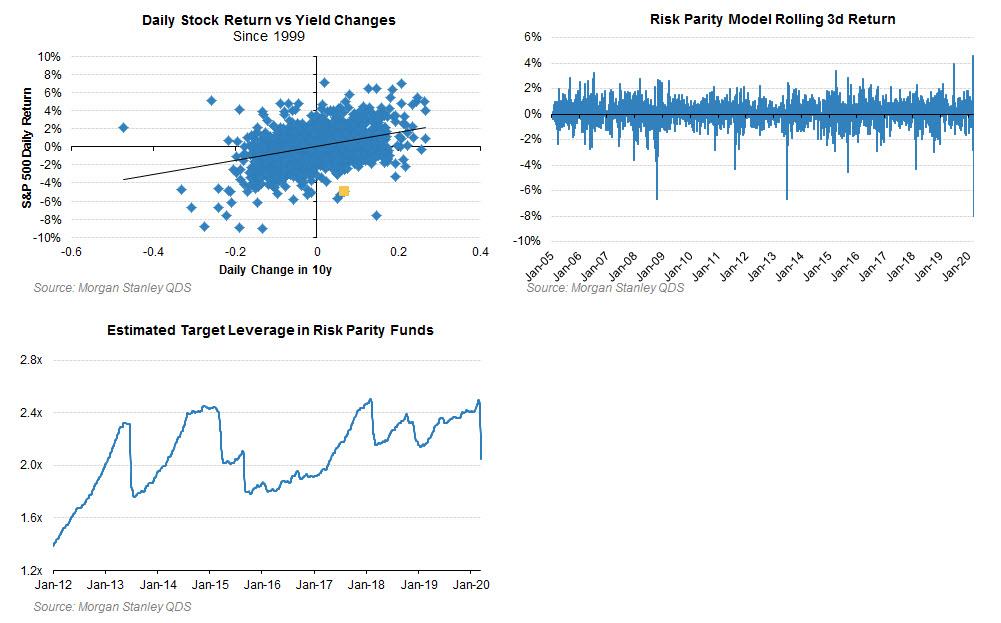

- There are signs of a breakdown in stock-bond correlation, with stocks underperforming 10-year yields by nearly 5 standard deviations yesterday. This puts stress on all multi-asset portfolios, but Risk Parity funds in particular are likely struggling, having the worst 3 day period on record on QDS’s model.

- As previously noted Risk Parity funds are the class of the systematic strategies that are likely still running high leverage – 50th %ile since 2012 and 70th %ile since 2005 on QDS’s model. This means they could have $10bn or more of stock to sell / day in these kinds of environments – and since they often will be selling stocks and bonds together, their flow can reinforce correlation breakdowns like we are seeing here. Also note that a stock-bond correlation breakdown can also threaten many consensus equity trades, and potentially could force the long awaited L/S degrossing. Lower stocks can put pressure on the long (Growth/Tech) side of portfolios while higher rates gives some support to the short (Cyclical/Value) side of books.

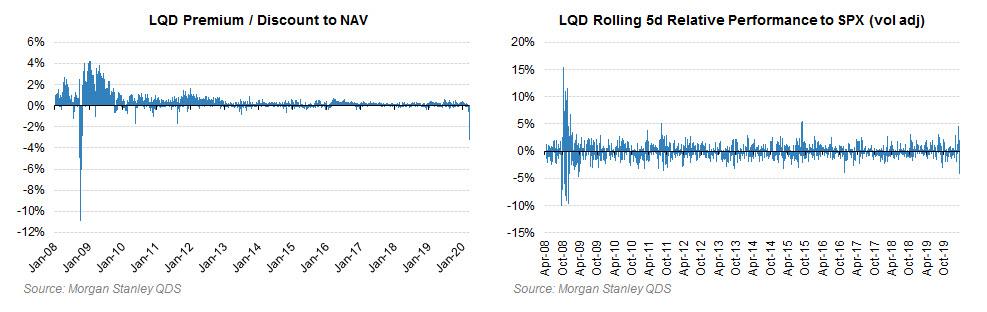

- Financing stresses are growing. The blowout in the basis between Treasury futures and cash bonds is reminiscent of 2008 as anything that required cash to buy traded cheap relative to synthetic / derivative exposures. While this may be a one-off dislocation that Fed repo can solve, it is putting pressure on credit as well. LQD (IG credit ETF) is trading at its steepest discount to the underlying bonds since 2008, in part reflecting the lack of trading in those bonds. High Yield is obviously under pressure as well on the back of fundamental and credit stresses, while the dislocation in IG indicates more risk premium and funding stresses (both bad and can compound).

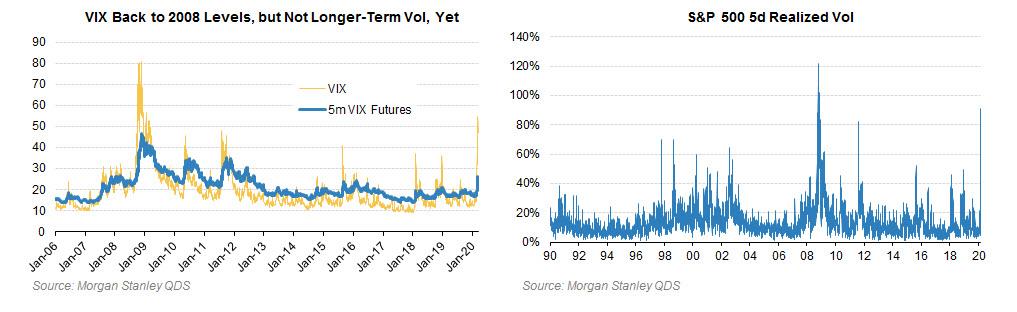

- Higher volatility will drive lower leverage. Systematic strategies that directly lever up and down based on realized volatility have sold, but Hedge Funds have been one of the big holdouts this cycle, not aggressively selling and actually adding to gross leverage – but as volatility continues to march higher risk limits dictate that leverage has to decline.

- 5-day realized vol for the S&P 500 has hit 80%, the highest since 2008/9. During the 2008 cycle realized vol crossed 80% in early October, before the VIX peaked on November 20th and before the S&P 500 bottomed on March 9th. As higher volatility is sustained, longer-dated implied volatility should rise more. And as QDS has noted previously, when volatility rises significantly, the bottom in equities often comes well after the spike (i.e. no V-shaped recovery in markets).

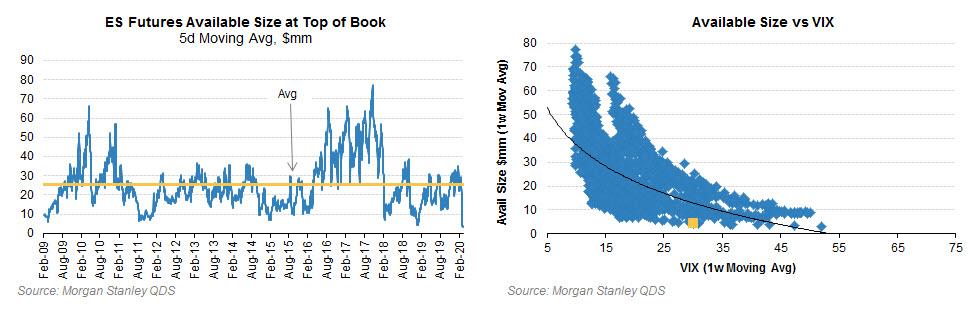

- Liquidity is obviously challenging as well. While much of this is due to elevated volatility rather than a breakdown in market function, that doesn’t help anyone that has to manage risk.

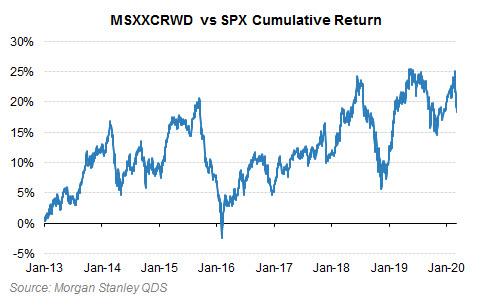

While the degrossing that QDS has been expecting has been elusive, as the situation gets worse pressure on the crowded longs should accelerate. The MS Crowding Basket (MSXXCRWD) has underperformed SPX by 5% over the last week and a half, and this gap should grow as expectations for economic growth deteriorate further.

Tyler Durden

Thu, 03/12/2020 – 13:30

via ZeroHedge News https://ift.tt/2Wei5PP Tyler Durden