“American Carnage” In Ten Bullet Points

Late last year, BofA’s Chief Investment Officer perfectly predicted how far the market meltup that was unleashed by the Fed’s “NOT QE” would push stocks higher, when he said that the S&P would hit 3,333 by March 3. He was right, and more notably, he was early, because the S&P rose just shy of 3,400 by late February… at which point everything imploded.

As a result, last week, in his latest Flow Show note, Hartnett reversed by 180 degrees and preemptively declared that based on the market’s response to the ongoing coronavirus pandemic, “We are in a global recession.” Which probably would imply that one week later, following the worst market rout since the global financial crisis, Hartnett would call his latest note “We are in a global depression.“

He did not go that far – it would not be professional for a Wall Street strategist to admit just how bad it could get – although certainly would be justified in light of the latest asset performance which is as follows:

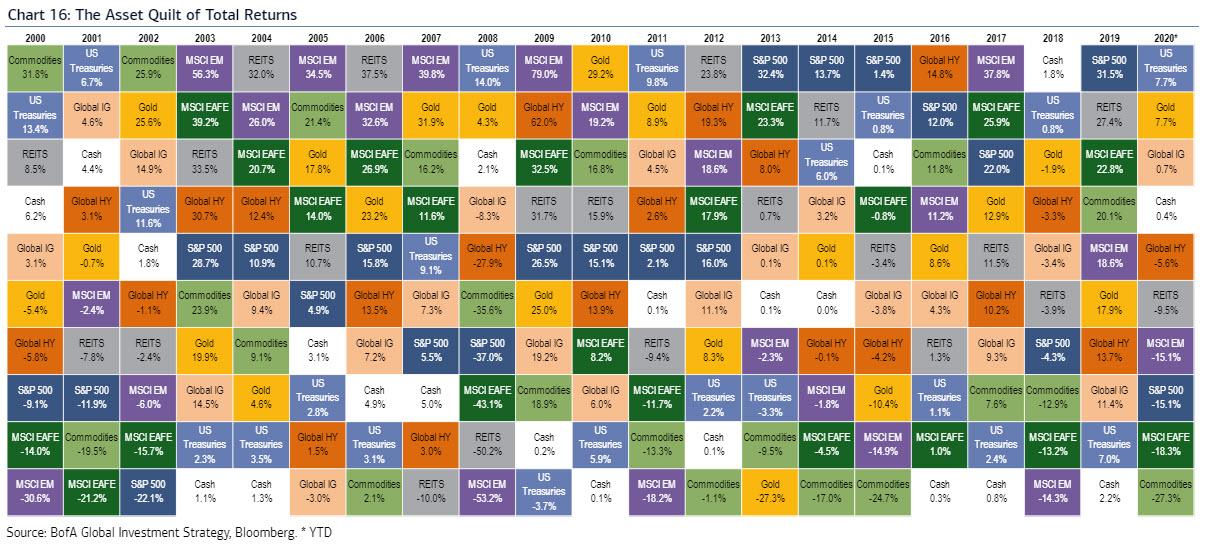

- gold 7.7%,

- government bonds 5.6%,

- IG bonds 0.4%,

- cash 0.4%,

- US dollar 0.1%,

- HY bonds -5.6%,

- global equities -15.9%,

- commodities -27.3% YTD.

Instead, Hartnett said that the “global recession began last week driven by virus + oil + asset prices…credit markets effectively closed, spreads discounting credit events in corporate debt, private equity/shadow banking, risk parity, emerging markets.”

The BofA CIO then summarized in 10 bullet points just how catastrophic to “American carnage” has been, to wit:

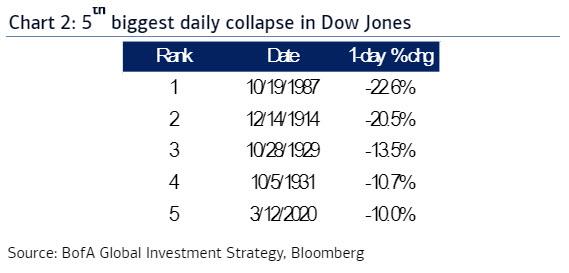

- Thursday’s 9.9% loss in Dow Jones = 5th largest daily loss of all-time.

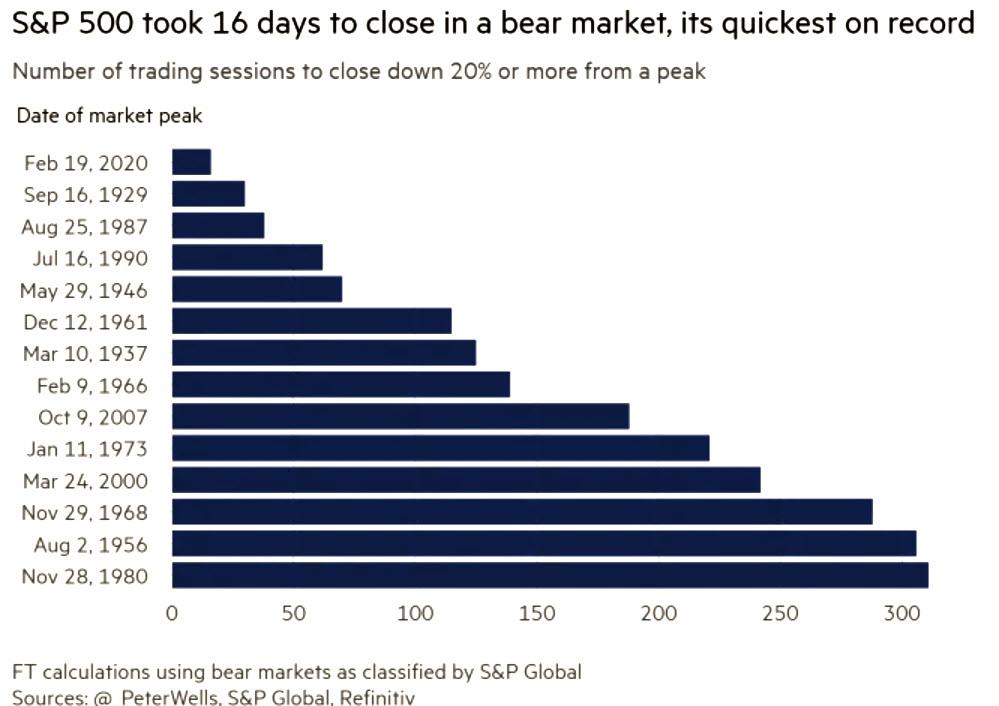

- 16 days from peak to US equity bear market fastest ever; comparable to 1929 & 1987.

- Global market cap loss past 3 weeks $16tn, >China GDP.

- S&P500 market cap loss equates to $28,066 per US citizen.

- MAGA stocks (Microsoft, Apple, Google, Amazon) all in bear market.

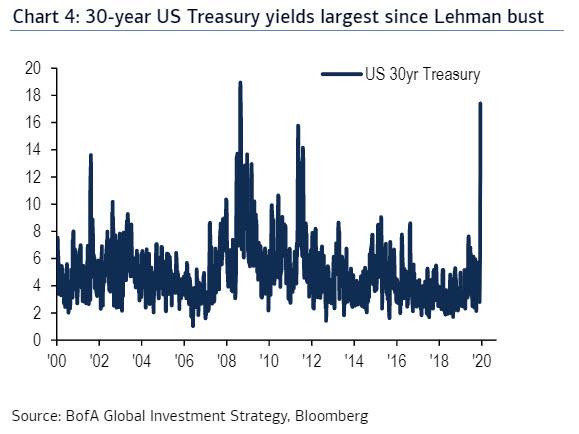

- Standard deviation in 30-year US Treasury yield largest since Lehman.

- CDX on IG & HY bonds widest since US debt downgrade in 2011.

- Record bond ETF liquidation despite QE (see MBV, MUB).

- Final capitulation indicated by safe haven selling (see TLT, GLD).

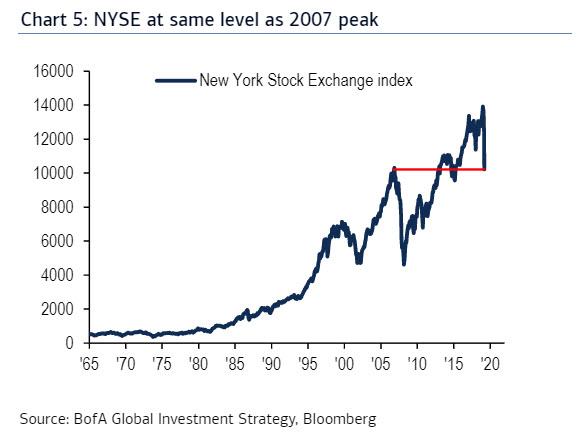

- NYSE index (NYA), which includes US stocks/ETFs, foreign stocks via ADRs, and all bond ETFs -30%…back at same level as 2007 peak (Chart 5).

Putting it together, one may want to just sniff some ether, which Hartnett’s recap references nicely: “Fear & Loathing: crash reflects fear of economic recession, debt defaults, forced Wall St liquidations, policy impotence/incompetence.”

Good luck to all.

Tyler Durden

Fri, 03/13/2020 – 13:04

via ZeroHedge News https://ift.tt/38LpSHq Tyler Durden