Bank of Canada Announces Emergency 50bps Rate Cut, As FinMin Unveils C$10BN Support Program

After a day of relentless central bank interventions across Asia and Europe, which jumped the Atlantic this morning when the Fed announced not one but 6 emergency QE POMOs, moments ago Canada joined the panic response, when the Bank of Canada announced an emergency 50bps rate cut, lowering the overnight rate from 1.25% to 0.75%, generally in line with the market’s expectations.

According to the central bank, “this unscheduled rate decision is a proactive measure taken in light of the negative shocks to Canada’s economy arising from the COVID-19 pandemic and the recent sharp drop in oil prices.”

The BOC maintained its easing bias, stating that it stood ready to adjust monetary policy further if required, while it dropped the reference in its January statement which stated policy was at an appropriate level. In its policy statement, the Bank said that while the economy had been operating close to potential, with inflation at target, the virus is a “material” negative shock to the Canadian and global outlooks; business activity in some regions has fallen sharply and supply chains have been disrupted, reflective in CAD and commodities, the statement noted.

The BOC also believes that as the virus spreads, business and consumer confidence will deteriorate further, which will depress activity. In light of all these developments, the central bank said that the outlook was clearly weaker now than it was in January.

Finally, the Bank said it “has also taken steps to ensure that the Canadian financial system has sufficient liquidity.”

Some more details from the announcement:

The Bank of Canada today lowered its target for the overnight rate by 50 basis points to ¾ percent. The Bank Rate is correspondingly 1 percent and the deposit rate is ½ percent. This unscheduled rate decision is a proactive measure taken in light of the negative shocks to Canada’s economy arising from the COVID-19 pandemic and the recent sharp drop in oil prices.

It is clear that the spread of the coronavirus is having serious consequences for Canadian families, and for Canada’s economy. In addition, lower prices for oil, even since our last scheduled rate decision on March 4, will weigh heavily on the economy, particularly in energy intensive regions.

The Bank will provide a full update of its outlook for the Canadian and global economies on April 15. As the situation evolves, Governing Council stands ready to adjust monetary policy further if required to support economic growth and keep inflation on target.

The Bank has also taken steps to ensure that the Canadian financial system has sufficient liquidity. These additional measures have been announced in separate notices on the Bank’s website. The Bank is closely monitoring economic and financial conditions, in coordination with other G7 central banks and fiscal authorities.

Separately, Canada’s finance minister said Canada is ready to take extraordinary measures to combat the COVID-19 outbreak, and to that purpose, Canada will establish credit support program to provide additional C$10 billion to businesses and stimulate the economy.

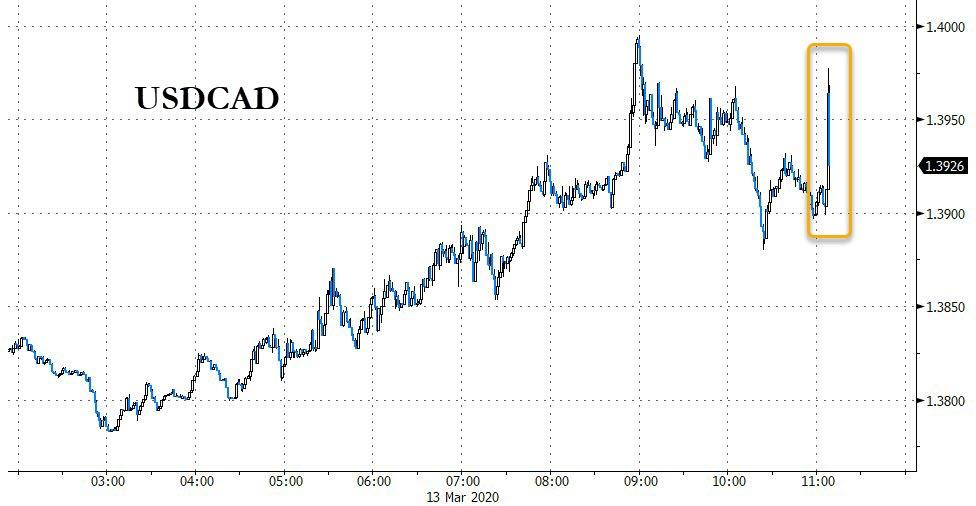

In response to the BOC announcement and modest fiscal stimulus, the Canadian dollar initially dropped but quickly regained all losses as the market was expecting the rate cut anyway, with money markets pricing in around 40bps worth of easing.

Tyler Durden

Fri, 03/13/2020 – 14:18

via ZeroHedge News https://ift.tt/38OVmfI Tyler Durden