Insider Buying Surges To Nearly Decade Long High Amid Coronavirus Sell-Off

Those asking who is “buying while there’s blood in the streets” over the last couple months may very well have their answer: corporate insiders.

While we are still waiting for the first big activist to take a swing – or the first signs of large M&A that can sometimes come with selloffs, there’s one group of people that aren’t waiting to pull the trigger.

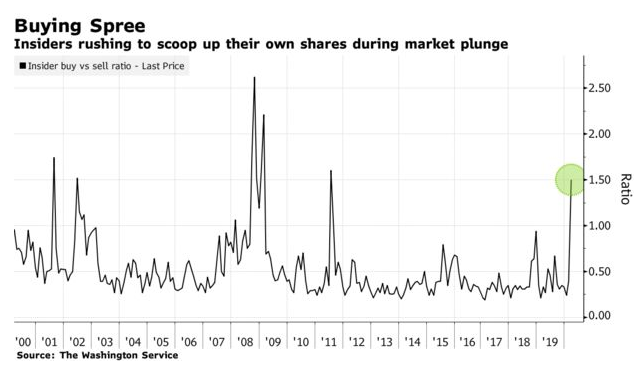

Executives are hitting the clearance rack and buying shares of their own companies at what Bloomberg calls a “breakneck” pace during the first couple of weeks of March. The total purchased has exceeded the last two months combined and insider buys are outpacing sales by the most since 2011.

Megan Horneman, director of portfolio strategy at Verdence Capital Advisors commented:

“When insiders are buying, they think their companies are well undervalued. It can be a good sign that we’re trying to find a bottom around here — not necessarily that it is the bottom but at least that we’re trying to find the bottom here.”

The S&P 500 is now trading at a 14% discount to its 5 year average, which could perhaps be why almost 1,400 executives have bought shares of their own companies. The list includes the CEO of Newell Brands and Kinder Morgan. Buyers outnumbered sellers by nearly a 3:2 ratio.

The last two times insiders bought similarly were in July 2011, preceding a 10% rally in the next two quarters, and in December 2018, preceding a 40% bounce off lows as the market rallied throughout 2019.

Dan Russo, chief market strategist at Chaikin Analytics said:

“To the extent that it’s executives and board members putting their own money to work, that’s encouraging. Who knows the company better than the people who run it?”

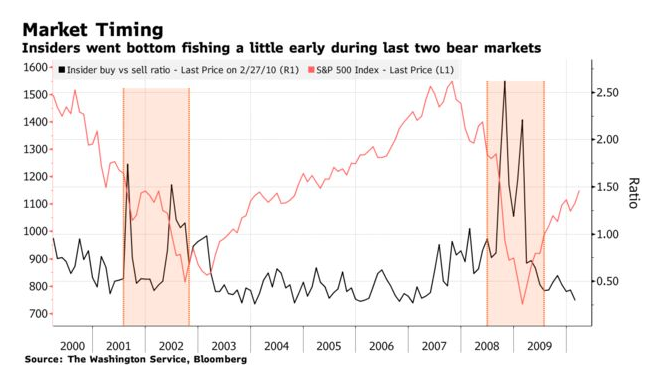

But, if you wanted to make a counterpoint, you could argue that this time it’s different. Neither in 2011 nor 2019 were we dealing with a potential existential threat similar to the coronavirus. Additionally, CEOs sometimes have a habit of buying too soon, before the market bottoms.

During 2008 and 2009, insider buying spiked, but then fell as the market continued to fall. There was a similar pattern during the dot com bubble burst of the early 2000’s.

Wayne Wicker, chief investment officer of Vantagepoint Investment Advisers commented:

“It does not tell you anything about the direction of the market because the market will overwhelm any insider buying based on the fear and optimism that swings markets in general every day.”

He concluded: “Insiders are a reasonable barometer for the outlook of companies — who better to know what your future prospects may be than the guys that are trying to put together the strategic plan and watching current sales and inventories than senior management?”

Tyler Durden

Fri, 03/13/2020 – 14:14

via ZeroHedge News https://ift.tt/2TQ44pL Tyler Durden