Saxobank: On Thursday Europe Committed An Historic Policy Mistake

Submitted by Peter Garnry of Saxobank

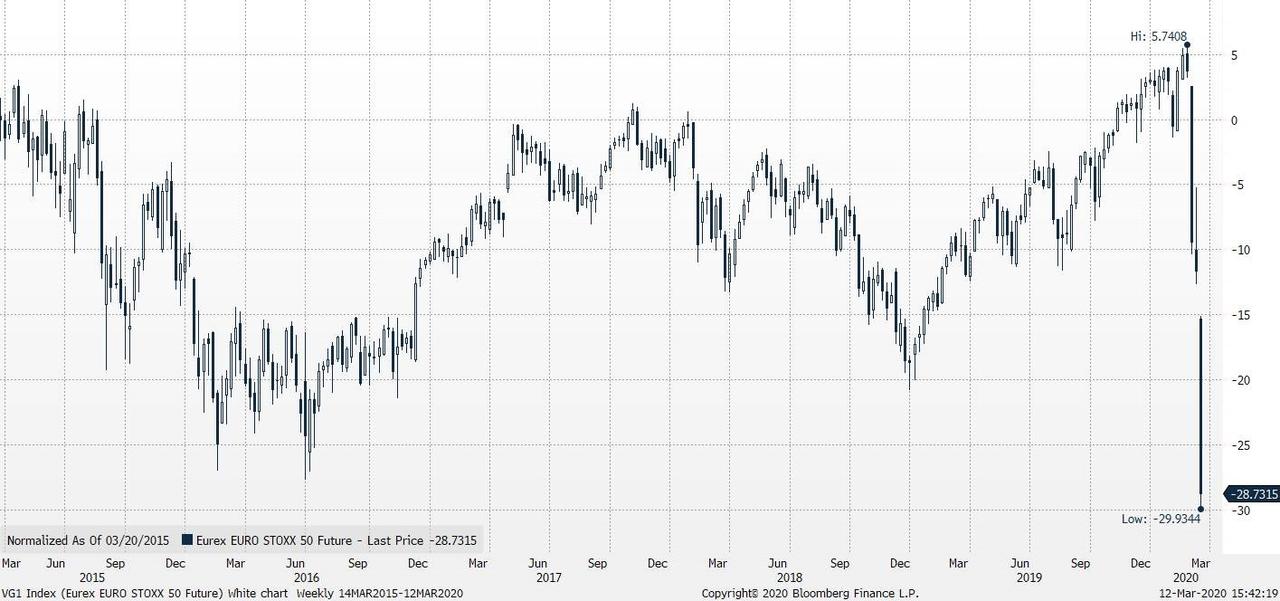

Summary: European equities were down 10% on Thursday, their biggest drop ever, as the day’s event which was supposed to have been the big rescue day ended being total shock for the market. The coordinated monetary and fiscal response the market had hoped for never came instead Lagarde sat on the press conference pleading for a coordinated response. The Germans sit with the key to allows a massive fiscal impulse but big question is whether they truly believe in the European project.

It was going to be the big rescue day in Europe. All eyes were on the ECB and expectations had increased that something coordinated with the EU would be announced. ECB went alone and the market is shocked. ECB boosted QE, added liquidity tools, allowing banks to breach capital pillars and offered new long-term loans. No rate cut but that was meaningless anyway, but Lagarde said that rates could go lower if deemed necessary. But the main message on the press conference from the ECB President was that an ambitious and coordinated fiscal response was needed. Here lies the policy mistake from Europe.

The COVID-19 is clearly pushing Europe into a recession full stop, but the response on the fiscal side has been embarrassing. The political crisis in Germany seems to have translated into shell-shocked German politicians afraid of committing themselves 100% to the European project. Despite cheap talk from Merkel about doing ‘whatever is necessary’ and drop the balanced budget principle the market has descended into something like a tailspin with terrible liquidity in bond markets and especially the corporate bond market. Equity markets in Europe are down 10%. What is needed?

The EU needs to abandon the 3% budget deficit rule until the crisis over allowing member states to increase the deficit as much as they need to offset the impact on the economy. No political fight, that’s the deal. The ECB will backstop the government bond market through yield curve control effectively delivering MMT, and much sooner than anyone had thought. In addition the ECB and the Fed will have to backstop credit and flush the system with USD.

For traders and investors this means that buying opportunities could come in high yield credit ETFs, investment grade bonds ETFs, banks, industrials and consumer discretionary stocks. Despite short-term rallies can occur in airliners they should generally be avoided despite government stimulus as the demand function is destroyed and will be destroyed even further due to lockdowns.

Tyler Durden

Fri, 03/13/2020 – 07:20

via ZeroHedge News https://ift.tt/2W80EjA Tyler Durden