“The Biggest VaR Shock In History”: Here’s The Reason Behind The Market’s Insane Moves In One Chart

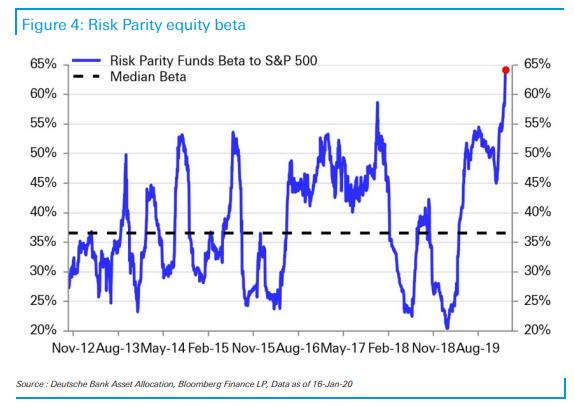

Less than two months ago, when we pointed out how virtually every investor class was all-in the stock market (something which we are certain they wish they could now undo), we highlighted that “among the systematics, the bullishness of risk parity is now almost literally off the charts.“

However, what goes up in a straight line usually comes down even more violently.

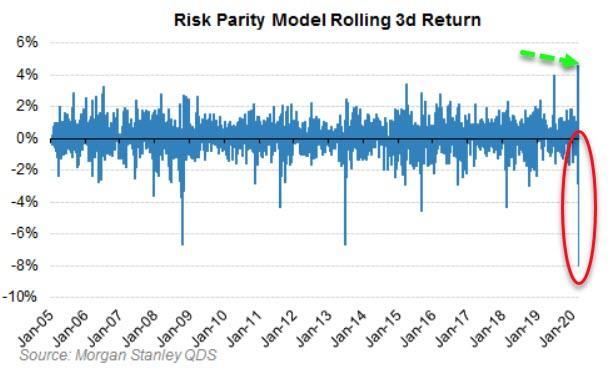

As first discussed two days ago, the “Late Day Treasury Futs Crash, Sparks Speculation Of Risk Parity Liquidation“, and as Morgan Stanley picked up one day later, there were numerous signs of a breakdown in stock-bond correlation, with stocks underperforming 10-year yields by nearly 5 standard deviations on Tuesday. This put stress on all multi-asset portfolios, but as MS cautioned, “Risk Parity funds in particular are likely struggling, having the worst 3 day period on record on QDS’s model.”

Some background for those unfamiliar: as we have previously explained on various occasions, Risk Parity funds are the class of the systematic strategies that tend to run very high leverage, especially when the VIX is low and markets are stable, effectively assuring a violent unwind when a “fat tail” (or “black bat) event occurs. This means they could have $10bn or more of stock to sell per day in these kinds of environments – and since they often will be selling stocks and bonds together, their flow can reinforce correlation breakdowns like what we have seen in the past weeks.

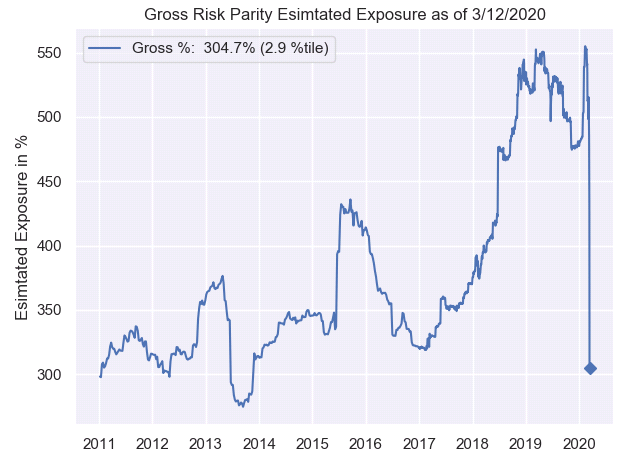

With that in mind, and considering the chart at the top of this post, today we wanted to bring attention to what happens to risk-parity leverage when a market crashes. To do that, we show the following chart from Nomura’s Charlie McElligott who writes today that the story yesterday was Risk Parity, which was “by far” the largest culprit in the cross-asset deleveraging purge, with Nomura’s model estimates showing aggregated gross-exposure slashed from 450% (61st %ile since ’11) down to 305% (2.9%ile) on the session.

And so, to help out BMO which earlier today said that “The Disconnect Between Treasuries And Stocks Is The Most Widely Debated Topic At The Moment”, as well as anyone else who is still confused, here is the chart showing the culprit behind this week’s chaotic, disorderly moves: the Risk Parity VaR shock, in one picture.

We hope that none of this is a shock to our readers. After all, over the weekend when discussing the aftermath of the Crude crash following the start of the oil price war by Saudi Arabia, we said very clearly that “once Brent craters on Monday to the mid-$30s or lower, the accompanying implosion in 10Y yields could make the record plunge in yields seen on Friday a dress rehearsal for what could be the biggest VaR shock of all time.”

And that’s exactly what happened, because as JPMorgan writes this morning “effectively nine years of previous equity-bond overweights have been unwound in only three weeks.“

What happens next – will these Risk Parity funds relever, resuming their purchases of both bonds and stocks, and under what conditions would that happen? To answer this question we go to JPM quant Nick Panigirtzoglou who looks at the biggest VaR shock since the Lehman crisis, and explains what needs to happen for the VaR shock to finally end:

- This week’s worsening is less about investors taking a fundamental view on the economy or responding to virus news. In our opinion this week’s worsening is more about investors responding to the biggest VaR shock since the Lehman crisis.

- This huge rise in volatility likely induced position reduction by VaR sensitive investors, not only asset managers but also dealers and market makers, as they breached their VaR limits.

- And with the lack of liquidity in markets, one is feeding the other: as volatility rises market makers step back from their market making role and raise bid offer spreads inducing low market depth and lower liquidity which in turns creates even more volatility.

- For the market rout to stop, we need VaR-insensitive investors to step in, such as pension funds, insurance companies, SWFs, endowments, households or large companies via share buybacks.

As usual, it will be up to the Fed to spark that all important moment of “this is the bottom” confidence… and if as many claim the Fed’s credibility and ability to impact markets is now gone, then it may be time to quietly get out of Dodge.

Tyler Durden

Fri, 03/13/2020 – 12:06

via ZeroHedge News https://ift.tt/2U4yrYw Tyler Durden