This Wasn’t Supposed To Happen: FRA/OIS Explodes Higher After Fed’s “Bazooka Repos” Misfire

Yesterday, in the aftermath of the Fed’s $1.5 trillion repo bazooka and QE4 announcement when dealers submitted a paltry $78.4 billion in securities to the Fed’s new and massively upsized $500BN 3-month repo operation, we asked if the Fed was using the wrong bazooka to fix the funding crisis, a question that was also asked by the market which tumbled shortly after the tiny repo uptake was announced, as “traders realized that what is ailing the market is not access to the Fed’s balance sheet.”

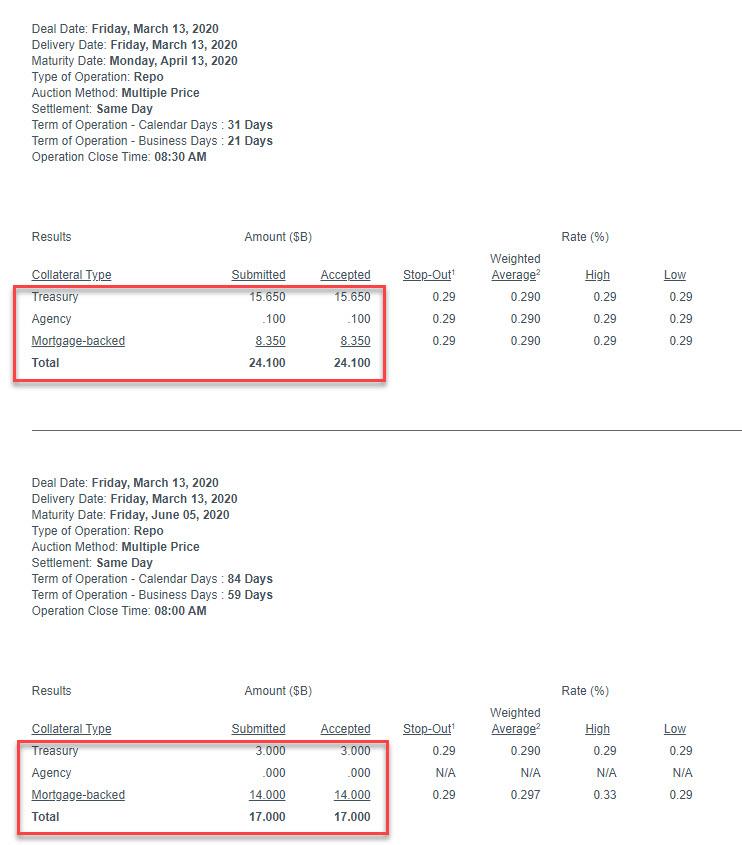

Moments ago the Fed announced the second and third results from the newly unveiled “bazooka repos”, and they too were major duds, with Dealers obtaining just $17BN in liquidity out of the $500BN total available in the second 3-Month repo, followed shortly after by just $24.1BN in the first $500BN 1-month repo, for a total liquidity injection of just $41.1BN.

The immediate problem that emerged is that while the Fed opened up to $1.5 trillion in virtually free liquidity access for banks, they have only used $119.5 billion of it, even as financial conditions remain perplexingly tight.

In other words, the same question as yesterday: is the Fed using a liquidity bazooka to fix a problem that is not based in a malfunction in the repo market.

And the clearest indication that that’s the case came moments after the result of the first repo was announced, when the all-important FRA/OIS spread which measures scarcity of dollar liquidity in interbank and funding markets, snapped higher by 10 bps, from 68 to 78…

… suggesting that repo may not be the proper fix to whatever it is that remains broken in the market.

And if indeed the Fed is using the wrong medicine to treat whatever the underlying condition is, what now?

Well, for now stocks are happy, with the ES still limit up, but shortly whatever is the real source of the marketwide funding shortage will reemerge again, and this time the market will demand the right answer from the Fed. If it does not get it, yesterday’s drop may be just a dress rehearsal for what is coming.

Tyler Durden

Fri, 03/13/2020 – 08:50

via ZeroHedge News https://ift.tt/33fKWVa Tyler Durden