Unprecedented NAV Discounts In Credit ETFs Underscore “Dash For Cash” Panic

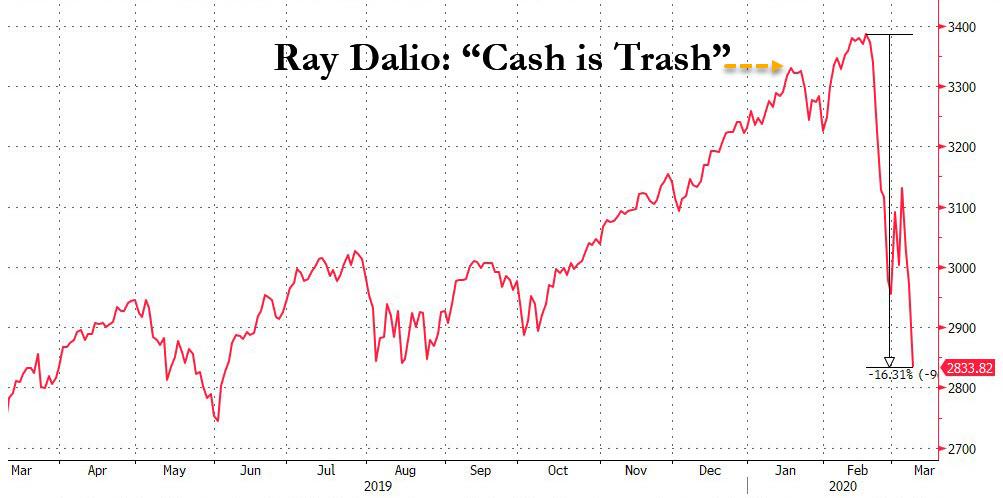

Less than two months ago, Ray Dalio came out with what may have been the worst market “hot take” in history when he said that “cash is trash” just weeks before the biggest market crash in generations and the biggest scramble into the safety of cash on record.

And besides risk assets themselves, noweher was this dash for cash more evident than what we saw over the past few days in ETFs. SaxoBank’s Peter Garnry explains:

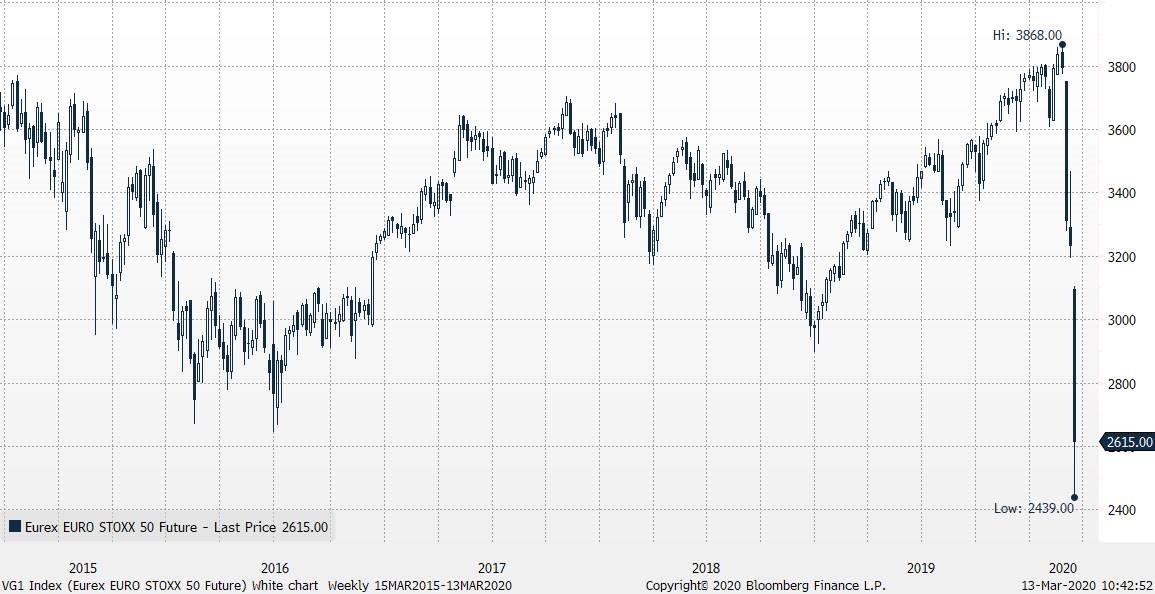

Summary: ETFs tracking credit are trading at large discounts to NAV showing the intense stress and breakdowns in one of the key markets for retail investors and large financial institutions doing asset allocation. If confidence rises enough due to the Fed’s liquidity provisions yesterday and several short selling bans, and market makers have the risk capital available then we could see a big rise in credit today as these discounts are being close. So far equities have responded to policy action with Euro STOXX 50 futures up 7% from the recent lows.

* * *

Events in markets are dramatic and in one corner underpinning main retail portfolios the stress is extreme. Passive investment vehicles such as ETFs are seeing disorderly price action with market makers posting wide bid-offer spreads but more importantly the traded prices are significantly below the actually NAV (net-asset-values) of the ETF fund. One of the ETFs we use in our tactical asset allocation is tracking global inflation-linked government bonds. The ETF closed yesterday with a 4.2% discount between the NAV and the last traded price. Almost every credit ETF in the US and Europe shows same stress. These discounts reflect that market makers cannot commit risk capital to arbitrage way this spread, but also risk aversion and general precautionary principles due to the massive uncertainty around those NAV values. The seeds are there for a massive rebound in credit bonds and the ETFs tracking them. But it requires more two-way flow by investors (one-side right now) and market makers willing to commit risk capital to close the discount.

Yesterday’s events will go down in the history books as one of the most violent trading days with clear liquidity disappearing from markets and a historic policy mistake in Europe. The S&P 500 cash index closed down 9.5% and the Europe STOXX 600 cash index closed down 11.5%. It all started with Trump’s horrible speech and travel ban Wednesday night which was followed up by probably one of the worst ECB meetings ever on par with Trichet’s massive rate hike blunder in 2011.

Yesterday was supposed to have been the big rescue day but ended up with Europe failing to deliver in terms of speed and size as we have gotten used to over the years. All eyes are now on Germany to open up the purse and allow deficits to increase dramatically to offset the economic pain from COVID-19 and credit market stress which will hit economic growth. The world needs a global coordinated action but the chance is little so policymakers and markets will be in a tug-of-war for some time, but eventually the policy response will equate the economic impact and markets will find its low.

The Fed did on the other hand deliver yesterday to save the money market and indirectly the hedge funds doing relative arbitrage with high leverage in the US Treasury market which uses the repo market for these strategies. The Fed’s liquidity provisions will hopefully stabilize credit markets and convince financial firms to commit risk capital to close obvious gaps across Treasuries and credit bonds. In addition several countries such as the UK, Spain, Italy and South Korea have all issued short selling bans which seems to be working today to increase confidence. Euro STOXX 50 futures are up 7% from the recent lows. But be aware that its Friday and many active funds don’t want too much risk into the weekend as these have proven bad for risk with Monday gaps as the market is digesting incoming COVID-19 numbers.

Tyler Durden

Fri, 03/13/2020 – 11:31

via ZeroHedge News https://ift.tt/38L59n6 Tyler Durden