“The Damage Is Not Theoretical” – It’s Deep, Global, & Pervasive

Authored by Sven Henrich via NorthmanTrader.com,

We just witnessed a global collapse in asset prices the likes we haven’t seen before. Not even in 2008 or 2000. All these prior beginnings of bear markets happened over time, relatively slowly at first, then accelerating to the downside.

This collapse here has come from some of the historically most stretched valuations ever setting the stage for the biggest bull trap ever. The coronavirus that no one could have predicted is brutally punishing investors that complacently bought into the multiple expansion story that was sold to them by Wall Street. Technical signals that outlined trouble way in advance were ignored while the Big Short 2 was already calling for a massive explosion in $VIX way before anybody ever heard of corona virus.

Worse, there is zero visibility going forward as nobody knows how to price in collapsing revenues and earnings amid entire countries shutting down virtually all public gatherings and activities. Denmark just shut down all of its borders on Friday, flight cancellations everywhere, the planet is literally shutting down in unprecedented fashion.

The message is clear:

The global recession has begun.

— Sven Henrich (@NorthmanTrader) March 13, 2020

The question is not if, but how long and deep:

“We have to get used to the fact that we are going into a global recession. Hopefully it will be short lived, but I can’t see how we will avoid a global recession,” says @elerianm. pic.twitter.com/O1rttbx331

— Squawk Box (@SquawkCNBC) March 13, 2020

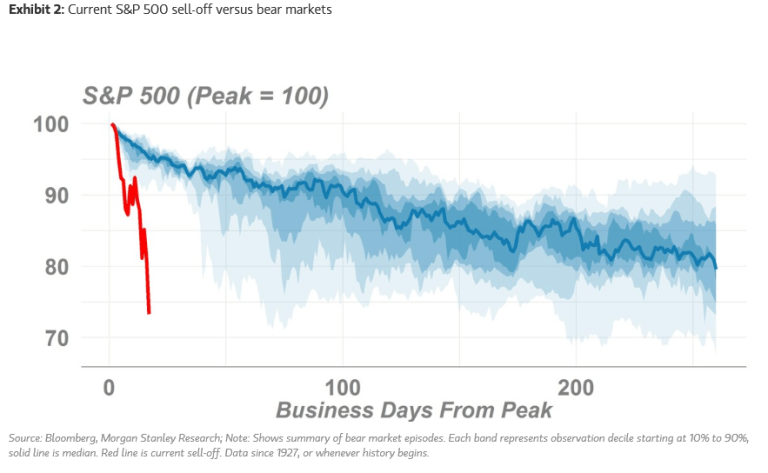

The damage is not theoretical, it’s real as we just saw the fasted collapse in asset prices in history:

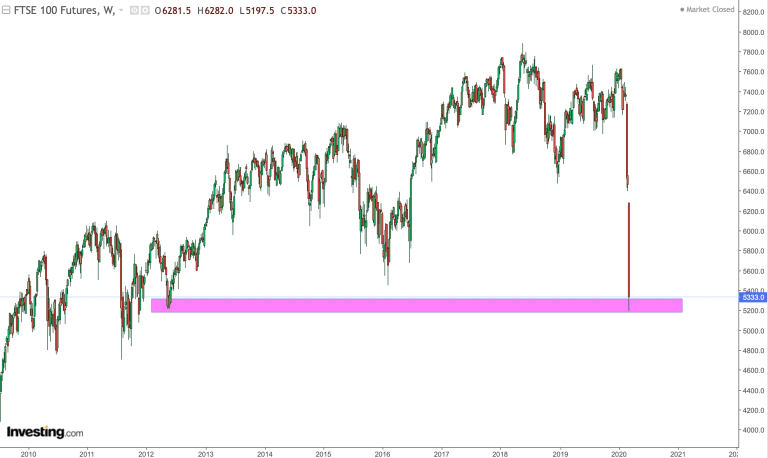

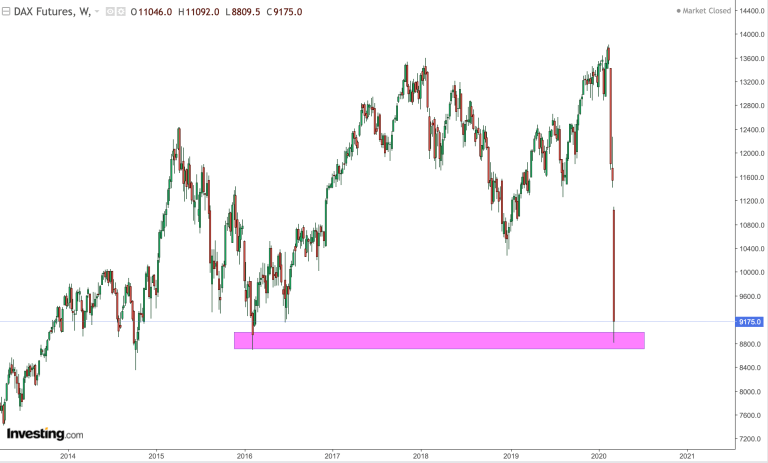

And it’s global, deep and pervasive.

$FTSE collapse to lows from 8 years ago:

$DAX collapsed from all time highs to the lows from 2016:

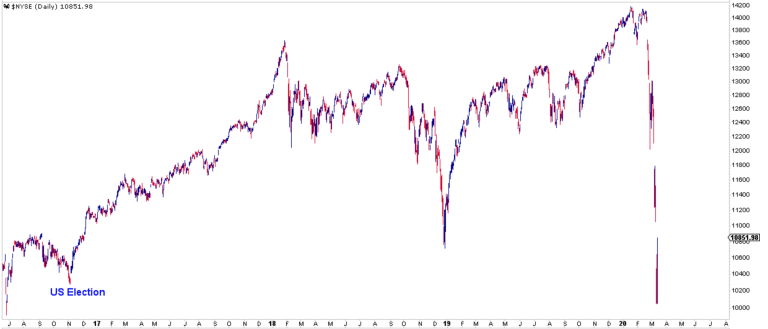

The US broader $NYSE dropped to below the US election lows of 2016:

Absolute carnage to investor portfolios who can only be assumed to have caught by total surprise by the severity of the 2020 market crash. The buy the dip mentality so pervasive over the last 11 years have come to a sudden end: Death by impact.

The damage is pervasive and structurally impacting. Trapped longs looking for rescue and salvation with confidence taking a major hit. And the only hope now are technically massive oversold readings, a Fed desperate trying to regain control and a desperate search for signs that the coronavirus situation can be brought under control.

Central bank efforts over the past 2 weeks have been a miserable failure and emergency rate cuts have not been able to stem the tide of system selling and liquidations. Until Friday that is perhaps. The Fed resorted to unprecedented and some may say pathetically desperate efforts to stem the bleeding by announcing $500B repos including a $1 trillion repo on Friday.

To put these numbers in perspective:

Today’s Fed liquidity injections: The same size as the annual US military budget.

Tomorrow’s Fed liquidity injections: The same size as the annual US military budget.Let it sink in.

— Sven Henrich (@NorthmanTrader) March 12, 2020

There is no precedence for the situation we are facing now. An epic battle of humanity trying to combat a new virus for which there is no cure and still no all clear signal, a global asset price collapse at the end of an aging and highly indebted business cycle and central banks with limited ammunition desperately trying to regain and maintain control.

And this week the Fed is on tap to prove it can still reassert control. Already now expected to cut rates to zero large scale asset purchases and a relaunch of full QE is perhaps only a question of when and not if. Given the current state of markets perhaps the Fed can’t afford to wait. So this coming week is key for markets and a Fed whose credibility is already on the ropes.

It’s a very difficult environment for investors and traders as the action is whipsawing more intensely than we’ve ever seen before.

But technicals help us to guide us through the challenge. Even Friday’s record bounce rally was in the technical picture.

What are the risks of a major bear market yet to come and what are the rally opportunities?

For our analysis please see this weekend’s market review video:

* * *

Please be sure to watch it in HD for clarity. To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Sat, 03/14/2020 – 16:50

via ZeroHedge News https://ift.tt/2vrzSrK Tyler Durden