Aramco Cuts CapEx By $10 Billion As Profits Plunge

In the aftermath of Saudi Arabia’s declaration of an oil price war last weekend, which sent the price of crude tumbling about 30% overnight, and making profitability life for US E&P companies virtually impossible, it didn’t take long for US shale producers to take the hammer to their spending plans, and following a historic cut to Occidental dividend, which was slashed from 79 cents to just 11 cents, the first such cut in almost three decades…

… coupled with a massive cut to the company’s capex plans, which are now expected to be just $3.5- $3.7 billion, down from from $5.2 billion to $5.4 billion, a torrent of other shale names has followed suit in announcing massive capex cuts to reflect the new price war reality:

- Devon energy reduced its 2020 capex by $500MM to $1.3BN.

- Murphy Oil reduced 2020 capex from $1.4-$1.5Bn to $950mm.

- Aoache reduced 2020 capex from $1.6 – $1.9Bn to $1.0 – $1.2Bn

- ONEOK reduced 2020 growth capex by -$500mm to $1.6 – $2.4Bn

- PDC Energy cut 2020 capex of $1.0 – $1.1Bn by 20-25%

It’s not just US shale companies that are forced to retrench as they scramble to survive in a world where the price of their key commodity was just whacked by a third: overnight the world’s largest oil producer, Saudi Aramco, announced it will slash planned spending this year in the first sign that plunging demand and the oil-price war which the Saudi unleashed are starting to hit home.

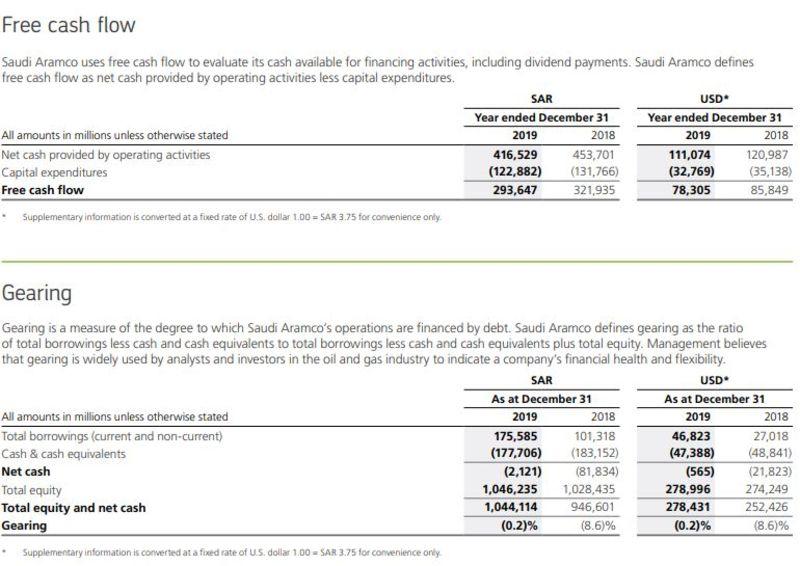

In a statement, Aramco said that its capex budget for 2020 will be cut by almost a third, and will be between $25 billion and $30 billion in 2020 as spending plans for next year and beyond are being reviewed. Prior to the cut, Aramco had expected a planned capex in the range of $35 billion to $40 billion per its IPO prospectus, and compares with $32.8 billion in 2019.

The capex cut comes as Aramco’s profit tumbles 21% in lower oil prices and production. Of course, the worst is yet to come as none of the numbers below capture the historic crash in the price of oil which is the primary driver behind the company’s revenue and profits:

- Net income including minority interests: 331 billion riyals ($88 billion) vs 417 billion in 2018

- Revenue: 1.11 trillion riyals vs 1.19 trillion riyals

- Operating profit: 675 billion riyals vs 798 billion riyals

“We have already taken steps to rationalize our planned 2020 capital spending,” Aramco CEO Amin Nasser said. Given the impact of the coronavirus pandemic on economic growth and demand, Aramco is adopting “a flexible approach to capital allocation.”

“That was the surprise,” Ahmed EFG Hermes analyst Hazem Maher. “They’re adding production in a low price environment so their cash flows could be impacted.” Cutting investment could help absorb some of the impact of the drop in oil prices, but it would also have substantial consequences on the local economy as far fewer people are employed.

The capex cut is just the start. As Bloomberg writes this morning, echoing what we said last weekend, the oil-price war led by Saudi Arabia and Russia will mean more pain for Aramco as producing nations prepare to boost supply. Discounted pricing to markets already reeling from weak demand and crude that lost roughly half its value since the beginning of the year is likely to hit revenue further.

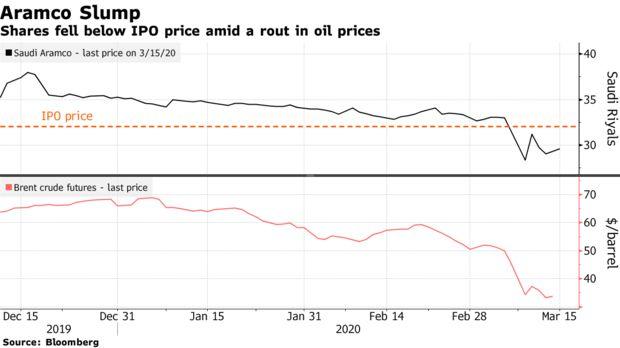

It also means that anyone who bought into the Aramco IPO is ruing the day: the Saudi oil giant’s shares fell as much as 0.9% on Sunday, extending the decline this year to about 18%. Aramco’s market value has slumped from a peak of over $2 trillion in December to about $1.5 trillion, and it has much more to drop if the oil price war does not end soon.

What is odd is that Saudi Arabia pledged to supply 25% more oil in April than it produced last month, and Wednesday ordered Aramco to boost output capacity by 1 million barrels a day. However it is not clear how the oil giant will do that if its capex is slashed by $10 billion.

The coronavirus’ blow to oil use has overwhelmed OPEC’s initial optimism for demand this year, with analysts now expecting a drop in consumption. The OPEC+ group’s failure on March 6 to agree on further cuts is only exacerbating a glut as buyers search for storage tanks and vessels.

While Aramco took a machete to its capex plans, its shareholder-friendly actions have yet to be affected, and the company reiterated its plan to pay $75 billion in dividends this year, as it scrambles between its pledge to pay investors with spending on its upstream projects – such as maintaining oil production and expanding fields – and boosting its global refining and chemical operations – the downstream segment of the business. Of course, just like its US peers, it is only a matter of time before Aramco is forced to slash its dividend spending as well, sending its stock price cratering.

“Aramco can restructure the strategy to concentrate more on the upstream expansion rather than downstream,” said Mazen Al-Sudairi, head of research at Al Rajhi Capital. “They can do it easily from their cash flow. But it might affect the money transfer to the government for one or two quarters.”

Or more longer, depending on the severity and duration of the oil price war will be. One thing we do know: Russia has already said it can last at –. If that’s the case, Saudi Arabia as we know it, will cease to exist.

Putting the price of oil in context, Brent crude averaged $71.67 a barrel in 2018, dropping to $64.12 in 2019. It traded in the low 30s this week. Meanwhile, Saudi production slipped to an average of 9.83 million barrels a day from 10.65 million in 2018, however the company has pledged to pump 12mmb/d or more as it scrambles to steal market share from its higher-cost peers.

That said, Aramco will be ok for the near future: the company netted $111 billion , which made it by far the world’s most profitable company, exceeding the combined incomes of some of the world’s biggest companies including Apple, Samsung Electronics Co. and Alphabet.

Tyler Durden

Sun, 03/15/2020 – 11:48

via ZeroHedge News https://ift.tt/39NXFRv Tyler Durden