JPMorgan Suspends Stock Buybacks

Last week it was the oil and energy companies. This week it will be the banks.

Moments ago the largest US bank by assets and market cap, JPMorgan, announced that it is suspending its stock repurchase, in a move that will i) spark concerns about JPM’s liquidity state and ii) trigger a kneejerk reaction as all other banks follow suit, and the bank sector plunges tomorrow as the biggest buyer of bank stocks is no longer there.

The question, of course, is whether the buyback suspension will end with US banks, or if all US companies will follow suit in a panicked scramble to preserve liquidity, something which already started in recent months, as we reported previously in “Stock Buybacks Crash Just As Markets Need Them Most.”

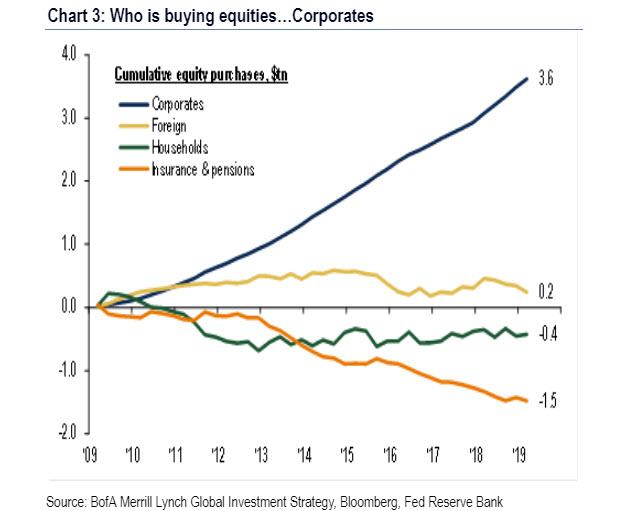

That the disappearance of buybacks is a problem is an understatement: as we reported recently for the past decade, the only source of buying have been companies themselves, repurchasing their stock.

Ironically, while companies should have stopped repurchasing their stock a long time ago, buyback appetite remained strong in recent weeks, and in the final week of February, when the S&P 500 tumbled the most since 2008, Goldman’s corporate clients snapped up their own shares at the fastest rate in two years, with volume running at 2.3 times the average in 2019. Unfortunately, it now appears they used up much of their dry powder just as stocks were about to take another leg lower.

And here is a modest proposal: instead of rushing to bail out all these companies that repurchased trillions in stock in the past decade, lifting their stock price to all time highs, making their shareholders and management extremely rich at the expense of corporate viability (corporate debt is at an all time high) while leaving rank and file workers out to dry, how about forcing companies to shore up liquidity by selling their stock now, as the party of the last decade ends with a bang.

Tyler Durden

Sun, 03/15/2020 – 18:46

via ZeroHedge News https://ift.tt/2QhhQ2A Tyler Durden