New Zealand Unexpectedly Slashes Rates by 75bps To Record Low 0.25%; Warns Kiwi QE Coming

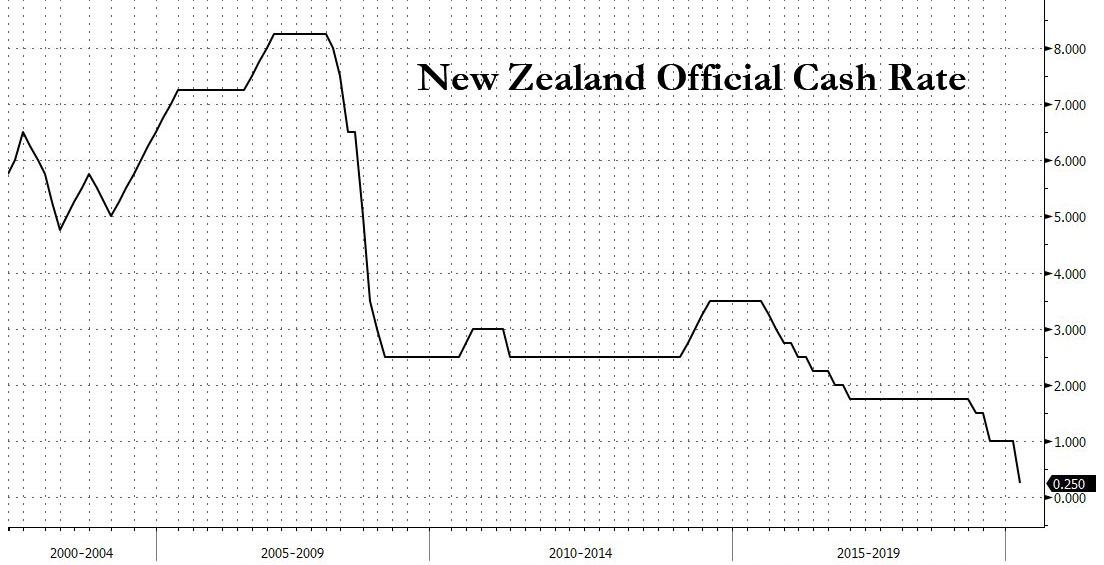

Following in the footsteps of the Bank of Canada which on Friday was the latest bank to announce an “unexpected” rate cut, following a barrage of central bank easing on Friday morning, moments ago New Zealand became the latest bank to join the “emergency” rate cut fray when the RBNZ announced an unexpected, whopping 75bps rate cut bringing the policy rate to just 0.25%, the lowest on record.

Dipping into armageddon calendar guidance, in its statement, the RBNZ said the rate will remain at this level for at least the next 12 months, suggesting it may well go lower.

The central bank also said the negative economic implications of the COVID-19 virus continue to rise, warranting further monetary stimulus, noting that “since the outbreak of the virus, global trade, travel, and business and consumer spending have been curtailed significantly. Increasingly, governments internationally have imposed a variety of restraints on people movement within and across national borders in order to mitigate the virus transmission.”

And since “financial market pricing has responded to these events with declining global equity prices and increased interest rate spreads on traditionally riskier asset classes”, the “negative impact on the New Zealand economy is, and will continue to be, significant. Demand for New Zealand’s goods and services will be constrained, as will domestic production. Spending and investment will be subdued for an extended period while the responses to the COVID-19 virus evolve.”

Of course, that’s the same identical script followed by every major central banks which has been quick to blame the coming economic Armageddon on the viral pandemic.

And since the rate cut will do nothing to stabilize the economy, which is crippled as a result of the pandemic, the Monetary Policy Committee also “agreed that should further stimulus be required, a Large Scale Asset Purchase program of New Zealand government bonds would be preferable to further OCR reductions.”

Translation: Kiwi QE coming (say that fast 5 times), and the currency has reacted appropriately, with the NZD plunging as low as 0.5944 after closing 0.6134 on Friday, the lowest level since May 2009.

Tyler Durden

Sun, 03/15/2020 – 15:49

via ZeroHedge News https://ift.tt/2U5Xhak Tyler Durden