“How To Invest When The World Stops”

With traders and investors living in a state of near constant panic (while working from home or their parents’ basement in the case of millennials who just got blown up on all their “growth” stocks), virtually nobody has any idea what to do in a market that is either cratering or soaring with no middle ground. And so, to answer pent up question about “how to invest when the world stops”, BofA has published a report which seeks to answer some of the top questions it has received about its market outlook, such as:

1. How have the coronavirus & oil shocks changed our outlook?

We’re very cautious about growth & earnings.

2. Is this like 2008, and what are the biggest risks?

No. The risks are worsening liquidity, credit contagion, layoffs and recession.

3. What can policymakers do to help?

Only a large, coordinated fiscal stimulus package matters now.

4. Why stay invested?

Not staying invested means missing most of the long-term market upside.

5. When will it be time to buy?

Watch our trading rules and watch for signs of a policy panic.

6. What is our asset allocation?

We are bullish on equities, credit, and gold and neutral on government bonds.

7. Where should we invest in equities?

Buy quality companies in defensive sectors like staples and health care.

8. Where should we invest in fixed income?

Rotate out of Treasuries into munis, corporates & mortgage-backed securities.

BofA, whose CIO recently declared that he is operating under the assumption that “we are in a global recession”, then takes a more detailed look at some of these questions, starting with:

1. How have the coronavirus and oil shocks changed our outlook?

BofA states that it is “very cautious about short-term growth & earnings. Markets are trading like a recession is already assured. Our economists Ethan Harris and Michelle Meyer have reduced their 2020 GDP growth forecasts from 3.1% to 2.2% globally and to 1.2% in the US”, something which the Fed’s emergency rate cut to 0% effectively confirmed.

In fixed income, the bank expects 10-year Treasury yields to be volatile before rising to 1.25% by year-end, and while 1.25% may be the right number, the real question is whether it will have a minus sign ahead of it. BofA is bullish on munis, on investment grade bonds and on mortgage-backed securities, all of which have gotten mauled in recent weeks. In equities, BofA’s strategist Savita Subramanian has reduced the S&P 500 year-end price target to 3100 and 2020 EPS from $177 to $169. She will reduce her targets far, far lower before it’s all over.

Why these changes? As BofA explains, “the manageable supply-side disturbance in China became a demand-side shock as the virus spread into Europe & North America. Investor fears have been compounded by the OPEC oil shock and the glacial response from fiscal authorities.”

* * *

2. Is this like 2008, and what are the biggest risks?

Noting that “every recession is different” BofA differentiates the current market crash from the financial crisis noting that in 2008, the big excesses were in household and financial balance sheets; today, household debt is low and the financial system is very well-capitalized. In 2020 the risk is from corporate profitability and the real economy, not systemic solvency (with about $20 trillion in global liquidity injected by central banks, one can only hope no systemic solvency is lurking).

At the same time, “every recession is the same”, and whatever the causes, once confidence falls and markets drop, all that matters is the policy response. The US economy was on relatively stable footing to start the year (low unemployment, rising wages, strong housing), but is now in a recessionary environment now, with concerns about three areas:

- Liquidity: in the past 12 months, the key market supports have been net inflows from US households ($160bn) and corporates ($715bn). If investor selling continues just as corporates enter the buyback “blackout period” (late March & much of April), BofA expects even more market dislocations. Indeed, hedge fund liquidity has already vanished, as seen in equity futures and Treasury markets.

- Corporate debt: the credit market has shuttered and companies are highly levered, with debt a record 92% of GDP, the share of developed-market “zombie” firms at a post-crisis high of 12%, and US bankruptcies on pace to exceed the 2008 total. The OPEC/Russia oil price war will pressure the energy sector and investors have begun distancing themselves from credit funds ($66bn outflows in recent weeks).

- Jobs: BofA’s Consumer Confidence Indicator is tumbling, showing that the pandemic is already affecting consumer behavior. If the virus recession persists without offsetting stimulus, companies may begin laying off workers. In coming weeks watch for initial jobless claims >240k.

* * *

3. What can policy makers do to help?

Fed rate cuts, liquidity measures (QE5), and even lending to non-financial firms can prevent markets from seizing up, although as we saw over the past 24 hours, can no longer prop up stocks, something central banks have been doing for the past decade. At the of the day, “only Congress and the President can help stop the virus or provide support to the real economy.”

Bad news: the market breaks until “whatever it takes”. In 2008-2009, global fiscal stimulus was worth >3.5% of world GDP. Thus far, we have seen a paltry 0.2%, with nothing from the US.

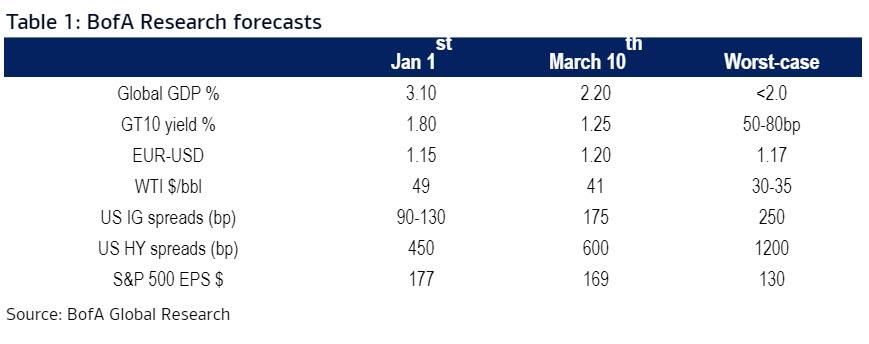

Good news: the US government has a massive amount of fiscal firepower, largely thanks to the dollar’s status as reserve currency. Furthermore, at negative real interest rates across the curve, governments are effectively getting paid to borrow, which is key when $1 of stimulus generates $2 to $2.4 of GDP such as when invested in infrastructure, health care and R&D (Chart 2).

4. Why stay invested?

Here BofA pulls a CNBC, and “explains” that not staying invested means missing most of the long-term market upside…it’s simply too difficult to time the market, and adds that “a strong impulse to hide out in cash is often a sign that a buying moment is near.” On the other hand, few have the stomach, or balance sheet, to survive a 30%, 40% or greater drawdown. And while in theory it is great for everyone to stay invested, in practice it is impossible as one sees years of market gains disappear in a matter of hours.

- In any case, here is how BofA urges its clients to never sell:

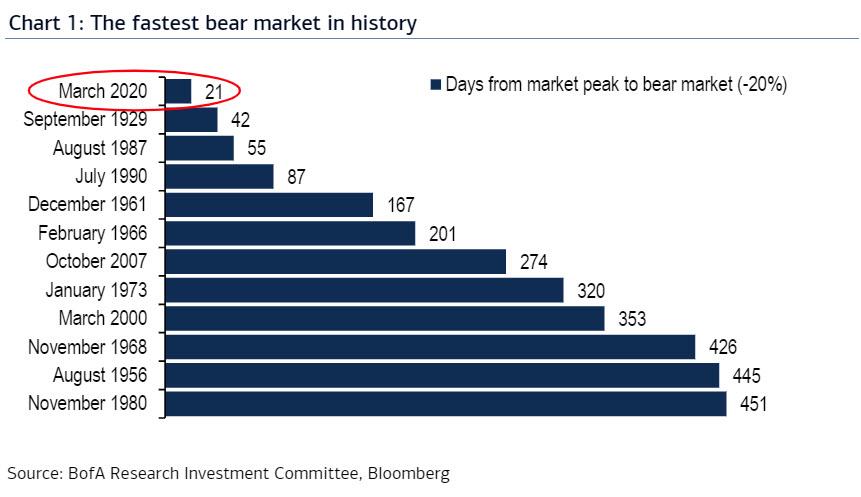

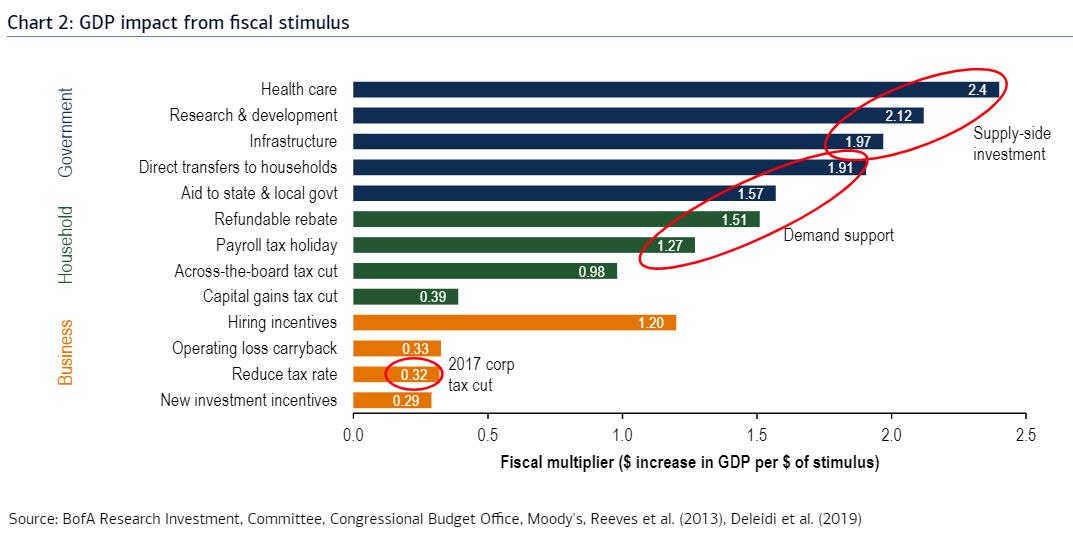

- We know that the best days often follow the worst and this has been the sharpest drop into a bear market in history (Chart 3);

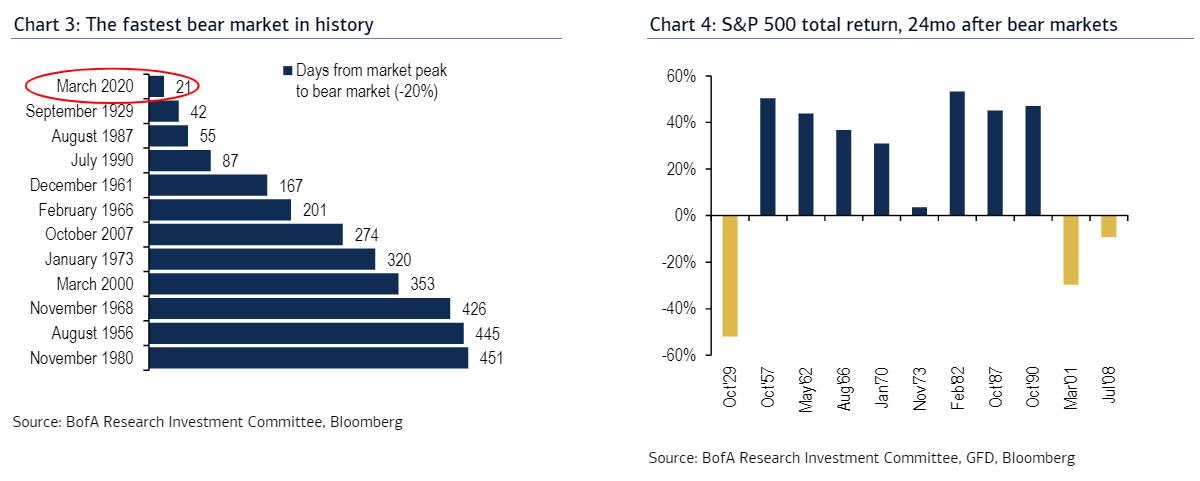

- Since 1929, in the 24 months following a bear market, S&P 500 total returns have averaged 20%. Excluding the Great Depression, the average gain was 27% (Chart 4);

- Since 1931, an investor who missed the 10 best days of each decade made 91% in equities. Staying invested meant earning 14,962%;

- In the 2010s, missing the 10 best days meant gaining only 95% instead of 190%;

- Over any 10-year period, the odds of ending with equity losses are just 4%;

* * *

5. When will it be time to buy?

BofA believes that we are near the point of capitulation (we disagree quite vocally), where positioning & technical signals turn bullish:

- The BofA Bull and Bear Indicator is at 2.5 (<2 = "buy");

- The Global Flow Trading Rule registered a buy signal after big outflows of >1% of global equity assets;

- Global Risk-Love sentiment fell to the 5th percentile; the last 5 out of 5 signals saw +20% returns over the next year;

- Stephen Suttmeier flags oversold levels in volatility, put/call ratios, and distribution;

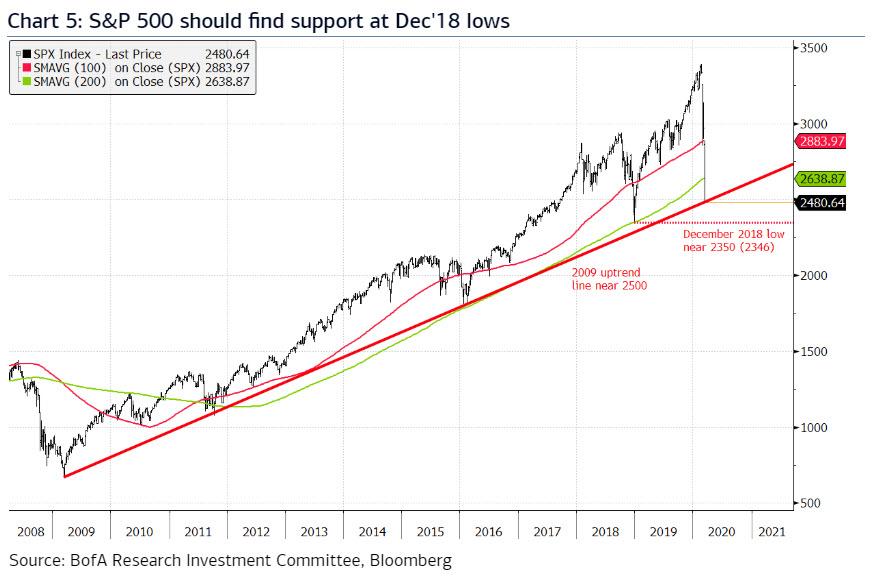

- SPX broke its 200-week average…2500 & 2350 support levels are key (Chart 5)

Here the bank hedges by noting that most sentiment indicators are designed for a “rational” market environment where mean-reversion dominates. In a momentum-driven, irrational market, conditions tend to get even more extreme than history would imply. Meanwhile, to turn short-term bullish with conviction, the bank would look for a big, coordinated fiscal response from US policymakers.

* * *

6. What is BofA’s asset allocation?

Here BofA surprised us by noting that “the consensus 60/40 allocation model may be enjoying its last hurrah”, and instead BofA is now pitching a 25/25/25/25 model, in which it is bullish on equities & corporate bonds, neutral on Treasuries, bullish on gold, and bearish on oil.

Given year-to-date returns (equities -23%, HY -9%, Treasuries +7%), once markets find their footing a violent rotation is likely out of safe havens. With every passing day, equity & corporate bond valuations are getting more attractive, although at this rate they will likely get even more attractive; At the same time, Treasuries are the most expensive in history, and

“buying them here is like buying all your stocks at 52-week highs.” Yes sure, we have heard that argument every year last decade, and yet bonds continue to outperform stocks.

In any case, 60/40 may lose either way, as “A big policy response can cause yields to painfully overshoot, while bonds have been no hedge at all since the March 9th lows: 10-year yields jumped 48bps, and Treasury volatility is the highest since 2008.”

* * *

7. Where should one invest in equities?

Once markets stabilize – when that happens is anyone’s guess – BofA says to buy quality stocks, especially in defensive sectors like health care, staples, and utilities. Regionally, BofA keeps a US bias and would add to EM ex-China in a rebound, but need evidence of a structural shift in policy to buy Europe & Japan. Some traditionally cyclical industries in the US may prove more resilient here, too:

- Cybersecurity has little supply chain exposure with less discretionary revenue;

- National defense is not exposed to the economic cycle & outperformed in the last 5 recessions by 13ppt on average;

- Homebuilders benefit from record-low mortgage rates, minimal supply chain risk, and demographic tailwinds; and

Banks have already priced-in a recession, pay well-guarded dividends of 5%, and may earn higher multiples once the downturn is over.

For global quality, look for the latest update soon to our Global Best of Breed screen. Many of these sectors & themes are accessible via funds & ETFs, which Eli Lanik ranks.

* * *

8. How about bonds: where should one invest in fixed income?

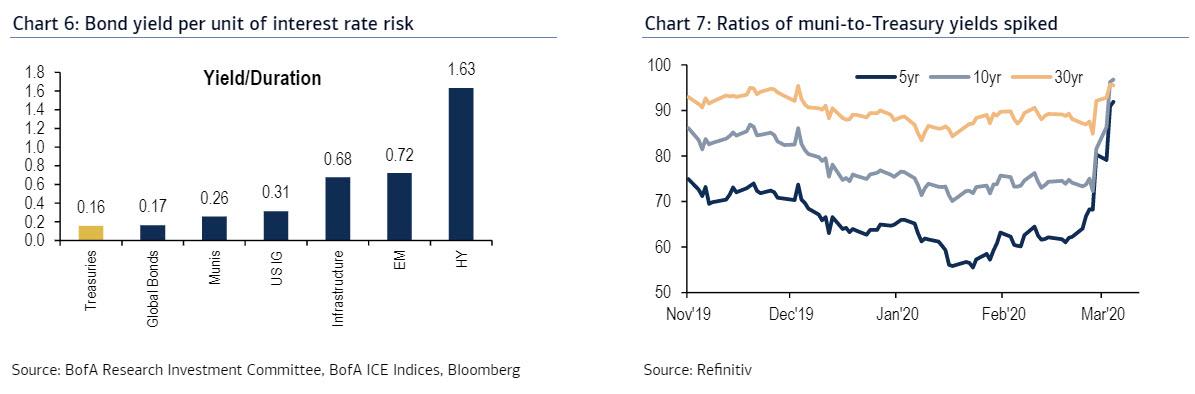

BofA says that it would rotate out of Treasury bonds and into municipals, investment grade corporates, and mortgage-backed securities (hardly a new take for the bank that has hated TSYs for years, losing greatly in the process). That said, treasuries today yield just 16bp per unit of risk vs. 60bp historically, and every other fixed income sector offers a better risk/reward profile once markets stabilize.

Meanwhile, the ratios of muni bond yields to Treasuries spiked so sharply that BofA’s team suggests “buying the whole curve”.

Finally, mortgage-backed securities are the cheapest since 2008, and attractive on the prospect of the Fed re-entering the market. Finally, our analysts are bullish on investment grade bonds at spreads above 200bps.

Tyler Durden

Mon, 03/16/2020 – 17:10

via ZeroHedge News https://ift.tt/38VXFxA Tyler Durden