Quarantative Easing Fails: S&P, Brent Down 10%, European Banks Hit All Time Low In Monday Massacre

The Fed’s quarantative easing has failed.

After last week’s miserable Monday moves, we are running out “black Monday” designations, so we’ll keep today’s Ides of March action simple, especially since it is likely to recur for many weeks to come: just call it the Ides Of March Mondays Massacre.

With S&P futures promptly plunging 5% limit down at the Sunday reopen of electronic trading after the Fed quite literally “blew” its largest emergency intervention ever, which instead of calming markets only exacerbated the sense of panic and dread, this morning the SPY ETF shows what to expect, and it’s a disaster, as the S&P is indicated to open about 10% lower, which will be sufficient for at least one 15 minute trading halt when markets reopen at 930am. The fact that Nike and Apple announced mass store closings, did not help, neither did Chairman Powell’s warning that US growth next quarter will be weak.

The question, however, is whether the market will be halted fully and indefinitely to prevent further selling and to “own the shorts” whether due to continued selling or by presidential decree. We will find out in a few hours, and until then here are the appropriate circuit breaker levels. If the S&P drops to 2,168 it may be all over.

- 2521.25 (down 7%)

- 2358.59 (down 13%)

- 2168.82 (down 20%)

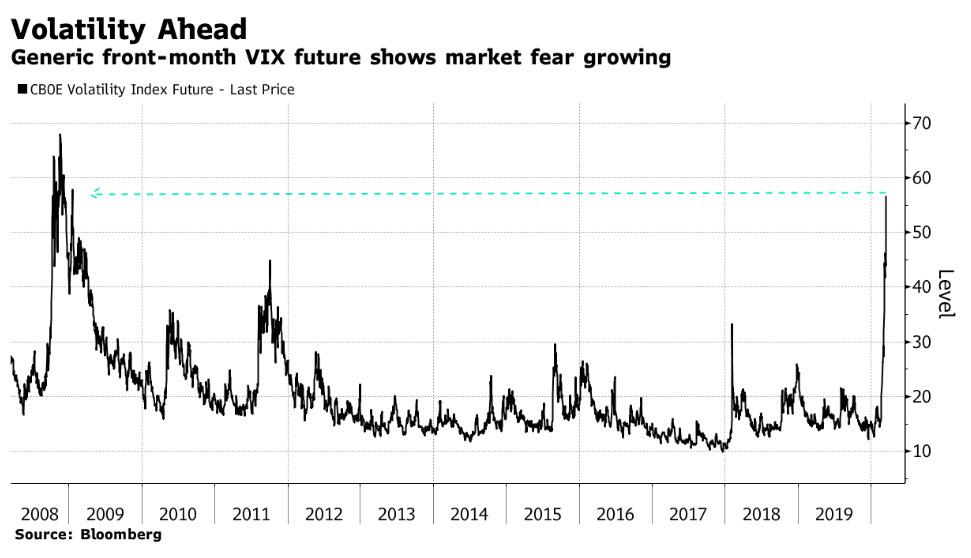

Until then, we can merely list the carnage in the market which includes a near record surge in the VIX, whose front-month futures contract jumped as high as 57.9 on Monday. The actual spot VIX which tracks the 30-day implied volatility of the S&P 500 based on out-of-the-money options prices, wasn’t quoted as of 9:15 a.m. London time. A notice on Cboe’s website said the opening for S&P 500 and VIX products has been delayed, meaning we can now add a broken VIX to the list of everything else that is broken about this market.

As Bloomberg notes, Monday’s surge sent VIX futures beyond their highs of last week, which included several limit-down pauses to U.S. stocks and the S&P 500’s biggest tumble since the crash on Black Monday in 1987.

Investors have been unable to digest a ceaseless newsflow of companies shutting operations, countries sealing borders and governments devising targeted rescue plans. The Fed cut its key interest rate by a full percentage point to near zero and said it will boost its bond holdings by $700 billion. The Bank of Japan moved to accelerate asset purchases, doubling the amount of equity ETFs the central bank buys every year to 12 trillion.

“In normal circumstances, a large policy response like this would put a floor under risk assets and support a recovery,” Jason Daw, a strategist at Societe Generale SA in Singapore, wrote in a note. “However, the size of the growth shock is becoming exponential and markets are rightfully questioning what else monetary policy can do and discounting its effectiveness in mitigating coronavirus-induced downside risks.”

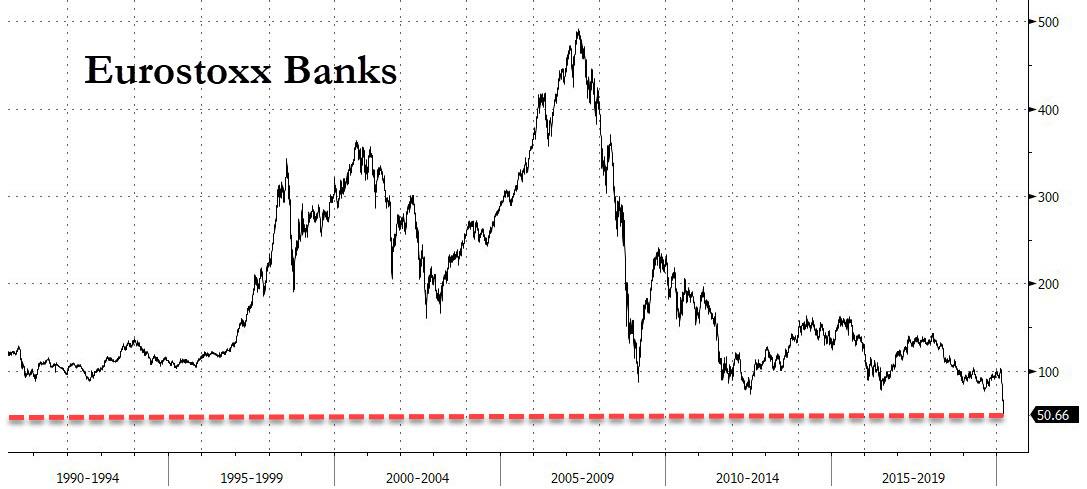

European stocks were not halted but the carnage was just as bad, with all sectors tumbling, while the European Stoxx 600 Banks Index plunged 7.8% Monday, falling below its low of 2009, in the aftermath of the Global Financial Crisis. Banks have underperformed the wider market as European countries are increasingly going into lock-down mode.

Predictably, debt insurance costs for European banks and sovereigns rose sharply on Monday, shrugging off massive rate-cutting moves and liquidity injections by the U.S. Federal Reserve and other global central banks over the weekend. Five-year credit default swaps for Italy’s UniCredit rose 33 basis points (bps) from Friday’s close to 243 bps, Deutsche Bank saw levels jump 18 bps to 138 bps while France’s Societe Generale saw a 10 bps rise. Sovereign debt CDS levels also gained with southern European issues suffering the sharpest increase. Italy saw CDS levels spike 18 bps to 246 bps to revisit last week’s levels while Spain gained 14 bps to 119 bps – its highest level since June 2016.

Earlier, all markets in the Asian region were also down, with Thailand’s SET falling 6.4%. The Topix declined 2%, with Kurabo and Maeda Road falling the most. The Shanghai Composite Index retreated 3.4%, with Kangni Mechanical and Sunny Loan Top posting the biggest slides. Australian equities fell almost 10%, the most since 1992, even after the Reserve Bank of Australia said it stood ready to buy bonds for the first time – an announcement that sent yields tumbling.

In rates, after the Fed cut rates to zero, 10Y US Treasury yields retreated more than 33 bps at one point overnight, but have since trimmed the move, while bonds were mixed in Europe as Italian and Greek yields blew out amid fears the ECB will not be there to bail everyone out.

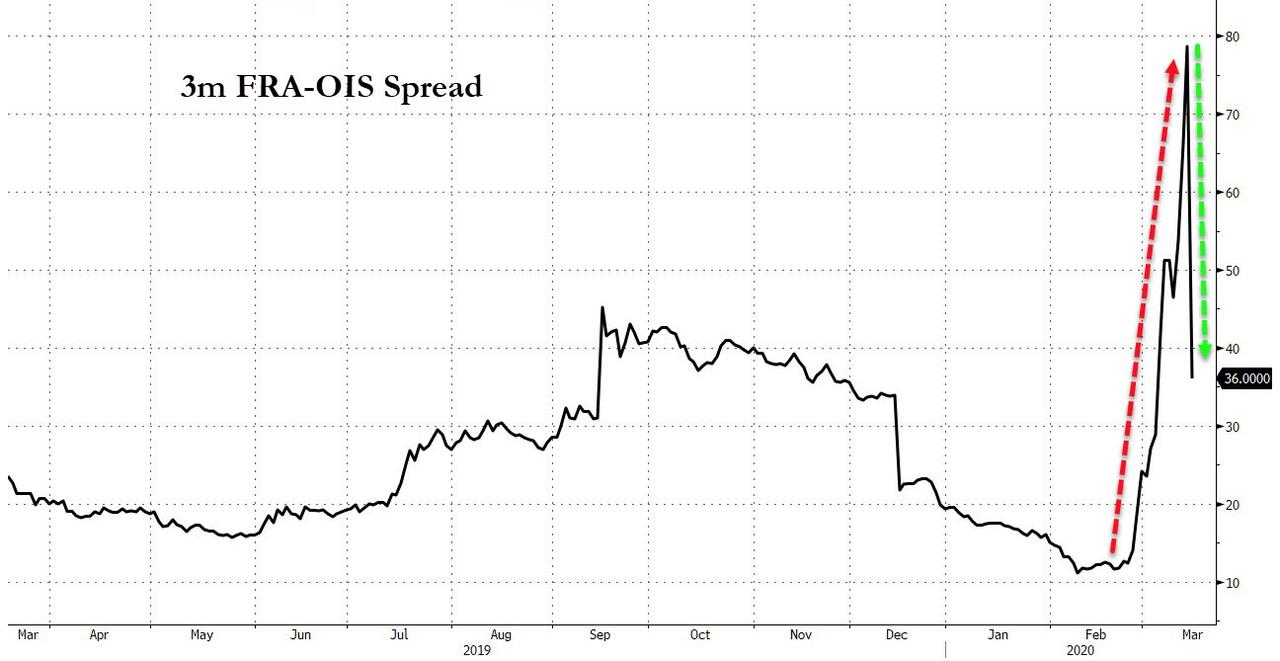

There was one silver lining: the all important FRA/OIS spread suggests that liquidity may be returning to the bond market after the Fed’s Sunday bazooka, although it is just as likely that this is a misprint.

Still, until there is some confirmation that liquidity is returning to normal, investors are liquidating first and asking questions later, and nowhere is this more obvious than in the plunge in precious metals with gold crashing to $1,465, down almost $250 in just a few days.

In FX, the yen rebounded from Friday’s plunge after the Fed and five counterparts said they would deploy foreign-exchange swap lines. New Zealand’s currency slumped after an emergency rate cut by the country’s central bank.

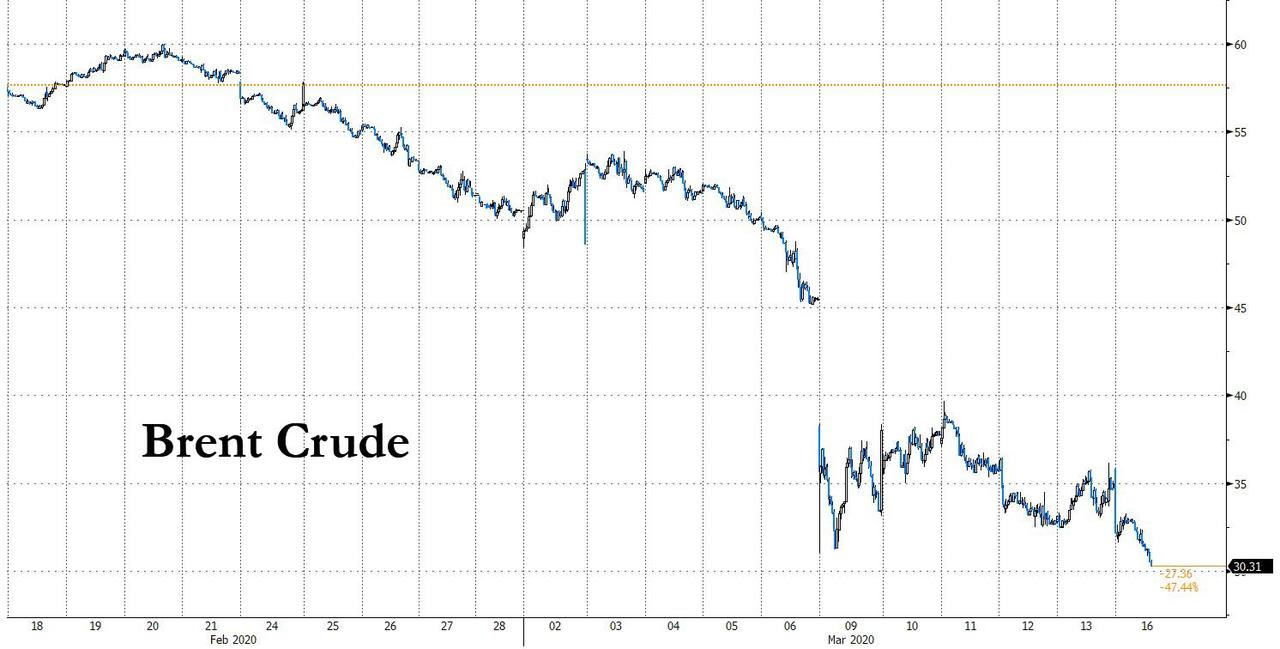

In commodities, besides the precious metals rout, the selling shifted back to oil, which crashed to a fresh 4 year low after Goldman calculated over the weekend that the US SPR crude buying would barely make a dent on overall demand.

Economic data include Empire manufacturing survey. Tencent Music is among companies reporting earnings

Market Snapshot

- S&P 500 futures down 4.8% to 2,567.50

- STOXX Europe 600 down 8.4% to 274.06

- MXAP down 3.8% to 131.51

- MXAPJ down 5% to 434.15

- Nikkei down 2.5% to 17,002.04

- Topix down 2% to 1,236.34

- Hang Seng Index down 4% to 23,063.57

- Shanghai Composite down 3.4% to 2,789.25

- Sensex down 6.3% to 31,956.62

- Australia S&P/ASX 200 down 9.7% to 5,002.00

- Kospi down 3.2% to 1,714.86

- German 10Y yield fell 3.5 bps to -0.579%

- Euro up 0.9% to $1.1211

- Brent Futures down 6.7% to $31.58/bbl

- Italian 10Y yield rose 2.5 bps to 1.611%

- Spanish 10Y yield rose 11.3 bps to 0.735%

- Brent Futures down 6.7% to $31.58/bbl

- Gold spot up 0.6% to $1,539.15

- U.S. Dollar Index down 1.1% to 97.65

Top Overnight News

- The Federal Reserve on Sunday cut its benchmark rate by a full percentage point to near zero and will boost its bond holdings by $700 billion to cushion the U.S. economy from the coronavirus outbreak

- Credit markets reeling from their worst week since the global financial crisis weren’t impressed by a dramatic rate cut by the Federal Reserve, as investors including Pacific Investment Management Co. called for governments to do more to avert a meltdown

- Italy’s government will meet Monday to pass a new package of measures including increased spending for its stricken healthcare sector and moves to cover extraordinarylayoffs after deaths in the country from the coronavirus jumped by 368 Sunday

- Deutsche Bank AG will operate in split teams globally from Monday as a way to curb the spread of the coronavirus

Asian equity markets weakened and US equity futures hit limit down to start the week as coronavirus fears and disruptions continued to spook investor sentiment, despite numerous policy measures to address the fallout from the outbreak including the Fed throwing the kitchen sink with a 100bps emergency cut and USD 700bln QE announcement. This followed the national emergency declaration by US President Trump last Friday which opens access to USD 50bln of emergency funds for states to tackle the coronavirus, while BoC and RBNZ also recently announced emergency cuts of 50bps and 75bps respectively. Nonetheless, ASX 200 (-9.7%) failed to benefit from the global policy measures and announcement the RBA stands ready to purchase government bonds, with heavy losses in mining names, financials and industrials resulting the index’s worst ever drop, while Nikkei 225 (-2.6%) was choppy amid the BoJ’s emergency meeting in which it kept rates and the yield target unchanged but doubled ETF and J-REIT purchases. Hang Seng (-4%) and Shanghai Comp. (-3.4%) were both negative due to widespread fears and after surprise contractions to Chinese Industrial Production (-13.5% vs. Exp. 1.5%) and Retail Sales (-20.5% vs. Exp. 0.8%), but with losses in the mainland stemmed after the PBoC’s recent targeted RRR cuts of 50bps-100bps and additional 100bps cut for joint-stock banks which will unleash CNY 550bln of funds, while the HKMA authority also announced a rate cut in lock step with the Fed albeit to a lesser extent of just 64bps. Finally, 10yr JGBs opened lower due to the after-hours slump on Friday as stock markets found some firm but brief relief, although JGB prices rebounded off their lows as fears returned to the fore of investors’ minds before retreating again after the BoJ announced to keep main policy settings unchanged but instead boosted purchases of ETFs, J-REIT, Commercial Paper and Corporate Bonds, while pressure was also seen in the Australian 10yr yield after the RBA signalled a readiness to purchase government bonds.

Top Asian News

- Shell-Shocked Markets Find Little Relief in Volatile FX Trading

- RBNZ Delays New Capital Rules; Sees NZ$47b Boost to Lending

- India’s RBI to Hold Briefing Amid Flurry of Asia Rate Cuts

- China’s Economy Set to Shrink 6% This Quarter, Macquarie Says

European equities continue to erode in early trade [Euro Stoxx 50 -8.5%] despite pre-emptive monetary easing measures from global Central Banks including a 1ppt reduction by the Fed alongside a USD 700bln QE boost. The downbeat sentiment from the APAC session reverberated into Europe as the underlying coronavirus theme further crystallises, which saw US equity futures hit the 5% limit down at the open and hover at the levels during European trade thus far (Full details available here). Meanwhile, Euronext stated that it will be doubling the ETF threshold amid “exceptional market conditions caused by recent news and events”, with the normal threshold set to return once condition return back to normal. Sector-wise, the usual suspects show underperformance – Financials (-9.6%) sink as banks bear the brunt of the lower yield environment, whilst Consumer Discretionary (-9.3%) follow closely amid a further deterioration in Travel & Leisure (-18.0%) in light of renewed fleet groundings in airline and cruise names. On that front, Air France-KLM (-16.7%) remains a laggard in the Stoxx 600 after noting that flight activity will be reduced significantly over the next few days, with the number of seats available per km seen dropping between 70-90%. easyJet (-21.0%) meanwhile stated that it has taken on further cancellations, with these actions to continue for the foreseeable future. Tui (-30.0%) plumbed the depths following after withdrawing its FY20 guidance and applying for state aid to support the business. Credit Suisse (-12.0%) shares feel extra pressure after US prosecutors are pursuing the Co. for its role in a USD 2bln Mozambieq corruption case, in which they believe that they have enough evidence against the Co. Elsewhere, Associated British Foods saw considerable downside in early European trade despite a rosier trading update (sees adj. operating profit ahead of prior guidance), with some attributing the move to a fat-finger. Finally, Bayer (-4.7%) outperforms the German index but conforms to the overall sell-off despite source reports that the Co. is a step closer in agreeing to draft settlement regarding tens of thousands Roundup weed killer claims.

Top European News

- U.K.’s FCA Suspends Finablr Trading in London

- H&M, Primark Brace for Downturn in Europe as Epicenter Shifts

- Virus Delivers New Blow to Rio Tinto’s Flagship Copper Project

In FX, the Greenback has handed back almost all Friday’s gains and would surely be even weaker if the non-US Dollars were not underperforming on a combination of rate cuts and risk aversion. Indeed, the DXY is only just off its pre-weekend low of 97.335 within a 97.446-98.473 range after the Fed’s latest intermeeting policy action (-100 bp FF cut to 0-0.25% and Usd700 bn QE) as the US Treasury curve unwinds some of its initial bull-steepening.

- CAD/NZD/AUD – As noted above, the Loonie, Kiwi and Aussie are all conceding ground to their US counterpart in wake of various forms of stimulus designed to protect respective economies from further COVID-19 contagion, including a standard 50 bp BoC rate cut (on top of the ½ point reduction at the scheduled March meeting), -75 bp from the RBNZ and the RBA introducing more repos ahead of additional ‘measures’ to come on Thursday that may involve some for of asset purchases. Usd/Cad is back up near 1.3900, Nzd/Usd is straddling 0.6000 within a wide 0.6153-0.5945 band and Aud/Usd is hovering around 0.6170 between 0.6303-0.6097 parameters, with the latter also taking on board extremely bleak Chinese data (ip and retail sales) that is keeping Usd/CNH afloat on the 7.0000 handle.

- JPY/CHF/EUR – It’s abundantly evident that safe-haven appeal is considerably stronger than any negativity associated with looser monetary policy or the prospect in the case of the Yen and Franc that have both strengthened vs the Buck and generally. Usd/Jpy has retreated through 106.00 from almost 108.00, while Usd/Chf has tested 0.9400, with Eur/Jpy and Eur/Chf eyeing 118.00 and sub-1.0550 respectively even though the single currency is outpacing the Usd either side of 1.1200. To recap, the BoJ joined others in the fight against nCoV via increased QE, while the clock is ticking down to the SNB’s quarterly policy review this Thursday and latest weekly Swiss sight deposits suggest more intervention. For its part, ECB’s Holzmann has reiterated that the GC is willing to do more after last week’s targeted measures.

- SCANDI/EM – As usual when oil and other commodities (Gold also) succumb to broad and severe risk-off positioning, the Nok, Rub, Mxn and Zar tend to get hit harder than most and today is no exception, albeit with crude prices not quite experiencing the near panic selling/liquidation seen this time last week. However, many regional currencies are at fresh record or multi-year lows and only being propped by intervention, like the Ils to name just one.

In commodities, WTI and Brent front-month futures continue to deteriorate amid further materialisation in coronavirus woes, and with further cancellations in the Travel and Leisure sector dampening demand growth in the complex. WTI Apr’20 dipped below USD 30/bbl at the open of electronic trade before taking multiple stabs at the level to the downside since Europe entered the market, although giving up the handle at the time of writing. Meanwhile, Brent May’20 underperforms its US counterpart with the prospect of the OPEC breakdown further weighing on the contract – Brent gapped lower to sub-40/bbl vs. Friday’s close of ~USD 45/bbl. Analysts at ING state that the underperformance doesn’t come as too much of a surprise “given the severity of the breakout across Europe, along with the action taken by governments to try to contain the virus”. The Dutch bank also suggests that the current weakness in oil prices is likely to persist through Q2 this year as the surge in supply and demand hit means that the markets will likely see a significant surplus. Elsewhere, spot gold (-1.8%) trades weaker as investors flee for cash holdings amid significant losses in riskier assets, traders also note that a decline below USD 1500/oz may induce a stop-chase, with the yellow metal’s 200DMA ~1500.25/oz and a Fib level at USD 1495.96/oz. On that front, spot silver (-10.7%) slid since the open and briefly fell south of USD 13/oz to levels last seen in 2009. Similarly, the flight to cash and a significant slump in Chinese IP figures have prompted copper prices to crash from ~USD 2.55/lb to sub USD 2.40/lb.

US Event Calendar

- 8:30am: Empire Manufacturing, est. 4.9, prior 12.9

- 4pm: Net Long- term TIC Flows, prior $85.6b

- 4pm: Total Net TIC Flows, prior $78.2b

DB’s Jim Reid concludes the overnight wrap

What a weekend in terms of news-flow as more and more evidence mounted that the global economy is about to go into an unprecedented hibernation. Then just as I was going to bed last night the Fed cut rates 100bps to near zero and announced that it was going to increase their bond purchases by “at least” $700billion split $500bn Treasuries and $200bn MBS. The forward guidance is that they will keep them here until “confident that the economy has weathered recent events and is on track to achieve maximum employment and price stability”. The Fed also announced it was reducing reserve requirements for banks to zero as well as letting banks borrow at the discount window for up to 90 days. In a coordinated move with other central banks, the Fed lowered the rate on USD liquidity swap arrangement by 25 bps.

During the ensuing press conferences, Fed Chair Powell noted that the virus was having a profound impact on the U.S economy and that financial conditions have tightened significantly. He noted that the shutdown and the “illness will have a significant effect on the economic activity in the near term.” He also expects that inflation will be held down this year given the recent events. As far as emergency rate cuts go, this is the largest on record and probably only stopped from being more by the fact that we’re at the zero bound now. The Fed chair expects the second quarter to be weak, but that “after that it’s very hard to say how big the effects will be”, and so the FOMC forecasts will return next quarter. Powell continued to reiterate that forward guidance and asset purchases will be the toolkit going forward rather than negative rates. The chair also acknowledged that the central bank does not have tools to reach individuals and smaller businesses”, but then added that “(The committee) thinks fiscal response is critical”, and is happy to see those being considered.

The 100bps cut was almost all priced in so that was to be expected. The QE was more of a an immediate surprise. The reason we’ve maintained and extended our bearish view on credit is that we think the global economy screeching to a halt is more worrying than the Fed is comforting. 0% interest rates won’t make up for much of the massive loss of activity/income for companies and consumers.

Even with the surprise move by the Fed, futures on the S&P 500 are down -4.79% after hitting the lower circuit limit while those on the Dow (-4.56%) and Nasdaq (-4.55%) are also down. Because the S&P rose c.7% in the last 30 minutes of trading on Friday for no apparent reason its hard to disentangle the Fed impact from a reversal of this. Elsewhere yields on 10yr USTs are down -30.9bps to 0.655% while those on 30yrs are down -26.8bps to 1.268%. Asia equity bourses are also trading down (but for most not aggressively) with the Nikkei (-0.21%), Hang Seng (-2.60%), Shanghai Comp (-0.55%) and Kospi (-2.10%) falling. However the ASX is down nearly -10% which is around the largest fall since October 1987. As for fx, the Japanese yen is up +0.78% while the Swiss franc is up +0.25%. In commodities, brent crude oil prices are down -3.16% while gold is up +1.03%.

In other news, as we go to print, the BoJ have just met after bringing forward Thursday’s meeting. They have said that they will continue to buy more commercial paper and corporate bonds until end-September and have also introduced low-cost lending facility for companies affected by the virus. They’ve raised their annual ETF purchase target to JPY 12tn (vs. JPY 6tn previously) while the JREIT target was revised up to JPY 180bn. The bank guideline for ETF and JREIT purchases reiterated the prior language that “in principle,” the BOJ will buy 6t yen ETFs and 90b yen JREITs, though these amounts may rise or fall depending on market conditions.

Elsewhere New Zealand issued an overnight emergency cut of 75ps and promised to keep the rate that low for a year while on the liquidity side, the PBoC injected $14.3 billion into the financial system while leaving interest rates unchanged. The RBA also boosted cash injections and said it “stands ready” to purchase government bonds. Australia is also considering further fiscal easing.

Back to our credit view, on Friday we published a short note looking at a framework for where Credit trades in a recession. We think the normal boom to recession pricing is c.100-250bps for cash IG and c.350-1000bps for HY. We also talk about what might make this cycle better or worse than a “normal” recession. Given that US HY is now in the 730bp area, we still don’t feel that enough risk is priced in yet, especially when you consider the huge illiquidity issue that the market would face in normal times if clients became forced sellers. Given that these aren’t normal times with traders, sales and PMs seeing compromised working conditions, liquidity is likely to be far worse in this current episode. We’ve previously published that the next recession would likely be the third worst for spreads in history and behind only the Great Depression and the GFC due to the massive mismatch between the likely desired liquidity and what will be on offer. It’s probably time to back up that call. In fact we are going to put out a note today increasing our already bearish HY spread forecasts in US and Europe to around +1000bps from our previous target of just under +750bps (US) in light of the more draconian measures adopted by Western governments over the weekend. See Friday’s note here which will explain most of the reasons. We will publish more later which will also extend our spread widening view for IG.

There isn’t a lot of point going through all the weekend virus developments as I’m sure you are all watching the news but for a moment let’s step back and take in how remarkable the following announcements were. For example;

* Spain is now on lockdown (joining Italy) and will only allow people to leave their homes to buy essentials, for special circumstances or to work.

* France has closed all non-essential stores/shops and done the same for all restaurants and cafes. Travel across the country is being discouraged.

* Germany has closed it’s borders with France, Switzerland and Austria outside of goods and commuter traffic.

* All main European and US Ski resorts are now closed.

* The U.K. may tell all people over 70 to stay at home and isolate soon.

* Austria has banned gatherings of more than FIVE people. Sounds like my old band could still play in Vienna then. * In Italy I saw on the telly last night long queues for supermarkets but with 2 meter gaps between people in these queues. It was quite surreal.

* In micro terms SAS is idling 90% of all its staff and will cancel most flights from today.

* NYC joins many in the world in terms of shutting down schools. The U.K. and other parts of the US remain out on a limb in keeping them open for now.

* NYC and Los Angeles also said overnight that they will close nightclubs and entertainment venues while limiting restaurants and bars to takeout and delivery.

Assuming these aggressive measures carry on then surely over the next 10-14 days the number of new cases in Europe should slow dramatically. Clearly these stats will be complicated by some countries deliberately (or from lack of resources) not testing all potential victims but we should see the direction of travel. Whether these draconian measures are the correct ones or not will be debated for months or maybe years to come. It’s irrelevant for now as it’s happening, whether you agree with it or not. What it does mean, is that most Western governments have decided to take the maximum short term economic pain route in order to stop the spread. The problem with this is that it’s not clear when you can end this once you start it. Although the case numbers should soon slow, one would think that the minimum time until we slowly re-open economies would be a month’s time at the very earliest. That’s a lot of economic and market disruption to come. The U.K. has come under criticism for not being as aggressive as many countries at closing down schools etc. However in listening to the U.K. Chief Medical Officer he made the point that if they close too early then children might be forced to spend a lot more time with their grandparents as child carers. Given this group is more likely at risk then this could be counterproductive. He also said the danger is also that we get isolation fatigue if we shut down too early as it would have to go on for a long period. So whether this is right or wrong, it certainly has been thought through. However I suspect the U.K. will soon be pressurised to move in line with everyone else.

We also got China’s monthly economic data dump overnight and it highlighted an even deeper slump in economic activity than expected. YTD Feb industrial production recorded the largest decline since the series began in January 1997 at -13.5% yoy (vs. -3.0% yoy expected) while retail sales printed at -20.5% yoy (vs. -4.0% yoy est.), the largest decline since January 1998, and fixed asset investment dropped to -24.5% (vs. -2.0% yoy est.), the largest decline since January 1997. February unemployment rate also rose to a record 6.2% as the outbreak worsened in China.

In term of this week’s planned events (I suspect they’ll be a lot of unplanned ones) the Fed meeting on Wednesday was going to be the highlight but they have upstaged themselves by last night’s actions.

Elsewhere, the Eurogroup (euro area finance ministers) meets today with the EU counterpart —ECOFIN — meeting tomorrow. So these are crucial meetings to learn what the phrase “whatever is necessary” that has been used by Merkel, Scholz and European Commission President von der Leyen over the last few days means. For more on the German government interventions last week see our economists piece from Friday night here. Mark Wall’s team have previewed the two days of very important meetings in this note here. It is well worth a read as it outlines what they might do and what the size of the potential package might be relative to the GFC.

For all data in the week ahead best to see our day by day calendar at the end. It’s still too early for the three week market crisis to feed into much of the data but you’ll start to get the first signs, especially in some of the sentiment indicators.

This past week saw an even more volatile week than the last, with European and US Equity markets seeing truly once-in-a-generation sized moves. The S&P 500 saw its 5th worst daily loss since 1927 on Thursday when it was down -9.51% before rallying +9.29% on Friday – which was the 10th largest daily gain in the history of the index – as there seemed to be a clear response to the US government’s initial fiscal actions. Considering that with only 27 minutes before the close the index was only up +2.4% shows what a remarkable end to the week we saw.

In total, the index was still down -8.79% on the week though. Although this was less than 2 weeks ago, it was still the 24th worst week in the history of the index, with all of the other weeks taking place during the Great Depression, October 1987, the Dot Com Bubble, or the Financial Crisis. On Friday, The S&P 500 posted only its 5th daily gain in 19 sessions. Since its record high on Feb. 19, the index is now down just under 20% at -19.94% and entered “bear market” territory on Thursday for the first time since 2009. The large cap index has lost $5.7 trillion of market capitalization since those all-time highs.

10-year U.S. Treasury yield were up even as equities continued lower on the week as correlations started to breakdown. Yields rose just under +20bps over the week to finish at 0.960% (+15.6bps Friday, +19.8bps last week). 30y US treasuries were +24.2bps on the week (+8.9bps Friday). At one point last week, the entire US Yield curve fell under 1.0% for the first time in history. Oil had its worst week since 2008 – down -25.23% on week, up +1.90% Friday – with the commodity being hit from a demand shock as the global economy slows due to Covid-19, while simultaneously being hit by a supply shock as Saudi Arabia and Russia continue their price war on crude.

If anything it was more volatile in Europe, where many indices saw their worst day on record this past week on Thursday as the STOXX 600 fell -18.44% on the week (+1.43% on Friday) Much of the underperformance relative to the US last week was due to the very late mammoth US rally on Friday. Italy lagged with the FTSE MIB down -23.30% on the week (+7.12% Friday on the hope of fiscal stimulus and bouncing off the worst ever recorded day on Thursday), while BTP yield saw their worst day on record on Thursday (+58.5bps on week, 2.5bps Friday). 10yr bund yields finished the week at -0.544%, rising +19.7bps on Friday and +16.6bps over the week. Credit spreads were wider as well on both HY and IG – US HY was +167bps wider on the week (-11bps Friday), while IG was +80bps wider on the week (+7bps Friday). In Europe, HY was +189bps wider on the week (+5bps Friday), while IG was +46bps wider on the week (+1bps Friday). The VIX closed the week at 57.8, which is the highest closing level since the Financial Crisis. It spiked over 75 at the close on Thursday in the worst of the selloff. Gold sold off -8.60% on the week (down -2.9% Friday), as the risk off hedge did not seem to work with dollar rallying +2.9% around the same time (+1.3% Friday).

Tyler Durden

Mon, 03/16/2020 – 07:53

via ZeroHedge News https://ift.tt/33o9fjG Tyler Durden