“Total F**king Carnage” – Global Liquidation Accelerates Despite Massive Monetary Intervention

The Fed unleashed a massive QE5/rate-cut/swap-line splooge overnight…

From reddit pic.twitter.com/PwX3YrWPxB

— Stalingrad & Poorski (@Stalingrad_Poor) March 16, 2020

And here’s what The Fed hoped it would achieve…

BREAKING: Federal Reserve cuts rates to zero and launches massive $700 billion quantitative easing program pic.twitter.com/GilDEux96B

— Fischer Black (@fischersblack) March 15, 2020

Here’s what the market thought of it…

As one veteran trader exclaimed in FULL CAPS over text: “it’s total f**king global carnage” as wherever you look today there is blood in the streets.

For example:

-

STOXX EUROPE 600 ENDS DOWN 4.9%, LOWEST CLOSE SINCE MID-2013

-

SOUTH AFRICA’S FTSE/JSE INDEX FALLS AS MUCH AS 12.2%, MOST EVER

-

MUNI BONDS EXTEND WORST ROUT SINCE 1987

-

COPPER SLUMPS AS MUCH AS 5.2% AMID WEAKENING RISK APPETITE

-

BRENT CRUDE OIL PLUNGES BELOW $30 FOR FIRST TIME SINCE 2016

-

SILVER PLUNGES TO 2011 LOWS

-

U.S. WHOLESALE GASOLINE PRICES PLUNGE 21%

-

HYG WORST DROP SINCE 2008

-

LQD WORST DROP SINCE 2008

Year-to-date, the long-bond is the best-performing asset with stocks the worst and gold just dipping into the red today…

Source: Bloomberg

Only Dow Industrials is still green from the start of 2019…

Source: Bloomberg

Since Trump’s election, Small Caps and Transports are now down 8% and 12% respectively…

Source: Bloomberg

And to comprehend what just happened, Small Caps and Trannies are down 35% from their highs and the rest of the majors down around 27%…

Source: Bloomberg

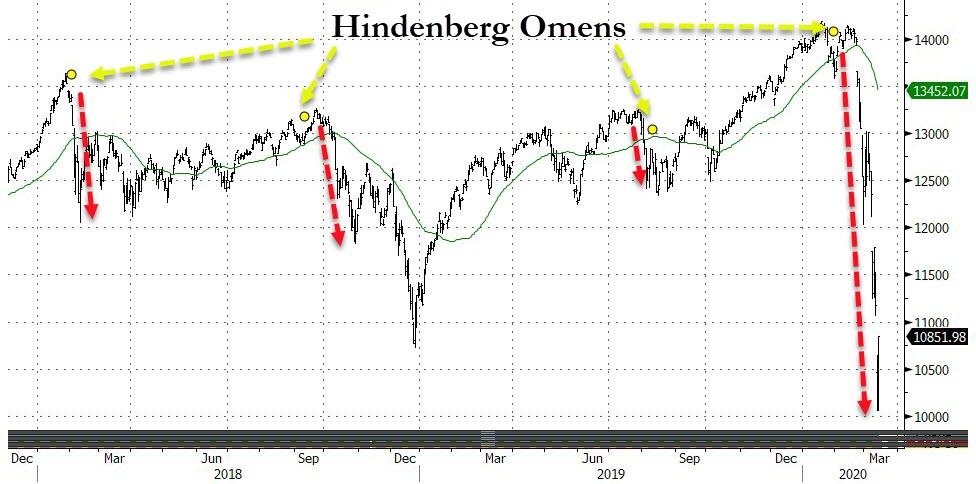

Seems like Hindenberg nailed it again…

Source: Bloomberg

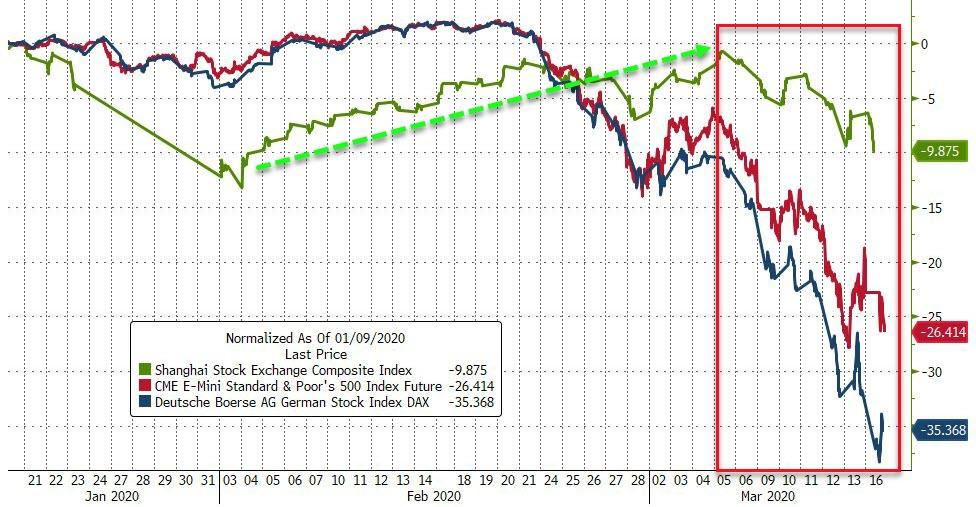

Chinese stocks are starting to awaken from their margin-fueled stupor…

Source: Bloomberg

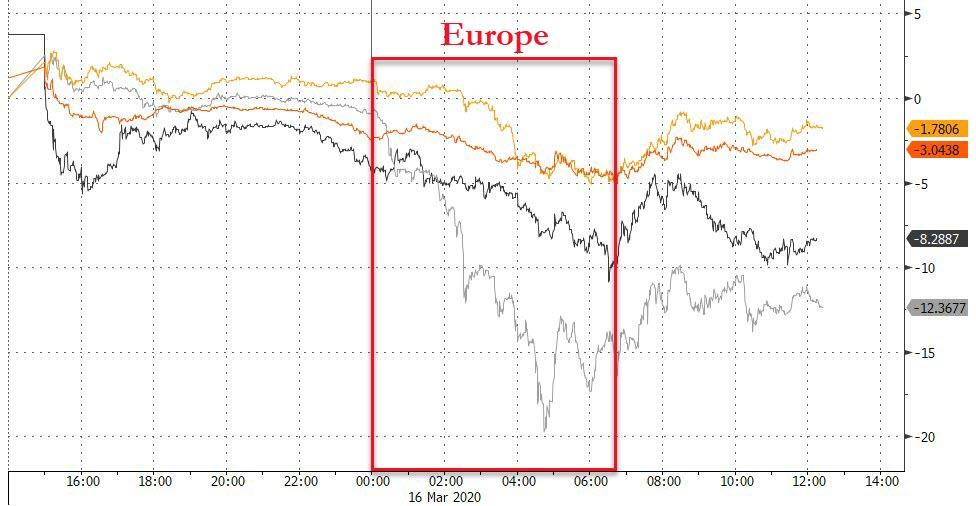

European stocks crashed to their lowest since Nov 2012…

Source: Bloomberg

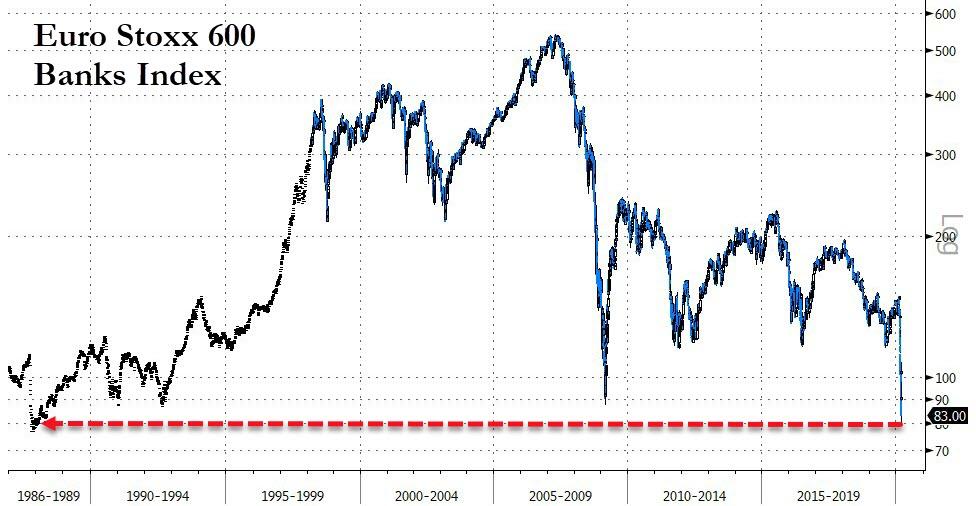

Elsewhere in Europe, banking stocks were a bloodbath, smashed to their lowest since 1987…

Source: Bloomberg

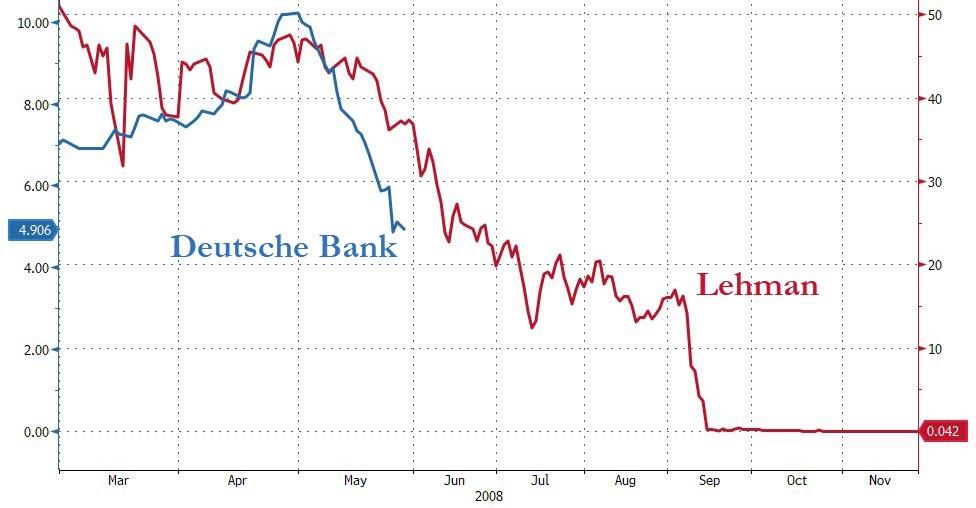

With Deutsche Bank reaching the vinegar strokes, below EUR5 for the first time ever…

Source: Bloomberg

US Futures were halted limit-down overnight, and when cash markets opened, they were halted (down over 7%) before rallying all the way back up to the halted levels before slumping back… Losses accelerated into the close as the White House press conference began…

US Equity ETFs showed the price action a little better (as they were not halted overnight)…

On the cash side, The Dow ended back below 21,000 (crashing 3,000 points today)…

…but Small Caps were the worst hit on the day…

The December 2018 lows are all that matters for now for the S&P 500…

Source: Bloomberg

And the S&P is at key support…

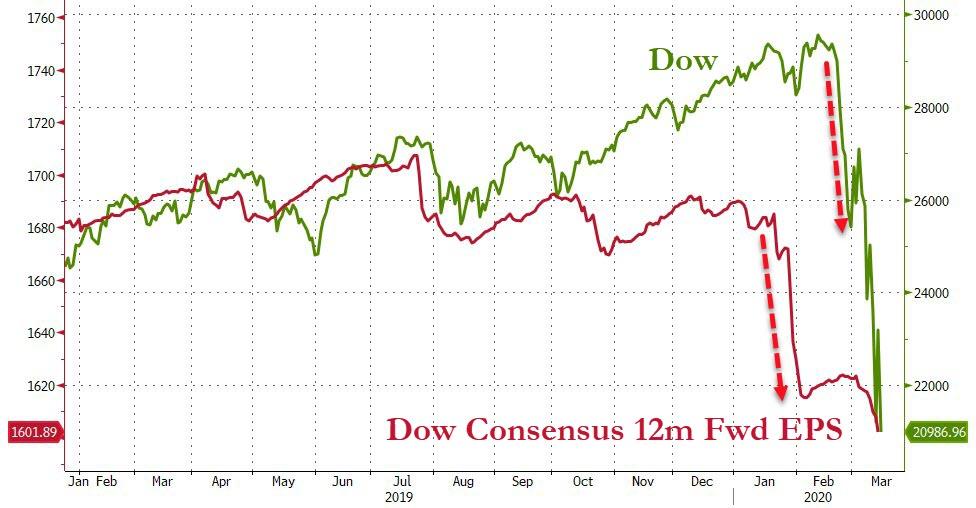

The Dow has caught down to its EPS contraction… but will multiples collapse even more?

Source: Bloomberg

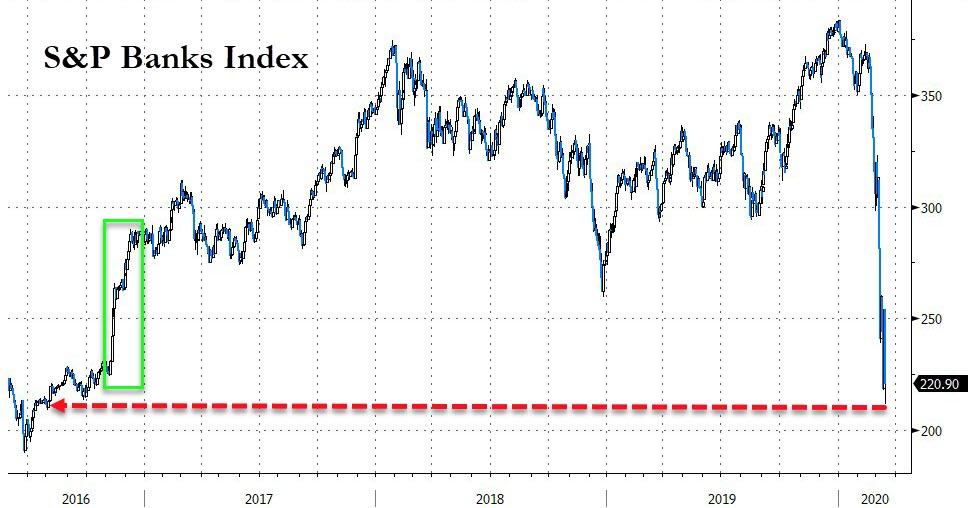

Bank stocks were destroyed today after abandoning buyback plans, erasing all post-Trump-election gains…

Source: Bloomberg

And just when you thought virus-impacted sectors had priced it all in… they plunge another 10-12%…

Source: Bloomberg

It’s been total liquidation…

Source: Bloomberg

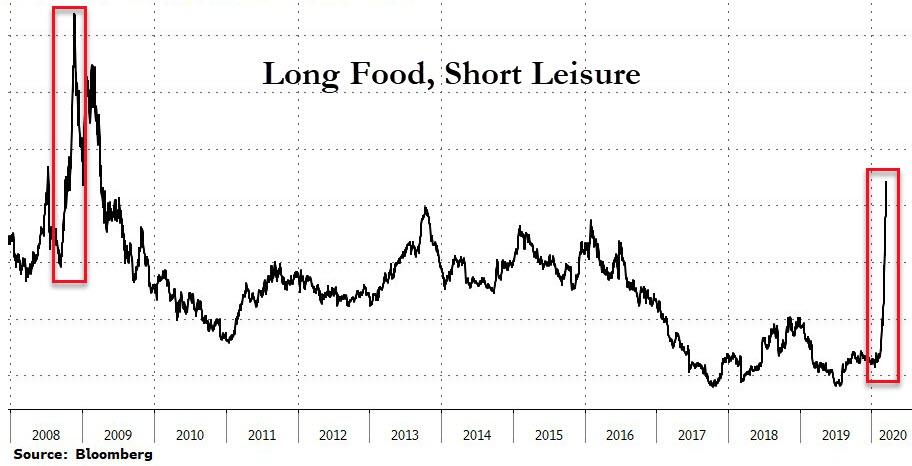

The virus trade continues to play extremely well… Long Food, Short Leisure…

Source: Bloomberg

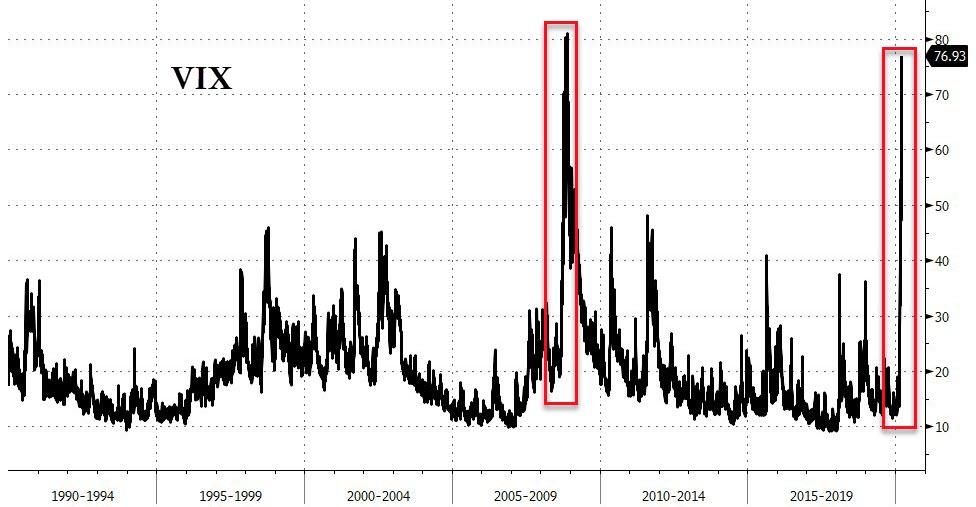

VIX spiked even higher today, within reach of its record highs…

Source: Bloomberg

And systemic event risk is soaring…

Source: Bloomberg

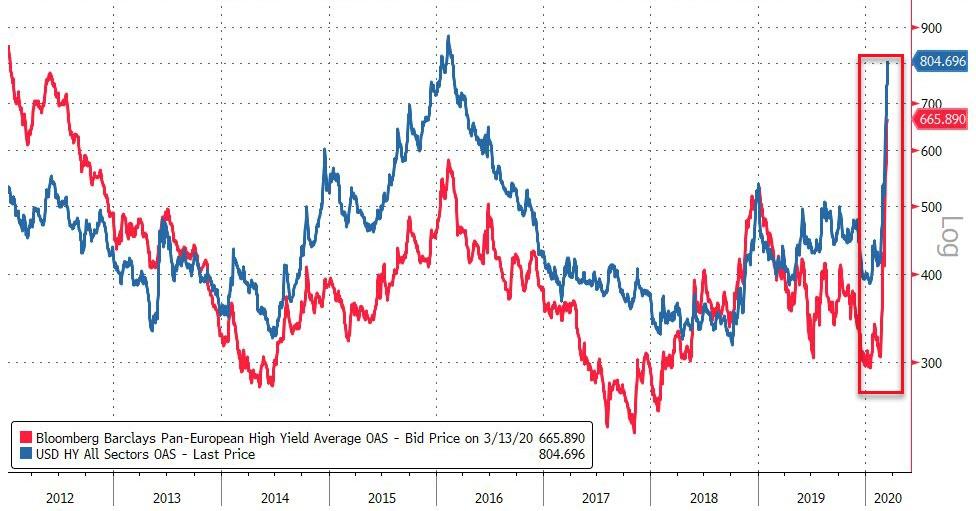

Credit markets suffered more carnage with IG spreads exploding higher…

Source: Bloomberg

As well as HY…

Source: Bloomberg

Treasury yields plunged today, crashing at the open before rising around the European open before being dumped after Europe closed…

Source: Bloomberg

The entire curve was lower but the short-end underperformed…flattening the yield curve.

Source: Bloomberg

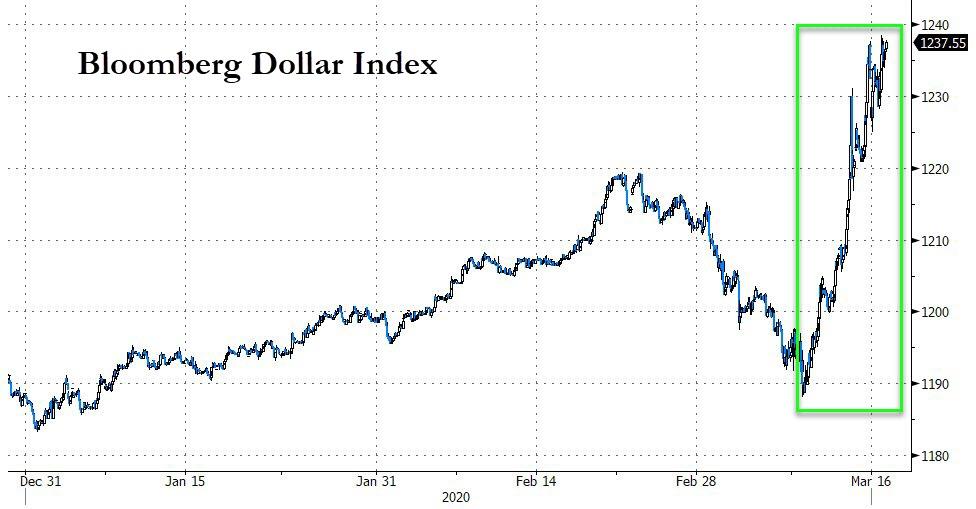

The Dollar surged for the 5th straight day, rallying 3.9% – the biggest 5-day jump since Lehman…

Source: Bloomberg

Cryptos went on a wild roller-coaster in the last 24 hours, crashing 10-2% before ripping back…

Source: Bloomberg

The dollar’s ongoing surge (amid liquidity shortages) prompted further liquidations across commodities with Silver slammed the most…

Source: Bloomberg

Precious metals were broadly pummelled today with gold majorly outperforming (NOTE – the precious metal puke started as Europe opened)…

Source: Bloomberg

Silver puke below $12 today…

Which sent the gold/silver ratio exploding to a record high…

Source: Bloomberg

And WTI busted back below $30…

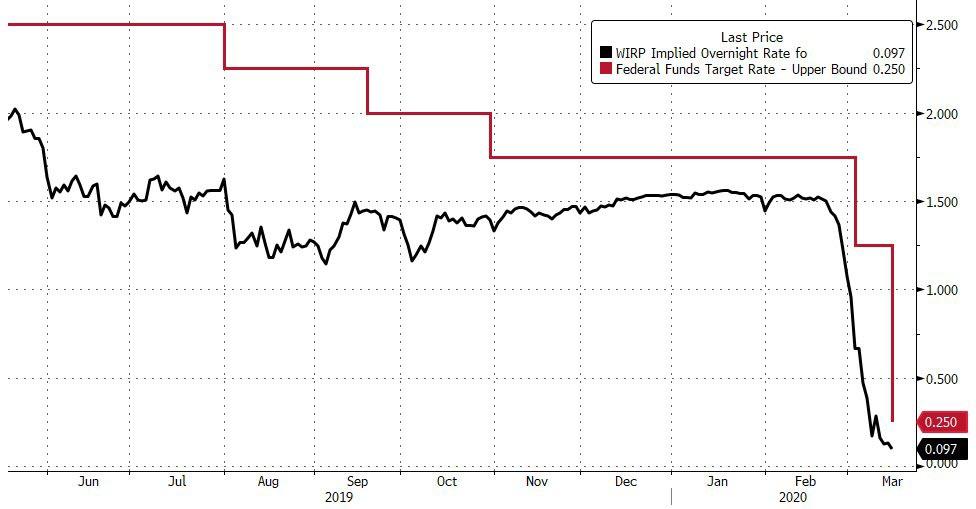

And finally, despite massive monetary intervention overnight, the global shortage just went to ’11’…

Source: Bloomberg

The market got its 100bps cut and is still demanding more…

Source: Bloomberg

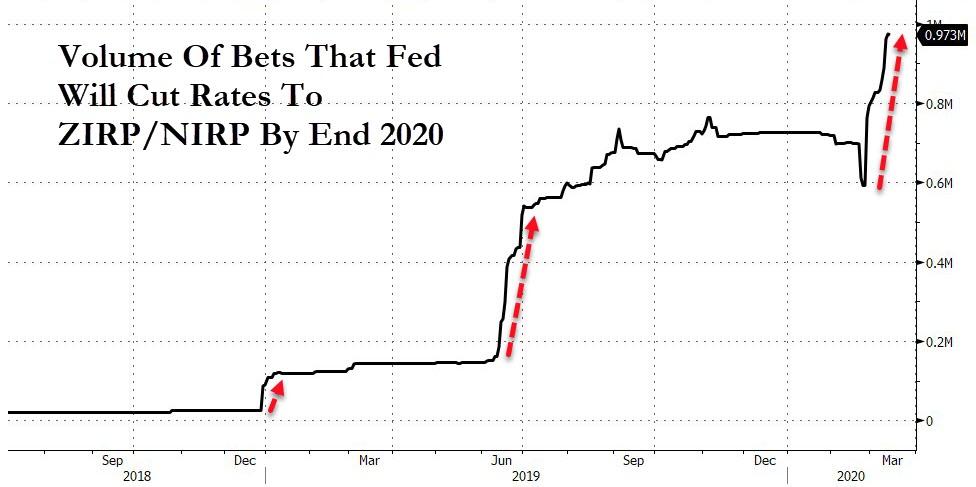

And the number of bets on The Fed going negative are soaring…

Source: Bloomberg

Tyler Durden

Mon, 03/16/2020 – 16:00

via ZeroHedge News https://ift.tt/38TIqp0 Tyler Durden