VIX Closes At Record High As S&P Breaks Critical Trendline Support

Just to provide a little focused context on US markets, three major things occurred today:

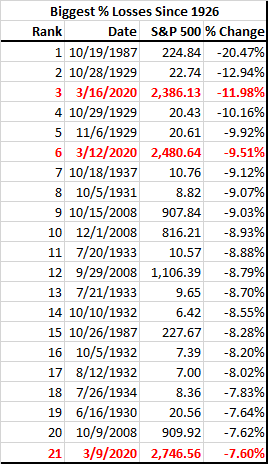

1) this was the 3rd biggest down day for stocks… ever – Great Depression, 1987 and… now

Source: Bianco Research

2) VIX closed at a record high – higher than the highest close during the Great Financial Crisis…

3) The S&P 500 broke below (and closed below) the 11-year up-trendline from the March 2009 ‘generational low’ for the first time…

And all that amid the most massive monetary intervention ever seen. As we detailed earlier, while this deserves an extended discussion, we will merely point out that each day there a distinct part of the credit and/or funding market is breaking:

-

One day it is ETF NAV discounts blowing out

-

The next day the treasury Treasury/Swap basis surges and basis funds suffer a historic VaR crash amid forced liquidations

-

Day three sees the FRA/OIS explode higher as a massive dollar funding margin call strikes

-

Then, day four sees the same repo crisis that was supposed to be fixed back in September return with a vengeance, as banks freak out about counterparty risk.

What the Fed needs is the monetary equivalent of Dr. House: someone who can diagnose what is actually wrong with the monetary plumbing, instead of using the same old shotgun approach of shoveling trillions in blunt liquidity into the market, which clearly is not working anymore.

Tyler Durden

Mon, 03/16/2020 – 16:27

via ZeroHedge News https://ift.tt/2vv4SHk Tyler Durden