Does Any Of This Look Like The Fed Has Anything Under Control?

The Fed has gushed trillions into the short-term money markets in an attempt to fill what appears to be a bottomless pit and now Treasury and the government are discussing direct loans to businesses and banks have used the discount window en masse “to avoid any stigma”

As one veteran trader – who has seen a few cycles, as opposed to just trading the last 10 years uptrend – exclaimed:

“Something is very wrong,” in the short-term liquidity markets.

He is not wrong.

The Dollar shortage is exploding to crisis levels as – despite unlimited Fed swap lines – global basis swaps are soaring…

And as that dollar shortage builds, so the dollar index is manically bid in a scramble for liquidity (and all other assets are sold – including gold and bonds)…

“Funding tensions and the direction of U.S. stocks will largely dictate movement for the G-10 currencies in the short run,” according to Shaun Osborne, chief foreign exchange strategist at Scotiabank

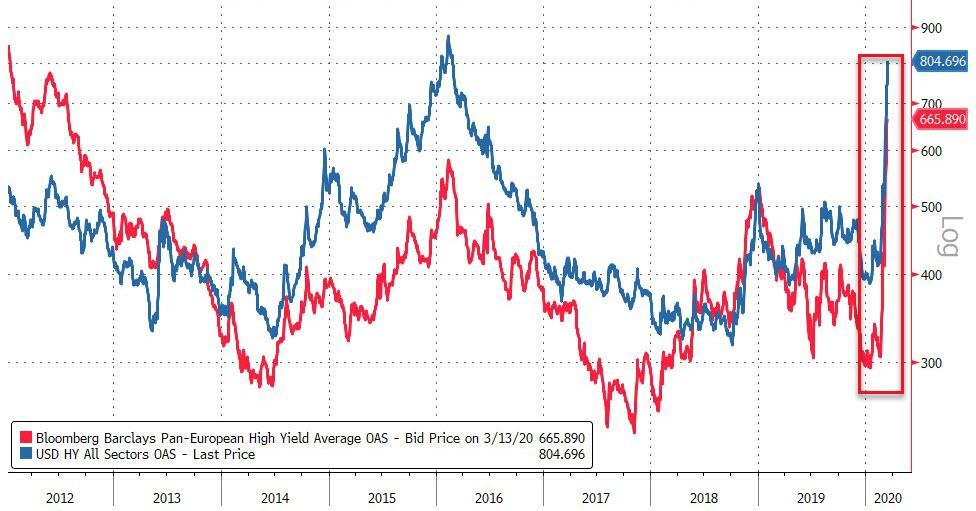

Broad credit markets are utter carnage… especially in Investment-Grade…

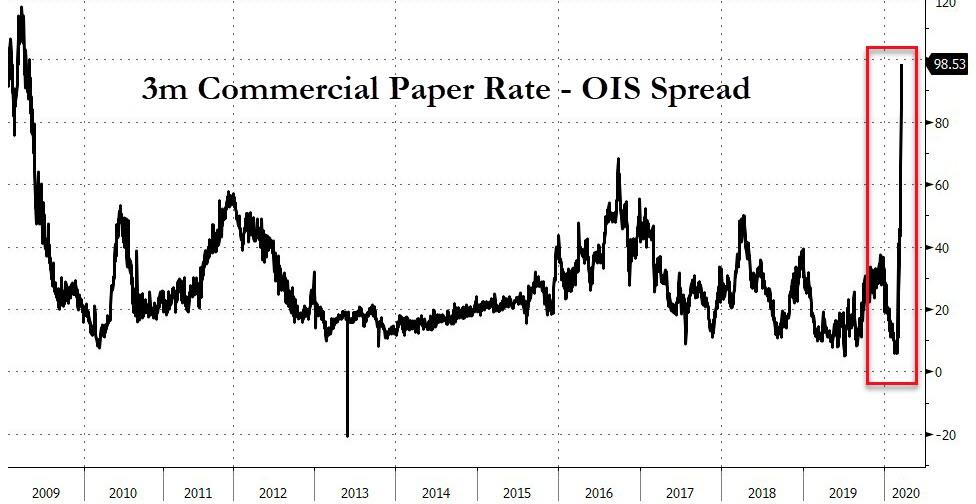

But the credit problem is much more short-term with Commercial Paper markets freezing…

As TD Economics warns:

Shortly after the collapse in the stock market into bear territory in December 2018, we produced analysis to argue against fearing stock market volatility. Granted the recent rout that dialed the S&P 500 Index back to late 2018 levels in a short period is not common. The sharp move corresponds to a 7 standard deviation from historical norms.

However, our eyebrows have been raised at the broadening of financial stress across multiple bond, credit, liquidity and corporate indicators. This is a cause for concern of a possible larger negative credit-event.

And the pace of tightening in financial conditions must be terrifying The Fed…

All of which explains why, as CNBC’s Steve Liesman reported earlier, The Fed and Treasury are considering a commercial paper bailout facility. Exactly as we warned on Sunday…

What, specifically, would the Fed announce?

To address the current frozen CP market BofA expects the Fed to announce two CP facilities, likely on Sunday night. These facilities include:

a reintroduction of the 2008 “Commercial Paper Funding Facility” or CPFF

a facility that would specifically target purchases of CP on dealer balance sheets which we will call a “Commercial Paper Dealer Purchase Facility” or CPDPF.

There is a potential hurdle in that both of these facilities – which would seek to explicitly bail out corporations in need of funding and MMFs – likely cannot be unilaterally authorized by the Fed due to law changes since the financial crisis. The existence of these facilities would only occur through the authority of section 13-3 of the Federal Reserve Act. The Federal Reserve used the “unusual and exigent circumstances” clause (i.e. “section 13(3)”) of the Federal Reserve Act to extend credit to financial firms during the Global Financial Crisis in 2008. Using this broad authority, the Fed created and implemented five funding facilities to provide liquidity to primary dealers and act as a backstop to the commercial paper and asset-back securities markets. BofA explains further:

Congressional action has reined in some of the Fed’s emergency lending powers. The new guidelines do not eliminate the Fed’s lending authority but raise the procedural bar. The new law still allows the Fed act as the “lender of last resort” and create broad funding facilities to help market functioning. However, there are more hoops to jump. The Fed is also restricted from providing “tailored” help to individual firms.

To recap, the Dodd Frank Act of 2010 changed the Fed’s 13(3) authority and requires programs established under this authority to have:

Approval from the US Treasury Secretary

“Broad based eligibility” is meant to include a program or facility that is not designed for the purpose of aiding any number of failing firms and in which at least five entities would be eligible to participate. It also suggests programs should not be for the purpose of aiding specific companies to avoid bankruptcy or resolution.

Limited risk of insolvency: the definition of insolvency to cover borrowers who fail to pay undisputed debts as they become due during the 90 days prior to borrowing or who are determined by the Board or lending Reserve Bank to be insolvent.

All three conditions would easily be met in the current market panic.

Which brings us to the question of “when” will the Fed announce these facilities? Here, as above, BofA repeats that “time is of the essence on these facilities and expect the Fed will announce them this coming Sunday night.”

We believe it imperative the Fed roll out these facilities on Sunday night given the looming expected prime MMF outflows and necessity of their ability to sell CP in order to raise cash. If the Fed waits too long the MMF outflow pressure could mount and the risk of a large scale MMF run could increase.

Will that work?

We suspect not as The Fed is mis-diagnosing – fixing the CP freeze will not solve what may reeally be happening under the surface – a major financial crisis in the global banking system.

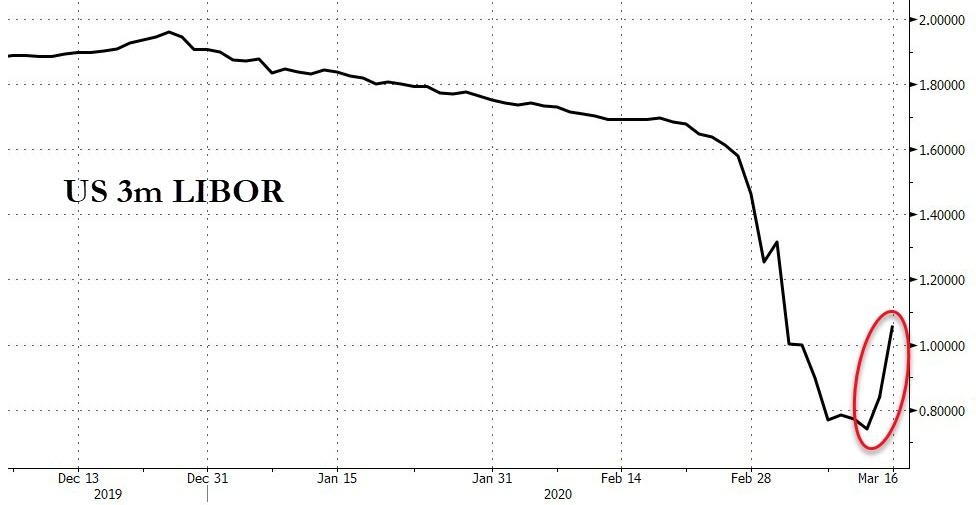

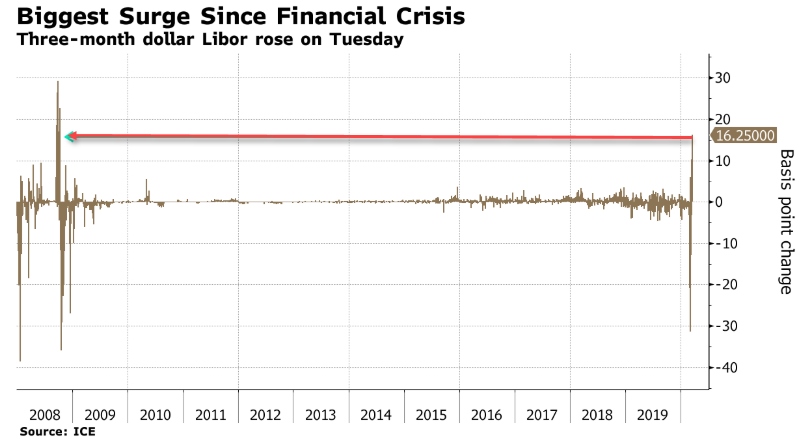

Amid all this liquidity and largesse from the central planners, LIBOR is rising…rapidly…

Three-month Libor rose by 16.25 basis points to 1.05188%. That’s the biggest one-day jump since October 2008, the height of the global financial crisis.

They have entirely lost control.

As our veteran trader warned:

“Libor is spiking just like in 2008 suggesting counterparty risk concerns are spooking the interbank markets…”

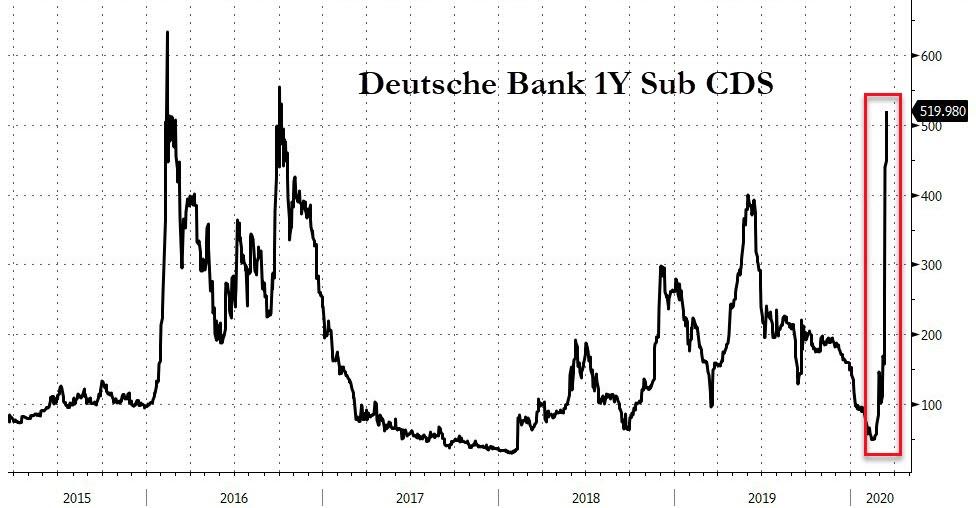

And we wonder if this is the canary in the coalmine…

Why are traders panic-buying short-term Sub CDS protection against Deutsche Bank? This is a pure counterparty risk hedge and while it is speculation, it would not be a huge jump to suggest that under the hood, LIBOR is being sent higher by a systemic fear from ‘lending’ banks that one of the ‘borrowers’ is a far greater risk than ‘risk-free’.

When does The Fed, ECB bailout Deutsche Bank?

Tyler Durden

Tue, 03/17/2020 – 09:00

via ZeroHedge News https://ift.tt/39YMW6S Tyler Durden