Fed Injects $189BN In Repo Liquidity As Libor Explodes

In light of the frozen funding markets, which are now demanding the Commercial Paper bailout facility we discussed on Sunday, which the Fed failed to deliver and which CNBC’s Steve Liesman said may be coming any moment as without we will see a relentless barrage of companies drawing down on their revolvers as they are locked out of other sources of funding, moments ago the Fed continued to inject liquidity, by conudcing two repos amounting to just under $189BN.

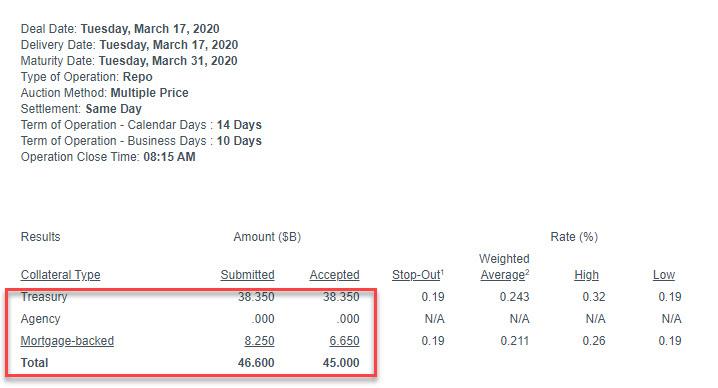

The first one was an oversubscribed 14-Day repo, which saw $46.6BN in submissions, with the max available $45BN allotted.

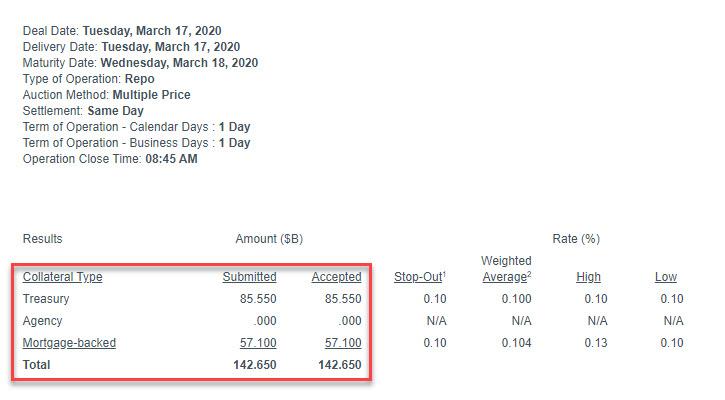

This was followed half an hour later by the $500BN overnight repo which merely rolls over the prior day’s expiring overnight, and which saw some $142.65BN in usage.

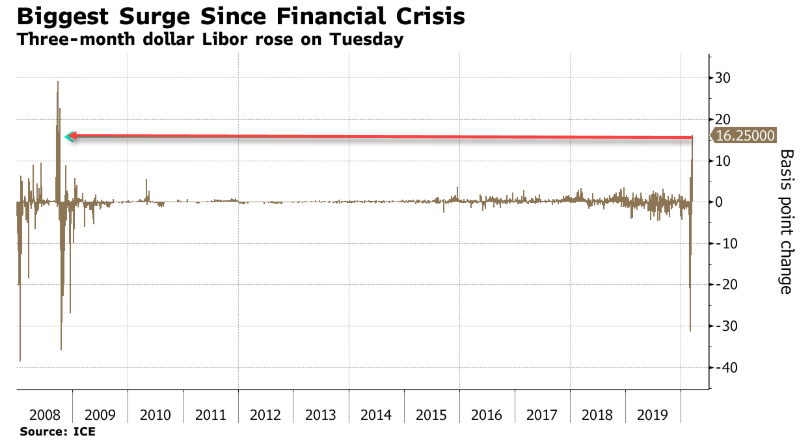

With no other repos scheduled for today, and the next $500BN 84-day facility not due until Friday, banks may soon find themselves in another funding panic, and the Fed may respond as it did yesterday, with an ad hoc $500BN facility later in the day if funding conditions refuse to ease, which considering the biggest one-day jump in LIBOR since the crisis screaming systemic funding stress and now counterparty risk…

… is very unlikely.

Tyler Durden

Tue, 03/17/2020 – 08:59

via ZeroHedge News https://ift.tt/2TWcoUT Tyler Durden