Is The Bottom Finally In: Bridgewater Puts On $14 Billion Short

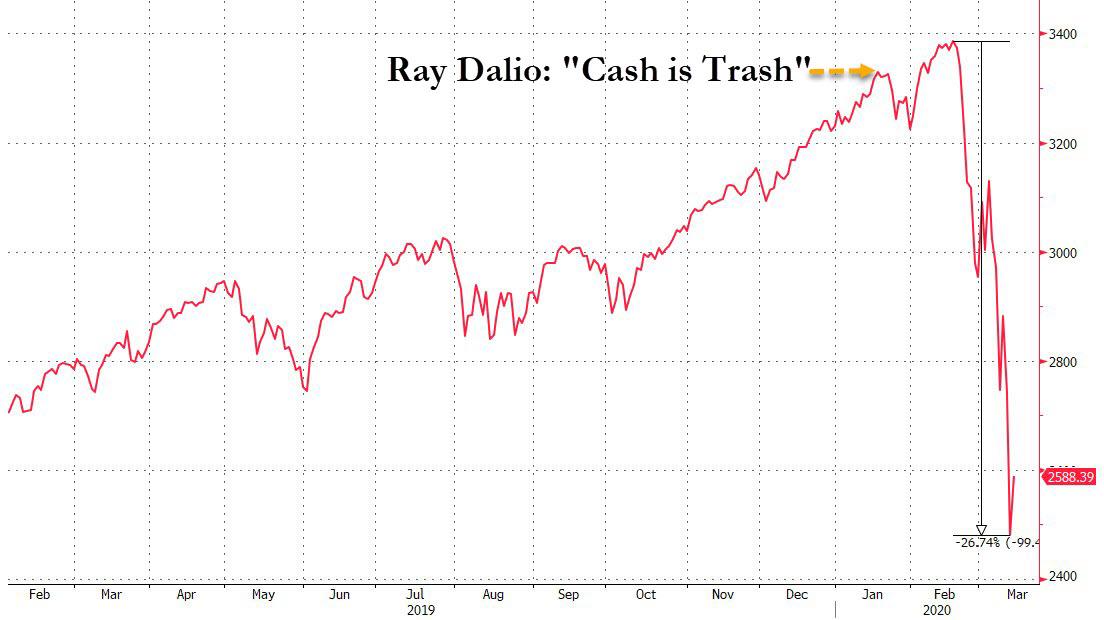

2020 has been a bizarre year: not only did stocks finally crash after the longest and most artificial “bull market” in history, sending an entire generation of clueless traders who had never seen more than a 10% correction puking into their toilet paper-free bathrooms as the Fed finally ran out of ammo to artificially prop up markets, but the metaphorical demise of Dennis Gartman meant a replacement had to be found for the market’s biggest counter-indicator, and how refreshingly surreal is it that the new Gartman turned out to be none other than Ray “Cash is Trash” Dalio.

You see, back in late January when stocks were melting up to new record highs every single day, Ray Dalio speaking from the Coronavirus-free billionaire boondoggle of Davos, put on his best momentum extrapolation hat on, and predicted that “cash is trash.”

Little did Dalio know that just a few months earlier some Chinaman had bitten off the head of a typhoid bat, in the process setting off the apocalypse, and as the world literally ground to a halt amid a cascade of sovereign quarantines, global stocks suffered their biggest crash since Black Monday.

It got so bad that Dalio’s own macro fund suffered its worst start to a year in history, losing an epic 20% in just a few weeks (we are still waiting for confirmation that the Bridgewater risk parity fund still exists). Speaking to the FT, as if compelled to explain why his performance was so dismal to the general public, Dalio said “we did not know how to navigate the virus and chose not to because we didn’t think we had an edge in trading it. So, we stayed in our positions and in retrospect we should have cut all risk. We’re disappointed because we should have made money rather than lost money in this move the way we did in 2008.“

And while Dalio didn’t specify “in what terms” he should have made money, just like that the new Dennis Gartman was not only born but baptized in blood, er bat.

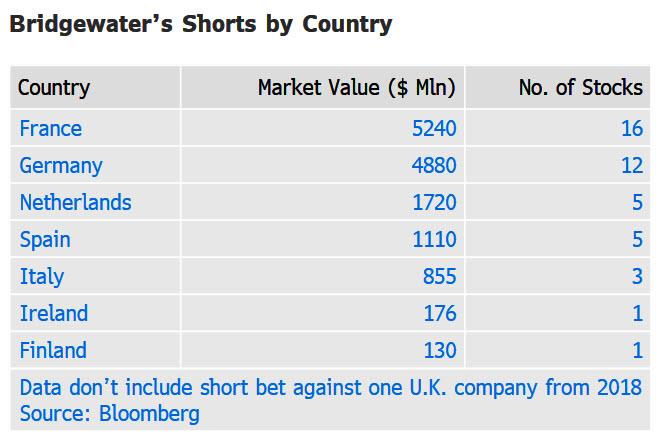

Which is great new for all the bulls who have just suffered through the most painful three weeks of their careers, because if Dalio is indeed the new Gartman, his turning bearish would mean the bottom is in… which according to media reports, that’s just what the billionaire Bridgewater founder is now. Bloomberg writes that Dalio – perhaps disgusted from seeing his reputation sink to the level of a newsletter author – has built up a $14 billion short position in European companies, expecting they will “continue to sink amid the worsening coronavirus outbreak.”

According to the report, Bridgewater has made a string of wagers-against stocks in countries from Germany to Italy, according to filings between March 9 and 12 compiled by Bloomberg. They include a $1 billion bet against software company SAP SE and a $715 million wager against semiconductor equipment maker ASML Holding NV, with France and Germany at the top, responsible for roughly $5 billion in short positions each.

And while the value of Bridgewater’s European shorts has been rising this month as European stocks – well, really all stocks – got crushed, it appears the fund still has more than an offsetting amount of longs as the fund already lost about 12% in just the first two weeks of March.

Naturally, it’s not clear whether the bet is an outright wager on a fall in shares or part of a broader hedging strategy of the firm that manages about $160 billion. Ironically, a similar report published by the WSJ last November suggesting Dalio had developed a “bearish view on the stock market”, was met with harsh criticism by Dalio and a barrage of petulant LinkedIn posts. Ironically, if only Dalio had been bearish, he would be on top of the world now instead of being the butt of watercooler jokes about cash somehow being trash at a time when the Fed just backstopped or injected over $6 trillion in, drumroll, cash.

However suggesting that this time Dalio was indeed bearish was his latest LinkedIn post in which he said that the Fed’s decision to cut rates to almost zero puts the markets in an even more precarious position.

“Long-term interest rates hitting the hard 0% floor means that virtually all asset classes go down because the positive effects of interest rates falling won’t exist (at least not much).”

“Hitting this 0% floor also means that virtually all the reserve country central banks’ interest rate stimulation tools (including cutting them and yield curve guidance) won’t work.”

So yeah, it looks like Dalio has indeed gone to the dark side which in this bizarro world, in which the founder of the world’s (formerly) biggest hedge funds is now also the market’s most reliable contrarian indicator, is probably the best news the steamrolled bulls could hope for.

Tyler Durden

Mon, 03/16/2020 – 20:52

via ZeroHedge News https://ift.tt/2UgJXQq Tyler Durden