Markets In Crisis: Gundlach Live Webcast

Jeffrey Gundlach, the billionaire chief investment officer of DoubleLine Capital, is scheduled to conduct his periodic live webcast for his DoubleLine Total Return Bond Fund at 4:15 p.m. New York time. With the webcast coming in a time of markets in crisis, the theme of the webcast today is “The price is right” which this week is a laughable concept when even some of the most “liquid” ETFs saw their NAV tumble far below their stated value, when the Treasury market froze up and when stocks have traded limit up or down virtually every day.

Readers can listen to the webcast at the following link.

Unlike Gundlach’s annual “Just Markets” webcast in January, the fund-specific presentation will likely narrow the otherwise whimsical scope of the Gundlach’s commentary on broader topics, such as the presidential race, the NFL and public health.

As Bloomberg reminds us, the key takeaways from Gundlach’s January “Just Markets” webcast included:

- Top conviction is the dollar will weaken as foreign investors divest from U.S. assets

- Commodity prices will likely rise as a consequence of the weaker dollar

- Overseas equity markets are likely to outperform the U.S. indexes, which bested most of the world in 2019

- Bullish on gold and Bitcoin

- Bernie Sanders is the likely Democratic presidential nominee

Two months later, we doubt he will be too happy with on those predictions. Here are some early presentation highlights, courtesy of BBG:

- “Lots going on in the market. It’s just incredible” — Gundlach starts off the webcast after thanking everyone for joining.

- Gundlach says the webcast title of “The Price Is Right” was chosen because he couldn’t believe how markets were moving before this sell-off.

- He’s pleased that unlike a lot of active bond funds, DoubleLine is doing quite well.

- Stock market is in a “world of hurt.” Gundlach says he will speak about that in this webcast.

- Gundlach expresses concern that Trump’s stimulus plan could be prone to abuse; and says $1 trillion is just the beginning of the fiscal stimulus. “One you start giving cash to business people, I can’t imagine the level of graft and corruption,” he says.

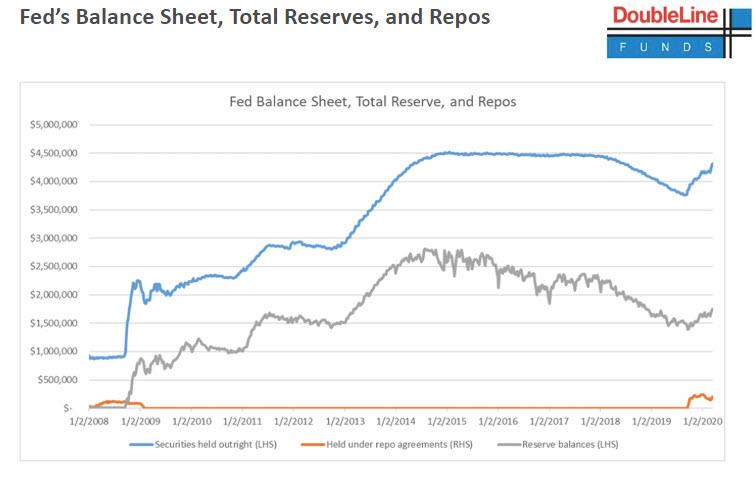

- Gundlach then says the Fed’s rate cuts are “obviously an admission we’re not going back to anywhere normal”, and says that we will soon need a $10 trillion Y axis on the Fed balance sheet chart as a result of the latest massive monetary injection.

Gundlach said he was concerned policy makers are in a “rinse and repeat” cycle where stimulus is followed by other intervention over and over.

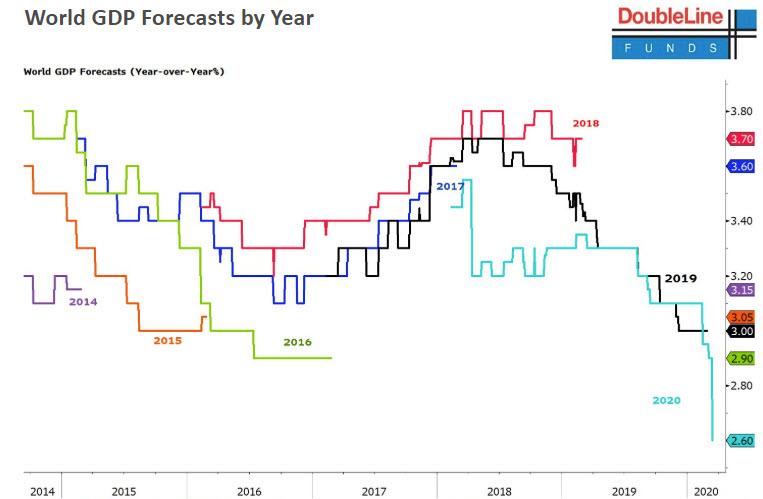

On the other hand, with the world entering a recession if not depression, central banks may have no other choice, even though as Gundlach notes, the latest forecast chart has a way to go…

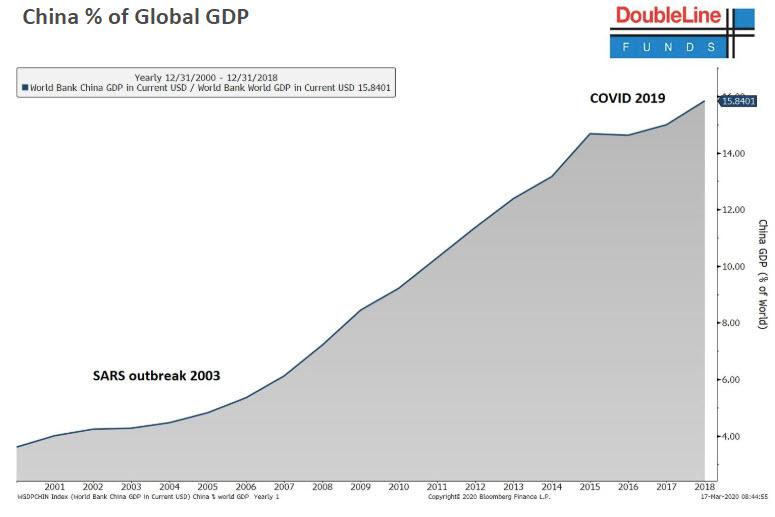

… with the billionaire saying that “I would bet dollars to donuts” that the global economic forecasts will drop from what was projected on Feb. 28.” A big reason for this is the collapse in China’s economy, which is 16% of global GDP now…

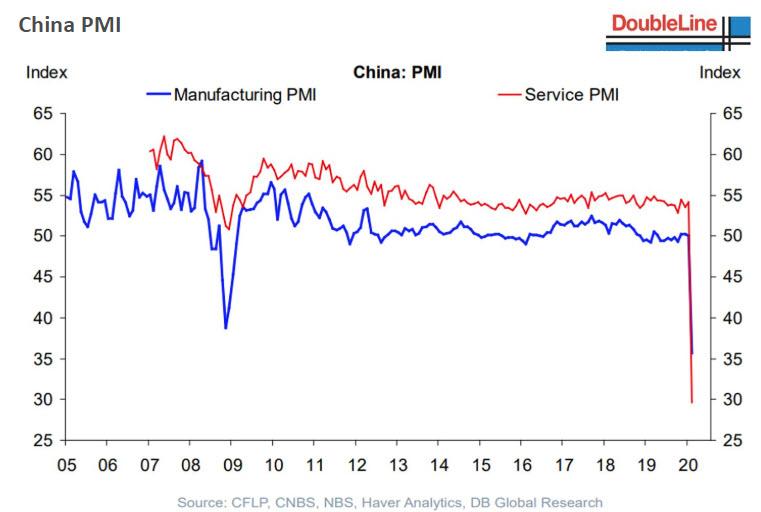

… and which has fallen off a cliff.

Summarizing the economic situation, Gundlach pronounces that “this is the end of the longest post-war expansion.”

Which means that “we’re in a tricky environment” to trade in, which of course is an understatement.

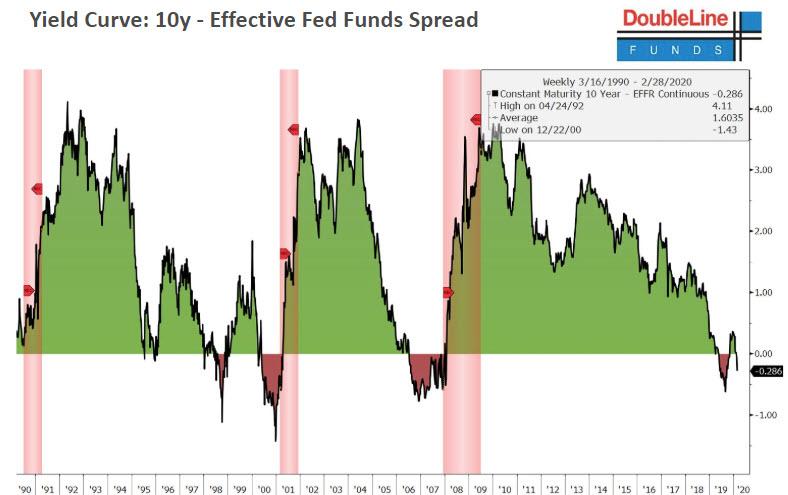

Gundlach also looked at the spread between the effective fed funds and the 10Y, which as regular readers know well, is where recessions usually begin, and where the yield curve steepens sharply in response.

There is much more in the presentation slide deck below:

Tyler Durden

Tue, 03/17/2020 – 16:17

via ZeroHedge News https://ift.tt/2UeGFgH Tyler Durden