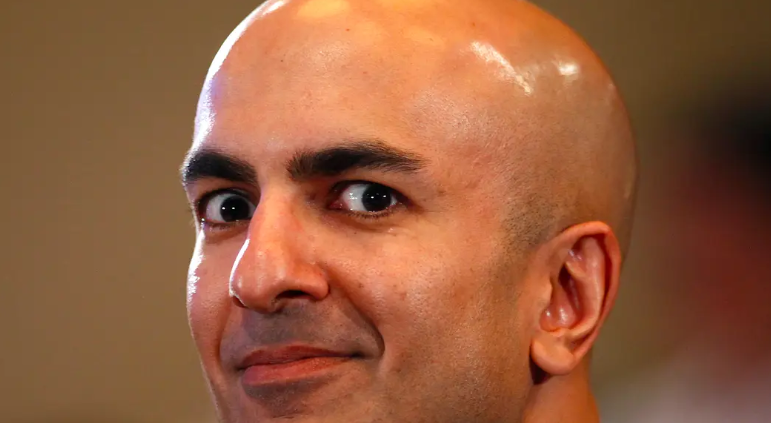

Neel Kashkari Defends Fed’s Actions After 12% Market Rout, Says Negative Rates “Not Off The Table”

Neel Kashkari took to CNBC this morning to not only display his ignorance of the basic laws of economics and finance, but also of epidemiology and medicine. Who knew Neel was such a non-expert in so many fields?

Kashkari, who while the market was rallying spent his days on social media taking shots at the “Zerohedge” and “conspiracy” crowd, is now taking to TV to try and defend the Fed’s “effective” ideas that left the stock market crippled by 12% in one trading session after the Fed took unprecedented stimulus actions, including 150 bps in rate cuts in less than a month and more than $2 trillion in liquidity being injected into financial system.

First, Kashkari defended the Fed for panicking and taking drastic action in what could be the very “early innings” of the coronavirus economic slowdown. “The notion we should have saved our cuts for later is a colorful metaphor, but it’s just flat wrong,” he told Joe Kernen. As we know now, the market disagreed, promptly plunging limit down about an hour after the Fed’s action on Sunday night.

Kashkari also gave a range of outcomes for the current situation, stating that his base case scenario is a 2001-like recession and his bear case is a 2008-like recession. Clearly clueless about the virus and the measures the rest of the world has taken, Kashkari said a best case would be people staying at home for a few weeks or a few months.

So, his prediction for this pullback is somewhere between a totally mild recession that lasts a couple weeks and the worst financial crisis the U.S. has had in almost 100 years.

Great. That helps, Neel.

He “hopes it’s more on the lines of a short, shallow downturn as in 2001 rather than something steeper like what hit the economy from 2007-09,” CNBC wrote. If only hope was an actual policy prescription.

“I hear we have plenty of tools left,” Joe Kernen says to Kashkari at one point, hosting the show from what appeared to be the study from the board game Clue. He then asked about the possibility of negative rates.

“You going to go below zero?” Kernen begrudgingly asks, sounding exhausted.

Kashkari responded: “The Fed’s authority is very powerful if the Fed chairman chooses to use them. Nothing is completely off the table, we need to see what is necessary to keep the economy moving. Hypothetically if the 10 year treasury were at zero, we might want to have a positive sloping year curve, I might want to go negative on the front end. But that’s not something any of us are planning for or expecting to happen.”

Kashkari concluded: “We’re going to do our part.”

Yeah, your part to further widen the inequality gap, your part to bail out companies that irresponsibly bought back their own stock while levered up and your part to part your boot on the neck of the purchasing power of the U.S. dollar.

You can watch Kashkari’s full stream of deep thoughts here:

Tyler Durden

Tue, 03/17/2020 – 09:15

via ZeroHedge News https://ift.tt/2ITQF9P Tyler Durden