Total Pukefest: Futures Soar Limit Up, Crash, Then Soar Again

The thing about the VIX at 80 – a level it did not hit even during the financial crisis – is that nobody has seen a market as volatile as like this.

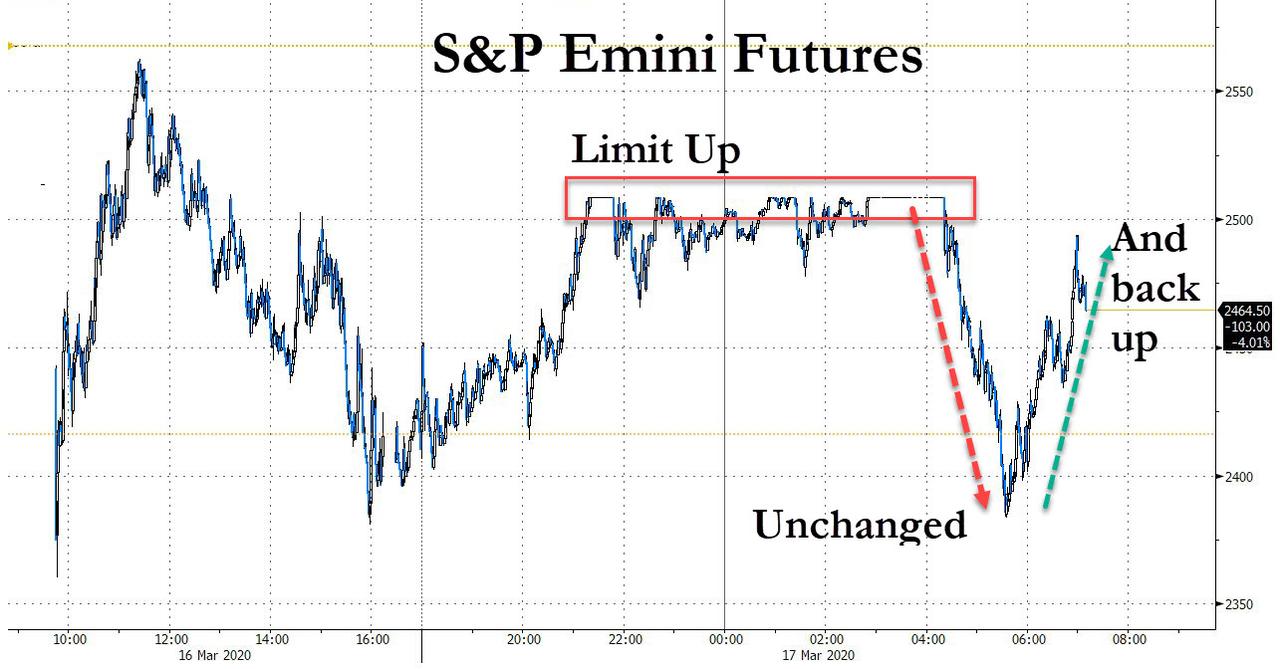

Case in point: the rollercoaster in overnight futures alone may have bankrupted an unknown number of traders: after another historic crash on Monday which saw US stocks plunge most since Black Monday 1987, futures initially soared as much as the 3.9% limit up band, before plunging straight down to slightly red on the session(!) after the European open, before surging once again.

Needless to say, anyone who had margin positions on was likely stopped out, while CNBC’s perpetual permabull Jim Cramer had a nervous breakdown.

The futures are a total joke. Don’t even look at them. You can’t have a bull market at 3:30 a.m. and have it end by 7 a.m.

— Jim Cramer (@jimcramer) March 17, 2020

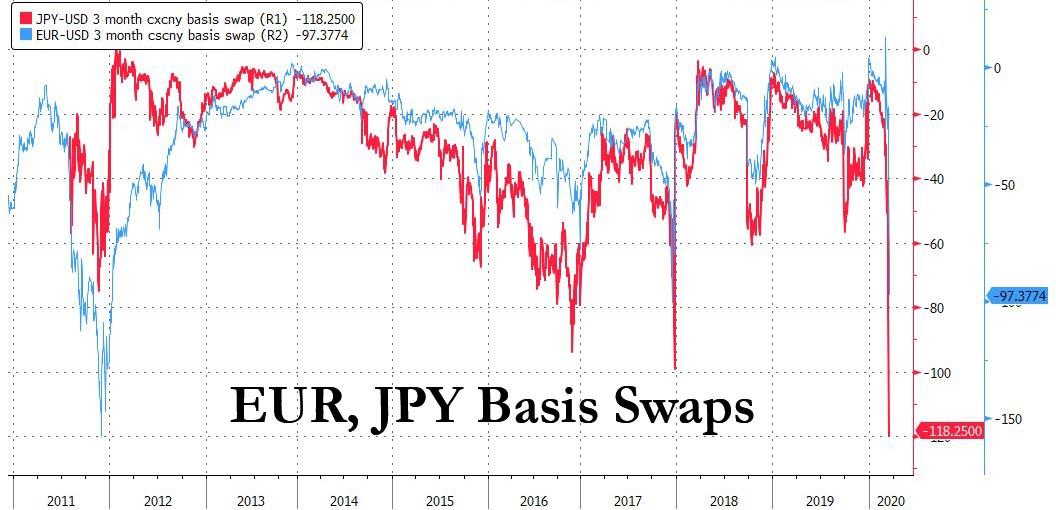

The catalyst for the selloff was fresh signs of stress in short-term funding markets, where as we warned yesterday nothing has been fixed despite the Fed’s multi-trillion waterpistol, and where the premium for getting dollars against the euro and yen exploded to the widest since 2011.

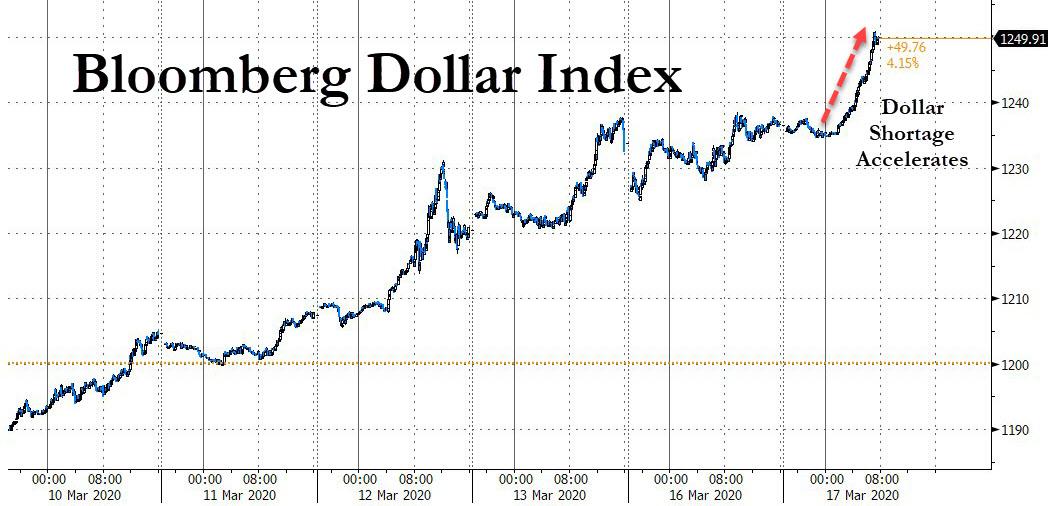

And with the dollar shortage getting worse again, the dollar index continued to surge while Treasuries retreated with gold after yields plummeted almost a quarter percentage point on Monday.

European bonds tracked the US 10Y, while the Stoxx Europe 600 Index swung from limit up to a big loss before recovering, despite a harrowing plunge in the German ZEW expectations, which cratered to -49.5, the lowest since the European sovereign debt crisis.

Equities in Asia endured a similarly volatile session, and markets in the region mixed with Jakarta Composite and Taiwan’s Taiex Index falling, and Australia’s S&P/ASX 200 and Japan’s Topix Index rising. The Topix gained 2.6%, with Phyz Holdings Inc and Raksul Inc rising the most. The Shanghai Composite Index retreated 0.3%, with HNA Innovation and Hunan Huasheng posting the biggest slides. Australian stocks posted their biggest jump since 1997 while benchmarks in Hong Kong and China saw more muted moves. The yuan weakened, with economists starting to forecast a contraction in China’s economy for the current quarter.

On Monday, US stocks crashed into the closing bell on Monday after President Trump warned of a possible recession, with economic disruption from the coronavirus potentially extending into summer. In the latest attempts to stem the spread of the virus, Hong Kong was set to issue its second-highest travel alert for residents and extend quarantine measures for people coming from abroad. The Philippines became the first country to shut its financial markets, though it aims to reopen Thursday.

“A bear market does not preclude rallies,” said Eleanor Creagh, market strategist at Saxo Capital Markets. “In fact, the biggest rallies can be in bear markets — erratic swings are exacerbated by the present high-volatility regime and strained liquidity conditions. With VIX remaining significantly above the long-term equilibrium, alarm bells are still sounding and traders should be wary of relief rallies.”

Meanwhile, after the Federal Reserve and other central banks dramatically stepped up efforts to stabilize capital markets and liquidity, traders have been looking to fiscal authorities for action. While Congress is still working on a package that reportedly could be around $750 billion, New Zealand announced a NZ$12.1 billion ($7.3 billion) plan and Australia’s government is preparing to scale up just days after announcing a A$17.6 billion ($10.7 billion) initiative.

In FX, as noted above, the dollar rallied against everything as cross-currency basis swaps kept getting more expensive. The pound fell for a sixth day, the longest losing streak since May, as concern lingered that the U.K. is slow to counter the coronavirus threat even after Prime Minister Boris Johnson escalated the nation’s response to the outbreak. Gilts fell for a third day. Kiwi dollar outperforms its Aussie peer, with pair edging closer to parity after the New Zealand government announced fiscal spending worth 4% of GDP to combat the economic impact of the coronavirus. The Australian dollar hit an 11-year low ahead of a speech by Governor Philip Lowe on Thursday, when the Reserve Bank is set to announce more policy steps.

In rates, US Treasuries fell, underperforming bunds; European semi-core debt extended recent declines led by France, while ECB conducts extraordinary liquidity operation; Swedish bonds rallied after the Riksbank announced additional QE.

In commodities, West Texas Intermediate crude rose 2.2% to $29.34 a barrel, while gold decreased 2.9% to $1,470.09 an ounce as the dollar surge continued.

Looking at the day ahead the data highlights will include employment data from the UK for January and the ZEW survey from Germany for March. Meanwhile from the US, there’ll be retail sales, industrial production and capacity utilisation for February, business inventories and JOLTS job openings for January, and the NAHB housing market index for March. Finally, though it feels somewhat peripheral given the current international situation, there’ll be a further 4 US states holding primary votes today on the Democratic side: Florida, Illinois, Ohio and Arizona. Between them, they hold a further 577 delegates, which is nearly 15% of the total up for grabs. Former Vice President Biden is the favourite to win in all 4 states on both FiveThirtyEight’s models and PredictIt, giving him the chance to further extend his delegate lead over Senator Bernie Sanders. For context, all four states went for Hillary Clinton over Bernie Sanders in the 2016 cycle.

Market Snapshot

- S&P 500 futures down 1.2% to 2,376.00

- STOXX Europe 600 -2.5% to 277.55

- MXAP up 0.3% to 131.14

- MXAPJ down 0.1% to 428.37

- Nikkei up 0.06% to 17,011.53

- Topix up 2.6% to 1,268.46

- Hang Seng Index up 0.9% to 23,263.73

- Shanghai Composite down 0.3% to 2,779.64

- Sensex up 0.3% to 31,490.23

- Australia S&P/ASX 200 up 5.8% to 5,293.41

- Kospi down 2.5% to 1,672.44

- Brent Futures up 1.4% to $30.47/bbl

- Gold spot down 1.8% to $1,486.46

- U.S. Dollar Index up 0.4% to 98.45

- German 10Y yield rose 4.3 bps to -0.418%

- Euro down 0.5% to $1.1129

- Brent Futures up 1.4% to $30.47/bbl

- Italian 10Y yield rose 37.6 bps to 1.987%

- Spanish 10Y yield rose 5.6 bps to 0.897%

Top Overnight News

- Regulators in France, Italy and Belgium banned short selling in some stocks for the day. France’s AMF halted such trades in 92 stocks, while Italy’s Consob blocked the transactions in 20 and Belgium’s FSMA imposed a similar restriction. Spain went further, telling market participants late Monday they couldn’t bet on share declines for a month

- Eight giant U.S. banks said they would access the Federal Reserve’s discount window, in a move meant to remove the longstanding stigma of using it, as the financial system comes under mounting pressure from the coronavirus pandemic

- The Bank of Japan vowed to consider additional action if the economic impact from the virus outbreak gets worse

- The euro area’s gigantic bailout fund is exploring how it can use its reserves to cushion the impact of a virus-induced recession, in a move that could help reassure markets after a spike in borrowing costs for the region’s most vulnerable economies

- The European Union gave Spain the OK to spend its way through the coronavirus crisis. But the left-wing government in Madrid is unsure whether to take full advantage.The socialist economy minister is trying to stop the deficit blowing out, while a former spending watchdog is urging her to open the taps to stop the economy collapsing. The cabinet meets Tuesday to thrash it out

Asia-Pac equity markets traded mixed and US equity futures hit limit up overnight as stock markets attempted to nurse the recent heavy losses that resulted to the worst day on Wall St. since 1987 and a near 3000-point decline in the DJIA for its largest point drop on record, despite the Fed’s recent emergency measures. The tone in Asia improved from the open spurring mixed views regarding a potential capitulation after the recent sell-off and some murmurs of a dead-cat bounce, although there were further supportive measures including a NZD 12.1bln economic package from New Zealand and the US House passing a revised coronavirus bill, as well as efforts from the Trump administration for an additional measure targeting airlines and small businesses. ASX 200 (+5.8%) outperformed after a rebound from support at the 5000 level to recoup some of the prior day’s record losses of 9.7% and eventually post its largest intraday gain since 2008 with miners and financials front running the recovery, while Nikkei 225 (+0.1%) fluctuated between gains and losses with sentiment flimsy alongside an indecisive currency. Hang Seng (+0.9%) and Shanghai Comp. (+0.9%) were both positive in early trade but then reversed course/trimmed gains as early optimism across the region slightly faded and following further liquidity inaction by the PBoC, although reports have suggested the central bank may still reduce the Loan Prime Rate this week even though it opted to maintain rates in yesterday’s Medium-term Lending Facility. Finally, 10yr JGBs were initially lower as they tracked the recent selling in USTs but with some of the downside later reversed after prices found a platform around 152.50 and with the BoJ also in the market today under a special operation for JPY 200bln of JGBs with 3yr-10yr maturities.

Top Asian News

- Abe Taps Hitachi Executive Nakamura for BOJ Policy Board

- Singapore’s Largest Companies Raise Female Board Participation

- Singapore Faces Bigger Contraction as Malaysia Shuts Borders

- Thailand Confirms Plan to Shut Schools, Delay Holidays on Virus

Choppy trade in the equity sphere [Euro Stoxx 50 +1.0%] following on from a mixed APAC session, as what seemed like a sentiment turnaround subsided in early EU trade – although reports that US Treasury Secretary Mnuchin is seeing a USD 850bln package later induced a modest bounce off lows. Major bourses are mixed with Spain’s IBEX (+2.4%) the standout outperformer amid after Spain banned short-selling for a month amid the virus-induced selloff. DAX 30 cash briefly dipped below 8500 before trimming some losses, albeit remain some way off its 9145 session high. CAC (-0.6%) failed to glean much support after AMF regulator’s announcement of a 24hr short-selling ban on 92 stocks vs. Spain’s carpet ban, although France’s measure seems more of a cushion against losses as opposed to a deterrent. Sectors are mixed with no clear reflection of the risk tone, with energy and material benefitting from the overnight rebound in respective complexes. In terms of individual movers. Iliad (+18.0%) tops the gains in the Stoxx 600 post-earnings in which anticipated coronavirus losses are expected to be less severe than feared. Elsewhere, Pandora (-2.9%) withdrew guidance amid the outbreak and noted that China since Jan LFL sales fell 70-80% on a YY basis.

Top European News

- Global Deaths Top 7,000; San Francisco Shuts Down: Virus Update

- Europe Weighs Using Bailout Fund Bazooka In Virus Crisis

- Battered European Stocks Stage a Comeback Tour: Markets Live

- Compass Drops After Profit Warning; MS Notes Sharp Slowdown

In FX, the Dollar is firmer across the board after losing momentum during Monday’s global stock market swoon, with the DXY firmly back on the 98.000 handle and breaching resistance ahead of the next big figure (like February 13’s 98.810 high) amidst more reports of the White House mulling a big aid package (Usd850 bn or perhaps more). However, safer-havens are clawing back some lost ground as the mood remains extremely fragile on COVID-19 factors and ahead of US data (retail sales and ip) that could highlight more of the economic contagion like yesterday’s NY Fed manufacturing survey.

- AUD/NZD – Minutes from the RBA’s March policy meeting did not offer anything new in terms of forward guidance overnight, but the Aussie is on the defensive in advance of Thursday’s new measures from the Central Bank that could include QE. Aud/Usd is slipping back towards 0.6000 and Aud/Nzd remains south of 1.0100 even though Nzd/Usd has retreated through 0.6000 and the Kiwi only got a fleeting fillip from Nzd12.1 bn fiscal stimulus in similar vein to the Aussie after Government and RBA cash/liquidity injections.

- GBP/EUR – A relatively upbeat UK labour and wage report has been dismissed as too old or irrelevant in the context of nCoV, as the Pound weakens across the board towards 1.2100 in Cable terms and sub-0.9100 on the Eur/Gbp cross. Indeed, Sterling is marginally underperforming vs the single currency despite a dire ZEW survey that has pushed Eur/Usd below 1.1100 (close to the 200 DMA) and eyeing Monday’s session trough just under 1.1050.

- CHF/JPY – The Franc and Yen are both off best levels vs the Greenback, but retaining an underlying bid within 0.9458-0.9554 and 105.88-107.18 respective ranges in advance of the SNB quarterly review and following ramped ETF purchases from the BoJ today.

- CAD/SEK/NOK – The Loonie is trying to stop the rot after losing 1.4000+ status against its US counterpart and tumbling to new multi-year lows not far from 1.4100, while the Swedish Crown is weaker vs the Euro inches from 11.0000 in wake of the Riskbank unleashing QE, finally and lagging its Scandi peer the is benefiting from a degree of consolidation and comparative stabilisation in crude prices, albeit choppy and still trending lower.

In commodities, WTI and Brent front-month futures have trimmed overnight gains during early EU trade, with the latter dipping into negative territory as the sentiment/consolidation seen in the APAC session abated as the underlying themes persist. WTI Apr’20 futures have extended losses below the USD 30/bbl mark, having earlier briefly breached the level to the upside, with the next pertinent support level at the YTD low around USD 27.40/bbl. Meanwhile, Brent May’20 underperforms its WTI counterpart given the OPEC rhetoric surrounding the global benchmark, with the front-month contract back below USD 30/bbl and just off its YTD lows at ~USD 29.50/bbl vs. intraday high of USD 31.20/bbl. Meanwhile, the spread between the two contracts continue to narrow and currently stands at under USD 1/bbl vs. ~USD 1.30/bbl at yesterday’s close. Elsewhere, spot gold continues to bear the brunt of liquidating positions as investors convert to cash and remain on the sidelines. The yellow metal trades firmly below 1500/oz (200 DMA ~1498/oz) ahead of the 50WMA (1462/oz) and yesterday’s 1450/oz low. Similar losses are seen across other precious metals with Silver approaching 12/oz after fleetingly dipping below the figure during yesterday’s trade. Copper prices unsurprisingly conform to the risk-turnaround as prices slide further below 2.5/lb and eyes USD 2.0/lb for barriers.

US Event Calendar

- 8:30am: Retail Sales Advance MoM, est. 0.2%, prior 0.3%; Retail Sales Ex Auto MoM, est. 0.1%, prior 0.3%

- 8:30am: Retail Sales Ex Auto and Gas, est. 0.3%, prior 0.4%; Retail Sales Control Group, est. 0.4%, prior 0.0%

- 9:15am: Industrial Production MoM, est. 0.4%, prior -0.3%; Capacity Utilization, est. 77.1%, prior 76.8%

- 10am: Business Inventories, est. -0.1%, prior 0.1%;

- 10am: JOLTS Job Openings, est. 6,400, prior 6,423;

- 10am: NAHB Housing Market Index, est. 73, prior 74

DB’s Jim Reid concludes the overnight wrap

Also today we are going to start publishing a daily table and graph looking at new case growth of the virus in the main impacted countries around the world. The table will look at the last 5 days of % growth for each of the top 10 countries and where we were in % growth terms 14 days ago. We’ll refresh this at 5am every day and you’ll find it in the pdf link. At the moment new cases are growing at between 15-30% per day in the main European countries. If you’re looking for good news Korean cases have been growing at ‘only’ 0.9-1.5% over the last 5 days after being at c.14% daily growth two weeks ago.

For now though, it’s becoming clearer that the impact of the various Western World shutdowns will mean that at its peak the Covid-19 impact on the global economy will likely be worse than the peak of the GFC. It is also looking increasingly likely to linger well into the summer. Once you shut down economies, the hurdle rate to reopen them is pretty high. The good news is that the response from the authorities might eventually (but not yet) end up being greater too. It will need to be, because many individuals and businesses will risk losing their livelihoods as a result of this crisis. I suspect central banks will end up printing fresh money to hand to those most impacted. Because of the nature of this event there will unlikely be any moral hazard warnings, which will give the authorities the political capital to act. There are many longer-term implications if we go down that route but that’s a topic for another day.

It was another wild and historically significant day in financial markets yesterday with traders having to navigate further wild swings across different asset classes. In fact for the S&P 500, we haven’t seen a daily move of less than 1% either way all month. Indeed 12 of the last 16 trading sessions have now seen moves of at least 3% in either direction. Yesterday’s moves were yet another in this pattern, with trading halted at the open after the S&P fell through the -7% circuit breaker, before falling to just shy of the lows of the day (-11.41%) after trading restarted. The S&P 500 then recovered much of its losses to be down “only” -5.37% before closing at the lows of the day at -11.98%. This leaves the index down -29.53% since its peak less than 4 weeks ago. In terms of our worst days in history this ranked 3rd out of 23,161 since 1927 behind only 19 October 1987, down -20.47%, and 28 October 1929, down -12.94%. These are truly historical moments in the history of financial markets. 2020 will go alongside 1929, 1987 and 2008 in the text books of financial market panics.

The sell-off accelerated into the close after President Trump held a press conference where his tone was more sombre on the virus than it had been previously. The President urged Americans to practice social distancing and then warned that the economic impact could last well into the summer, as late as August. He also signalled that a recession was possible – a big admission for him. At the same time French President Macron said that EU borders would close from today for at least 30 days, and that French citizens should stay home in lockdown for 15 days starting midday today. I’m really not sure I’ll see anything like this again in my lifetime. It’s remarkable and global economies have effectively been put on war footing but without the usual intense war time economic activity.

We also heard more about the possibility of a coordinated response from the G7 yesterday. In a joint statement the G7 leaders said they would “do whatever is necessary” to support the global economy, in what is quickly becoming a common refrain. There was little else for now but it was a strong statement.

In the US Senate Democrats are preparing a new coronavirus aid package, with at least $750 billion in funding for increasing hospital capacity, unemployment insurance and other direct aid toward American households and businesses. This is a separate bill than the earlier aid package from the House, which provides sick pay, free testing, and emergency food aid for families that will soon be voted on in the Senate that already has President Trump’s approval. Senator Mitt Romney also backed the idea of cash stipends of $1000 to every American in order to help people meet obligations and spur economic activity. This effectively amounts to helicopter money so we’re getting closer to this.

Over in Europe, the Eurogroup announced that they “have, so far, decided fiscal measures of about 1% of GDP, on average, for 2020 to support the economy, in addition to the impact of automatic stabilisers, which should work fully. They added that “we have, so far, committed to provide liquidity facilities of at least 10% of GDP, consisting of public guarantee schemes and deferred tax payments. These figures could be much larger going forward”. My colleague Mark Wall notes that this first wave response is basically in line with what he was expecting in his note from Sunday night we mentioned yesterday. There is likely more to come as there are increased chances of the ECB’s additional EUR 1.2 trillion (12% of GDP) in TLTRO3 liquidity being used, and that the package as a whole is not capped and “could be much larger going forward”.

Following yesterday’s decline, futures on the S&P 500 (+3.66%) and Nasdaq (+3.36%) are trading higher this morning after hitting their respective limit ups. Asian markets are trading mixed amidst continued volatility with the Nikkei (+0.20%) and Hang Seng (+1.18%) up while, the Shanghai Comp (+0.03%) is flat and the Kospi (-1.55%) is down. The ASX has just closed up +5.8% the largest gain since October 1987. Yields on 10y USTs are up +5.5bps to 0.776% and brent crude oil prices are up +2.40% this morning.

Overnight, one of the key stories is that the Philippines became the first country to shut its stock, bond and currency markets until further notice. Will this be the first in a trend? Meanwhile, New Zealand became the latest country to announce a fiscal package of NZD 12.1bn ($7.3bn), worth c. 4% of GDP, to counter the economic impact from the virus. Brazil also said overnight that it will inject BRL 150bn ($30bn) in to the economy with more than half of that amount earmarked to support the poor and elderly. Today, we are also likely to hear from the UK Chancellor Rishi Sunak on the measures he promised to deliver, during last week’s budget, to help companies and individuals pushed to the brink by the virus. So one to watch. On the monetary policy front the State Bank of Vietnam cut its refinance rate to 5% from 6%, and Japanese banks tapped $32bn from the Fed’s revamped swap lines in the first operation.

Back to yesterday and the VIX index surged to its highest closing level ever recorded as equities sold off into the US close. The vol index was up +24.86pts to 82.69, which puts it higher than the closing peak reached in November 2008, at the height of the financial crisis. Meanwhile credit spreads continued to widen massively. US IG and HY cash spreads were +26bps and +107bps wider with the European equivalents +15.4bps and +99bps wider. CDX HY and EUR Crossover widened +113bps and +100bps respectively.

Staying with fixed income, 10yr Treasury yields traded in a 23bps range after gapping lower after the Fed announcements Sunday night but ended up closing in the middle of it and -24.2bps lower. Sovereign debt sold off in Europe however, with yields on 10-year Italian debt closing above 2% for the first time since June, with the spread over bunds widening by a further +29.7bps to 2.63%, also their widest since June.

Airlines experienced some of the largest declines in equity markets yesterday, with the STOXX 600 Travel and Leisure index down -10.06% as it fell to its lowest level since October 2012. It comes as a number of major airlines have said they’ll be reducing the number of flights, with IAG, the owner of British Airways announcing that in April and May they’d be reducing capacity “by at least 75 per cent compared to the same period in 2019”. In terms of the individual movers, Tui fell -12.72%, recovering from an intraday low of -39.44%, following the previous day’s reports that it would apply for state aid guarantees and withdrew its guidance for FY 2020. Meanwhile Easyjet was down -19.32% (up from an intraday low of -32.77%) after the company said it wasn’t possible to provide guidance for the rest of FY20. Finally Reuters reported that the Italian government plans to renationalise the already bankrupt Alitalia as a planned sale has found no bidders.

Commodity markets provided their own headlines, with Brent Crude trading below $30 a barrel for the first time since 2016, closing at $30.05 down -11.23%. The impact of the oil moves were seen elsewhere, with the currencies of oil-producing nations suffering on the back of the moves. Indeed, the Norwegian Krone and the Canadian Dollar were the two worst-performing G10 currencies yesterday, falling -1.95% and -1.50% against the US dollar respectively. For energy stocks the picture was similarly dire, with the STOXX Oil & Gas index down -5.59% and at its lowest level since 1996, while the S&P 500 Energy industry grouping fell -13.63%.

Data releases have understandably taken a back seat to the coronavirus, though we did get the New York Fed’s Empire State manufacturing survey for March, which fell to -21.5 (vs. 3.0 expected), which was its lowest level since March 2009 and the largest monthly decline in the index on record. Sadly there wasn’t much optimism about the coming months either, with optimism about the six-month outlook now at 1.2, its lowest level since February 2009 .The responses for this survey were collected from March 2nd to 10th, so after concerns over the coronavirus had gone global.

To the day ahead now, and the data highlights will include employment data from the UK for January and the ZEW survey from Germany for March. Meanwhile from the US, there’ll be retail sales, industrial production and capacity utilisation for February, business inventories and JOLTS job openings for January, and the NAHB housing market index for March. Finally, though it feels somewhat peripheral given the current international situation, there’ll be a further 4 US states holding primary votes today on the Democratic side: Florida, Illinois, Ohio and Arizona. Between them, they hold a further 577 delegates, which is nearly 15% of the total up for grabs. Former Vice President Biden is the favourite to win in all 4 states on both FiveThirtyEight’s models and PredictIt, giving him the chance to further extend his delegate lead over Senator Bernie Sanders. For context, all four states went for Hillary Clinton over Bernie Sanders in the 2016 cycle.

Tyler Durden

Tue, 03/17/2020 – 08:03

via ZeroHedge News https://ift.tt/2Ur2kT9 Tyler Durden