WTI Hovers At 4-Year Lows After Surprise Inventory Draw, One Bank Expects Negative Oil Prices

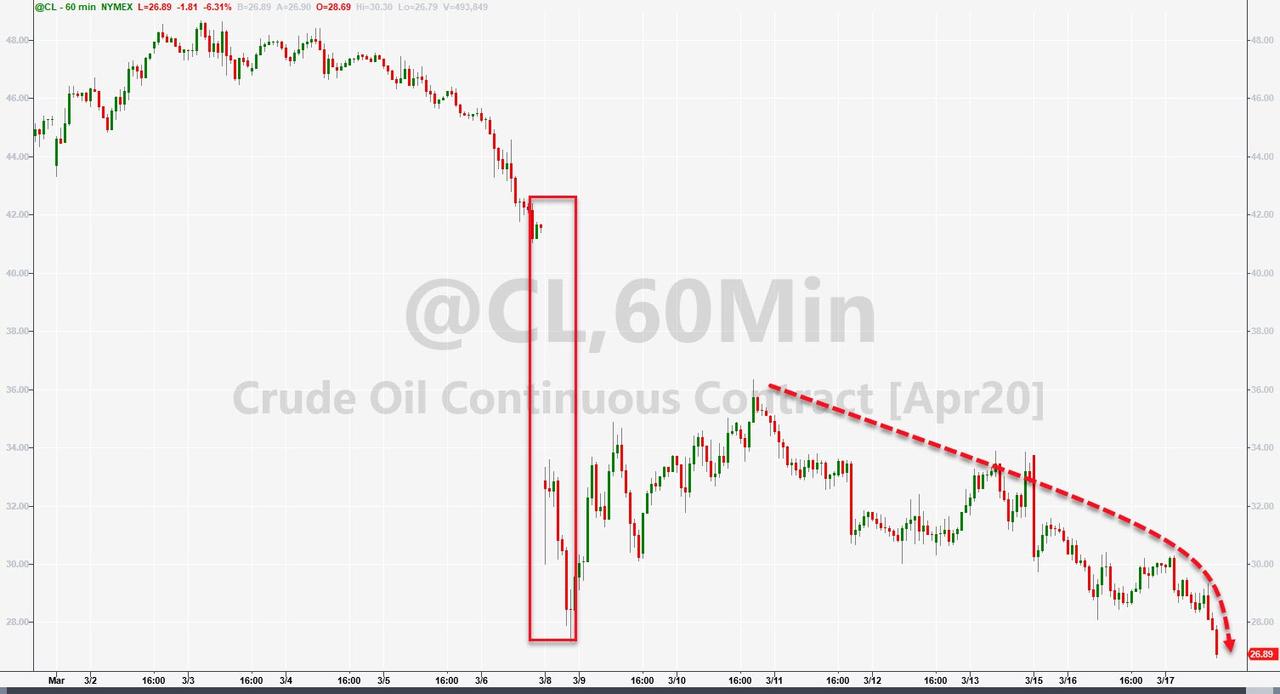

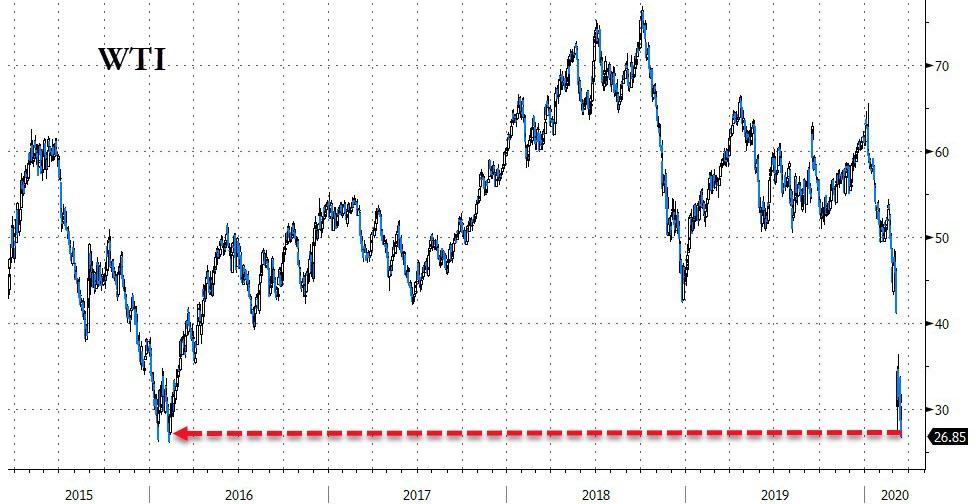

Oil prices plunge today with WTI back to a $26 handle, the lowest level since 2016, as the coronavirus pandemic threatens to bring the global economy to a standstill, battering fuel demand at a time when crude supply is surging.

“These are dramatic and unheard-of disruptions,” said Pavel Molchanov, energy research analyst at Raymond James & Associates Inc.

“Lockdowns around the world alone would be enough to trigger a bear market for oil. Add in the collapse of OPEC+, those two create an unbelievably toxic combination. This crisis is shaping up to be the worst shock to global demand in modern history.”

So all eyes are once again on inventories to see if the virus effects are beginning to be evident in the data…

API

-

Crude -421k (+3.1mm exp)

-

Cushing +66k

-

Gasoline -7.8mm (-2.4mm exp)

-

Distillates -3.6mm (-2.3mm exp)

After a seven week run of builds, API reports a surprise crude inventory draw last week and huge product draws…

Source: Bloomberg

WTI was trading around $26.90 ahead of the API print…

And barely budged on the surprise draw…

The supply and demand shocks have dimmed Wall Street’s outlook for oil.

Just this morning, Goldman lowered its Brent forecast from $30 to $20, as the oil market will have to contend with a record surplus driven by a peak c.8 million b/d decline in oil demand and a peak c.3 million b/d rise in oil supplies in the coming months.

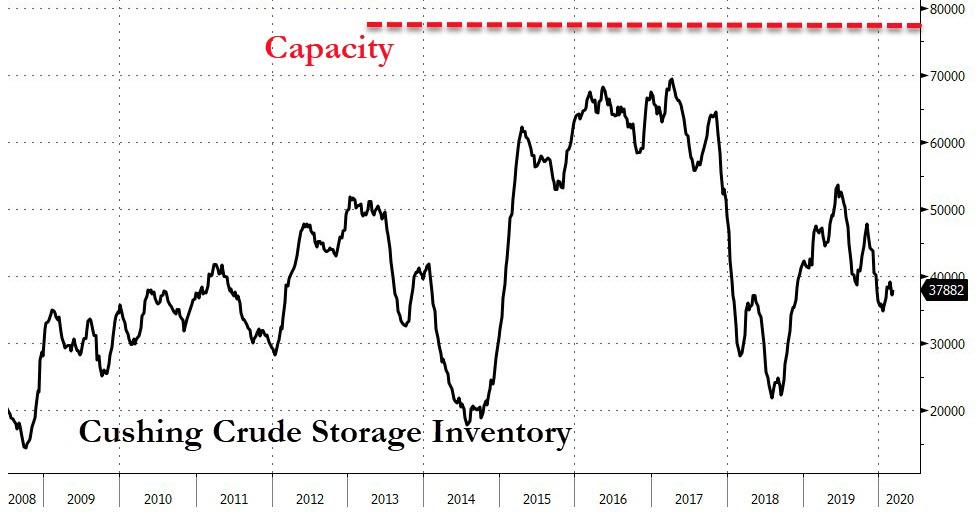

While we do not expect this to lead to a breach in storage capacity which still has over 1 billion barrels, it will likely lead to a breach in logistical capacity, meaning ships, pipelines, terminals and processing units. As the market hits these constraints spot prices are likely to separate from forward prices (as the cash-and-carry arb will cease to exist) plunging to levels to force production shut-ins, as more excess crude will simply not be able to be delivered into the system.

As it becomes increasingly clear that Saudi Arabia is likely to maintain output near 12.0 million b/d during 2Q20, we are now shifting to our downside scenario of $20/bbl which is consistent with the market breaching cash costs. There are questions recently around whether Saudi Arabia can maintain 12.0 million b/d during 2Q20 and raise capacity to 13.0 million b/d. We believe that because Saudi Aramco is now a public company and eager to pursue an international offering that the accuracy of their guidance is now extremely important.

As Goldman concludes, rather ominously, the revenge of the old economy is how we have described the underinvestment that has impacted commodity production historically, as in the late 1990s and in the current environment. The recent collapse in oil prices will only accelerate this underinvestment thesis and create supply constraints in 1-3 years that will be extremely binding, which is why we termed the current environment the revenge of the new oil order.

It is not only oil that will be impacted, but metals as well via the negative feedback loop with emerging markets, i.e. lower commodity prices hurt EM demand and drive up funding costs, which in turn drives down prices further, creating a vicious cycle.

However, Goldman are relatively bullish compared to Mizuho’s Paul Sankey wrote today in a note to clients that we may be 15m b/d oversupplied currently, and warned that crude prices could go negative as Saudi and Russian barrels enter the market.

Much of America’s 4m b/d of crude exports are likely to be curtailed as prices fall and tanker rates soar and as Sankey notes, U.S. storage is currently at ~50% capacity and can add 14m bbl/week for 10 weeks until full.

Sankey concludes, a race set up between filling storage and negative pricing “unless U.S. decline rates can outpace inventory builds, which we very much doubt.”

And lending credibility to this admittedly scary scenario, the shale industry is getting desperate…

13 GOP senators are asking Saudi Arabia to rethink its plans to boost oil production: “We urge the Kingdom to assert constructive leadership in stabilizing the world economy by calming economic anxiety in the oil and gas sector.” https://t.co/AN36F4BBSF pic.twitter.com/i3CP3aIRf2

— Anthony Adragna (@AnthonyAdragna) March 16, 2020

Tyler Durden

Tue, 03/17/2020 – 16:38

via ZeroHedge News https://ift.tt/3d7AW56 Tyler Durden