“Revolver Run”: Banks Suffer Record $200BN In Outflows As Frenzied Companies Draw Down Revolvers

Last Friday, we reported that in the aftermath of the great Commercial Paper panic of 2020, which erupted over the past two weeks when the Fed only launched a Commercial Paper backstop facility after the market freaked out last Tuesday, countless blue chip (and less than clue chip) companies found themselves with gaping liquidity shortfalls, and to bridge their funding needs, they rushed to draw on their existing credit facilities (also a hedge in case the banking system imposes a lending moratorium similar to what happened in the 2008 crash).

As a result, as of last Friday, corporate borrowers worldwide, including Boeing, Hilton, Wynn, Kraft Heinz and literally thousands more, had drawn about $60 billion from revolving credit facilities this week in a frantic dash for cash as liquidity tightens.

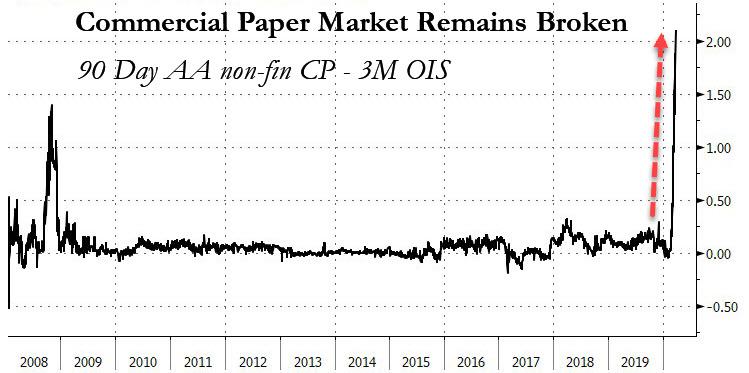

In the meantime, any hope that the Fed had unclogged the commercial paper market were crushed after the Commercial Paper 90 Day AA non-fin spread to 3M OIS dipped a bit earlier this week…

… after the Fed announced the launch of a Commercial Paper and Money Market backstop facility, but has since continued to blow out and has blown out well beyond the wides reached during the financial crisis.

As a result what was a revolver “bank run” has become a spring for the ages as virtually every company has rushed out to draw down its revolver for two reasons i) with the CP market still locked up, even blue chips have no access to short-term funding, ii) increasingly more companies are concerned their banks may not survive so why not just draw down the facility and hold the cash instead of being subject to the whims of some fickle bank Treasurer who may not have a job tomorrow, or who decided to abrogate all revolver contracts with the blink of an eye (see “Bankrupt Oil Company Trolls Its Banks, Says They May Fail Too“).

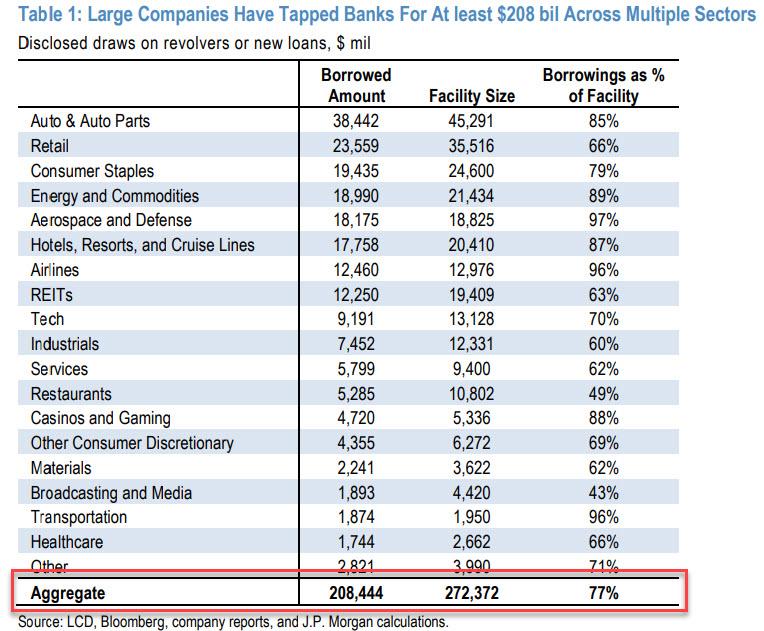

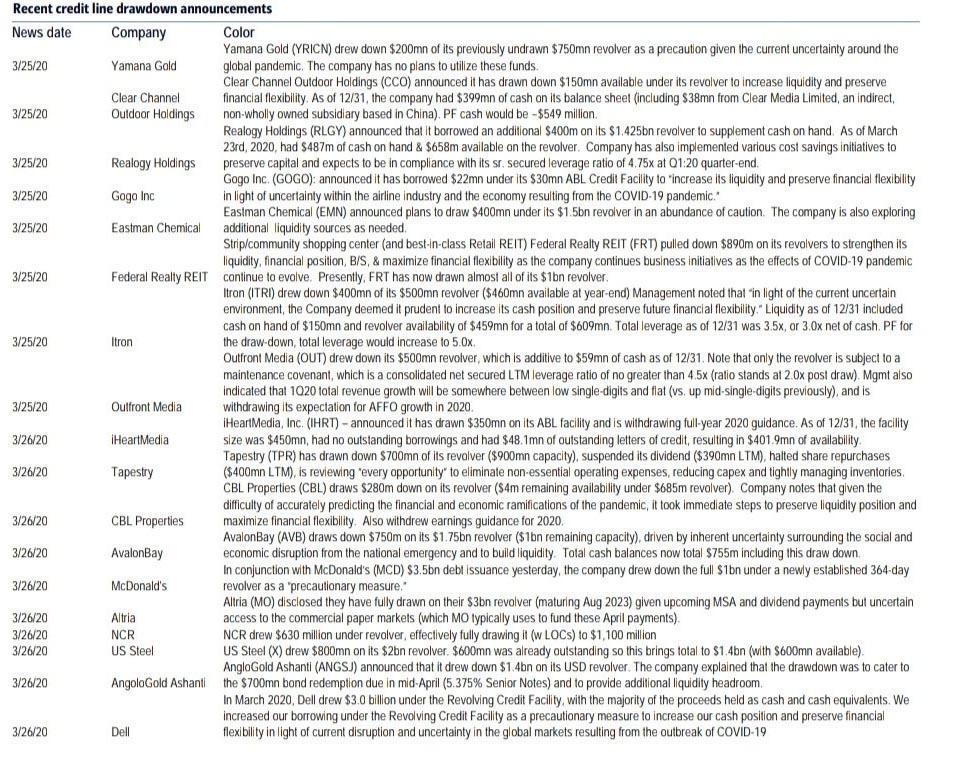

Confirming the unprecedented revolver drawdown scramble of 2020, JPMorgan reports that its tracker of known corporates that have tapped banks for funding rose further to a record $208 billion on Thursday, up $15 billion from $193 billion on Wednesday and $112BN on Sunday. That’s right: nearly $100 billion in liquidity was drained from banks in the past week; is there any wonder that the interbank dollar squeeze as indicated by the FRA/OIS continues?

And another staggering number: according to JPMorgan, in aggregate corporate borrowings represent 77% of the total facilities, with JPM noting that the total amount of borrowing by companies is likely significantly greater than this, well above 80%, as it only reflects disclosed amounts by large companies, and there are likely undisclosed borrowings by middle market companies.

Some more observations on corporate drawdowns:

- these exclude $41 BN of rumored borrowings, uncompleted deals, and new credit lines that are not clear if drawn for Airbus, AT&T, Daimler, Fiat Chrysler, and Honeywell.

- 25 new borrowers added today, and largest were: H&R Block ($2 bil) and McDonald’s, Lear, and Red Rock Resorts (each ~$1 bil). There are now 238 borrowers in total, and the five largest (GM, Ford, Boeing, AB InBev, Petrobras) account for $62 bil.

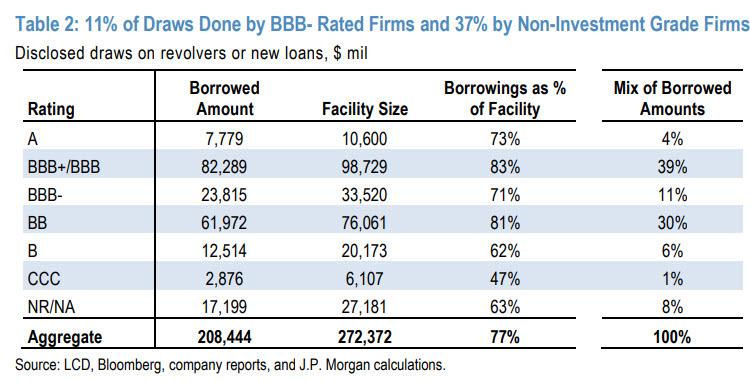

- 55% of announced borrowings are by investment grade firms, of which $24 bil or 19% are BBB- rated, $77 bil or 37% are by non-investment grade firms, and 8% did not have available ratings. Relative to yesterday, the rise in non-IG borrowings reflects Ford being moved to BB.

And while JPM does not expect this record drawdown to “cause capital concerns at banks” as these loans are (allegedly) broadly syndicated, and funding will come from a broad group of banks including foreign banks, the simple fact that FRA-OIS refuses to drop may be the clearest indication yet of just how crippling for bank liquidity the “revolver run” has been.

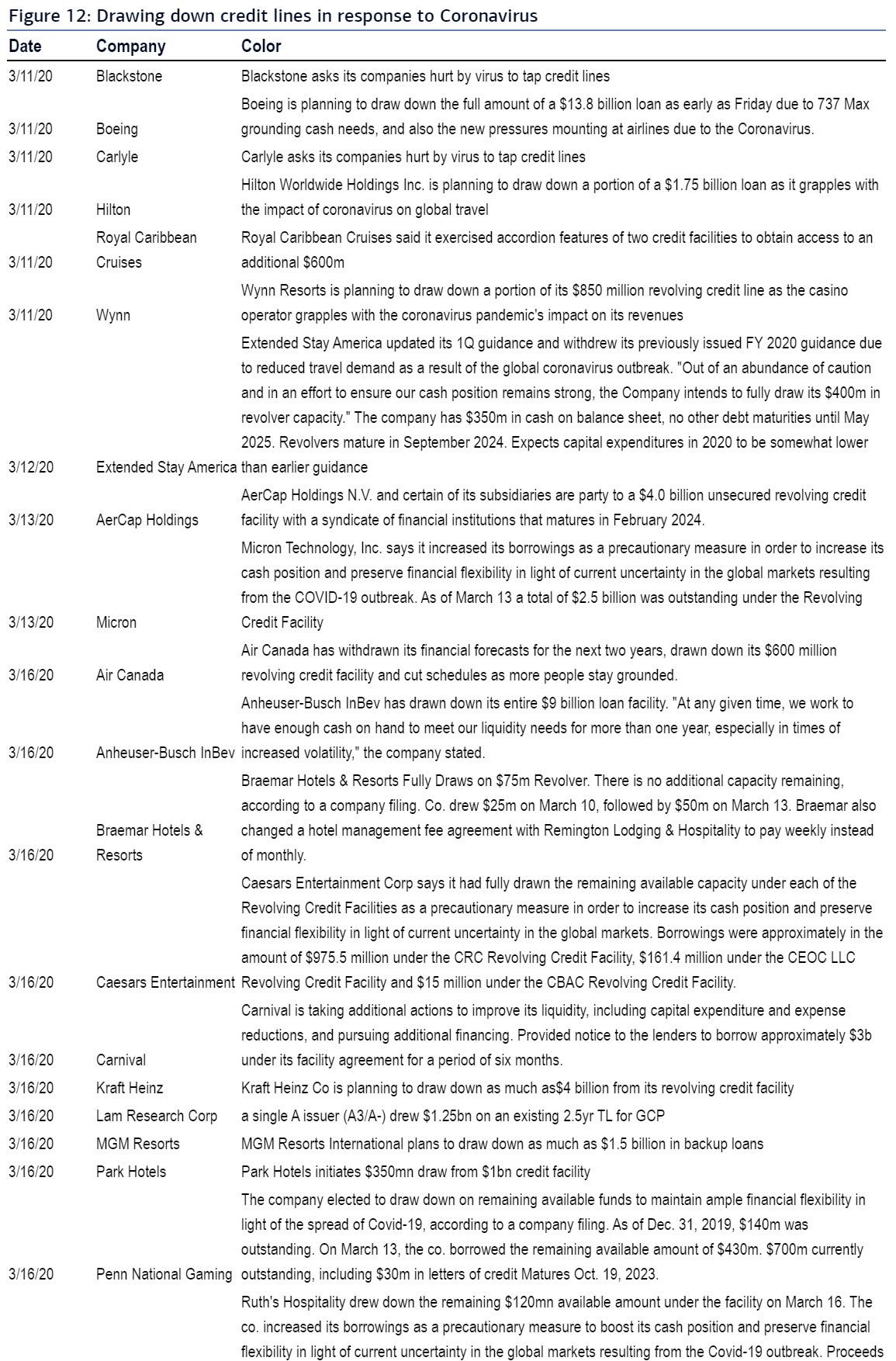

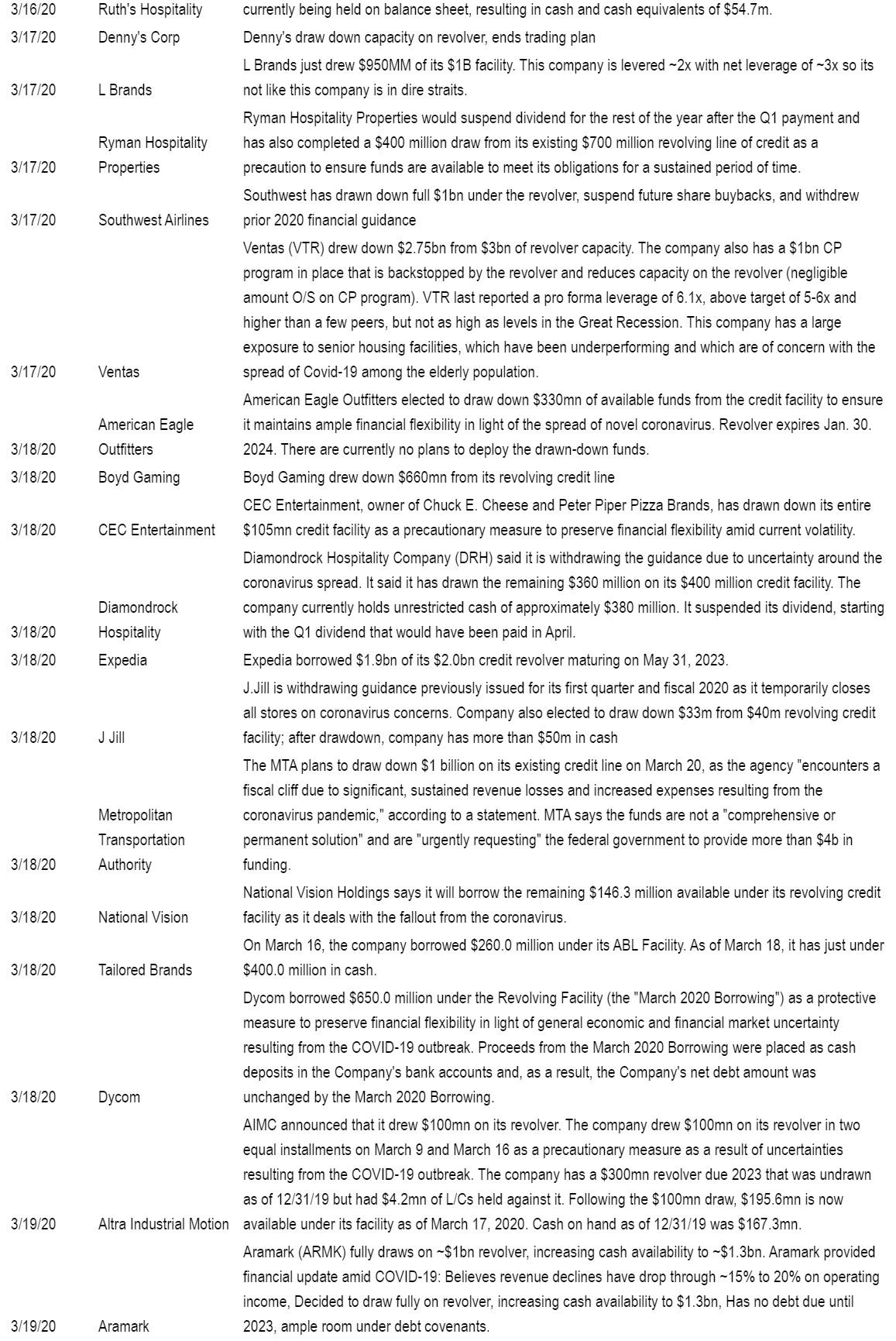

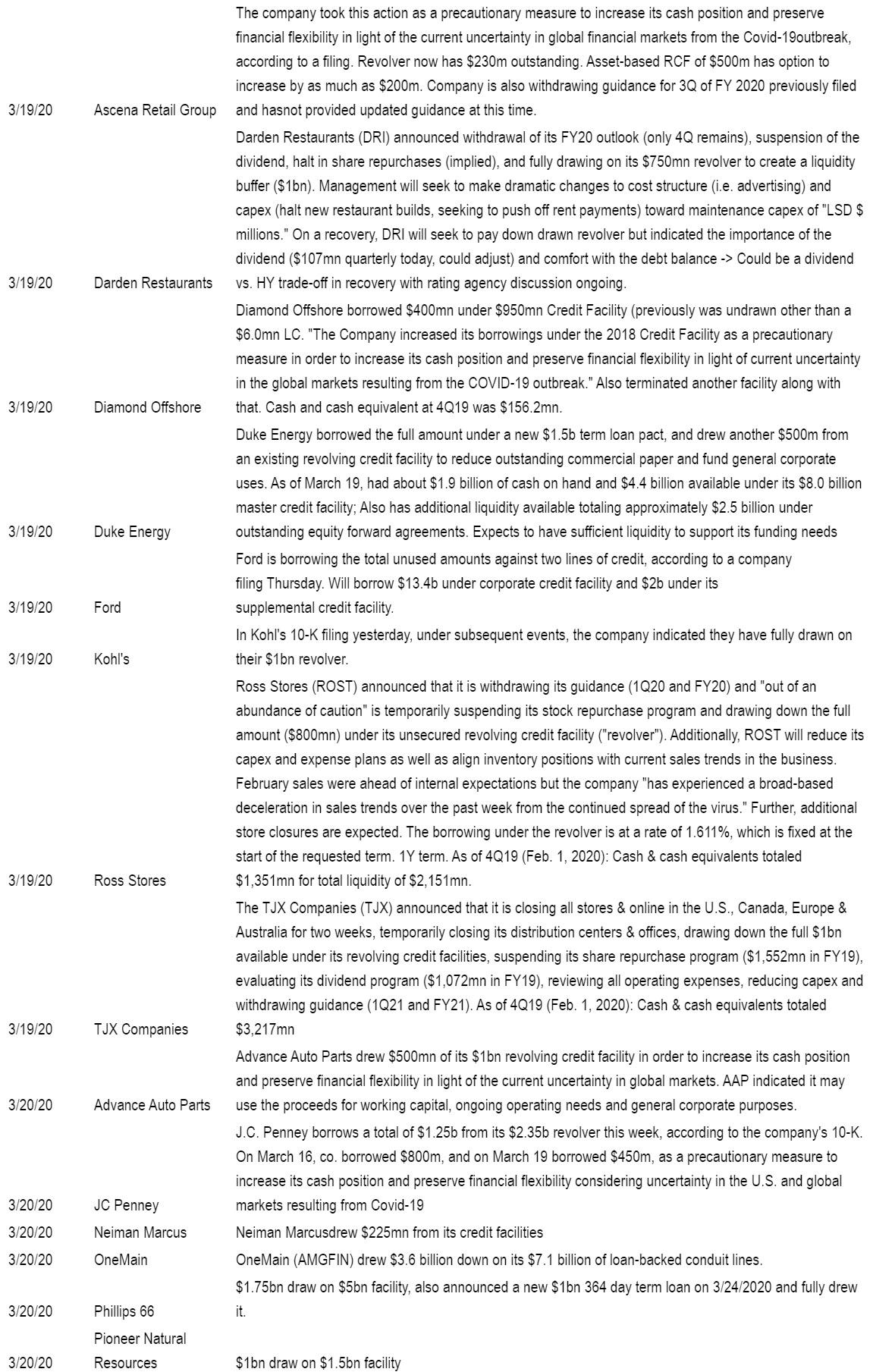

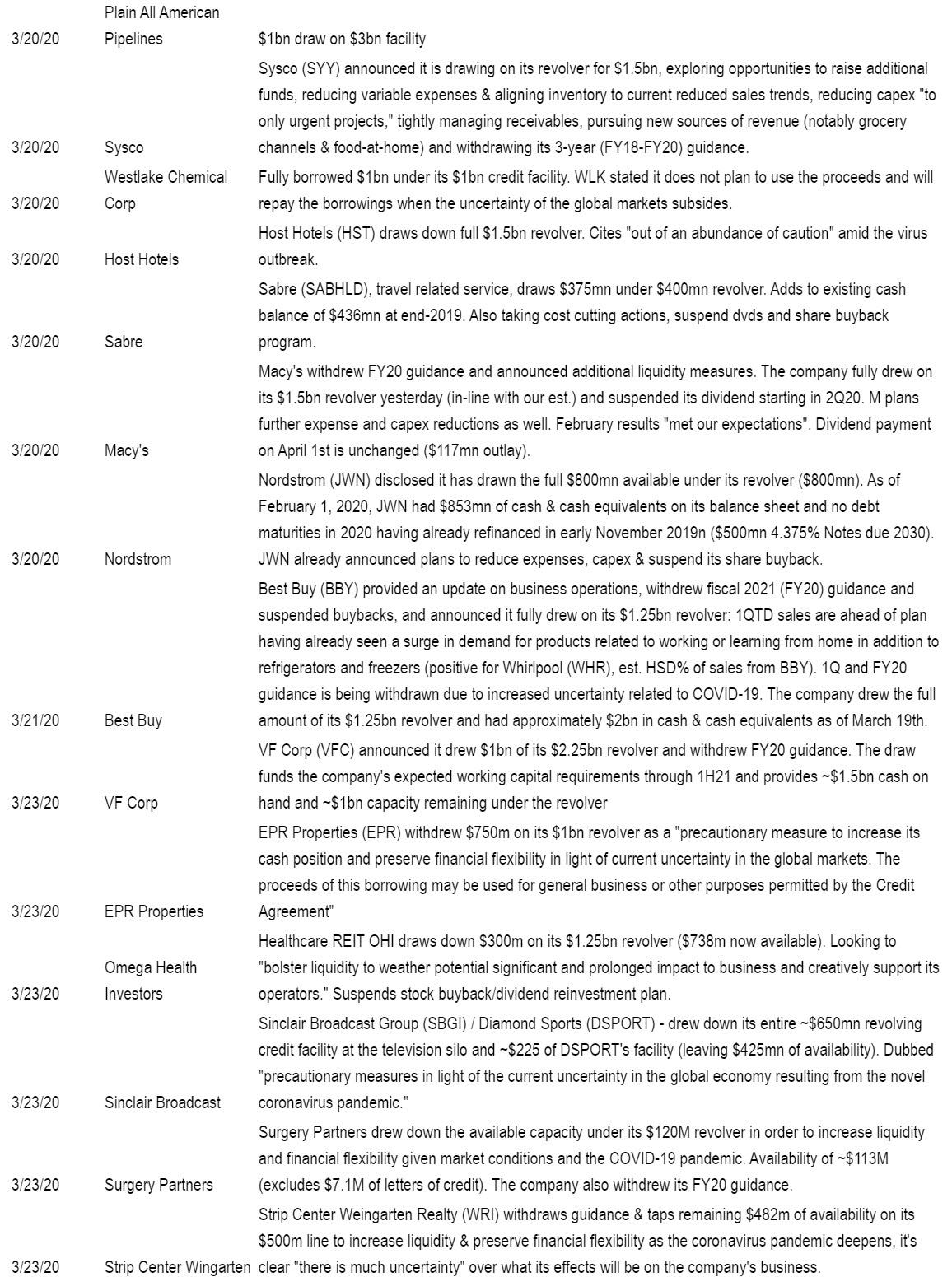

As a reference, here is BofA’s (woefully incomplete) attempt at tracking the micro level detail of most companies that have had a “revolver run” in recent days:

Finally, here is a rundown of the companies in the just the last few days.

Tyler Durden

Sat, 03/28/2020 – 12:32

via ZeroHedge News https://ift.tt/2QVmio2 Tyler Durden