“Beware A Disorderly Dollar Surge”: Goldman Says The Dollar Rally “Is Not Over”

Two weeks ago we said that the unprecedented (and continuing) surge in the dollar is the result of a historic, 12 trillion dollar margin call, as issuers of dollar-denominated debt obligations around the globe, seeing their cash flows collapse scrambled to repatriate funds ahead of coming dollar maturities.

The result was the sharpest dollar spike in decades. Of course, such a margin call meant that not only was the economy about to crater but it could also drag the entire global financial system with it unless policymakers somehow found a way to inject trillions of fresh liquidity into the system and restore some confidence that the Fed was still in control. That’s what happened last week, when the Fed expanded various Lehman-era liquidity facilities and added a whole host of new ones – including buying IG corporate bonds – while central banks around the globe intervened with their own set of coordinated liquidity operations.

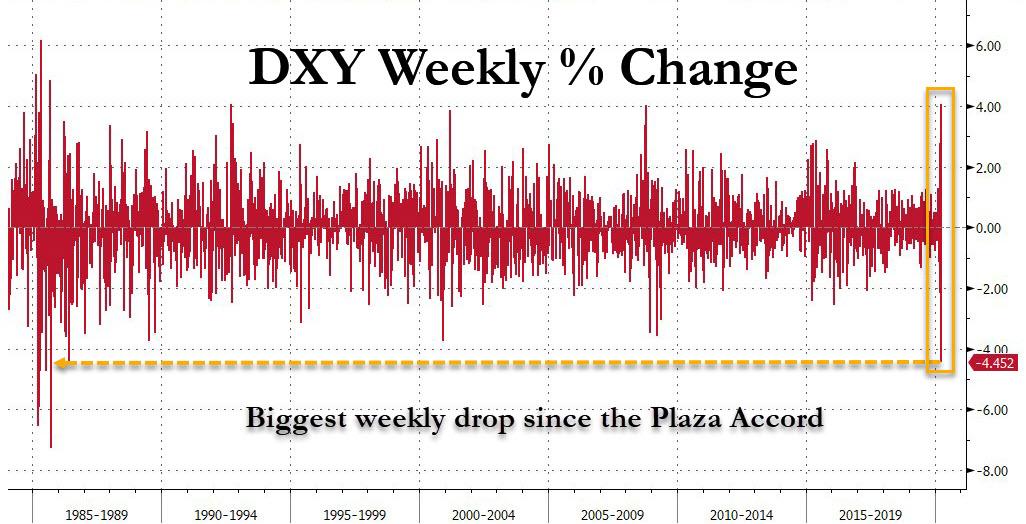

Long story short, the intervention worked – for now – and the result was the biggest weekly drop in the DXY Dollar index since, drumroll, the Plaza Accord which saw another massive coordinated intervention to crush the US dollar.

And, as Goldman’s FX strategist notes, “we are about to find out whether it will be enough.”

The problem is that while both the monetary and fiscal bazookas have been fired (and according to Paul Tudor Jones, it was actually nuclear bombs, not bazookas), “in the West, the economic fallout from the outbreak is only just beginning.”

Furthermore, while markets may be able to look through some pretty horrible economic data—like the non-reaction to the historic spike in US jobless claims last week—they will will be extremely sensitive to news on the duration of shutdowns and any signs of second-round effects (e.g. business failures, significant layoffs or earnings weakness outside of travel and hospitality sectors, or sovereign downgrades).

With that in mind, Goldman does see a light at the end of the tunnel: “there is still a reasonably strong argument for a V-shaped recovery, and policymakers are working hard to bring about that outcome.” But, as Pandl notes, “without medical breakthroughs of some kind, the next few weeks could be challenging for markets as we price in a deep global recession.”

What does that mean for the dollar? Long story short, what just came down, may soon go up.

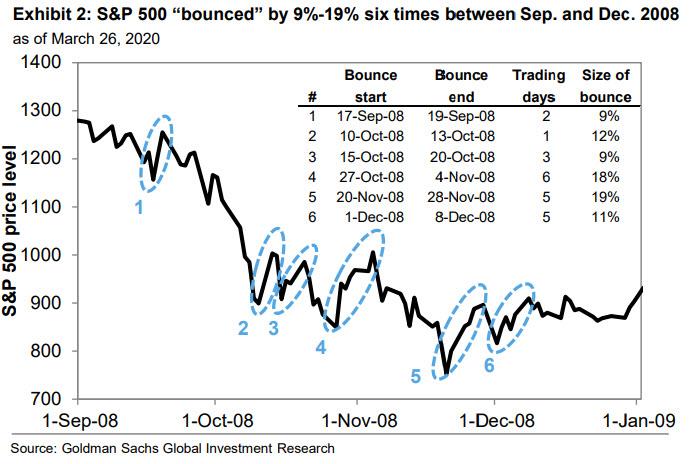

As Pandl summarizes, “the Dollar pulled back this week as risk assets rebounded, but our best guess is that the historic rally is not quite over” and in a further equity market drawdown – one which Goldman believes is inevitable…

… the real trade-weighted Dollar has perhaps 3-5% upside from the latest highs, in our view.

This would take the Dollar close to its peak during the last bull market (which ended in February 2002) and key crosses (e.g. EUR/USD and USD/CAD) to levels which might prompt debate over US-directed intervention.

In terms of specific trades, Goldman believes that”

- FX investors should remain cautious, with longs in traditional safe havens such as USD, JPY, CHF, and a focus on relative value

- Investors should stay defensive in emerging-market currencies as markets continue to digest incoming news on the virus and its impact on economic activity

- MXN, last week’s outperformer, will likely give up some of its gains should risk sentiment sour again

- EM high-yielders that have yet to surpass “severe’’ undervaluation levels, and face rising concerns surrounding Covid-19, such as RUB and ZAR, may also be hit hard

- Deeply undervalued currencies in Latin America, including BRL, CLP and COP, appear to be attractive when paired against oil-importing and lower-volatility currencies of EM Asia

His conclusion: “Although intervention has been rare in recent years, the disorderly surge could call for a policy response.”

Goldman is not alone in expecting more dollar upside after last week’s historic drop: according to BofA’s fundamental and technical analysts, the ongoing COVID-19-related financial market & economic shocks suggest “further USD appreciation ahead”, to wit:

Further financial market de-risking, persistent USD demand, sticky FX carry and continued US economic divergence underpin the case for more USD strength ahead, after the recent retracement. This despite sharply lower bond yield differentials, which have turned correlations on end, highlighting the extent of USD overshoot and rich long-term overvaluation.

To simply the message, here is an even quicker hot take: “Market turbulence + global recession = USD higher”

Out economists are now calling for a global recession. Economic contractions around the world are likely to be significant, notwithstanding policy response. A history of recessions indicates that risk assets are likely to remain under pressure for an extended period – months and possibly quarters.

We therefore continue to think that the US dollar will remain supported as economic and financial fallout of COVID-19 leads to persistently volatile conditions in which flows tend to seek perceived safe havens, the US included.

Our call remains that in such conditions:

- USD should continue to appreciate on most pairs with the exception of JPY and CHF, and that

- currencies suffering the greatest term of trade declines due to the energy market crash and the highest external financing requirements (necessitating large capital inflows) are likely to continue to underperform (Chart 6).

And although the US runs a substantial current account deficit, USD carry and favorable relative growth prospects probably offset these external sector-related risks, particularly given that USD is the world’s reserve currency.

Picking up where Goldman leaves off, and using almost the exact same words, BofA warns that “sharp, potentially “disorderly” USD appreciation is increasingly consistent with coordinated FX interventions in the past. Typically, the DXY appreciates 3-5% over a 1-2 month window in volatile conditions prior to interventions to sell USD, based on our research. And although G20 commitments expressly forbid targeting exchange rate levels for competitive purposes, history suggests that levels do play an important role in the decision to conduct coordinated interventions, with USD often making new highs prior to efforts to suppress strength historically. In our view, any intervention to counter excessive USD appreciation must be coordinated to be successful. Coordinated, clearly-articulated intervention among global central banks and finance ministers sends a strong and unified signal to markets that cannot be duplicated with sporadic intervention flow, which given the limited size of CB balance sheets is extremely small in relation to FX turnover.”

Which brings us to the $12 trillion question: when will the dollar be so high as to trigger intervention? BofA’s answer:

When could the case for intervention build? Floating exchange rates are designed to address economic and terms-of-trade shocks such as COVID-19. A key tradeoff is shock absorption vs. market disorder and capital flight risk. We do not think that exchange rates have adjusted enough to justify global central bank participation just yet. But because the virus is global, weak FX translates to tighter US financial conditions. Consequently, we suspect that the US could begin to push for a coordinated FX response with DXY above 104 and EUR/USD below 1.05 (highest and lowest levels since 2002). But we suspect that broad agreement on the need to contain dollar strength will emerge at higher USD levels.

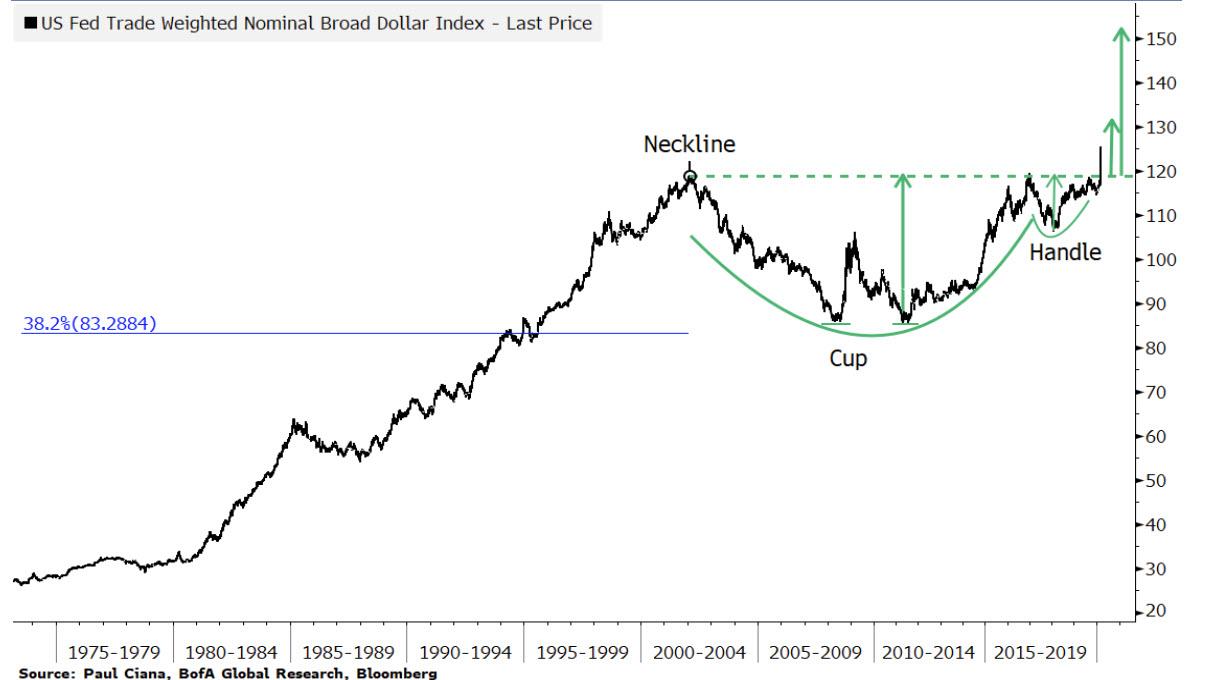

One last point in case the above was not enough, here is BofA’s Chief Technician, Paul Siena calling for a long-term bullish breaking in the US trade weighted dollar:

The US Federal Reserve’s trade weighted nominal broad dollar index data begins in 1973. Since then the trend has been up with notable corrections in 1978, 1985-1988, 2002-2010 and 2017. A double bottom began to form in 2011 and thereafter the trend began rounding out the “cup” portion of a bullish cup and handle technical pattern. The correction in 2017-2018 and rally back in 2018-present formed the “handle.” The surge in the US dollar this year broke the neckline of the pattern as the index reached a new all-time high. This breakout confirms the pattern, suggests more new highs to come and activates an initial upside target in the low 130s and an overall bullish trend into the 150s. This supports our bullish USD view.

Tyler Durden

Sun, 03/29/2020 – 18:01

via ZeroHedge News https://ift.tt/3dDtM8S Tyler Durden